Bioplastics Market Size, Share & Industry Analysis, By Type (Biodegradable {Starch blends, Polylactic acid, Polybutylene Adipate Terephthalate, Polybutylene Succinate} & Non-Biodegradable {Bio- Polyethylene Terephthalate , Bio-Polyamide, Bio-Polyethylene, Bio-Polytrimethylene Terephthalate}), By Application (Rigid Packaging {Bottles & Jars, Trays}, Flexible Packaging {Pouches, Shopping/Waste Bags}, Textiles, Automotive & Transportation) & Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

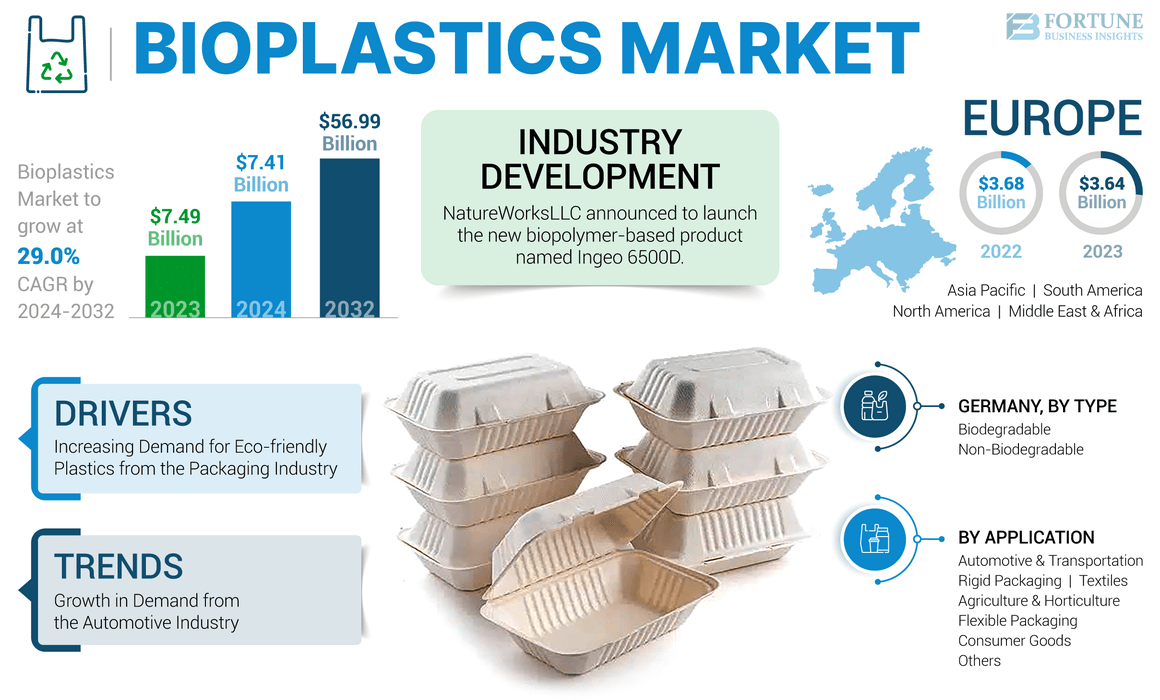

The global bioplastics market size was valued at USD 7.49 billion in 2023 and is projected to grow from USD 7.41 billion in 2024 to USD 56.99 billion by 2032, exhibiting a CAGR of 29.0% during the forecast period. Europe dominated the bioplastics market with a market share of 48.6% in 2023. The bioplastics market in the U.S. is projected to grow significantly, reaching an estimated value of USD 11.11 billion by 2032, driven by growing demand for lightweight automobile parts and electronic goods.

Bioplastics, originating from renewable sources, serve as a promising solution for curbing plastic waste. They typically stem from materials such as plant starch, cellulose, and natural sugars, with ongoing exploration into alternative sources such as seaweed and insects. While not all bioplastics are biodegradable, many boast the advantage of swift natural degradation, distinguishing them from conventional plastics. In response to tightening regulations on non-renewable plastics, industries such as packaging, textiles, electronics, automotive parts, and furniture are increasingly turning to bio-degradable options.

The COVID-19 pandemic impacted the market growth significantly owing to the restrictions on raw material transportation. Despite challenges faced by the market on its growth owing to the impact of the COVID-19 pandemic and the higher cost compared to conventional plastics, there is a rising demand for the product from several industries driven by environmental concerns. Noteworthy innovations include the development of compostable plastics tailored for agriculture and horticulture applications, further fueling the market growth.

Global Bioplastics Market Key Takeaways

Market Size & Forecast:

- 2023 Market Size: USD 7.49 billion

- 2024 Market Size: USD 7.41 billion

- 2032 Forecast Market Size: USD 56.99 billion

- CAGR: 29.0% from 2024–2032

Market Share:

- Europe dominated the bioplastics market with a 48.6% share in 2023, driven by strong research & development, rising demand for bio-based packaging, and a robust automotive sector across countries like Germany, France, and Italy.

- By type, the biodegradable segment leads the market due to high demand from packaging, agriculture, textiles, and consumer goods sectors seeking sustainable alternatives amid rising environmental concerns and regulatory restrictions on single-use plastics.

Key Country Highlights:

- United States: The bioplastics market is projected to reach USD 11.11 billion by 2032, driven by growing demand for lightweight automotive parts, electronic goods, and high-quality consumer products.

- China: Rapid growth in packaging, large-scale manufacturing capabilities, and renewed foreign investment under China’s investment law are expected to propel bioplastics production.

- Germany: A strong automotive base and strict environmental policies continue to support bioplastics innovation and adoption in packaging and car components.

- India: Expansion in agriculture and horticulture applications of bioplastics, supported by sustainability initiatives, is contributing to rising demand.

- Brazil: Increased food processing and horticulture activities, combined with bans on traditional plastics, are pushing bioplastics adoption.

- Japan: Rising use of bioplastics in rigid packaging and consumer goods is bolstered by advancements in composting technology and sustainability mandates.

Bioplastics Market Trends

Growth in Demand from the Automotive Industry to Create Growth Prospects

The primary objective and challenge for the automotive industry is to decrease fuel consumption and emissions by reducing vehicle weight. Bioplastics have emerged as suitable materials for achieving this goal, with key automobile manufacturers adopting smart plastics such as bio-PA and bio-PP to minimize environmental impact and enhance the strength of automobile components. The European Associates predicts that the technical application of these plastics in the automotive sector will see significant growth, with production volumes expected to reach approximately 170 KT by 2024. As a result, the heightened demand for bioplastics in automotive applications, driven by their superior properties, is anticipated to create favorable growth prospects for companies in the market. Europe witnessed a growth from USD 3.68 billion in 2022 to USD 3.64 billion in 2023.

Download Free sample to learn more about this report.

Bioplastics Market Growth Factors

Increasing Demand for Eco-friendly Plastics from the Packaging Industry to Propel Market Growth

Plastic, which is utilized for various purposes, such as constructing greenhouses, producing bins, silos, and storage bags, plays a significant role in horticulture and agriculture. In addition, in intensive and semi-intensive farming practices, sustainable quantities of mulching films and harvest-protection bags are employed to deter weeds, shield crops from pests, and regulate soil moisture and nutrient levels to establish favorable microclimates. However, traditional plastics, being non-biodegradable, persist in the environment for multiple harvest cycles, posing environmental hazards and impeding crop growth by hampering root access to water and nutrients in the soil. As a result, many companies specializing in agricultural plastics are turning to biodegradable alternatives made from renewable and sustainable sources. These polymers offer both technical feasibility and economic viability. Furthermore, besides fostering plant growth, bioplastic decomposes naturally, enriching the soil in the process. Hence, the demand for such bio-based plastics is on the rise in agriculture and horticulture, which is poised to generate favorable growth prospects for the global market during the forecast period.

RESTRAINING FACTORS

Need for Infrastructure for Composting Process May Restrain the Biodegradability of Bioplastics

Biodegradability is a key advantage of bioplastic and its breakdown often requires specific industrial composting conditions that are not widely available. Many bioplastic grades necessitate a controlled environment with specific temperatures, moisture levels, and microbial activity to degrade efficiently. However, the infrastructure for such composting facilities is limited, and only a handful of countries have invested in the necessary technology and facilities. This limitation means that in the regions lacking adequate composting infrastructure, bioplastics may end up in landfills or contaminating traditional recycling streams, thereby restraining the bioplastics market growth.

Bioplastics Market Segmentation Analysis

By Type Analysis

Biodegradable Segment Leads Due to Substantial Demand from Consumer Goods Industry

Based on type, the market is segmented into biodegradable and non-biodegradable.

The biodegradable segment accounts for the largest bioplastics market share due to significant demand from textiles, packaging, consumer goods, and agriculture & horticulture industries. These industries favor biodegradable plastics, including their performance and sustainability. Further, environmental consciousness, fueled by growing concerns over plastic pollution and its adverse impacts on ecosystems and human health, has prompted both consumers and governments to seek sustainable alternatives. Regulatory initiatives imposing bans or restrictions on single-use plastics have further incentivized industries to invest in biodegradable options.

On the other side, non-biodegradable plastics see notable adoption in consumer goods, food packaging, and automotive industries. Additionally, their unparalleled durability, low cost of production, and versatile applications and inherent resistance to degradation ensures prolonged shelf life for products, making them indispensable in Industries such as construction and manufacturing. This will drive the segment growth significantly during review period.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Rigid Packaging Segment to Dominate Due to Growing Preference for Sturdy Packaging Products Among Shipping Companies

Based on application, the bioplastics market is segmented into rigid packaging, textiles, automotive & transportation, flexible packaging, agriculture & horticulture, consumer goods, and others. The rigid packaging segment is further divided into bottles & jars, trays, and others, while the flexible packaging segment is further categorized into pouches, shopping/waste bags, and others.

The rigid packaging segment is expected to remain dominant during the forecast period. In rigid packaging applications, bio-based plastics have found traction due to shipping companies seeking sustainable yet sturdy packaging products. Additionally, rigid packaging made from bioplastics ensures protection against external elements, safeguarding contents from damage during transit and storage. Market demands for sustainability propel innovation, pushing manufacturers towards eco-friendly materials and designs, minimizing environmental impact.

The increasing utilization of flexible packaging in industries such as food and pharmaceuticals is expected to provide significant growth opportunities in the global market during the forecast period. In the food industry, flexible packaging offers numerous advantages such as extended shelf life, improved convenience, and enhanced product protection against moisture, oxygen, and light, ensuring the preservation of freshness and quality. Whereas, in the pharmaceutical industry, flexible packaging provides benefits like dosage accuracy, tamper resistance, and barrier properties that safeguard the integrity and efficacy of medicinal products. Hence, growth in these industry is propelled by several factors, including increasing demand for convenience foods, expanding pharmaceutical markets, advancements in packaging materials, and technology advancement.

The primary concern for automotive manufacturers is to reduce the fuel consumption and weight of the vehicle. Bio-based plastics are well suited for this purpose and thus have witnessed high demand from the automotive industry. Properties such as high strength-to-weight ratio, durability, rust-proof, and self-heating have fueled the demand for such plastics in automotive applications.

REGIONAL INSIGHTS

Regionally, the market is divided into the Asia Pacific, Europe, North America, and the rest of the world.

Europe Bioplastics Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the bioplastics market size of USD 3.64 billion with a market share of 48.6% in 2023. Europe is a crucial hub as it is the dominant region in the research & development and consumption of the product. Currently, the region holds about 25% of production of bioplastics as per the data by the European Bioplastics. In addition, a robust automotive industry and the increasing demand for bio-based packaging products by various manufacturers in the region are expected to favor the market growth.

To know how our report can help streamline your business, Speak to Analyst

The Asia Pacific has the largest production capabilities and regional development. According to a report by European Bioplastics, about 56% of the product is manufactured in the region. The industry is expected to grow rapidly in this region as China focuses on implementing its foreign investment law, which was delayed due to the global pandemic. The booming packaging industry in the region shall further bolster regional growth.

North America is projected to experience steady growth in the market during the forecast period due to the growing demand for lightweight automobile parts and electronic goods in the region. Consumer goods is another vertical that shall fuel the market growth in the region owing to the high living standards of the people, who prefer quality products instead of cheaper products.

The increasing demand for products for agriculture & horticulture is one of the vital factors influencing the market in the rest of the world. Furthermore, the expansion of the food products manufacturing industry is expected to be the region's growth-defining factor. With the imposition of restrictions on usage of conventional plastics by communities across the globe, the manufacturers have looked for sustainable solutions for packaging their products.

Key Companies in Bioplastics Industry

Companies Focus on Collaborations to Maintain Their Market Position

Capacity expansion and collaborations across the value chain are important aspects among companies to maintain their market position. Novamont is one of the key players operating in the market. The company operates four production sites and two research centers and has a distribution network spread across 25 countries. In addition, it has innovated five proprietary technologies and filed over 1800 patent applications. It dedicates around 5% of its annual revenue to research, development, and innovation and promotes a bio-economy model based on efficient resource usage and regeneration.

LIST OF KEY COMPANIES PROFILED:

- Novamont S.p.A. (Italy)

- Arkema S.A. (France)

- Matrìca S.p.A. (Italy)

- NatureWorks LLC (U.S.)

- TotalEnergies Corbion (Netherlands)

- PTT MCC Biochem Co., Ltd. (Thailand)

- Roquette Frères (France)

- Biofase (Mexico)

- Genecis (Canada)

- Trifilon (Sweden)

- Solvay S.A. (Belgium)

- Avantium (Netherlands)

- Toray Industries, Inc. (Japan)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- BASF SE (Germany)

- BioApply (Switzerland)

- Braskem (Brazil)

- Kaneka Takasago (Japan)

- Danimer Scientific (U.S.)

- Taghleef Industries (U.A.E.)

- Advance Bio Material P. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- May 2023- TotalEnergies Corbion announced its partnership with the Changsu Industrial to advance adoption of sustainable biobased BOPLA films. This partnership will strengthen TotalEnergies Corbion’s revenue generation from the biobased products.

- April 2023 - Solvay declared its strategic collaboration with Ginkgo Bioworks to expand its R&I footprint in the U.S. The purpose of the collaboration is to develop new sustainable biopolymers and establish its presence in North America.

- April 2023 - NatureWorksLLC announced to launch the new biopolymer-based product named Ingeo 6500D. The product is expected to offer a solution for enhanced strength and softness in biobased nonwovens for hygiene applications.

- January 2023 - Arkema announced to showcase the bio-circular material during the MIDO show in Milan. The group aims to launch several new biobased and recycled materials at the event.

- November 2022 - TotalEnergies Corbion and Be Good Friends (BGF) entered a partnership by signing a long-term collaborative agreement to develop the bio-based Luminy PLA product. The purpose of the collaboration is to maximize the revenue.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, types, applications, and products. In addition, it provides quantitative data in terms of volume and value, market analysis, research methodology for market data, and insights into market trends. It highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 29.0% from 2024 to 2032 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Type

By Application

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global bioplastics market size was USD 7.49 billion in 2023 and is projected to reach USD 56.99 billion by 2032.

In 2023, the Europe market value stood at USD 3.64 billion.

Registering a significant CAGR of 29.0%, the market is expected to exhibit considerable growth over the forecast period (2024-2032).

By application, the rigid packaging is expected to be the leading segment in this market during the forecast period.

The increasing demand for eco-friendly plastics from the packaging industry is poised to propel the market growth.

Braskem, Arkema S.A., Novamont, and LyondellBasell are the leading players in this market.

The demand for compostable plastics is expected to drive product adoption over the forecast period, driving the market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us