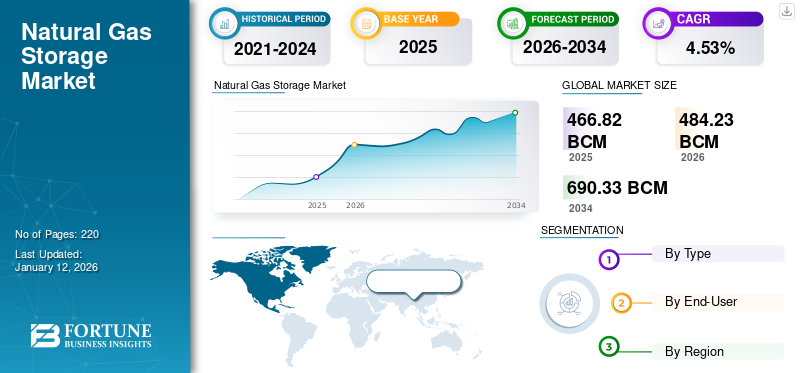

Natural Gas Storage Market Size, Share & Industry Analysis, By Type (Underground {Depleted Gas Reservoirs, Salt Caverns, and Aquifier Reservoirs} and Above Ground {Liquefied Natural Gas (LNG) Storage, Compressed Natural Gas (CNG) Storage, and Others}), By End-User (Natural Gas Producers, Utility Companies, Industrial Customers, Power Generation Companies, and Others), Regional Forecast, 2026-2034

Natural Gas Storage Market Size and Future Outlook

The global natural gas storage market size was valued at 466.82 billion cubic metres (bcm) in 2025 and is projected to grow from 484.23 billion cubic metres (bcm) in 2026 to USD 690.33 billion cubic metres (bcm) by 2034, exhibiting a CAGR of 4.53% during the forecast period. North America dominated the natural gas storage market with a market share of 38.53% in 2025.

The natural gas storage market demand is increasing rapidly owing to the growing demand from industrial and power generation sectors. As sectors such as chemicals, fertilizers, metals, and manufacturing progressively shift toward natural gas for a cleaner and more efficient energy solution, the demand for a steady and dependable supply of gas has grown. In 2024, the global consumption of industrial gas increased by close to 3%, as reported by the International Energy Agency (IEA), with the Asia Pacific and Middle East regions contributing significantly to this market growth. Moreover, natural gas is increasingly being employed as a balancing and peaking fuel to support system stability.

McDermott International, Inc., Enbridge, Inc., NAFTA A.S., Gazprom and others are the key companies operating in the natural gas storage industry. Enbridge’s natural-gas storage business includes integrated flexible storage assets across Canada and the U.S., offering working capacity through both its transmission operations and utility operations. For instance, the company reports about 622 billion cubic feet (Bcf) of net working storage across North America.

MARKET DYNAMICS

MARKET DRIVERS:

Growing Demand for Natural Gas from Utility Sector to Propel Market Growth

Utilities are increasingly opting for natural gas since it provides a versatile, lower-carbon substitute for coal and oil, aiding them achieve both reliability and emissions targets. Natural gas power plants can adjust output swiftly, making them well-suited to balance the fluctuating energy production from renewables such as solar and wind, a key factor driving market growth.

Globally, the demand for natural gas reached a record high in 2024, increasing by around 2.7% (approximately 115 billion cubic meters) compared to the previous year, largely fueled by electricity generation. In Latin America, demand saw a rise of about 1.6% in 2024, particularly in Brazil and Colombia, where drought conditions impacted hydropower availability and prompted utilities to rely more on gas-fired generation.

MARKET RESTRAINTS:

High Capital Investment & Fluctuating Natural Gas Prices to Restrict Market Expansion

The expansion of the natural gas storage sector faces several limitations, largely influenced by infrastructural, economic, and environmental factors. A significant drawback is the substantial capital investment required for the establishment and upkeep of underground storage facilities, such as depleted reservoirs, aquifers, or salt caverns. These initiatives entail intricate geological evaluations, regulatory clearances, and lengthy construction schedules, which considerably postpones the increase in capacity. Furthermore, the volatility of natural gas prices and market fluctuations discourage funding for large-scale storage, as profitability largely reliant on seasonal demand variations.

MARKET OPPORTUNITIES:

Advancements in Digital Monitoring, Pressure Management, and Leak Detection to Create Growth Opportunities

Advancements in digital monitoring, automation, and sensor technology are revolutionizing the efficiency and safety of natural gas storage facilities, driving excellent market opportunity. Contemporary storage sites are increasingly utilizing real-time data analytics and Internet of Things (IoT) technologies to consistently monitor variables such as pressure, temperature, and gas flow. These digital solutions enable operators to identify irregularities promptly, averting leaks, pressure variations, or equipment failures before they become serious. Cutting-edge leak detection methods, such as fiber-optic sensing and acoustic monitoring, offer immediate notifications, greatly lowering methane emissions and environmental hazards. For instance, AI-driven predictive maintenance tools equipment performance trends to foresee component degradation or possible system issues, thereby minimizing downtime and prolonging asset longevity.

NATURAL GAS STORAGE MARKET TRENDS:

Global Energy Transition Toward Clean & Resilient Energy Systems are the Key Market Trends

The natural gas storage sector is undergoing a significant transformation, influenced by global shifts toward energy transition, concerns about supply security, and swift technological progress. As nations strive for cleaner and more robust energy solutions, natural gas continues to be vital for maintaining stability, particularly with the rising integration of renewables. For instance, CEDIGAZ reports that global underground working gas storage (UGS) capacity hit about 437 billion cubic meters (bcm) in 2023, a 2% annual increase, which represents largest growth since 2015. Currently, there are more than 680 storage facilities operating around the globe, with approximately 70 new projects underway, anticipated to contribute an additional 55 bcm in capacity in the coming years.

MARKET CHALLENGES:

Environmental Concerns Over Methane Emissions and Groundwater Contamination to Hamper Market Growth

One of the major challenges facing the natural gas storage industry is methane emissions and the potential for groundwater contamination. Methane, the primary component of natural gas, is a potent greenhouse gas with a global warming potential more than 25 times higher than that of carbon dioxide over a 100-year period.

For instance, high-profile incidents, such as the 2015 Aliso Canyon gas leak in California have heightened public awareness and regulatory scrutiny of methane emissions from storage infrastructure. Additionally, improper site management or geological instability can lead to groundwater contamination, as brine or hydrocarbons may migrate into aquifers, posing health and environmental risks.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Underground Segment to Dominate, Driven by its Ability to Offer Safe and Economical Method

On the basis of type, the market is classified into underground and above ground. In 2025, the underground segment is anticipated to dominate with a share of 77.97% in 2026. Underground natural gas storage is widely preffered as it offers a safe, efficient, and economical method to align supply with demand, ensuring energy reliability. Storing gas underground in depleted oil or gas fields, aquifers, or salt caverns enables operators to gather gas during low-demand periods (typically in summer) and extract it when demand is high (such as in winter). This seasonal adaptability is essential for utilities and gas providers to maintain a steady supply and stabilize market prices.

The above ground segment is experiencing the fastest growth and is expected to grow at a CAGR of 6.16%. Above ground natural gas storage is gaining traction due to its increased flexibility, quicker setup, and easier accessibility in comparison to underground storage systems. Unlike underground facilities that depend on certain geological formations and lengthy development periods, above ground storage, such as pressurized steel tanks, LNG (liquefied natural gas) tanks, and bullet tanks can be established almost anywhere, provided that safety and space conditions are met.

By End-User

Utility Companies Segment Dominates the Market due to its Ability to Provide Continous Power Supply

In terms of end-user, the market is categorized into natural gas producers, utility companies, industrial customers, power generation companies, and others. The utility companies is the dominant segment in the market contributing 39.87% globally in 2026, and is set to hold the largest market share of 39.74% share in 2025. Utility companies use natural gas storage primarily to ensure reliable, continuous, and cost-effective energy supply for their customers throughout the year.

The power generation companies are anticipated to grow at a highest CAGR of 5.98% during the forecast period. Natural gas serves as a crucial energy source for power plants, particularly for combined-cycle and peaking facilities, which must quickly respond to fluctuations in electricity demand.

To know how our report can help streamline your business, Speak to Analyst

Natural Gas Storage Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America held the dominant share in 2025, valued at 179.86 bcm, and maintained its leading position in 2026 with 186.11 bcm. The need for natural gas storage in North America is rising due to several significant factors. Seasonal variations have a major impact as gas usage dramatically increases in winter for heating and in summer for electricity production, necessitating storage to align supply with demand.

In 2026, the U.S. natural gas storage market valued at 137.56 bcm. The natural gas storage demand in the U.S. is growing owing to rising energy consumption, seasonal fluctuations, and more. In winter, there is a spike in the need for heating, whereas in summer, natural gas is predominantly used for electricity generation, necessitating ample storage reserves to ensure a balance in supply.

- For instance, as states by the Energy Information Administration (EIA), by the end of the injection season in 2025, inventories are expected to reach nearly 3,980 Bcf, which would be about 5% above the five-year average.

Europe & Asia Pacific

Other regions, such as Europe and the Asia Pacific, are anticipated to witness a notable growth in the coming years. During the forecast period, the Europe is projected to record a growth rate of 5.12% and reach the valuation of 133.66 bcm in 2026. In Europe, the natural gas storage market share is driven by concerns over energy security, fluctuations in seasonal demand, and the continent's shift toward more sustainable energy source. European nations have taken significant steps. For instance, the regulations from the European Union now mandate that storage facilities must be filled to a minimum of 90% capacity prior to winter, resulting in ongoing demand for storage.

Backed by these factors, countries including Germany are expected to record the valuation of 24.36 bcm, The UK market is projected to reach USD 1.38 bcm by 2026, and Russia to record 41.35 bcm in 2025. After Europe, the market in Asia Pacific is estimated to reach 111.18 bcm in 2026 and secure the position of the third-largest region in the market. In the region, China is estimated to reach 67.45 bcm in 2026, the Japan market is projected to reach USD 14.74 bcm by 2026, and the India market is projected to reach USD 2.87 bcm by 2026.

Latin America and Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions are anticipated to show tremendous opportunities for natural gas storage, as countries such as Brazil, Argentina, and the Rest of Latin America are emerging countries. Brazil's energy system relies significantly on hydropower, which is susceptible to drought and fluctuations in seasonal rainfall. Furthermore, the growth of LNG imports and offshore gas production demands infrastructure to handle fluctuating inflows and peak demand. The Latin American market in 2025 is set to record 29.62 bcm in its valuation. In the Middle East and Africa, the natural gas storage market growth is driven by the countries, namely Saudi Arabia, the UAE, Egypt, and South Africa, that are diversifying their energy mix by using more natural gas for power generation, industrial feedstock, and desalination. In this region, GCC reached a valuation of 13.16 bcm in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players:

Vendors are Focusing on Strategic Partnerships to Maintain Operational Stability

McDermott International, Inc., Enbridge, Inc., NAFTA A.S., and others are acknowledged as major participants in the natural gas storage market, as each firm is actively involved in the expanding and modernizing storage capacity, LNG & floating storage expansion, and others.

In August 2025, PetroChina, an oil and gas producer based in China, revealed its intention to purchase three natural gas storage facilities from China National Petroleum Corporation (CNPC) for 40.01 billion yuan ($5.59 billion), excluding tax. This acquisition aims to strengthen the company’s natural gas supply chain and maintain operational stability. The deal encompasses the complete equity interests in Xinjiang Gas Storage, Xiangguosi Gas Storage, and Liaohe Gas Storage, with respective valuations of 17.06 billion yuan (USD 2.39 billion), 9.99 billion yuan ($1.46 billion), and 12.95 billion yuan (USD 1.89 billion).

LIST OF KEY NATURAL GAS STORAGE MARKET PROFILED:

- McDermott International, Inc. (U.S.)

- Enbridge, Inc. (Canada)

- NAFTA A.S. (Slovakia)

- Gazprom (Russia)

- Royal Vopak N.V. (Netherlands)

- TransCanada Corp. (Canada)

- Uniper (Germany)

- Sempra (U.S.)

- Chart Industries (U.S.)

- Martin Midstream Partners L.P. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In July 2025, the European Parliament approved relaxed rules for natural gas storage refills across the EU, allowing member states a 10-percentage-point deviation from the bloc’s 90% storage target.

- In February 2025, Germany urged the European Union to relax its strict gas storage targets, citing concerns over high costs. The current rules, introduced after the Ukraine war, mandate all EU members to refill storage sites to 90% capacity by November, with interim milestones in February, May, July, and September each year.

- In May 2025, NeuVentus LLC announced an open season for up to 20 billion cubic feet (Bcf) of firm storage capacity offering quick-inject/quick-withdraw capability for LNG export, power generation, industrial and gas-pipeline customers.

- In April 2025, Ukraine’s state energy company Naftogaz has begun injecting natural gas into its underground storage facilities after reserves hit record lows in April, aiming to rebuild stocks ahead of winter.

- In November 2024, Enbridge moved to bring a fourth cavern online at its Tres Palacios natural gas storage facility in Texas. The company claims to hold about 622.7 Bcf of net natural gas storage capacity across North America in its integrated assets.

REPORT COVERAGE

The global natural gas storage market analysis provides an in-depth study of the market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, operational costs, and details on partnerships, increased investments, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTE | DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Growth Rate | CAGR of 4.53% from 2026-2034 |

| Unit | Volume (billion cubic metres (bcm)) |

| Segmentation |

By Type

By End-User

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at 484.23 billion cubic metres (bcm) in 2026 and is projected to reach 690.33 billion cubic metres (bcm) by 2034.

In 2025, the market value stood at 179.86 bcm.

The market is expected to exhibit a CAGR of 4.53% during the forecast period (2026-2034).

The utility companies segment led the market by End-User.

Growing adoption of the product in the utility & energy sector to propel market growth.

McDermott International, Inc., Enbridge, Inc., NAFTA A.S., and others are some of the top players in the market.

North America dominated the market in 2025.

Growing energy-security concerns and seasonal/peak demand variability, rising LNG import/export flows, increased gas-fired power to balance renewables favors product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us