Video on Demand Market Size, Share & Industry Analysis, By Revenue Model (Subscription Video on Demand (SVoD), Transactional Video on Demand (TVoD), and Advertisement Based Video on Demand (AVoD)), By Content Type (Sports, Music, TV Entertainment, Kids, Movies, and Others), and Regional Forecast, 2026-2034

Video on Demand Market Size & Forecast

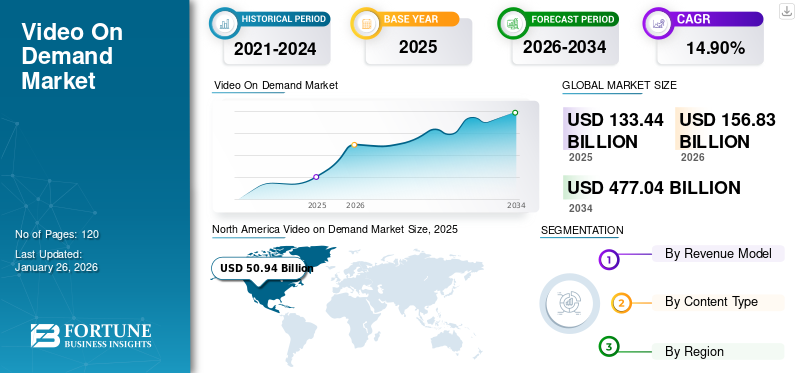

The global video on demand market size was valued at USD 133.44 billion in 2025 and is projected to grow from USD 156.83 billion in 2026 to USD 477.04 billion by 2034, exhibiting a CAGR of 14.90% during the forecast period. North America dominated the video on demand market with a market share of 38.20% in 2025.

The increasing adoption of mobile phones, surging internet penetration, and rising demand for subscription-based TV shows, movies, and documentaries drive the growth of the market. According to the GSMA Intelligence Report in 2020, an estimated 4 billion or 51% of the global population is connected to the mobile internet. The number increased by 225 million in 2020 compared to the previous year, 2019. Such an increase in mobile internet penetration drives the demand for subscription-based on-demand videos globally.

The market overview covers Video on Demand (VoD) services offered by players such as Netflix Inc., Alphabet Inc., Hulu LLC (the Walt Disney Company), Apple Inc., and others. These players are offering subscription-based VoD services through their platforms. For instance, Netflix Inc. offers VoD streaming services to provide a wide range of movies, TV shows, documentaries, and others. Also, several VoD platforms include YouTube Premium offered by Alphabet Inc., Amazon Prime by Amazon.com, Inc., and Apple TV+ by Apple, Inc. In addition, Verizon Communications Inc. provides Pay-Per-View (PPV) and Subscription or fee-based content VoD service.

The COVID-19 pandemic accelerated the demand for smartphones, broadband connections, internet usage, and digital platforms such as video streaming and conferencing. Also, movie theaters and shows were temporarily closed owing to government restrictions and self-imposed social separation guidelines to avoid viral infection. As a result of the pandemic, the demand for these services increased among new and existing consumers.

Video on Demand Market Trends

Enhanced User Experience and Ease of Use are Considered Emerging Trends

VoD offers viewers an online video library that can be easily accessed from any compatible device. Ease of access, integrated services, and other product offerings would help establish a favorable environment for subscription-based services. According to PwC Consumer Intelligence Series 2021 video survey findings, the respondents best enjoyed their preferred services, "ease of use“(55%), along with "knowing they'll always be able to find something to watch“ (35%). Video on demand platforms are leveraging data analytics and machine learning algorithms to personalize content recommendations for users. By analyzing viewing habits, preferences, and demographic data, platforms can suggest relevant content to users, improving the user experience and increasing engagement. Personalization features, such as watchlists, curated playlists, and algorithmic recommendations are becoming standard features on video on demand platforms.

Consumer preferences and needs change over time but the growing demand for value and ease of use remains constant. This is one of the most important aspects of building a unique user experience. Owing to these factors, video on demand and OTT services will remain popular for a long time.

Download Free sample to learn more about this report.

Video on Demand Market Growth Factors

Increasing Adoption of Smart Devices and Online Streaming Applications to Propel Market Growth

The rising penetration of smartphones and smart TVs and the adoption of the OTT platform accelerate the volume of video on demand service traffic, according to a March 2020 report by Cisco Systems, Inc. that by 2023, mobile connectivity will be available to more than 70% of the global population. Besides, the global mobile subscriber rate is expected to rise from 5.1 billion (66% of the population) in 2018 to 5.7 billion (71%) by 2023. Moreover, online streaming applications typically offer a wide selection of content across various genres, languages, and categories. Users can choose from thousands of titles, including recent releases, classic films, and exclusive originals, thereby catering to diverse tastes and preferences. This extensive library of content ensures that users can always find something to watch, regardless of their interests or mood.

Over the last few years, online media consumption has surged. Mobile devices have surpassed desktop computers as the major source for consuming online media. As smartphone popularity rises, data usage will inevitably rise, resulting in an increase in online video consumption.

Further, Over-the-Top (OTT) platforms are content providers that are rapidly expanding as more people turn toward online channels for entertainment. According to a report published by ComScore in November 2021, over 50 million households around the globe already have access to OTT video, which they watch at the same rates as traditional TV viewers.

RESTRAINING FACTORS

Concern Regarding the Privacy of Video Content to Hinder the Market Growth

Rising concerns amongst market players about video content protection and piracy are expected to hinder the video on demand market growth. It can reduce the number of consumers who are viewing content. This is due to the policy of a few VOD platforms that share user data with third-party advertisers, content providers, or analytics companies for targeted advertising, content licensing, or data monetization purposes. Video content players face piracy risk that leads to substantial revenue losses. For instance, in October 2020, according to VdoCipher Media Solutions, the movie business alone lost between USD 40 to USD 97.1 billion due to digital video piracy.

Video on Demand Market Segmentation Analysis

By Revenue Model Analysis

Increasing Demand for Subscription-based Video Content to Aid Market Growth

Based on revenue model, the market is divided into transactional VoD, subscription VoD, and advertisement based VoD. The subscription VoD segment accounting for 48.91% of the global market share in 2026. This is mainly attributed to the rising subscribers to adopt OTT platforms. In April 2020, according to Zemoga, Inc., in terms of OTT time on home TVs of, 30% goes to free streaming, 5% goes to transactional VoD, and 65% goes to subscription VoD.

Also, advertisement based VoD services are growing steadily due to increased demand for advertising videos for product and service promotions.

By Content Type Analysis

To know how our report can help streamline your business, Speak to Analyst

High Demand for TV Channels with a Surge in Strategic Partnerships by Key Players to Drive the Market Expansion

Based on content type, the market is divided into TV entertainment, music, sports, kids, movies, and others. Among this, the TV entertainment segment held 27.41% of the global market share in 2026. This is primarily attributed to the increasing number of drama series projects, big-budget movies, and advertising online videos. Key companies are developing VoD platforms by adopting various business strategies such as partnerships and collaborations. For instance,

- November 2021: Netflix Inc. collaborated with Hirokazu Koreeda, Japan’s filmmaker, to develop two projects and create big-budget movies and drama series.

The movies segment is expected to grow with the highest CAGR during the forecast period. This is primarily attributed to the increasing on-demand movies by consumers. Also, several movie directors collaborate with streaming service providers to facilitate their films for their consumers. For instance,

- September 2021: Netflix Inc. signed an agreement deal with Timo Tjahjanto, Indonesian director, for a new movie release on the platform. The strategy would provide international exposure for a film released in 2022.

REGIONAL INSIGHTS

The market has been analyzed across five major regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Video on Demand Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Middle East & Africa market

The Middle East & Africa market is expected to develop significantly during the forecast period. This is primarily owing to the surge in the development of the media & entertainment industry. The South America market is also growing at a moderate growth rate owing to increasing investments by globally leading players. The surge in smartphone penetration and internet connectivity in Brazil, Argentina, and others is considered one of the driving factors.

North America

North America accounted for USD 50.94 billion in 2025. Key players in the region, such as Apple, Inc., Amazon, Netflix, and others, are focused on developing advanced VoD services for users. The region is highly diverse, owing to rising investment by key players and a surge in the adoption of advanced technologies such as AI and cloud computing. The U.S. market reaching USD 41.32 billion by 2026. These technologies are used by VoD platform developers to automate the video streaming process efficiently. For instance,

- In October 2020, NVIDIA Corporation launched a cloud-based Maxine platform, which provides developers to enhance streaming video with GPU-accelerated AI software. The NVIDIA Maxine suite is a cloud-based streaming video AI platform for service video streaming providers.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

is anticipated to grow with the highest CAGR during the forecast period. This is primarily attributed to a huge customer base and rising mobile internet users across various populous countries. The global players in the market are expanding their footprint in this region owing to growing demand from end-users such as sports, music, TV entertainment, and others. The Japan market reaching USD 7.74 billion by 2026, the China market reaching USD 10.72 billion by 2026, and the India market reaching USD 8.51 billion by 2026. For instance,

- According to a Media Partners Asia (MPA) report, Disney’s Hotstar had around 39 million active users in 2021. The report further states that India will have 1 billion video screens by 2024.

Key Industry Players

Increasing Business Expansion Strategies by Key Players Aid the Market Growth

Key players in the market, including Alphabet, Inc., Amazon.com, Inc., Hulu LLC (The Walt Disney Company), AT&T, Inc., Netflix, Inc., Apple, Inc., and others are focused on offering online VoD services. These players are entering into strategic partnerships to grow their businesses across countries.

- July 2021: The Carlyle Group acquired Liveu's live video streaming company for around USD 400 million. This strengthens the video transmission and video streaming service.

- May 2021: AT&T, Inc. signed a deal to combine its content unit WarnerMedia LLC with Discovery, Inc. AT&T also owns HBO, CNN, and Warner Bros. Discovery Inc.’s channels such as TLC, Animal Planet, and the Discovery Channel.

List of Top Video on Demand Companies:

- Google LLC. (U.S.)

- Amazon.com, Inc. (U.S.)

- Hulu LLC (The Walt Disney Company) (U.S.)

- AT&T, Inc. (Warner Media, LLC and Discovery, Inc.) (U.S.)

- Netflix, Inc. (U.S.)

- Apple, Inc. (U.S.)

- Comcast Corporation (U.S.)

- Facebook, Inc. (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Verizon Communications Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Evision expanded its strategic partnership with Disney Star. Through this collaboration, Evision aims to bring South Asian entertainment content to audiences across the Middle East & Africa (MENA).

- August 2023: DistroTV entered a partnership with Network18. Through this partnership, users of DistroTV in India will be able to stream Network18's wide range of channels live and for free.

- July 2022: Netflix partnered with Microsoft to offer new ad-supported subscription plans. Through this partnership, Microsoft became Netflix's global ad technology and delivery partner to support all advertising needs.

- April 2022: Hulu developed U.S. streaming rights to Schitt’s Creek. By this acquisition, the company became the exclusive subscription VoD destination for the fan-favorite and critically acclaimed series "Schitt's Creek" in the U.S.

- September 2021: Amazon.com Inc. launched prime video channels across India. The premium video channels provide access to several on-demand video channels, including Lionsgate Play, discovery+, Eros Now, Docubay, Hoichoi, MUB, Manorama Max, and Shorts TV for its prime members.

- July 2021: Comcast Corporation and ViacomCBS Inc. partnered to expand their streaming services in the international market. Comcast Corporation’s NBCUniversal Peacock has more than 42 million subscribers in the U.S. Also, ViacomCBS Inc.’s Paramount+ has around 36 million subscribers base for its video streaming platform.

REPORT COVERAGE

The research report highlights leading regions to give a better understanding of the industry to the user. In addition, the report examines the technology and provides insights into most recent video on demand market trends. It also highlights some of the market's growth-stimulating and restraining factors.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Revenue Model

By Content Type

By Region

|

Frequently Asked Questions

According to a study by Fortune Business Insights, the market value is projected to reach USD 477.04 billion by 2034.

In 2025, the market value stood at USD 133.44 billion.

The market is projected to record a CAGR of 14.90% over the forecast period.

Based on revenue model, the Subscription Video on Demand (SVoD) segment is likely to lead the market.

The increasing adoption of video streaming and OTT platforms is expected to drive market growth.

Alphabet, Inc., Amazon.com, Inc., Hulu LLC (The Walt Disney Company), AT&T (WarnerMedia, LLC and Discovery, Inc.), Netflix, Inc., and Apple, Inc. are the top players in the market.

North America is expected to hold the largest share in the market.

Based on content type, the movies segment is expected to record the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us