Machine Vision Market Size, Share & Industry Analysis, By Type (1-D Vision System, 2-D Vision System, and 3-D Vision System), By System (PC Based, Smart Camera, and Others), By Scan Systems (Area Scan and Line Scan), By Industry (Semiconductor, Healthcare, Automotive, Manufacturing, and Others), and Regional Forecast, 2026–2034

Machine Vision Market Size

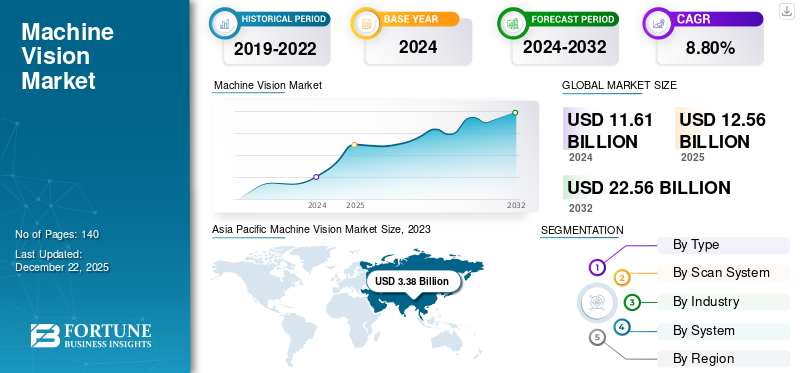

The global machine vision market size was valued at USD 12.56 billion in 2025 and is projected to grow from USD 13.61 billion in 2026 to USD 26.88 billion by 2034, registering a CAGR of 8.90% over the forecast period. Asia Pacific dominated the machine vision market with a market share of 32.10% in 2025.

Machine Vision (MV) systems are the modern components that essentially revolutionize the digital system interaction with the real world. They allow automated systems to identify components, products, patterns, and other objects. There are two key criteria of MV systems, i.e., resolution and sensitivity that depend on four major components, which include lighting, camera, processor, and output. Resolution is set up to distinguish between objects. On the other hand, sensitivity makes it possible to find objects in environments with low light or complete darkness. This system has a dominant adoption across the industries such as semiconductors, healthcare, automotive, manufacturing, and others.

Download Free sample to learn more about this report.

The global machine vision market is growing, influenced by technological advancements, such as AI image recognition, and the increasing need for automation. The machine vision system regional growth pattern reflects the adoption and investment in vision technology, with each region contributing at its unique levels to the global market landscape.

The COVID-19 pandemic caused a significant decline for manufacturers and consumers due to halted operations for several months as a result of the lockdown. However, a steady increase in demand for the implementation of techniques in the healthcare industry was also witnessed, such as camera-based vision systems that aided hospital administration in tracking patients. The government is enticing businesses to unlock their potential by amplifying demand as businesses invest heavily in digital transformation, which expands the machine vision market growth during the forecast period.

Machine Vision Market Trends

Demand for 3D Imaging and AI Robotic Vision in Manufacturing Are Accelerating Market Growth

Technology and application base are involved in the more obvious technological trends. Robotics that are guided by 3D vision cameras and AI algorithms are the technology and significant application. The continued advancement of 3D imaging system capabilities is paving the way for the growth of vision-guided AI robotics solutions across a wide range of industrial markets. The most notable development has been the emergence of standard solutions that combine 3D imaging technology, cutting-edge AI software, a robot, and related components in integrated systems. These advancements demand an integration of vision systems for part handling, robotic guidance, and even random object pick and place tasks, making industrial and logistic operations easier for collaborative robots. Thus, increased productivity by eliminating human error upto 26% and improved product quality/reducing defects by 28% are significant benefits supporting the trend in the long term.

- For instance, in September 2022, Basler announced its camera kits with 5 and 13 MP to support NVIDIA Jetson OrinTM Nano system-on-modules (SOMs), which have raised the bar for entry-level edge Artificial Intelligence (AI) and robotics.

Machine Vision Market Growth Factors

Increasing Demand for Quality Inspection & Automation to Bolster Market Growth

The market is probably going to be driven by the increasing demand for quality inspection & automation across various industrial sectors. Vision systems in the industry allow robotics and inspection devices to capture real-time images at complex and stringent places, which improves productivity and the ability to watch, examine, and scrutinize. The automation system, including a logic computer, analyzes these data after it has been captured and produces the desired output. Any MV system's efficacy depends on its sensitivity and vision, which delivers high-resolution images in low light or invisible wavelength by precisely identifying objects. These factors drive modern vision technology demand for quality inspection and implementation across industrial robotics and automotive technologies, significantly boosting machine vision market share across all regions globally.

- For instance, in September 2022, Teledyne, a prominent vision technology provider, introduced an e2v turnkey optical module 2-megapixel Optimom that can be "instantly" integrated into embedded-vision systems. It has a compact board, an FPC connector that is widely used in the industry, an integrated low-noise global shutter image sensor from Teledyne e2v, and supplemental lenses.

RESTRAINING FACTORS

Upfront Costs and Complexity are Obstructions to Market Growth

Most companies are using machine vision systems to transform conventional engineering through digital transformation. However, MV systems are using it in some or limited ways owing to the high upfront cost for the installation and the ease of operations, which minimizes investment for new machines in the short term. Additionally, growing maintenance costs by varied parts integration and complexity in replacement are minor obstructions to market growth.

Machine Vision Market Segmentation Analysis

By Type Analysis

Use of 2-D Vision Systems in Cameras for Capturing Object Images to Dominate Market Segment

Based on type, the market is divided into 1-D vision system, 2-D vision system, and 3-D vision systems.

The 2-D vision system segment accounting for 42.32% of the global market share in 2026 owing to its usage of a digital camera to capture images of the object for efficient details mapping on the 2D X-Y axis. These 2-D systems were traditionally employed for barcode reading, printing verification, and label orientation. This segment dominated the market with a major share of 43% in 2024.

3D vision systems use multiple camera systems, which allows them to accurately and fully capture the product's orientation and dimensions for efficient operation. Consequently, these systems use multiple cameras fixed to various locations to determine the product's objective position in three dimensions.

Furthermore, 1D vision systems typically classify flaws in goods produced using a cycle or continuous process, such as metals, paper, and plastics, along with other sheet or rolled goods.

By Scan System Analysis

Growing Use of Area Scan Systems for Object Identification in Inspection Systems to Bolster Market

The scan system category is classified into two major components, including area scan systems and line scan systems.

Area scan systems are dominating the segment with hefty usage in inspection systems for efficient object identification and commercial logistic operations. Area scan takes a single frame using a rectangular sensor, which is used for scanning objects and delivering 2D image mapping with the same size. Additionally, it is used for three-dimensional mapping of objects using 3D vision systems. This segment is likely to record a substantial CAGR of 10% during the forecast period (2025-2032).

The Line Scan segment dominated by product type, holding 53.93% of the market share in 2026. A line system camera uses pixels to build images suited for taking images of inline items of irregular sizes. Line system has a steady demand for barcode and QR code scanning systems in the e-commerce and retail segment, further supporting demand for machine vision systems in the short term. The segment is poised to grow with a share of 54% in 2025.

By Industry Analysis

MV System Advancement in Semiconductor Industry’s Components to Amplify Market Growth

The industry is classified into semiconductor, healthcare, automotive, manufacturing, and others (retail, banking, etc.).

The Semiconductor end-use segment captured 35.19% of the global market share in 2026. The semiconductor industry is poised to exhibit the highest CAGR, acquiring the largest market share during the forecast period owing to the expanding need to automate high-quality inspection tasks in the electronics and semiconductor space. Also, advancements in machine vision electronics semiconductor chipsets for better image processing and robotic object tracking have further extended the potential of MV systems in the semiconductor industry. This segment is expected to hold 35% of the market share in 2025.

MV systems are heavily implemented in advanced automotive driving systems to help provide real-time vehicle information and smart features for advanced vehicle controlling, which will significantly drive demand across automotive industries in the long term. Additionally, product features, such as ADAS and Lane detection, have helped the market boost MV system market potential in untapped markets such as India, Africa, Brazil, and the Middle East. This segment is forecasted to display a CAGR of 9% during the forecast period (2025-2032).

Healthcare, including manufacturing & others such as banking, food & beverage, retail, solar panel, agriculture, security & surveillance, and rubber and plastic processing, are also predicted to develop at a substantial CAGR in the coming years.

By System Analysis

PC Based Industry to Remain at the Forefront On the Account of MV Systems Application in Production Lines

By system, the market is segregated into PC based, smart camera, and others (Compact, etc.).

PC based machine vision systems are the most popular category, acquiring the highest market share in the market outlook. The dominance is due to its increasing usage in the production lines for optimal identification of the product quality and packaging lines. In these systems, cameras are fixed above the assembly line, depending on the system, to detect and scan products and collect data.

Furthermore, smart camera systems are witnessed to grow at a significant rate due to the expanding use of cameras in 3D sensing and imaging. This growing adoption is anticipated to increase the industry's use of these cameras and their optimal use in product design and appearance. Other systems in the segment will receive subsequent growth as the growing integration of this system into application-specific needs.

- The PC-based segment accounted for 52.09% of the market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The global market covers region that include North America, Europe, Asia Pacific, Middle East and Africa, and South America.

Asia Pacific

Asia Pacific is likely to gain USD 4.03 Billion in 2025. The region is anticipated to grow with the highest CAGR of 10% during the forecast period (2025-2032), acquiring the largest market share owing to its dominant demand for autonomous vehicle vision systems. The MV system in autonomous vehicles allows users to control vehicles with advanced intelligent systems, such as the Advance Driver Assistance System (ADAS). Furthermore, growing semiconductor usage in advanced vehicle vision systems and other intelligent electronic components drives the demand across countries such as China, Japan, India, and other Asia Pacific regions. The China market is expected to reach USD 1.13 billion. The Japan market is projected to reach USD 0.95 billion, and India is expected to reach USD 0.71 billion by 2026.

Asia Pacific Machine Vision Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

China will showcase the highest growth because of its competitive edge over other countries in the Asia Pacific region. The dominance is owed to its strong industrial manufacturing presence and heavy investments in technological advancements. All these factors act as drivers for the MV systems market in the U.S. Furthermore, growing foreign investments in manufacturing advancements across Japan, India, South Korea, and other Asia Pacific countries drive MV system demand in the long term.

North America

North America dominated the market with a valuation of USD 3.40 Billion in 2024 and USD 3.67 Billion in 2024. North America machine vision market is a prominent sizable market that is expected to grow steadily over the forecast period as a result of automation's early adoption in manufacturing. Furthermore, the presence of ample vendors counts with regional roots. Additionally, the dominance of the semiconductor sector for advance semiconductor chipsets in MV systems is influenced by this region. All these factors encompass the market size during the forecast period. The U.S. market is expected to reach USD 2.04 billion by 2026.

Europe

Europe is the third largest market anticipated to be valued at USD 2.81 Billion in 2025. Meanwhile, Europe will witness substantial growth in the forthcoming years attributed to the impressive developments in automation and technology that are essential to MV systems. The UK market is expected to reach USD 0.66 billion, while Germany is projected to reach USD 0.57 billion by 2026.

MEA

MEA region is progressively moving from the oil & gas sector to other services & manufacturing sectors. Thus, there is scope for increasing investments in the process and manufacturing industries in the region, thus increasing the demand for MV systems in the long term. The GCC market is projected to hold USD 0.17 Billion in 2025.

Latin America

The market in Latin America is predicted to experience steady growth, mostly owing to the convenience of smart cameras.

South America

South America is the fourth leading region poised to be worth USD 1.14 Billion in 2025. Some of the industries driving the MV market in South America are automotive, pharmaceutical & health care, processing & packaging, and electronics.

KEY INDUSTRY PLAYERS

Emphasis on MV System Innovation Will Extend Key Players Market Potential

Market players are constantly expanding their reach with heavy investments in technological advancements and product innovation. Prominent players in the market hold 58-66% of the market share owing to their specialization in MV systems used for autonomous vehicles. Also, prominent players, such as Omron, Panasonic, and Toshiba, are offering MV systems to perform character inspections, appearance inspections, defect inspections, and positioning inspections. These product offerings and emphasis on technological integration will extend product potential, significantly growing machine vision market share for the pro-long period.

List of Top Machine Vision Companies:

- Cognex Corporation (U.S.)

- Basler AG (Germany)

- Omron Corporation (Japan)

- Keyence Corporation (Japan)

- National Instruments (U.S.)

- Sony Corporation (Japan)

- Teledyne Technologies (U.S.)

- Texas Instruments (U.S.)

- Intel Corporation (U.S.)

- ViDi Systems SA (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: Kayence, a leading machine system and component manufacturer, launched its all-in-one 3D inspection system, the 3D laser snapshot sensor LJ-S8000 series, with a building scanning mechanism. It has versatile applications in 3D dimensional measurement, 3D appearance inspection, and 3D identification and differentiation.

- June 2024: Kayence, a prominent vision system and component manufacturer, announced the launch of a radar-level sensor that offers a measurement range of 15m and an accuracy of 1mm. It is a non-contact sensor used in liquid and powder process lines unaffected by built-up, ripples, foam, and others.

- May 2024: Kayence launched a portable handheld 3D probing and scanning system-wide area CMM WM 6000 that features a non-contact probe for laser scanning. The advanced probe allows users easy portability and scanning with high precision in complex conditions.

- March 2024: Cognex, a prominent industrial MV System supplier, extended its product portfolio with a modern vision tunnel featuring a DataMan 380 barcode reader. The 380 modular vision offers high throughput and traceability with a 380 barcode reader and robust system architecture.

- Jan 2024: CGI Inc., a prominent Vision technology solution provider, launched CGI Machine Vision, developed by CGI AI experts that uses deep neural network AI technologies that extract data from Internet of Things (IoT) sensors. The solutions enable business users to improve processes, increase efficiencies, and reduce costs by business intelligence.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Scan System

By Industry

By System

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market size was valued at USD 12.56 billion in 2025 and is projected to grow from USD 13.61 billion in 2026 to USD 26.88 billion by 2034

In 2025, the market was valued at USD 12.56 Billion.

The market is projected to record a CAGR of 8.90% during the forecast period.

PC based segment is leading the market, acquiring the largest share.

Increasing demand for quality inspection & automation to bolster market growth.

Cognex Corporation, Basler AG, Omron Corporation, Keyence, National Instruments, and Sony Corporation are the key market players.

Asia Pacific dominated the global market with its competitive advantage and integration of vision system automation in manufacturing.

The semiconductor industry is forecasted to grow with the highest CAGR owing to its advancements in image processing and automation.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us