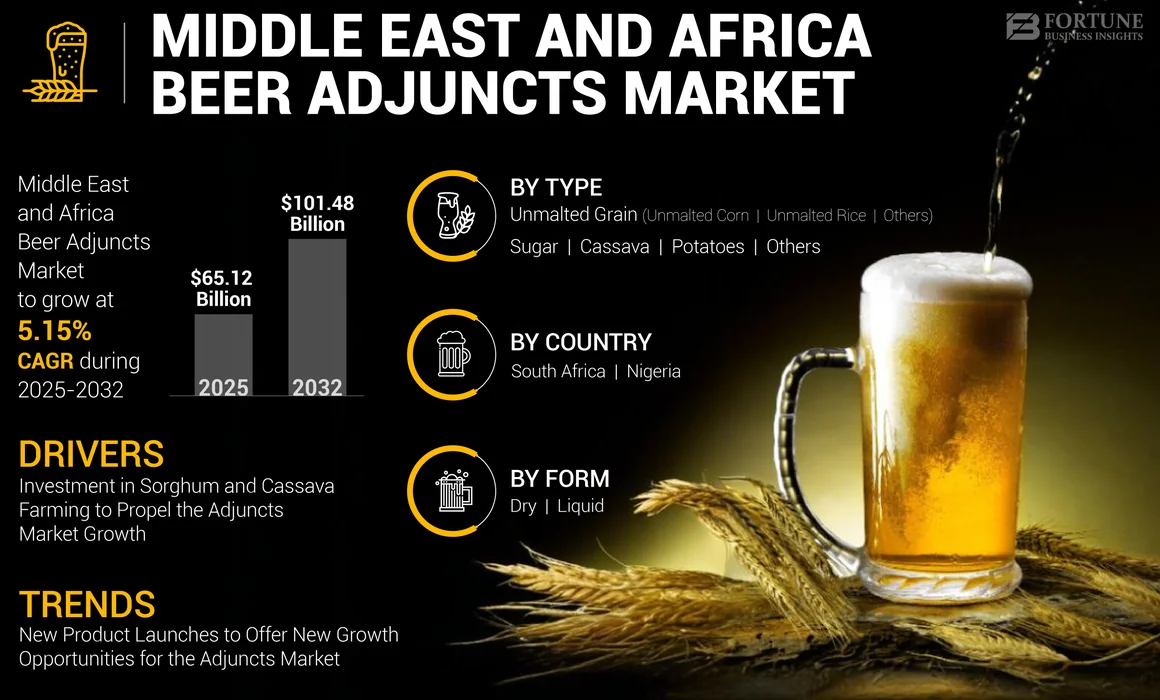

Middle East and Africa Beer Adjuncts Market Size, Share & COVID-19 Impact Analysis, By Type (Unmalted Grain [Unmalted Corn, Unmalted Rice, Others], Sugar, Cassava, Potatoes and Others), By Form (Dry, Liquid) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

Middle East and Africa is projected to grow at a CAGR of 5.15% during the forecast period. The global market for beer adjuncts is projected to grow from USD 65.12 billion in 2025 to USD 101.48 billion by 2032.

Adjuncts are unmalted grains such as corn, rice, rye, oats, barley, sugars, and wheat used in beer-making to supplement the main mash ingredient, malted barley. These adjuncts help enhance beer's characteristics and reduce the overall production cost. The growing demand for flavored and craft beers help propel the demand for such adjuncts.

Our report on the Middle East and Africa Beer Adjuncts market covers the following countries South Africa and Nigeria.

LATEST TRENDS

New Product Launches to Offer New Growth Opportunities for the Adjuncts Market

Beer drinking is an integral part of South African culture. The rising beer popularity in the region is shifting consumers to demand flavored beers. Therefore, the players in the region are on developing products with new adjuncts and flavors in order to meet the increasing demand.

- For instance, in June 2022, Delta Corporation Ltd, an African brewing company, launched a new beer with a banana flavor under its brand Chibuku. The new product is a banana-flavored version of sorghum beer.

DRIVING FACTORS

Investment in Sorghum and Cassava Farming to Propel the Adjuncts Market Growth

Sorghum is a particularly essential crop in Nigeria and the African region. In South Africa, barley production is very low due to tropical climatic conditions. Therefore, crops such as sorghum, rice, cassava, and maize thrive in the beer adjuncts market in these regions. Furthermore, several market players are adopting strategies to increase the sorghum production capacity, propelling the beer adjunct market in Nigeria.

- For instance, in November 2021, Nigerian Breweries (NB) Plc, a Nigeria-based brewing company, invested USD 189.5 million in sorghum and cassava cultivation. The company directly purchased commercial and smallholder farming in Nigeria to increase the production of sorghum and cassava, fueling the demand for beer adjuncts in the country.

RESTRAINING FACTORS

Local Sourcing and Quality Discrepancies to Limit the Market Growth

The brewers in the region are focused on sourcing local ingredients to manufacture beers and other alcoholic beverages. The brewers use cheap, locally sourced grains such as corn, sorghum, and rice to

replace expensive barley malt owing to trade restrictions and currency conversion rates. These factors may impose several technical challenges in maintaining the quality of the product. Furthermore, using unmalted grains may affect the product's functionality, impeding the market's growth.

KEY INDUSTRY PLAYERS

In terms of the competitive landscape, South African Breweries, Heineken South Africa, and Anheuser-Busch InBev SA/NV are the key players in the Middle East and Africa market, owing to new product launches and extensive product portfolio, which help them gain a competitive advantage and enter new markets.

Other prominent players, such as Nigeria Breweries Plc. and Guinness Nigeria Plc., are also leading the market due to their strong distribution network and diverse beer portfolios. Some of the other major players are Diageo Plc., Golden Breweries, and others. These companies are focused on local sourcing of raw materials, empowerment initiatives of local communities, and increasing their market share in the Middle East and Africa markets.

LIST OF KEY COMPANIES PROFILED:

- South African Breweries (South Africa)

- Heineken N.V. (Netherlands)

- Anheuser-Busch InBev SA/NV (Belgium)

- Nigeria Breweries Plc. (Nigeria)

- Consolidated Breweries Limited (Nigeria)

- Guinness Nigeria Plc. (Nigeria)

- Golden Breweries (Nigeria)

- Diageo Plc. (U.K.)

- Carling Brewing Company (Canada)

- Pernod Ricard (France)

KEY INDUSTRY DEVELOPMENTS:

- July 2022: Diageo Plc., a British multinational alcoholic beverage company, announced to sell of Guinness Cameroon S.A, its brewery in Cameroon, to Castel Group, a French beverage company. The Castel Group invested USD 468 million, and the agreement would provide a robust platform for Guinness's expansion in both production and distribution due to the company’s five brewing sites and national distribution network.

- February 2022: Royal Swinkels Family Brewers, a manufacturer of beer, soft drinks, and malt beverages under the brand Bavaria, launched Bavaria 0.0% beer and Bavaria 0.0% IPA in the South African market.

- August 2021: South African Breweries, a major brewery in South Africa, launched its country’s first double malt beer, dubbed Castle Double Malt. The new range comprises Castle Lager, Castle alcohol-free Lager, Castle Lite, and Castle Milk Stout.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The Middle East and Africa Beer Adjuncts market report provides qualitative and quantitative insights on the market and a detailed analysis of the Middle East and Africa market size & growth rate for all possible segments in the market. Along with the Middle East and Africa Beer Adjuncts market forecast, the research report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are overview of the number of procedures, an overview of price analysis of types of products, overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships and, the impact of COVID-19 on the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.15% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

Type; Form; and Country |

|

By Type |

|

|

By Form |

|

|

By Country |

|

Frequently Asked Questions

At what CAGR is the Middle East and Africa Beer Adjuncts market projected to grow over the forecast period (2025-2032)?

Investment in sorghum and cassava farming, coupled with new product launches, are the major factors driving the growth of the market.

South African Breweries, Heineken South Africa and Anheuser-Busch InBev SA/NV are the major market players in the Middle East and Africa markets.

South Africa dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us