U.S. Non-Alcoholic Beverages Market Size, Share & Industry Analysis, By Type (Fruits & Vegetable Juice, RTD Coffee, RTD Tea, Functional Drinks, Flavored Water, Coffee, Tea, Smoothies, and Others), By Distribution Channel (Food Service and Retail [Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and Others]), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

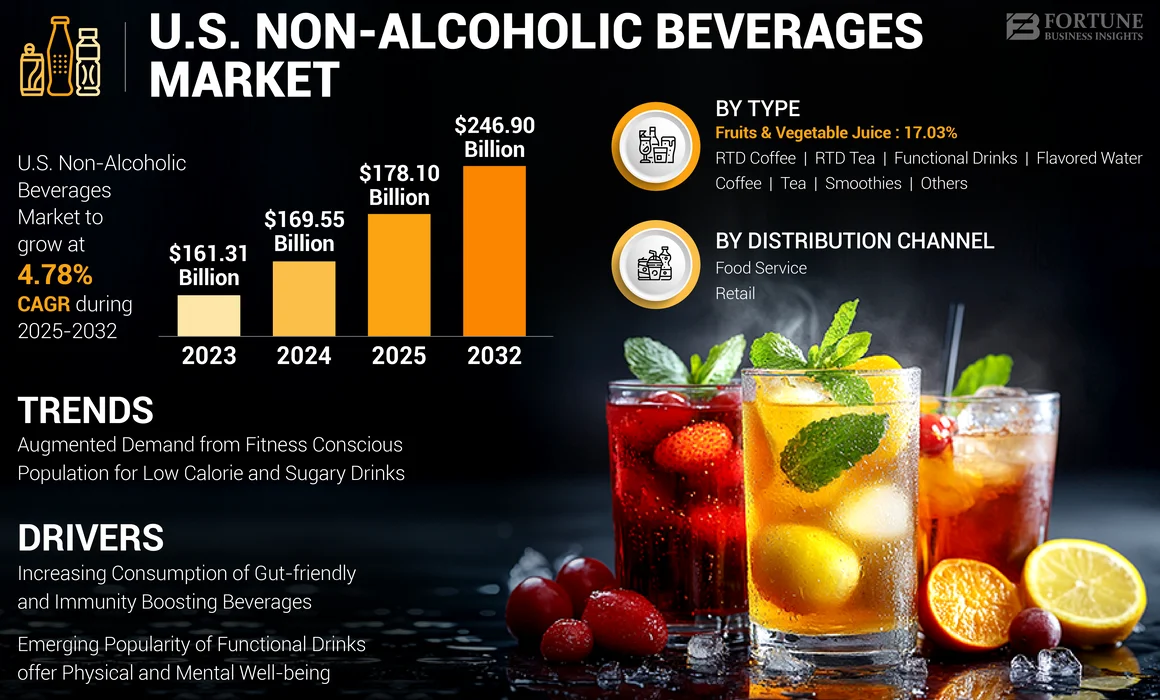

The U.S. non-alcoholic beverages market size was valued at USD 169.55 billion in 2024. The market is projected to grow from USD 178.10 billion in 2025 to USD 246.90 billion by 2032, exhibiting a CAGR of 4.78% during the forecast period of 2025-2032.

Some of the prominent manufacturers in the industry are Starbucks Corporation, Dutch Bros Inc., Black Rifle Coffee Company, Joe & The Juice, and Dunkin. Beverage products include fruit juices, coffee, tea, functional beverages, smoothies, and other non-alcoholic beverages such as wine that are widely consumed by customers across the world, including the U.S. The increasing consumers' preference for convenient, less-calorie, and reduced-sugar RTD beverage products will propel the market expansion during the forecast period. An increasing number of food service centers such as coffee chains, bakery industries, and popular restaurants offer a wide variety of nonalcoholic drinks as per consumer choices. The trending concept of “customization” is also projected to boost the sales of non-alcoholic beverages in the upcoming years. Moreover, strong collaboration and mergers among U.S.-based companies are expanding production capabilities and market across, further contributing to the U.S. non-alcoholic beverages market.

U.S. Non-Alcoholic Beverages Market Overview

Market Size & Forecast:

- 2024 Market Size: USD 169.55 billion

- 2025 Market Size: USD 178.10 billion

- 2032 Forecast Market Size: USD 246.90 billion

- CAGR: 4.78% from 2025–2032

Market Share:

- The U.S. non-alcoholic beverages market is segmented by type into fruits & vegetable juice, RTD coffee, RTD tea, functional drinks, flavored water, coffee, tea, smoothies, and others, and by distribution channel into food service and retail. In 2023, coffee held the largest market share, driven by its daily consumption and innovation in premium offerings. The retail segment dominated distribution due to wide availability and accessibility through supermarkets, convenience stores, and online platforms.

Key Country Highlights:

- United States: Market growth is driven by increasing demand for gut-friendly, immunity-boosting, and functional beverages, as well as rising health consciousness and preference for low-calorie drinks. The trend toward sustainable packaging and product innovation is further supported by major players like Coca-Cola and Starbucks. Challenges such as sugar taxation and food adulteration persist but are counterbalanced by emerging opportunities in probiotic smoothies, nootropic drinks, and sustainable packaging solutions.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Consumption of Gut-friendly and Immunity Boosting Beverages to Propel Product Demand

Consumer focus on health-improving products is increasing, driven by rising awareness about the importance of digestive health in improving immunity and overall well-being. Therefore, gut health-boosting products have emerged as the latest options driving the demand for functional beverage trends across the U.S. market.

With this trend becoming more mainstream, consumers are willing to try different flavors under the gut health-promoting products such as smoothies. This shift is compelling industry players to develop and introduce new products enriched with active prebiotic and probiotic ingredients in the U.S. market. Such innovations will drive market growth in the upcoming years. For instance, in January 2025, Lifeway Foods, a U.S.-based fermented and probiotic product manufacturer, expanded its product range by launching its new functional beverages - Probiotic Smoothie + Collagen. The newly launched product is available in Matcha Latte, Berry Blast, Tropical Fruit, and Plain and contains 5 grams of collagen in each serving.

Download Free sample to learn more about this report.

Emerging Popularity of Functional Drinks offering Physical and Mental Well-being Drives Market Growth

Health and wellness continue to be a key focus in the beverage industry, with the COVID-19 pandemic accelerating this trend. Thus, there is a rising demand for food and beverages fortified with functional ingredients such as vitamins, minerals and proteins that support both physical and mental health. This shift is likely to drive the demand for nootropic drinks in the upcoming years. Since the outbreak of the COVID-19 virus, consumers have placed more priority on food & beverage products that contain health-boosting ingredients beyond basic nutrition. According to the 2022 consumer survey by Kerry Group Plc., a multinational ingredients manufacturer, which gathered responses from more than 10,000 consumers across 18 different countries, nearly 86% of consumers are willing to buy functional beverages that support additional health benefits, whereas more than 44% of consumers prefers to purchase immunity-boosting products.

MARKET RESTRAINTS

High-Added Sugar and Tax Rates to Impede Industry Growth

The United States market is observing a rapid increase in consumption of ready-to-drink beverages due to factors such as convenience, taste, and availability of a wide variety of flavored products. However, increasing health and wellness awareness among consumers is limiting the consumption of sugary and carbonated soft drinks. High sugar levels in beverages lead to obesity and other health problems, prompting consumers to reduce their consumption of non-alcoholic drinks, which can impede the growth of the industry in the upcoming year.

Additionally, as sugar-sweetened packaged drinks are associated with digestive diseases, leading government regulatory authorities impose higher taxation on these products to promote public health. Taxes may highly impact the consumption of sugar-sweetened RTD beverages. Regional governments follow different tax rates to regulate the high usage of artificial sweeteners in preparing ready-to-drink beverage products. This factor negatively impacts the company's pricing strategy and revenue generation, which may slow down the U.S. non-alcoholic beverages market growth.

MARKET CHALLENGES

Increasing Fraud and Adulteration to Create Challenges for Key Players

Food fraud, adulteration, and the usage of hazardous chemical additives in ready-to-drink beverages presents key challenges. Increasing incidents of such activities have led to a wrong perception of the products, which may negatively impact the industry's growth in the upcoming years. For instance, in December 2020, the Food and Drug Administration (FDA) accused a Washington-based fruit juice company of using heavy toxic metals in the preparation of products. These contaminated beverages were distributed through multiple channels, including three million servings per year supplied to children via the national lunch program. Other allegations include unsanitary facilities affected with rodents and birds, dead and alive, as well as their feces.

MARKET OPPORTUNITIES

Sustainable Packaging Solutions to Push Industry Growth to New Heights

Growing concerns regarding environmental sustainability among consumers are one of the crucial factors influencing the industry’s growth. Since consumers are committed to reducing carbon landfills, industry pioneers are reframing their commitments toward sustainability. This shift is bringing gradual changes across different beverage industry sectors, including the non-alcoholic RTD beverages segment. Companies are turning to alternative and recyclable packaging options to shrink their carbon footprint and support the development of a plastic-free environment.

Leading global brands are adopting strategies to rebrand their existing products with recyclable materials and focusing on reducing plastic usage in their packaging. For instance, in 2022, the Coca Cola Company announced its aim to have at least 25% of all its beverage products sold in refillable/returnable glass or plastic bottles globally. This growing focus on developing sustainable packaging is likely to drive the market growth.

U.S. Non-alcoholic Beverages Market Trends

Augmented Demand from Fitness Conscious Population for Low Calorie and Sugary Drinks Boosts Product Demand

Sugar-sweetened beverages remain a top public health concern, as numerous studies have showcased that they are associated with a variety of health ailments. As a result, individuals are shifting toward minimally processed, low-calorie drinks that provide several health benefits. Moreover, as consumers become more concerned about their physical fitness and health, food and beverage manufacturers are putting their best efforts to maximize the opportunity to develop health alternatives. For instance, in October 2024, REBBL, one of the emerging RTD beverage companies, launched its 26g Protein Shakes. This non-GMO certified product is made from plant-based natural ingredients, contains only 4g of sugar, and has no added artificial flavors. The rise of low-calorie, reduced-sugar, and sugar-free beverage innovations is likely to shape the U.S. non-alcoholic beverages industry on the global space.

Download Free sample to learn more about this report.

Impact of COVID-19

During the COVID-19 crisis, industry players experienced numerous challenges in managing sustainable business operations. Several international players, such as Starbucks, Black Rifle Coffee Company, and Dunkin, experienced operational difficulties in their sites, such as fluctuating demand, staffing shortages, and supply chain disruptions.

Health awareness among consumers increased during the pandemic period, leading to shifts in consumers' purchasing behavior. Increasing new product launches and the availability of a wide range of natural fortified beverages are contributing to the market growth. In response, companies began developing innovative products to meet evolving consumer needs. For instance, in April 2020, Javalution Coffee Company, a U.S.-based coffee company, launched four JavaFit cold coffee drinks formulated with functional ingredients designed to boost immunity, improve mental clarity, and suppress appetites.

SEGMENTATION ANALYSIS

By Type

Consumer Inclination toward Coffee has led to RTD Coffee Segment’s Prominence

Based on type, the market is segmented into fruits & vegetable juice, RTD coffee, RTD tea, functional drinks, flavored water, coffee, tea, smoothies, and others. The others segment includes energy drinks and sports drinks. The coffee segment held a major market share in 2023. In the U.S., coffee is among the most widely consumed beverages, with many Americans considering it a daily staple. Key players in the market are providing consumers with healthy, fresh, innovative, and premium coffee options. For instance, in October 2022, Starbucks Coffee Company opened a new Starbucks Reserve store in New York City, which offers exclusive, interactive coffee workshops, coffee-inspired cocktails, and premium food options for consumers. Such innovations will surge the demand for non-alcoholic beverages in the country.

Smoothies are exhibiting the fastest growth rate during the foreseeing period. Smoothies contain rich nutrients and assist consumers in achieving their fitness goals. Additionally, smoothies are becoming a popular dietary choice, helping individuals incorporate more fruits and vegetables into their diet. The inclusion of smoothies in daily routine can improve health by reducing the risk of diet-related illnesses. Furthermore, increasing new product launches to meet growing consumer demand is likely to propel the segment growth in the upcoming years.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel

Wider Availability and Easy Accessibility Allowed Retail Channels to hold Dominance

Based on distribution channel, the market is bifurcated into food service and retail. The retail segment is sub-categorized into supermarkets/hypermarkets, convenience stores, specialty stores, online retail stores, and others. The retail segment secures the dominant position in the market, generating the maximum revenue. The U.S. has one of the largest retail markets globally and is anticipated to grow at a higher pace in the near term. The industry growth is influenced by numerous factors, such as the evolving number of retail stores and rapid changes in consumer buying patterns. Moreover, the easy penetration of international brands into the U.S. market, and the wide availability of different product categories, such as fruit & vegetable juices, coffee, tea, and functional beverages, creates enormous opportunities for market expansion.

The food service segment is anticipated to experience the fastest growth during the forecast period. The growing trend of dine-out and the increasing presence of food service institutions in the U.S. contribute to the market’s growth. Additionally, the rising number of expatriates and the rising dual income households encourage consumers to experiment with new cuisines, further boosting market revenue.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focusing On Mergers and Acquisitions to Expand Their Market Presence

The U.S. non-alcoholic beverages market is highly fragmented, with a mix of international and regional players competing for market share. Starbucks Corporation, Dutch Bros Inc., Black Rifle Coffee Company, Joe and The Juice and Dunkin (Inspire Brands) hold prominent positions in the market, accounting for 16.74% of the U.S. non-alcoholic beverages market share. These market players have strong market recognition owing to their extensive product offerings, wide presence, and strong brand image. The key players in the industry are highly adopting new product launches and base expansion strategies to strengthen their market presence. Additionally, companies are adopting strategic partnerships and funding initiatives to drive growth and strengthen their competitive edge.

Major Players in the U.S. Non-alcoholic Beverages Market

To know how our report can help streamline your business, Speak to Analyst

LIST OF KEY U.S. NON-ALCOHOLIC BEVERAGES COMPANIES PROFILED

- Black Rifle Coffee Company (U.S.)

- Chamberlain Coffee Inc. (U.S.)

- DAVIDs TEA (Canada)

- Dunkin (U.S.)

- Dutch Bros Inc. (U.S.)

- HTeaO Franchising, LLP. (U.S.)

- Jamba Inc. (U.S.)

- Joe and The Juice (Denmark)

- Starbucks Corporation (U.S.)

- Stumptown Coffee Roasters (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2024: Suja Organic, an emerging RTD beverage company, launched its new line of plant-based protein shakes. The new product features 16 grams of protein derived from pea, rice, and hemp proteins and a dairy-free formulation utilizing almond milk and coconut cream. It is available in chocolate, vanilla cinnamon, and coffee bean flavors.

- July 2023: Keurig Dr Pepper, a leading global beverage company, entered into a strategic partnership with La Colombe, a cold brew coffee brand. Keurig invested nearly USD 300 million to purchase a 33% equity stake in La Colombe. This acquisition would help the company to expand its product range and geographical presence.

- March 2023: Ready, a U.S.-based sports nutrition company, introduced a new line of a light version of its Ready Sports Drink, containing no added sugars. These products are designed to optimize hydration replenishment and energy production. Moreover, it is produced from a blend of super fruits. It is widely available in four flavors: Classic lemonade, mango lemonade, strawberry lemonade, and watermelon lemonade.

- January 2023: Perricone Juice, a prominent premium and craft juice brand, entered into a partnership with Trivest Partners LP, a private equity firm known for creating strong strategic alliances. The partnership helped Perricone Juice’s business growth and operational expansions, strengthening its ability to serve its customers across the U.S. market.

- June 2022: Smoothie King, a U.S.-based company, launched a new line of gut health smoothies that includes prebiotics, fiber, and 40 billion colony-forming units of probiotics. The new smoothies will be available in three flavor choices: Greek yogurt strawberry blueberry, pineapple mango, and papaya mango ginger.

INVESTMENT ANALYSIS AND OPPORTUNITIES:

With the rapidly increasing demand for non-alcoholic RTD beverages, industry pioneers are expanding their production capacity to fulfill the growing demand for ready-to-drink beverages across the U.S. This expansion is likely to propel industry growth in the upcoming years. For instance, in August 2024, Westrock Coffee Co., one of the leading RTD coffee companies, opened its new roast-to-RTD coffee manufacturing plant in Conway, Arkansas. According to the company, the 570,000-square-foot facility, spanning 45 acres, is now the largest roast-to-ready-to-drink (RTD) manufacturing facility in North America. This production facility will enhance Westrock Coffee’s RTD coffee production capacity in the coming years.

Additionally, industry players are shifting toward recyclable packaging solutions. Several stakeholders in the RTD beverage supply chain are actively developing sustainable and recyclable packaging solutions for RTD beverage solutions, supporting market expansion. For instance, in February 2023, ProAmpac, one of the leaders in flexible packaging and material science, announced the launch of “ProActive Recyclable Paper-1000.” The newly developed packaging material is heat-sealable, offers a strong moisture barrier and strong tear properties.

REPORT COVERAGE

The report offers quantitative and qualitative insights into the market through different research methodologies. This includes a market forecast along with a detailed regional analysis, market analysis, market trends and dynamics. The report also offers a comprehensive outlook on market segments, growth rates, and key insights. Additionally, it covers related markets, the competitive landscape, recent industry developments, regulatory scenarios in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.78% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market size was valued at USD 149.62 billion in 2022 and is projected to reach USD 225.62 billion by 2030.

Recording a CAGR of 4.91%, the market will exhibit robust growth during the forecast period of 2019-2030.

The coffee segment is expected to hold a significant market share during the forecast period.

Rising demand for nutritious and functional drinks and growing familiarity with specialty coffee are the key driving factors of the U.S. market.

PepsiCo, Inc., Keurig Dr. Pepper Inc., The Coca-Cola Company, and Starbucks Corporation are some of the top players in the market.

The retail segment is expected to hold a dominant share in the U.S. market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us