Anionic Polyacrylamide Market Size, Share & Industry Analysis, By End-Use Industry (Water Treatment, Oil & Gas, Pulp & Paper, Mining, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

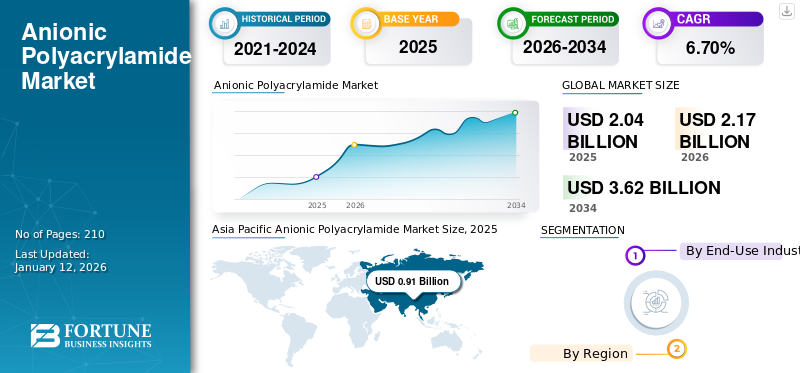

The global anionic polyacrylamide market size was USD 2.04 billion in 2025. The market is projected to grow from USD 2.17 billion in 2026 to USD 3.62 billion by 2034 at a CAGR of 6.70% during the forecast period. Asia Pacific dominated the anionic polyacrylamide market with a market share of 45% in 2025.

Anionic polyacrylamide (APAM) is a water-soluble synthetic polymer primarily used as a flocculant in industrial and municipal wastewater treatment processes. Characterized by negatively charged functional groups, APAM enhances solid-liquid separation by aggregating suspended particles into larger flocs for easier removal. Its applications span across mining, paper manufacturing, oil recovery, and agriculture, where it improves water efficiency and process productivity.

A major factor driving demand for anionic polyacrylamide is the tightening of global environmental regulations, particularly those governing industrial effluents. As regulatory scrutiny intensifies, industries are compelled to invest in efficient and cost-effective water treatment solutions, making APAM a vital component in compliance strategies and sustainability initiatives across both developed and emerging economies. SNF, Solenis, Kemira, and Anhui Jucheng Fine Chemicals Co., Ltd are the key players operating in the market.

Global Anionic Polyacrylamide Market Key Takeaways

Market Size & Forecast

- 2025 Market Size: USD 2.04 billion

- 2026 Market Size: USD 2.17 billion

- 2034 Forecast Market Size: USD 3.62 billion

- CAGR: 6.70% from 2026–2034

Market Share

- Asia Pacific held the largest share of 45% in 2025, driven by rapid industrial expansion, water scarcity concerns, and significant investments in municipal and industrial wastewater treatment infrastructure.

- By end-use industry, water treatment is expected to dominate, supported by stringent environmental regulations and increased adoption of advanced flocculants to improve solid-liquid separation efficiency.

Key Country Highlights

- China: Growth supported by extensive industrial activity, large-scale mining operations, and national policies aimed at improving wastewater treatment and reducing environmental pollution.

- India: Increased urbanization and government-led initiatives for wastewater management, along with expanding chemical, textile, and paper industries, are accelerating APAM adoption.

- United States: Strong demand from shale gas extraction, enhanced oil recovery, and highly regulated municipal wastewater treatment systems.

- Europe: Adoption driven by stringent EU environmental policies, the Water Framework Directive, and growing preference for eco-friendly, low-toxicity water treatment polymers.

ANIONIC POLYACRYLAMIDE MARKET TRENDS

Increase in Stricter Compliance Policies is Prompting Wider Anionic Polyacrylamide Adoption

Stringent environmental regulations across the globe are a primary driver of demand for anionic polyacrylamide. Governments and regulatory bodies, particularly in North America, Europe, and increasingly in Asia Pacific, are enforcing strict norms on the discharge of industrial and municipal wastewater. These mandates require industries to implement efficient water treatment solutions to minimize contaminants, suspended solids, and chemical oxygen demand levels before releasing effluents. APAM plays a vital role in achieving compliance due to its high flocculation efficiency and cost-effectiveness. The tightening of pollution controls in sectors such as mining, textiles, and petrochemicals is creating a sustained need for advanced water treatment chemicals, positioning APAM as a critical component in regulatory compliance strategies.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Industrialization and Subsequent Water Treatment Demand in Emerging Economies to Drive Market Growth

Emerging economies, particularly in Asia Pacific, Latin America, and parts of Africa, are undergoing rapid industrialization, which has significantly increased the volume of industrial wastewater generated. Sectors such as chemicals, paper, textiles, and food processing are expanding production capacities to meet rising domestic and export demand. This surge in industrial activity necessitates scalable, efficient wastewater treatment infrastructure to mitigate environmental impact and avoid regulatory penalties. Anionic polyacrylamide, with its superior performance in solid-liquid separation, is increasingly being adopted as a key component in industrial effluent treatment systems. Moreover, government initiatives promoting industrial development are often tied to environmental compliance, further supporting the uptake of APAM in these regions as industries seek reliable, cost-effective solutions for wastewater management. Thus, in turn, benefiting and driving anionic polyacrylamide market growth in tandem.

MARKET RESTRAINTS

Fluctuations in Raw Material Prices Due to Their Correlation with Crude Oil to Hinder Growth

Anionic polyacrylamide production depends on acrylamide monomers derived from petrochemical feedstocks including acrylonitrile. This factor makes the market highly sensitive to fluctuations in crude oil prices and raw material availability. Geopolitical tensions, trade policies, and environmental regulations affecting petrochemical supply chains can further disrupt production costs. Such volatility challenges manufacturers to maintain stable pricing and margins, complicating long-term planning and investment. For end users, particularly in cost-sensitive sectors including municipal water treatment, price unpredictability can deter procurement or shift preference toward lower-cost or alternative flocculants. Overall, raw material price instability remains a key restraint and may limit the scalability and consistent adoption of anionic polyacrylamide, stifling market growth.

MARKET OPPORTUNITIES

Development of Eco-Friendly Green Products to Create New Market Opportunities

An emerging opportunity in the anionic polyacrylamide market is the development of eco-friendly and biodegradable formulations. Conventional APAM, derived from acrylamide, poses environmental and toxicity concerns, prompting a shift toward greener alternatives. Growing regulatory pressure and demand for sustainable solutions are encouraging manufacturers to invest in R&D focused on bio-based or hybrid polymers with lower environmental impact. These innovations aim to reduce residual monomer content, enhance biodegradability, and align with global sustainability goals. By offering safer and more environmentally responsible solutions, companies can meet stricter compliance standards and gain a competitive edge, particularly in environmentally conscious markets such as Europe and North America, where sustainability increasingly influences purchasing decisions across industrial and municipal water treatment sectors.

MARKET CHALLENGES

Evolving Regulatory Policies to Increase R&D and Compliance Cost Hamper Market Growth

Compliance with evolving regulatory standards is a key challenge in the anionic polyacrylamide market. Environmental agencies including the EPA, REACH, and counterparts in Asia are imposing stricter controls on wastewater discharge and chemical usage, particularly concerning residual acrylamide due to its toxicity. This factor compels APAM producers to invest in reformulating products, improving manufacturing practices, and ensuring lower environmental impact. Meeting these regulatory demands increases R&D and compliance costs while potentially delaying product launch. Failure to adhere can result in restricted market access or legal penalties, especially in highly regulated regions. As a result, staying ahead of changing standards is crucial for maintaining competitiveness and ensuring sustainable market participation.

TRADE PROTECTIONISM AND ITS EFFECTS

Imposition of U.S. Tariff War to Prompt Domestic Production Changing Market Dynamics

The introduction of new U.S. tariffs on chemical imports, including key raw materials used in anionic polyacrylamide production, is likely to influence the global market by increasing manufacturing costs for domestic producers. This may reduce the price competitiveness of the U.S., make APAM, and shift sourcing preferences toward lower-cost international suppliers. At the same time, exporters, especially from Asia Pacific, are likely to face trade barriers or logistical delays, leading to potential supply disruptions. These changes could drive end-users to diversify sourcing strategies, explore alternative formulations, or invest in local production capabilities.

SEGMENTATION ANALYSIS

By End-Use Industry

Adoption of Stricter Environmental Regulations Associated with Water Treatment to Prompt Segment Domination

Based on the end-use industry, the anionic polyacrylamide market is divided into water treatment, oil & gas, pulp & paper, mining, and others.

The water treatment segment is anticipated to hold the dominant share during the forecast period. Demand for anionic polyacrylamide in water treatment is largely driven by increasingly strict environmental regulations requiring the effective removal of pollutants from municipal and industrial wastewater. APAM is widely used as a flocculant due to its ability to improve solid-liquid separation and reduce sludge volume. As urbanization grows and freshwater resources become more strained, governments and industries are investing in advanced water treatment systems to ensure compliance and sustainability. APAM's cost-effectiveness and performance make it a critical component in achieving these goals, driving steady growth in both centralized municipal facilities and decentralized industrial treatment systems worldwide.

In the oil and gas industry, APAM plays a key role in enhancing oil recovery and stabilizing drilling fluids. Its ability to increase water viscosity improves sweep efficiency in mature reservoirs, helping extract more crude oil economically.

In mining operations, APAM helps manage solids and maintain fluid integrity, contributing to more efficient and safer extraction processes. As companies seek to maximize production from existing fields and manage operational costs amid fluctuating oil prices, the demand for APAM is likely to continue its growth. Its effectiveness in improving yield and process efficiency makes it a vital chemical in upstream operations globally, driving market growth in tandem.

ANIONIC POLYACRYLAMIDE MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Anionic Polyacrylamide Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the highest market share of 0.98% in 2026. The region is experiencing significant growth in polyacrylamide demand, driven by rapid industrialization, urbanization, and rising water stress. Countries such as China and India are investing heavily in wastewater treatment infrastructure to meet the environmental regulations. In addition to this, extensive mining and oil exploration activities, particularly in China, Australia, and Southeast Asia, are increasing the demand for polyacrylamide-based flocculants. Agriculture also contributes significantly, with APAM used for irrigation efficiency and soil conditioning. Government-led initiatives for sustainable water management and industrial compliance further support long-term demand across municipal and industrial segments.

North America

In North America, demand for polyacrylamide is largely driven by stringent environmental regulations governing industrial wastewater discharge and hydraulic fracturing operations. The U.S. shale gas boom has significantly increased demand for polyacrylamide in enhanced oil recovery and drilling mud treatment. Furthermore, a strong institutional focus on water conservation and reuse supports growth in municipal water treatment. This includes industrial applications in pulp and paper, food processing, and textiles, contributing to steady demand and driving market growth in tandem.

Europe

Strict environmental policies and advanced water treatment infrastructure shape Europe’s demand for polyacrylamide. The EU Water Framework Directive and related environmental laws mandate high standards for wastewater treatment, prompting significant use of APAM in municipal and industrial facilities. In addition to this, the growing emphasis on sustainable manufacturing practices is driving demand for low-toxicity and biodegradable polyacrylamide variants. Demand is further supported by the region’s well-developed paper, textile, and chemical industries, which utilize polyacrylamide for process optimization and water recycling.

Latin America

Latin America’s polyacrylamide demand is fueled by the region’s mining, oil & gas, and agriculture sectors. Countries such as Brazil, Chile, and Argentina rely heavily on APAM for mineral extraction and enhanced oil recovery. Furthermore, increasing environmental regulations and efforts to modernize outdated water treatment systems are driving municipal and industrial demand. Agricultural use of APAM to improve irrigation efficiency and soil structure is also gaining traction, particularly in dry regions.

Middle East & Africa

In the Middle East & Africa, growing urban populations and water scarcity are key drivers of polyacrylamide demand, particularly in water treatment and desalination processes. Countries such as Saudi Arabia and UAE are investing in advanced water treatment plants, where polyacrylamide plays a critical role in sludge dewatering and purification. In Africa, rising industrial activities, mining expansion, and international development aid for infrastructure are increasing usage in wastewater and mineral processing. Market growth opportunities remain high as governments in the region prioritize water security and environmental management.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Compete on the Basis of R&D Investment and Sustainable Innovation

The global market is highly competitive, with major players including SNF, Solenis, Kemira, and Anhui Jucheng Fine Chemicals Co., Ltd. accounting for prominent anionic polyacrylamide market share. The global market is characterized by intense competitive rivalry due to the presence of several well-established international and regional players. Major players differentiate through R&D investments, sustainable formulations, and long-term supply contracts with key industries such as water treatment and oil & gas. However, price sensitivity in emerging markets and the commoditized nature of the product increase pricing pressure.

LIST OF KEY ANIONIC POLYACRYLAMIDE COMPANIES PROFILED

- SNF (France)

- Kemira (Finland)

- ANHUI JUCHENG FINE CHEMICALS CO., LTD (China)

- ZL GROUP (Canada)

- Black Rose Industries Ltd. (India)

- Dongying Kechuang Biochemical Co., Ltd. (China)

- YIXING BLUWAT CHEMICALS CO., LTD (China)

- Solenis (U.S.)

- CHINAFLOC (China)

- Shandong Crownchem Industries Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- May 2025 – ZL GROUP reported that its first phase of building polymer plants at Sohar Port and Freezone in Oman is likely to be launched in the first quarter of 2026. This new plant will primarily produce polyacrylamide and acrylamide monomers with a projected capacity of 350 kilotons per annum upon completion. The move is part of the company’s goal to be a prominent supplier of chemicals used in enhanced oil recovery and other oilfield operations for both domestic and international markets.

- August 2024 – SNF group inked an agreement to acquire PfP Industries and Ace Fluid Solutions. The acquisition will expand the company’s product offering, which will also include polyacrylamide-based products used as friction reducers in the oil and gas industry, along with water treatment products used across a wide range of end-use industries.

- June 2024 – SNF is reported to have completed upgrading its production plant in Lara, Australia. The company has invested around USD 18 million for this upgrade, enabling it to produce acrylamide, a crucial raw material in polyacrylamide production. The move is expected to strengthen the company's supply chain by reducing reliance on imported raw materials.

- February 2022 – Kemira announced the delivery of its first commercial shipment of bio-based polyacrylamide to a wastewater treatment plant in Helsinki, Finland. The move marks a milestone in the company’s commitment toward developing and marketing green chemistry-based products after commissioning its full-scale production line.

- May 2021 – Kemira started a new dry polyacrylamide production plant in Ulsan, South Korea. These products are primarily used for drainage and retention applications in the paper industry. The plant is the result of a joint venture between Kemira and Yongsan Chemicals. The move supports the company’s aim to expand in the Asia Pacific region to cater to the domestic paper and packaging industries.

REPORT COVERAGE

The global market report provides a detailed analysis of the market. It focuses on key aspects such as profiles of leading companies, and end-use industries of the product. Besides this, it offers insights into the analysis of key market trends and highlights key industry developments. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Volume (Kiloton); Value (USD Billion) |

|

Growth Rate |

CAGR of 6.70% during 2026-2034 |

|

Segmentation |

By End-Use Industry

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 2.04 billion in 2025 and is projected to record a valuation of USD 3.62 billion by 2034.

In 2025, Asia Pacific stood at USD 0.91 billion.

Registering a CAGR of 6.70%, the market will exhibit steady growth during the forecast period of 2026-2034.

The water treatment end-use industry is expected to lead the market during the forecast period.

Rapid industrialization and subsequent water treatment demand in emerging economies to drive market growth.

SNF, Solenis, Kemira, and Anhui Jucheng Fine Chemicals Co., Ltd are the major players operating in the market.

Asia Pacific dominated the anionic polyacrylamide market with a market share of 45% in 2025.

Stricter compliance policies are prompting wider adoption and driving market growth in tandem.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us