Asia Pacific Cloud Computing Market Size, Share & Analysis, By Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

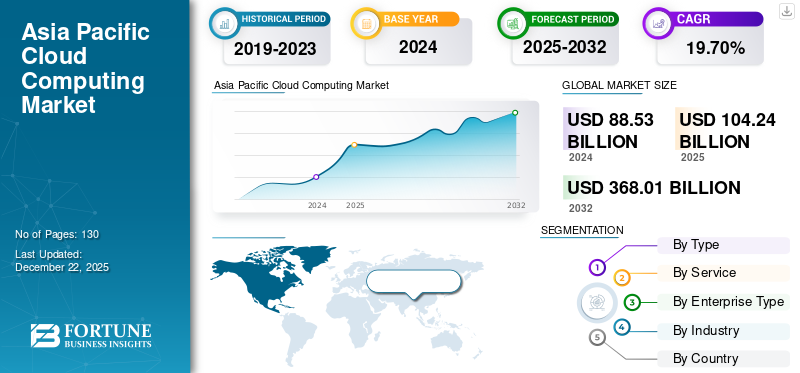

Asia Pacific cloud computing market size was valued at USD 88.53 billion in 2024. The market is projected to grow from USD 104.24 billion in 2025 to USD 368.01 billion by 2032, exhibiting a CAGR of 19.70% during the forecast period.

Cloud computing adoption in the Asia Pacific region is growing rapidly as organizations focus on agility, scalability, and digital resilience. Advances in technologies such as artificial intelligence, internet of things, and big data analytics are encouraging businesses of all sizes to move their operations to the cloud. This momentum is further supported by government initiatives promoting digital transformation and the need for data localization.

Asia Pacific Cloud Computing Market Trends

Expansion of Cloud Regions & Hyperscaler Investments to be Key Driver for Market Growth

The Asia-Pacific region is witnessing a significant expansion of cloud infrastructure as major cloud providers deepen their presence across key markets. Global hyperscalers are actively establishing new cloud regions and data centers to meet the rising demand for scalable, secure, and low-latency cloud services. Countries such as India, Singapore, Indonesia, Taiwan, and Australia have become strategic hubs due to their growing digital economies, favorable regulatory environments, and increasing enterprise cloud adoption.

- Asia-Pacific holds the largest share of global data centers at approximately 37%.

Key takeaways

- The Asia Pacific Cloud Computing Market is projected to be worth USD 368.01 billion in 2032.

- In the by type segmentation, public cloud accounts for around 59.9% of the Asia Pacific Cloud Computing Market in 2024.

- In the by service segmentation, Infrastructure as a Service (IaaS) is projected to grow at a CAGR of 20.9% in the forecast period.

- In the by enterprise type segmentation, Large Enterprises accounted for around 52.0% of the market in 2024.

- The Cloud Computing Market in China was worth USD 28.95 billion in 2024.

- In the by country segmentation, India is projected to grow at a CAGR of 21.8% in the forecast period.

Asia Pacific Cloud Computing Growth Factors

Rise of E-commerce and FinTech Initiatives to Boost Market Growth

The rapid growth of the e-commerce and FinTech industries in the Asia-Pacific region is a major factor driving the demand for cloud computing solutions. As more consumers embrace online shopping and digital financial services, companies must ensure their platforms can efficiently manage large amounts of data, handle sudden spikes in traffic, and provide reliable, uninterrupted service. Cloud infrastructure offers the flexibility and scalability needed to meet these demands, enabling businesses to quickly expand their capacity and respond to market fluctuations.

- According to Retail Asia, in 2023, the Asia-Pacific region contributed 46% of global online retail sales by value and is projected to drive 54% of the total global e-commerce sales growth between 2023 and 2028.

Asia Pacific Cloud Computing Market Restraints

Cultural and Organization Resistance to Change Restraint Market Growth

Cultural and organizational resistance to change remains a notable barrier to cloud adoption in the Asia-Pacific region, particularly among traditional industries and public sector institutions. Many organizations continue to rely on legacy systems and are hesitant to embrace cloud-based workflows due to longstanding operational habits, limited understanding of digital transformation benefits, and concerns over job displacement or business disruption.

Asia Pacific Cloud Computing Market Segmentation Analysis

By Type

Based on type, the market is divided into public cloud, private cloud, and hybrid cloud.

Public cloud continues to dominate the market, driven by its scalability, lower upfront costs, and growing adoption across businesses of all sizes. Meanwhile, the hybrid cloud segment is gaining rapid traction, as enterprises seek greater flexibility, data control, and seamless integration between on-premise and cloud environments which makes it the fastest-growing deployment model in the region.

- According to Kinsta, as of 2024, 33% of enterprise applications in Australia are hosted on the public cloud.

By Service

Based on service, the market is trifurcated into infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

SaaS remains the leading segment, propelled by the growing need for affordable, subscription-based applications that facilitate remote work, enhance customer engagement, and streamline business operations.

At the same time, IaaS is witnessing the most rapid expansion, driven by escalating investments in digital infrastructure, particularly from emerging startups, technology companies, and government agencies aiming to scale their operations efficiently while minimizing capital expenditures.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

In Asia Pacific, large enterprises in the region are leading cloud adoption, focusing on building robust, scalable infrastructure, and leveraging sophisticated cloud-native technologies to drive digital transformation. Meanwhile, SMEs are rapidly increasing their cloud usage, motivated by the availability of more affordable, flexible, and user-friendly cloud solutions that enable them to compete effectively in the digital economy.

- According to Communications Today, in 2024, 90% of Asia Pacific enterprises deploy significant workloads across multiple public clouds. In India, 85% of organizations have adopted true hybrid cloud environments for one or more workloads.

By Industry

Based on industry, the market is segmented into BFSI, IT and telecommunications, government, consumer goods and retail, healthcare, manufacturing, and others.

The IT and telecommunications sector remain the frontrunner in cloud adoption, leveraging cloud technologies to improve network capabilities, data handling, and digital innovation. Meanwhile, the healthcare industry is rapidly expanding its cloud usage, driven by increasing demand for secure patient data storage, telemedicine, and compliance with regional regulation.

By Country

Based on region, the market is segmented into China, Japan, India, South Korea, ASEAN, Oceania, and Rest of Asia Pacific.

China dominates the market, holding the majority Asia Pacific cloud computing market share. Such growth is due to its well-established digital infrastructure, robust government support for cloud adoption, and widespread integration of cloud services across key industries such as manufacturing, finance, e-commerce, and telecommunications. The country’s focus on smart city projects, data sovereignty, and cloud-native innovations further strengthens its leadership position in the region.

- As per Cloud Computing News, in the third quarter of 2023, China invested USD 9.2 billion in cloud infrastructure, accounting for more than 10% of the global cloud spending during that period.

At the same time, India is emerging as the fastest-growing market in Asia Pacific, expected to record the highest compound annual growth rate (CAGR) over the coming years. This rapid growth is fueled by the country’s accelerating digital transformation initiatives, expanding startup ecosystem, and increased cloud investments by enterprises and government bodies.

- For instance, AWS plans to invest USD 8.3 billion in Maharashtra’s cloud infrastructure by 2030, supporting USD 15.3 billion in GDP growth and over 81,000 jobs.

List of Key Companies in Asia Pacific Cloud Computing Market

Alibaba Cloud, Huawei, and Tencent stand out as major players in the Asia Pacific cloud computing market, known for their extensive infrastructure, strong focus on data sovereignty, and deep integration with local industries. These leading providers primarily serve large enterprises and government sectors, offering comprehensive cloud solutions tailored to meet regional compliance and security standards.

Emerging players such as Persistent Systems and Reliance Jio are rapidly gaining traction by targeting SMEs and startups with flexible, scalable cloud services. These companies are investing heavily in expanding their data center footprint, developing cloud-native applications, and enhancing service reliability to capture a growing share of the Asia Pacific market.

LIST OF KEY COMPANIES PROFILED:

- Alibaba Cloud (China)

- Huawei Cloud Computing Technologies Co., Ltd (China)

- Tencent Cloud (China)

- Persistent Systems (India)

- Reliance Jio (India)

- GMO Internet, Inc. (Japan)

- Sony Group (Japan)

- Samsung (South Korea)

- LG Electronics (South Korea)

- GoPomelo Co (Thailand)

- Cloud HM Company (Thailand)

- Slash (Thailand)

KEY INDUSTRY DEVELOPMENTS

- August 2025: NTT DATA has partnered with Finastra to expand its cloud-based lending services across the Asia Pacific (APAC), Middle East, Africa, and Latin America (LATAM). The collaboration aims to enhance scalability, automation, and operational efficiency for financial institutions. NTT DATA will manage the application lifecycle of Finastra’s lending cloud platform, helping accelerate deployments and improve performance.

- July 2025: Palo Alto Networks expanded its cloud infrastructure across the Asia Pacific and Japan region including India, Japan, Singapore, and Australia to strengthen cybersecurity and comply with local data residency requirements. At the center of this expansion is the launch of Prisma Access Browser 2.0, which provides secure browsing on both company and personal devices using Zero Trust security principles.

REPORT COVERAGE

The market report offers a detailed examination of the region’s cloud industry, focusing on market trends, policy updates, and key strategic activities such as collaborations, mergers, and data sovereignty measures. It highlights emerging developments including the push for environmentally friendly cloud solutions, Asia Pacific cloud computing market growth in sovereign cloud adoption, and advancements in AI and edge computing technologies. The report also assesses how these factors influence cloud service demand and provides a competitive analysis of leading global hyperscalers alongside regional cloud service providers.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 19.70% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Service

|

|

|

By Enterprise Type

|

|

|

By Industry

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 88.53 billion in 2024.

The market is expected to exhibit a CAGR of 19.70% during the forecast period.

By industry, the IT and telecommunications segment is set to lead the market.

Alibaba Cloud, Huawei Cloud, Persistent Systems, and GMO Internet are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us