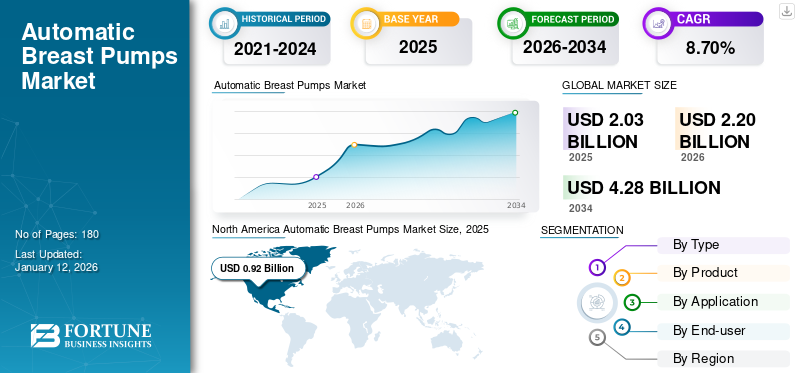

Automatic Breast Pumps Market Size, Share & Industry Analysis, By Type (Wearable and Non-wearable), By Product (Single and Double), By Application (Hospital-Grade and Consumer-Grade), By End-user (Hospitals, Maternity Clinics, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global automatic breast pumps market size was valued at USD 2.03 billion in 2025. The market is projected to grow from USD 2.2 billion in 2026 to USD 4.28 billion by 2034, exhibiting a CAGR of 8.70% during the forecast period. North America dominated the automatic breast pumps market with a market share of 45.40% in 2025.

Automatic breast pumps refer to powered devices that use a motor to create suction and extract milk by offering a hands-free experience for mothers. The growing awareness about the benefits of breast pumps and employment rates among the female population is resulting in the increasing demand for these breast pumps in the market. This, along with the increasing number of notable players, including Medela, Ameda, and others, focusing on research and development activities to develop and introduce advanced products for automatic breast pumps, is expected to contribute to their increasing global market share.

- According to statistics published by the Ministry of Women and Child Development, it was reported that the female labor force participation rate increased from 4.2% to 37.0% in 2023 in India.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Employment Rates among Women to Boost Breast Pump Demand

The increasing attainment rate is resulting in a rising working women globally. The increasing women's employment rate is leading to challenges in breastfeeding, resulting in a growing demand for advanced breastfeeding devices among the working female population.

- As per the 2024 data published by the U.S. Bureau of Labor Statistics, there are currently 163,944 employed women in the U.S.

- Additionally, according to the 2023 Mamava and Medela Survey, it was reported that about 1 in 3 women lack reliable access to a workplace lactation space in the U.S.

The rapidly growing number of working women, combined with awareness about the benefits of advanced breast pumps, is primarily responsible for the global automatic breast pumps market growth. These breast pumps enable mothers to store breast milk and feed babies at their convenience, aligning with their hectic lifestyles.

Moreover, the increasing number of women who undergo breast surgery and cannot nurse their babies is another crucial factor supporting the increasing demand for these breast pumps in the market globally. Moreover, the key players are also focusing on research and development activities to introduce novel products, thereby contributing to the global market growth.

Hence, the rising number of employed women and growing R&D activities among the key players are estimated to augment the demand for novel automatic breast pumps in the market globally.

MARKET RESTRAINTS

Substantial Cost Linked with Automatic Breast Pump Equipment to Hamper Market Growth

There is a growing number of benefits and demand for automatic breast pumps for breastfeeding among the female population. However, one of the prominent factors that restricts the adoption of these products is the substantial cost linked with these breast pumps. With the rise in implementation of cutting-edge technology in these devices among the notable players operating in the market, the costs for these devices are also increasing, further expected to restrict market growth substantially, particularly in lower-income nations such as Brazil, China, India, Poland, Mexico, and others.

- For instance, according to 2025 data published by Koninklijke Philips N.V., the retail price for Philips Avent Double Electric Breast Pump is USD 269.0

The substantial costs linked with automatic breast pumps are anticipated to limit the adoption rate of these products among the female population globally.

MARKET OPPORTUNITIES

Untapped Emerging Markets Present High Growth Opportunities

One of the critical factors responsible for the substantial increase in the adoption of these breast pumps is the rising demand for these technologically advanced products in developing nations such as China, Brazil, and India.

The market in emerging countries is growing, owing to the increasing awareness about novel products, the entry of prominent players in the market, and the increasing number of working mothers in developing countries. This is also as consumers in countries, including India and China demand the advanced quality products available in developed countries.

- According to statistics from The World Bank Group, about 53% of the female population was employed in 2024, compared to 52.1% in 2021 in Brazil.

Moreover, governmental and non-governmental organizations are also focusing on raising awareness about the benefits of breastfeeding among the female population. Increasing awareness and demand offer high potential for prominent players operating in the industry.

- In August 2023, the Breastfeeding Promotion Network of India (BPNI) organized a World Breastfeeding Week to raise awareness about breastfeeding and generate support for women in health facilities and workplaces in India.

Therefore, increasing awareness and the growing focus of key players toward R&D activities to launch innovative products are anticipated to support the rising adoption rate globally.

MARKET CHALLENGES

Stringent Regulations Regarding Automatic Breast Pumps to Hamper Market Growth

The lack of regulatory standardization for electric breast pumps raises concerns regarding their safety and efficacy among the general population. The absence of unified regulatory laws across nations leads to inconsistency in the maintenance of safety and efficacy standards, making it challenging for manufacturers to comply with diverse requirements.

Furthermore, stringent regulations and varying quality standards across countries pose challenges for manufacturers, resulting in product recalls for these breast pumps.

- For instance, in February 2023, the Government of Canada reported that the Momcozy wearable breast pumps were sold in the Canadian market without the proper authorization, highlighting the importance of standardization of the regulatory framework regarding these products globally.

Additionally, inadequate focus on insurance coverage policies for battery-operated breast pumps is likely to hinder the adoption rate for these products, especially in emerging nations such as China, India, and others.

Other Prominent Challenges

Cultural Barriers: The limited awareness about the benefits of breast pumps, lack of social and workplace support, combined with varied cultural norms, are resulting in negative perceptions about these products, further hindering the adoption rate in emerging countries such as South Africa, Southeast Asia, and others.

AUTOMATIC BREAST PUMPS MARKET TRENDS

Shift from Conventional to Modern Electric-Based Breast Pumps is a Market Trend

There has been a preferential shift toward technologically advanced breast pumps, including smart breast pumps, wearable breastfeeding monitors, and others. The introduction of novel technology has significantly improved the breastfeeding experience among females, making it more comfortable, convenient, and inclusive for mothers.

One of the prominent advancements in breastfeeding technology is the introduction of smart breast pumps. These advanced products integrate wireless Bluetooth connectivity, sensors, and tracking capabilities, which enable mothers to monitor milk production and pumping efficiency. These devices also connect to smartphone applications, providing real-time feedback, reminders, and personalized pumping schedules. These technologically advanced breast pumps also allow adjustable suction and massage settings for personalized comfort among the female population.

Increasing advantages of these devices are leading to growing demand, further driving the focus of key players toward R&D activities to develop and introduce novel devices in the market.

- For instance, in May 2025, Medela launched Magic InBra, a next-generation breast pump technology with FluidFeel technology, which combines hospital-grade performance with exceptional comfort and seamless convenience in one superior solution.

The benefits mentioned above associated with advanced devices have caused the shift from conventional to modern electric breast pumps.

Other Prominent Trends

E-commerce Growth - Increasing adoption of online sales channels such as Amazon, Walmart, and others among consumers is likely to drive demand for these breast pumps globally.

Download Free sample to learn more about this report.

Trade Protectionism

While not subject to specific trade bans, tariffs on electronic health devices, especially between the U.S., China, and European countries, can impact pricing and imports. Regulatory complexities also vary by region—compliance with the Food and Drug Administration (FDA), European Commission, and other standards is essential.

Segmentation Analysis

By Type

Non-wearable Segment Led Due to Its Convenience and High Suction Power

Based on type, the market is classified into wearable and non-wearable.

The non-wearable segment led the global automatic breast pumps market share in 2024. The increasing benefits of non-wearable products, including efficient milk expression, convenience, high suction power, and others, are key factors likely to back the growing demand for these products. This, along with the growing focus of key players toward acquisitions and mergers with other players to expand their product portfolio, is further likely to support segmental growth globally.

On the other hand, the wearable segment is estimated to grow with a substantial CAGR over the projected period. The growth is owing to growing demand, further directing the focus of prominent players toward research and development activities to introduce new products to strengthen their product portfolios in the market.

- For instance, in October 2023, Medela launched the Solo Hands-free, a single electric breast pump, to strengthen its product portfolio globally.

By Product

Double Segment Dominated Owing to Its Cost-effectiveness

Based on the product, the market is segregated into single and double.

The double segment led the market in 2024. The growth is due to the rising benefits of double electric breast pumps, including reduced pumping time, increased milk output, and cost-effectiveness, among others, further leading the focus of notable players on R&D activities to launch cutting-edge double breast pumps.

- For instance, according to 2025 statistics published by Medela, it was reported that double pumping results in 18% more milk volume being pumped over a 15-minute pumping duration than single pumping.

The single segment is anticipated to grow with a significant CAGR in the coming years. The growing number of employed women, increasing awareness about the benefits of breast pumps, along with the new product launches among the major players, are anticipated to aid the increasing adoption of these products in the market.

By Application

Increasing Adoption of Portable Pumps Boosted Consumer-Grade Segmental Growth

Based on application, the market is divided into hospital-grade and consumer-grade.

The consumer-grade segment dominated the market in 2024. The growth is due to the increasing demand for portable breast pumps, further leading the focus of major players on acquisitions and mergers to strengthen their R&D capabilities to introduce novel products in the market.

On the other hand, the hospital-grade segment is estimated to grow with a substantial CAGR during the projected period. Hospital-grade breast pumps have growing advantages, such as improved suction strength, durability, and the ability to double-pump. These advantages are driving the focus of key players toward R&D activities to launch new products, thereby contributing to the adoption rate for these products in the market.

- For instance, in October 2024, Elvie, one of the leading players dedicated to providing female technology products, launched their newest breast pump, Elvie Stride 2: a hands-free, closed system breast pump that offers hospital-grade suction combined with the comfort of lightweight ultra-soft silicone cup to optimize milk output.

By End-user

Implementation of Advanced Technology in Novel Products Led to Homecare Settings Segment Dominance

Based on end-user, the market is segmented into hospitals, maternity clinics, homecare settings, and others.

The homecare settings segment dominated the market in 2024. The growth is due to factors such as the gradual shift of women's preference toward homecare settings due to easy accessibility, reduced waiting time, and patient convenience. This, coupled with the growing number of product launches with advanced technology for homecare settings, is likely to contribute to the segmental growth.

- For instance, in March 2021, Koninklijke Philips N.V., launched Philips Avent Double Electric Breast Pump, which can be used in homecare settings to strengthen its product portfolio globally.

On the other hand, the hospitals segment is also anticipated to rise over the projected period. The increasing number of hospitals, improved accessibility to highly competent devices, improved level of care in hospitals, among others, are some of the few factors leading to the rise in the adoption rate of these products in hospitals, thereby supporting the segmental growth in the market.

Automatic Breast Pumps Market Regional Outlook

By geography, the market is segregated into North America, Europe, Latin America, the Middle East & Africa, and Asia Pacific.

North America

North America Automatic Breast Pumps Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market and generated USD 1.00 billion in 2026. The increasing per capita healthcare expenditure, adequate reimbursement policies, enhanced healthcare infrastructure, and the growing number of major players introducing technologically advanced breast pumps are a few factors contributing to the market growth.

- According to 2023 statistics published by the Centers for Medicare & Medicaid Services (CMS), the per capita healthcare expenditure is USD 14,750 in the U.S.

The growing number of employed women and consciousness about the benefits of advanced breast pumps are a few of the crucial factors liable for the growing demand for these products. This, along with an increasing number of players focusing on establishing new facilities for R&D activities for these breast pumps, is also expected to support market growth in the country.

Europe

Europe is anticipated to grow with a substantial CAGR during the projected period. The growth is due to the rising number of employed women, favorable maternity policies in European countries, including Germany and the U.K., and an increasing focus of the notable players toward R&D activities to launch advanced products in these nations. Increasing initiatives among governmental organizations to raise awareness about the benefits of these products are further estimated to increase the adoption rate of these products in the market.

- For instance, according to 2024 statistics published by the European Commission, it was reported that the female employment rate was 70.8% in Europe.

Asia Pacific

Asia Pacific is anticipated to grow with a considerable CAGR in the coming years. The growing female employment rate and developing healthcare infrastructure in Asia Pacific countries, including China and India, are crucial factors expected to boost market growth. In addition, a rising number of notable players focusing on expanding the product’s availability is further expected to contribute to the market growth in the region.

- For instance, in November 2024, Medela launched the “Medela Easy Electric Breast Pump,” an affordable, easy-to-use electric breast pump for mothers who want to produce breast milk electrically, for pre-order on Amazon in Japan.

Latin America

Rise in disposable income, increasing healthcare spending, growing awareness about the advantages of electric breast pumps, and increasing government focus on improving healthcare access are a few of the vital factors contributing to the market growth in the region.

- For instance, according to 2023 data published by the National Center for Biotechnology Information (NCBI), healthcare spending in Brazil increased from 8.3% of GDP in 2010 to 9.2% in 2018.

Middle East & Africa

There is an increasing focus on developing healthcare infrastructure, resulting in a growing number of hospitals and maternity clinics, further supporting the market growth. Furthermore, increasing initiatives toward mergers and partnerships among the key players to expand their presence in the Middle East countries are likely to propel market growth over the forecast period.

- For instance, according to 2025 statistics published by International Citizen Insurance, there are approximately 600 hospitals in South Africa.

COMPETITIVE LANDSCAPE

Key Industry Players

Launch of Novel and Advanced Automatic Breast Pumps by Notable Players Led to Their Dominating Positions in Market

The global market is consolidated with a few players, such as Medela, Ameda, and Koninklijke Philips N.V., accounting for most of the market share.

Medela is one of the leading players operating in the industry. The rise is primarily due to certain factors, including a strong focus on R&D initiatives to launch new products, a strong network of distribution across the globe, and acquisitions and collaborations among other companies in the market.

- In August 2024, Medela, one of the leading brands in breast pump technology and breastfeeding solutions, launched its Swing Maxi Hands-Free, a smart double electric breast pump catering to the growing demand among the female population globally.

On the other hand, other players, such as Spectra Baby, are also growing in the market in 2024. Increasing focus on expansion in emerging countries, including Brazil and India, among these players, is expected to support the company's global market share.

LIST OF KEY AUTOMATIC BREAST PUMP COMPANIES PROFILED

- Medela (Switzerland)

- Ameda (U.S.)

- Ardo Medical AG (Switzerland)

- Willow (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Spectra Baby USA (U.S.)

- Momycozy (U.S.)

- Freemie (U.S.)

- Evenflo Feeding (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2025: Willow, a player focused on developing products to elevate the maternal experience, launched its new Silicone Wearable Breast Pump to support and elevate the maternal experience among females globally. This helped the company in strengthening its global presence.

- August 2024: Annabella, one of the leading femtech brands, launched its FDA-approved double breast pump with 50% more milk production capacity to support the growing demand among the female population globally.

- May 2024: Medela, one of the leading companies, introduced a compact, portable electric breast pump, Medela Easy, which enables mothers to express their breastmilk efficiently at their convenience. This has supported the company in growing its brand presence.

- January 2024: Annabella, one of the leading FemTech brands, announced U.S. expansion and seed funding of USD 8.5 million with a target to create technologically advanced products to improve the breast pumping experience globally. This supported the company to grow its brand presence.

- January 2023: Medela, one of the leading players, launched its new Freestyle Hands-free Breast Pump with a target to strengthen its product portfolio globally.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.70% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Product

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.2 billion in 2026 and is projected to record a valuation of USD 4.28 billion by 2034.

In 2025, the market value stood at USD 2.03 billion.

The market is expected to exhibit a CAGR of 8.70% during the forecast period of 2026-2034.

The non-wearable segment led the market by type.

The key factors driving the market are the increasing number of employed women, the increasing number of product launches, and the growing development in healthcare infrastructure.

Medela, Ameda, and Koninklijke Philips N.V. are the top players in the market.

North America dominated the market in 2025.

Adoption of modern electric breast pumps, preference toward online channels, and others are some of the prominent trends in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us