Autonomous Mining Trucks Market Size, Share & Industry Analysis, By Autonomy Level (Fully-Autonomous and Semi-Autonomous), By Payload Capacity (Below 100 tons, 100–200 tons, and Above 200 tons), By Propulsion Type (Diesel-powered and Electric-powered), By End-User (Iron, Coal, Oil Sand and Others), and Regional Forecast, 2025 – 2032

KEY MARKET INSIGHTS

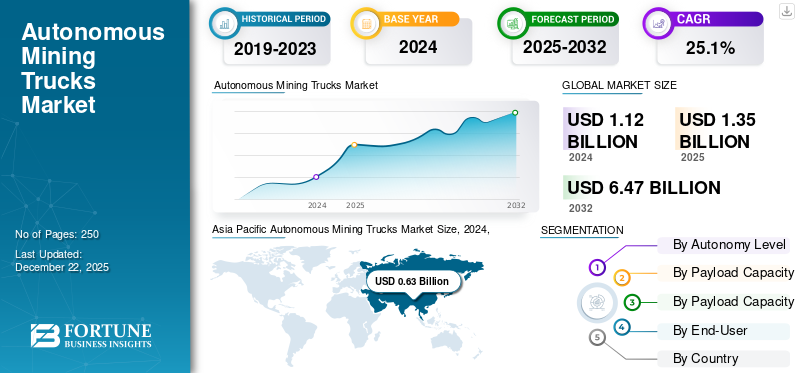

The global Autonomous Mining Trucks market size was valued at USD 1.12 billion in 2024. The market is expected to grow from USD 1.35 billion in 2025 to USD 6.47 billion by 2032, exhibiting a CAGR of 25.1% during the forecast period.

The autonomous mining trucks market refers to the global industry segment that encompasses the design, manufacture, deployment, retrofitting, operation, and servicing of haul trucks equipped with autonomous driving technology, specifically for mining applications. These vehicles are engineered to transport overburden, ore, coal, and other mined materials without a human driver physically operating the truck on board.

Autonomous Mining Trucks operate through a combination of advanced sensors such as LiDAR, radar, cameras, and ultrasonic devices for accurate environment perception; high-precision positioning systems such as GNSS (Global Navigation Satellite System) and RTK (Real-Time Kinematic) to ensure exact location tracking; and onboard computing units capable of processing vast amount of data in real time for immediate decision-making.

The trucks are controlled by vehicle control software that manages steering, braking, and throttle operations, while wireless communication systems, including private LTE, 5G, and mesh networks, maintain continuous connectivity with centralized mine control centers. Additionally, they integrate with fleet management systems (FMS) that handle route planning, dispatching, and operational optimization to ensure maximum efficiency and safety across the mining site.

The market exists to enhance mining operations by improving safety through the removal of operators from hazardous environments, thereby reducing accident risks. It also increases productivity by enabling consistent, round-the-clock operation without breaks or fatigue and ensuring steady output.

Major key companies design and manufacture mining trucks with factory-fitted autonomous haulage systems (AHS) and integrated fleet management platforms. Few key players in the market include Komatsu Ltd., Caterpillar Inc. and Hitachi Construction Machinery (HCM).

Autonomous Mining Trucks Market Trends

Rising Integration of Autonomous Trucks into Underground and Hybrid Mining Environments Fuels the Market Growth

The growing adoption of autonomous systems for underground mining and hybrid mine environments drives the market growth. Underground mines pose additional challenges due to the absence of GPS signals, confined spaces, steeper gradients, and complex tunnel networks. The autonomy providers are integrating LiDAR-based mapping, Simultaneous Localization and Mapping (SLAM) algorithms, inertial navigation systems (INS), and wireless mesh networks to maintain accurate positioning and safe navigation. This development drives the Autonomous Mining Trucks market growth.

In Hybrid operation, autonomous trucks are being designed to seamlessly transit between above-ground and below-ground haul routes, maintaining operational continuity. This expansion allows mining companies to extend the benefits of autonomy such as safety, productivity, and labor efficiency beyond open-pit sites, creating new opportunities for automation. Key manufacturers such as Sandvik, Epiroc, and Caterpillar are focused on underground-capable autonomous haulage solutions, particularly in gold, copper, and hard rock mines.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Labor Shortages in Remote Mining Regions Drive the Market Growth

Mining operations are often located in remote, harsh, and difficult-to-access regions, such as the Pilbara (Australia), Alberta Oil Sands (Canada), Atacama Desert (Chile), Siberia (Russia), and parts of Africa. These locations face workforce challenges, which directly increases the demand for the autonomous mining trucks. However, the autonomy enables the redeployment of workers into safer, higher-value roles such as remote fleet monitoring, predictive maintenance, and system control from centralized operations centers. This not only improves safety and work-life balance but also addresses long-term workforce shortages as the mining sector faces an aging labor pool. This development drives the market growth during the forecast period.

Autonomous Mining Trucks – Labor Shortage & Productivity

|

Category |

Statistic / Insight |

|

Labor Shortage |

>50% of mining companies report difficulty in filling skilled roles |

|

Mining Engineers |

Vacancy rates up to 14× higher than average in remote regions; graduates at ~1/3 of peak levels |

|

Productivity Gains |

+34% productivity using Komatsu AHS |

|

Per-Person Productivity |

+37% improvement at Rio Tinto |

|

Operating Hours |

700 more hours per truck annually than manned fleets |

|

Cost Reduction |

15% lower load-and-haul costs with autonomous trucks |

|

Operational Hours Increase |

+15–20% annual operating hours |

Market Restraints

High Initial Capital Investment May Hamper Market Growth

One of the major restraints in the market growth is high initial capital investment, as the cost of purchasing and deploying a Level 4 autonomous truck is substantially higher than a conventional vehicle. A standard heavy-duty truck typically costs around USD 110,000–USD 120,000, whereas a fully autonomous counterpart can reach USD 400,000–USD 450,000 due to the integration of advanced sensor suites, high-performance computing hardware, redundant control systems, and specialized software. Thus, the high initial capital investment may hamper the market growth.

Market Challenges

Regulatory Fragmentation and Legal Uncertainty Significantly Challenges Market Growth

Regulatory Fragmentation and Legal Uncertainty are critical challenges for the autonomous truck market, as the legal framework for testing and deploying self-driving trucks varies not only between countries but often within regions of the same country. For instance, in the U.S., particularly Arizona and Texas permit fully driverless operations for heavy-duty trucks, while others, such as California, currently restrict or prohibit the operation of autonomous trucks over a certain weight without a safety driver. Thus, the regulatory fragmentation and legal uncertainty significantly challenges market growth.

Market Opportunities

Expansion in Emerging Mining Regions is a Key Opportunity for Market

The market notices significant opportunities due to emerging mining geographies such as Africa, South America, Central Asia, and Southeast Asia, where governments and mining companies are open to automation-first strategies. For instance, in September 2024, Vale announced it plans to produce 323-330 billion tons of iron ore. The company, in particular, pointed to initiatives such as improving efficiency at the Serra Sul mining complex, using larger vessels to transport ore, and new processing methods at the Vargem Grande 1 project, which will eventually add about 15 billion tons to annual production. This development would drive the market growth during the forecast period.

Governments in these regions are also offering incentives and tax breaks to attract technology-driven mining investments. For instance,

- Chile has tested autonomous haulage in large copper mines to improve safety and operational efficiency.

- Botswana and Namibia are promoting automation adoption in diamond and uranium mining.

- Indonesia is investing in automation for nickel mines to support its EV battery ambitions.

Segmentation Analysis

By Autonomy Level

The Semi-Autonomous Segment leads due to Rising Adoption in Both Greenfield and Brownfield mining Project

By Autonomy Level, the market is classified into Fully-Autonomous and Semi-Autonomous.

The semi-autonomous segment held the largest market share in 2024. The segmental growth is attributed to increasing adoption in both greenfield and brownfield mining projects. Semi-automatic systems require human supervision but handle key haulage functions autonomously, offering a cost effective transition path for mining companies. These systems provide productivity benefits such as optimized haul cycles and reduced fuel consumption, decrease operating costs without the high upfront investment and infrastructure changes. These factors drive the market growth.

The fully autonomous segment held the second-largest market share in 2024. Due to technological advancements in LiDAR, GPS, and artificial intelligence-based fleet management systems, the segment is expected to register the fastest growth rate during the forecast period. Major mining companies in Australia, Canada, and Chile are adopting fully autonomous haulage operations to eliminate human error, reduce downtime, and achieve 24/7 production efficiency.

By Payload Capacity

Suitability for Large-Scale Open-Pit Mining Operations Drives the Above 200 tons Segment growth

Based on the payload capacity the market is classified into below 100 tons, 100–200 tons and above 200 tons.

The Above 200 tons’ payload capacity segment held the largest share in 2024. The segmental growth is attributed to its suitability for large-scale open-pit mining operations in iron ore, copper, and coal. These ultra-class trucks deliver high-volume haulage efficiency, significantly lowering the cost per ton transported. This devolvement drives the market growth.

The 100–200-ton segment was the second largest. The segmental growth is attributed to its versatility and broad applications. Trucks in the 100–200-ton range offer a good balance of capacity, maneuverability, and operational flexibility. They are suitable for a wide variety of mining operations, both at large-scale mines and moderately sized operations.

To know how our report can help streamline your business, Speak to Analyst

By Propulsion Type

Established Infrastructure, Reliability, and Widespread Compatibility Drives Diesel-powered Segment Growth

Based on the propulsion type the market is classified into Diesel-powered and Electric-powered.

The diesel-powered segment held the largest share in 2024. Diesel trucks dominate mining fleets due to its high performance in harsh environments, robust refueling infrastructure, and the ability to operate effectively for long shifts without the downtime required for charging batteries. This development drives the market growth. Most mines are located in remote areas where electric charging infrastructure is still underdeveloped; diesel's logistical advantages remain unmatched for continuous heavy-duty operations.

The electric-powered segment held a significant market share in 2024. Rapid improvements in battery technology, reductions in maintenance needs, and advances in charging capabilities are accelerating the adoption of the electric segment.

By End-User

Largest Scale Operation of Iron Commodity Drive the Market Growth

Based on the End-User the market is classified into Iron, Coal, Oil Sand and Others.

The iron segment held the largest share in 2024. Iron ore mining is one of the largest-scale operations globally, especially in regions such as Australia and Brazil. These mines require high-capacity haulage, and leading companies such as Rio Tinto have already adopted fleets of Autonomous Mining Trucks for transporting iron ore. This development drives the segment growth. Major global mining companies prioritize automation in their iron mines to boost productivity and worker safety, accelerate material transport, and reduce costs, driving rapid growth and segment dominance.

The Coal segment held a significant share in 2024. The segmental growth is attributed to increasing mining for coal. For instance, in March 2025, Australian coal producer, New Hope announced its increase in thermal coal production by 33pc on the year over the first half of its financial year, August 2024–January, while increasing its exposure to the coking coal market.

Autonomous Mining Trucks Market Regional Outlook

By region, the market is studied across Europe, Asia Pacific, North America, and the rest of the world.

Asia Pacific

Asia Pacific Autonomous Mining Trucks Market Size, 2024, (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region held the largest Autonomous Mining Trucks market share. The Asia Pacific region is the largest and fastest-growing market for Autonomous Mining Trucks. This dominance is due to the presence of large-scale mining operations and early adoption of automation technologies, particularly in Australia, where mining giants such as BHP, Rio Tinto, and Fortescue Metals Group have been operating autonomous haulage systems (AHS). Countries such as China and India are rapidly modernizing their mining fleets to boost productivity, reduce operational costs, and address labor shortages in remote mining regions.

North America

North America holds a significant market share of the market. The regional growth is driven by its large mining industry, advanced technological infrastructure, and strong OEM presence. Canada leads the region’s adoption, with large-scale deployments in the oil sands of Alberta and major iron ore and gold mines in Quebec and British Columbia. In the U.S., autonomous truck adoption is expanding across coal, copper, and iron ore mines, particularly in remote regions such as Wyoming, Arizona, and Minnesota. This development drives the regional market growth.

Europe

Europe held a significant market share in the market. Countries such as Sweden, Germany, Poland, and Finland are at the forefront, often through pilot projects and limited-scale deployments rather than full fleet conversions. Sweden, LKAB, has been a key testing ground for autonomous haulage systems (AHS) in iron ore extraction, supported by strong collaboration between mining companies, OEMs, and research and development institutes, driving the market growth.

Rest of the World

The rest of the world holds a significant market share. Chile leads in copper production, where mining companies such as Codelco and BHP are deploying autonomous haulage systems in large open-pit mines to improve safety and operational consistency in high-altitude, remote regions.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Expansion Through Strategic Partnership, Acquisition and Product Offering by key players

Key players in this market continuously innovate to meet evolving industry demands, expand their product offerings, and strengthen their market presence through strategic collaborations and acquisitions.

Several prominent companies dominate the market by leveraging advanced technologies, extensive distribution networks, and strong brand recognition. The major players in the market include Bridgestone Corporation, Michelin Group and Bridgestone Corporation

List of Key Autonomous Mining Trucks Companies Profiled

- Caterpillar Inc. (U.S.)

- Komatsu Ltd. (Japan)

- Hitachi Construction Machinery + Wenco Mining Systems (Japan/Canada)

- Epiroc AB + ASI Mining (Sweden/U.S)

- Liebherr Group (Switzerland/Germany)

- Volvo Autonomous Solutions (Sweden)

- Tage Idriver (China)

- WAYTOUS (China)

- EACON Mining Technology (China)

- Hexagon Mining (Sweden)

KEY INDUSTRY DEVELOPMENTS

- In August 2025, Komatsu signed an agreement with Pronto to launch an autonomous solution for quarry operations. The partnership focuses on the launch of Komatsu‘s smart quarry autonomous system, powered by Pronto, that integrates Pronto’s autonomy technologies into quarry-sized haul trucks.

- In March 2025, Caterpillar Inc. introduced the market’s first commercially available Autonomous Water Truck. The new Cat 789D Autonomous Water Truck (AWT) enhances productivity by enabling mine operations to track water consumption and reduce waste digitally. It offers the same potential for greater use than staffed equipment. The fully autonomous truck reduces shift changes, meal breaks, and other operational delays to improve efficiency.

- In November 2024, Caterpillar Inc. introduced the fully autonomous operation of its Cat 777 off-highway truck. This marks Caterpillar’s first deployment of autonomous technology in the aggregates industry and will expand the company’s autonomous truck fleet to include the 100-ton-class (90-tonne-class) Cat 777.

- In September 2024, Caterpillar introduced powertrain flexibility into its large mining truck strategy. Caterpillar is “purposefully” designing a modular Cat 793 large mining truck platform with powertrain flexibility. This platform will include diesel mechanical, diesel electric, and battery electric options.

- In June 2023, EACON announced the expansion at South Pit, adding 100 hybrid autonomous trucks. EACON designed the EEA (Electrical and Electronic Architecture), the specifications for the range extender, battery, and motor systems, and the truck control strategies.

REPORT COVERAGE

The Autonomous Mining Trucks market research report provides a detailed market analysis and focuses on key aspects such as leading market participants, competitive landscape, and type. Besides this, it includes insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 25.1% from 2025 to 2032 |

|

Unit |

Value (USD Billion ) |

|

Segmentation |

By Autonomy Level

|

|

By Payload Capacity

|

|

|

By Propulsion Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 1.12 billion in 2024.

The market is poised to grow at a CAGR of 25.1% during the forecast period (2025-2032).

By Autonomy Level, the Semi-Autonomous segment captures the largest share.

The market size in Asia Pacific stood at USD 0.63 billion in 2024.

Some of the Prominent players are Caterpillar Inc. (USA), Komatsu Ltd. (Japan) and Hitachi Construction Machinery.

Asia Pacific held the largest share of the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us