Autonomous Truck LiDAR Market Size, Share & Industry Analysis, By Level of Autonomy (Level 1, Level 2, Level 3, and Level 4), By Propulsion Type (ICE and Electric), By Truck Type (Light-Duty Truck, Medium-Duty Truck, and Heavy-Duty Truck), By LiDAR Type (Mechanical LiDAR and Solid-state LiDAR((MEMs), Flash LiDAR (FMCW), and others)), By Application (Mining, Construction, Freight Transport, Last Mile Delivery, and Others), By Region (U.S. Europe & Asia) and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

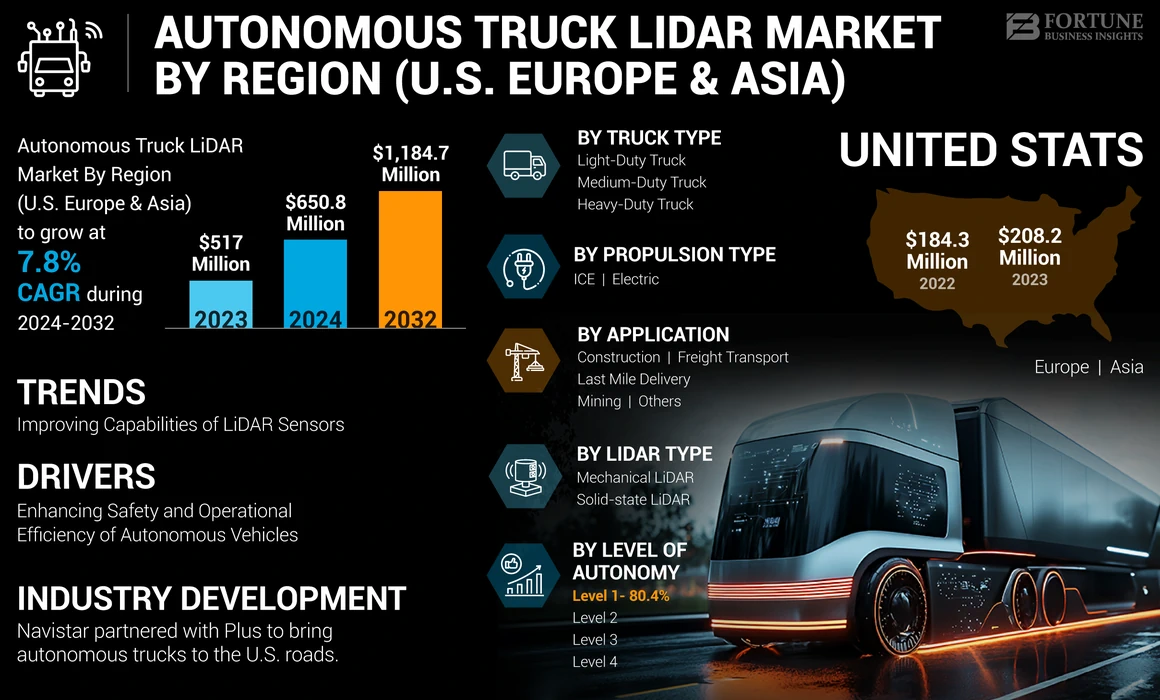

The Autonomous Truck LiDAR Market By Region (U.S. Europe & Asia) market size was valued at USD 517 million in 2023. The market is projected to grow from USD 650.8 million in 2024 to USD 1,184.7 million by 2032 at a CAGR of 7.8% during the forecast period. U.S. dominated the global market with a share of 40.27% in 2023.

LiDAR (Light Detection and Ranging) is a critical technology used in autonomous trucks for navigation and obstacle detection. It employs laser beams to measure distances by illuminating targets and analyzing the reflected light. This creates high-resolution, three-dimensional maps of the truck's surroundings in real-time, enabling precise detection of objects, road conditions, and other vehicles. LiDAR systems are essential for the safe operation of autonomous trucks as they provide accurate environmental data regardless of lighting conditions, ensuring that the vehicle can make informed decisions. By enhancing situational awareness, LiDAR technology significantly contributes to the reliability and safety of self-driving trucks.

The autonomous truck LiDAR market is rapidly expanding, driven by the increasing demand for Advanced Driver-Assistance Systems (ADAS) and autonomous driving capabilities in the logistics and transportation sectors. LiDAR technology, which uses laser pulses to create high-resolution 3D maps of the environment, is critical for the safe and efficient operation of autonomous trucks. The transition from mechanical to solid-state LiDAR is a notable trend, promising lower costs and improved durability. By 2025, it is expected that autonomous trucks equipped with advanced LiDAR systems will become a common sight on highways and in urban logistics networks, revolutionizing freight transport and last-mile delivery.

The COVID-19 pandemic accelerated the development and adoption of autonomous truck and LiDAR technology by highlighting the need for contactless delivery and logistics solutions. Supply chain disruptions and labor shortages prompted increased investment in automation to ensure resilience and efficiency. Companies accelerated their R&D efforts and pilot programs to meet the rising demand for autonomous logistics, boosting the LiDAR market for autonomous trucks during and post-pandemic.

Autonomous Truck LiDAR Market By Region (U.S. Europe & Asia) Trends

Improving Capabilities of LiDAR Sensors to Support Development of Autonomous Vehicles Will Emerge as Latest Market Trend

LiDAR is the key technology required for the development of autonomous trucks as it offers critical capabilities in perception, navigation, and safety. The latest generation of LiDAR sensors offers improvement in range, resolution, and reliability compared to the previous models. These power-generating equipment enhancements enable autonomous trucks to detect objects at greater distances and with higher precision, even in challenging environmental conditions.

One of the critical innovations in LiDAR technology is the development of solid-state LiDAR sensors. Unlike traditional mechanical LiDAR systems, solid-state LiDARs have no moving parts, which makes them more robust, compact, and cost-effective. Moreover, these types of LiDARs are being integrated with advanced computing platforms and Artificial Intelligence (AI) algorithms.

Download Free sample to learn more about this report.

Autonomous Truck LiDAR Market By Region (U.S. Europe & Asia) Growth Factors

Enhancing Safety and Operational Efficiency of Autonomous Vehicles to Drive Market Growth

As the logistics and transportation industries increasingly adopt autonomous solutions to address challenges, such as driver shortages and need for increased efficiency, LiDAR technology has emerged as a cornerstone of these advancements. LiDAR provides high-resolution, three-dimensional maps of the environment, which are essential for the safe navigation of autonomous vehicles.

The technology enables these vehicles to detect and identify objects with high accuracy and in real time, ensuring that they can safely maneuver in complex driving scenarios. Recent developments in Frequency Modulated Continuous Wave (FMCW) LiDAR, such as those pioneered by companies, such as Aeva, further enhance these capabilities by providing instant velocity data alongside traditional distance measurements. This allows for better differentiation between static and dynamic objects, a critical feature for autonomous driving at highway speeds.

- Major industry collaborations highlight the importance of LiDAR technology in autonomous trucks. For instance, in January 2024, Daimler Truck, one of the leading commercial vehicle manufacturers, partnered with Aeva and Torc Robotics to integrate advanced 4D LiDAR sensors into its Freightliner Cascadia trucks. This integration is a significant step toward achieving SAE Level 4 autonomy, where vehicles can operate without human intervention under specific conditions. The collaboration aims to bring these autonomous trucks to the U.S. market by 2027, with production starting in 2026. This partnership underscores the strategic importance of selecting robust and scalable LiDAR technology to meet the safety and efficiency requirements in commercial applications.

The advancements in LiDAR technology enhance the safety of autonomous trucks and contribute to operational efficiency. These trucks, equipped with advanced LiDAR, can operate for longer hours without fatigue, maintain consistent speeds, and optimize routes in real-time based on traffic conditions. This leads to reduced fuel consumption and operational costs. Additionally, the ability to operate continuously without the need for breaks can significantly decrease the overall delivery times, providing a competitive landscape in the logistics industry.

RESTRAINING FACTORS

Stringent Regulations to Act as Hurdle for Market Growth

Regulatory challenges rank as the top concern among industry experts, citing them as a significant barrier to the U.S., Europe, and Asia autonomous truck LiDAR market growth. The fragmented regulatory environment across different regions further complicates matters, with inconsistencies in standards and requirements hindering the deployment and scalability of autonomous trucks equipped with LiDAR technology. The lack of standardized regulations governing autonomous vehicle operation, particularly with respect to safety standards and liability frameworks, creates uncertainty and unpredictability. This can impede investment decisions and hinder the pace of technological innovation in the U.S., Europe, and Asia autonomous truck LiDAR market.

The impact of regulatory hurdles on market dynamics is also reflected in investment trends. Reports are highlighting a notable decline in venture capital funding for autonomous trucking startups in regions with stringent regulatory regimes. Investors are expressing reluctance to commit capital to projects facing prolonged regulatory uncertainty, preferring to allocate resources to markets with more favorable regulatory environments. This trend underscores the critical importance of regulatory clarity and consistency in driving investment and fostering innovation in the autonomous truck LiDAR market.

Furthermore, the lack of coordination among regulatory bodies and jurisdictions poses a significant challenge for global manufacturers and operators of autonomous trucks. Navigating the regulations adds complexity and cost to the development and deployment of autonomous trucking fleets, deterring market participants from scaling their operations across borders. The absence of a unified regulatory framework can hamper interoperability and standardization efforts, hindering the seamless integration of autonomous trucks into the existing transportation networks.

Autonomous Truck LiDAR Market By Region (U.S. Europe & Asia) Segmentation Analysis

By Level of Autonomy Analysis

Importance of Basic Driver Assistance Features Increased Demand for Level 1 Autonomy

By level of autonomy, the market is categorized as Level 1, Level 2, Level 3, and Level 4.

The Level 1 segment dominated the market in 2023 as these regions are progressively embracing autonomous technologies. Autonomy in trucks include driver assistance features, such as adaptive cruise control and lane-keeping assistance. These features are driving the adoption of autonomous technology, allowing for incremental improvements in safety and convenience while familiarizing drivers with semi-autonomous systems. This gradual integration is crucial for market growth, paving the way for more advanced levels of autonomy.

Level 4 autonomy can perform all driving tasks without human intervention in specific environments. The rise of robotaxis and autonomous delivery services is driving the demand for robust LiDAR systems to ensure safety and efficiency. Companies, such as Daimler are planning to roll out Level 4 trucks, which will substantially boost the LiDAR market by using the most advanced and reliable sensor systems to navigate complex environments autonomously. This anticipates growth of the segment in the market.

- For instance, in May 2024, Hyundai, together with its software partner Plus, presented an Xcient Fuel Cell equipped with technology for a Level 4 automated driving truck. The Xcient model, with Plus technology on board, is the first fuel cell-powered heavy-duty truck with Level 4 autonomy to undergo testing in the U.S.

The Level 2 and Level 3 segments also indicated a significant rise in the market.

To know how our report can help streamline your business, Speak to Analyst

By Propulsion Type Analysis

Existing Infrastructure and Technology Familiarity Helps ICE Segment Dominate Market

By propulsion type, the market is categorized as ICE and electric.

Despite the shift toward electrification, ICE-powered autonomous trucks continue to hold a dominant autonomous truck LiDAR market share due to their established infrastructure and longer-range capabilities. The integration of advanced LiDAR systems with ICE trucks improves their operational safety and efficiency, supporting their continued adoption in the autonomous truck market.

Electric autonomous trucks are at the forefront of innovation, combining the benefits of zero emissions with advanced autonomous capabilities. The use of LiDAR technology enhances the operational efficiency and safety of electric trucks, aligning with regulatory trends and environmental goals. Autonomous electric trucks benefit from advanced LiDAR systems that optimize battery usage by enabling precise navigation and reducing energy consumption, thus supporting market growth. This makes it the fastest-growing segment in the market as it addresses sustainability and technological advancement simultaneously.

By Truck Type Analysis

Growing E-Commerce Sector Drives Demand for Light-Duty Trucks Equipped With Lidar Technology

By truck type, the market is classified as light-duty truck, medium-duty truck, and heavy-duty truck. Light-duty autonomous trucks are ideal for urban deliveries and last-mile logistics. Their smaller size and agility make them suitable for navigating city environments, where LiDAR technology plays a vital role in ensuring safety and precision, making it dominate the market.

Heavy-duty trucks are essential for long-haul freight transportation. The implementation of autonomous driving technologies, supported by sophisticated autonomous truck LiDAR systems, enhances safety, reduces operational costs, and addresses driver shortages. These features make it the fastest-growing segment. The medium-duty trucks segment also showcased a significant growth rate.

By LiDAR Type Analysis

Precision and Reliability of Mechanical LiDAR Help Dominate Market

By LiDAR type, the market is segmented into mechanical LiDAR and solid-state LiDAR.

Mechanical LiDAR systems offer high-resolution and long-range capabilities, essential for autonomous trucks operating in varied environments. Despite being more expensive, their precision and reliability make them a preferred choice for early adopters in the autonomous trucking industry, thus helping them dominate the U.S., Europe, and Asia autonomous truck LiDAR market share.

Solid-state LiDAR is more cost-effective and durable, with fewer moving parts than mechanical LiDAR. Its integration into autonomous trucks supports the segment’s growth with higher CAGR due to lower costs and improved robustness.

By Application Analysis

Rising Demand for Efficient and Cost-Effective Transportation Solutions Helps Freight Transport Dominate Market

By application, the market is segmented into mining, construction, freight transport, last mile delivery, and others.

Freight transport benefits significantly from autonomous trucks using LiDAR as it enhances route planning and delivery efficiency. This reduces operational costs and improves supply chain reliability, boosting the market growth. With an increasing demand for efficient and cost-effective transportation solutions, autonomous trucks equipped with LiDAR technology offer significant potential for improving the logistics industry's efficiency, making it a dominant segment in the market.

LiDAR technology is critical for last-mile delivery trucks, enabling precise navigation and obstacle detection in urban environments. This application is driven by the increasing need for efficient, reliable delivery solutions in e-commerce, making it the fastest-growing segment.

Autonomous trucks in mining use LiDAR for navigating complex terrains and ensuring safety, thereby reducing the risk of accidents and increasing operational efficiency. This application drives the demand for advanced LiDAR systems tailored for harsh environments. Growing construction and infrastructure development activities in developing countries will help the construction segment grow in the market. The others segments also indicated considerable market growth.

REGIONAL INSIGHTS

Market segmentation based on geography is as follows: the U.S., Europe, and Asia.

The autonomous truck LiDAR market in the U.S. is expanding due to advanced R&D initiatives and supportive regulatory frameworks. The U.S. has become a dominating country in the market. Companies, such as Waymo and TuSimple lead with extensive pilot programs, thereby enhancing logistics efficiency. The surge in e-commerce activities post-pandemic has driven the demand for autonomous logistics solutions. Additionally, California and Texas offer conducive environments for testing and deploying these technologies.

Europe is growing due to strong regulatory support and sustainability goals. The EU's proactive regulatory framework will foster innovation in autonomous vehicle technology. Companies, such as Volvo and Einride are leading with significant investments and robust pilot projects. The focus on reducing carbon emissions and improving the transportation of heavy materials will boost the adoption of autonomous trucks.

Asia, particularly China and Japan, is rapidly advancing in the global autonomous truck LiDAR market, becoming the fastest growing segment. Companies, such as Baidu and Pony.ai are leading the regional market with their extensive pilot programs. Supportive government policies and significant investments in intelligent transportation infrastructure are driving the Asian market growth. China's focus on technological innovation and Japan's advancements in automation are also the key driving factors.

KEY INDUSTRY PLAYERS

Hesai Group’s Innovative LiDAR Technology and Strong Global Presence Places it Among Leading Players

Hesai Group is a prominent leader in the autonomous truck LiDAR market across the U.S., Europe, and Asia due to its innovative LiDAR technology and strong global presence. Hesai specializes in developing high-performance LiDAR sensors that are essential for autonomous driving systems. Its flagship product, the Pandar series, offers high-resolution 3D mapping and exceptional accuracy, which are critical for the safe operation of autonomous trucks.

In the U.S., Hesai has established partnerships with leading autonomous driving companies, such as Nuro and Zoox, enhancing its market penetration and demonstrating the reliability of its technology in real-world applications (Business Wire) (Stock Analysis). In Europe, Hesai has collaborated with key automotive manufacturers and technology firms, integrating its LiDAR systems into various autonomous vehicle projects. Its compliance with stringent European safety and quality standards further solidifies its market position.

In Asia, particularly in China, Hesai is a dominant player, benefiting from strong government support for autonomous vehicle development and significant investments in intelligent transportation infrastructure. The company’s extensive R&D capabilities and continuous innovation in LiDAR technology make it a preferred partner for numerous autonomous vehicle initiatives(Business Wire). Its ability to provide scalable and cost-effective solutions that are tailored to the needs of different markets underpins its leadership in the global autonomous truck LiDAR market. Quester Inc., Cepton Inc., and Robosense are some of the other prominent players in the market.

LIST OF TOP U.S. EUROPE & ASIA AUTONOMOUS TRUCK LIDAR COMPANIES:

- Ouster, Inc. (U.S.)

- Quanergy Solutions, Inc. (U.S.)

- Cepton, Inc. (U.S.)

- LeddarTech Inc. (Canada)

- Continental AG (Germany)

- Innoviz Technologies Ltd. (Israel)

- RoboSense Technology Co., Ltd. (China)

- Leishen Intelligent System Co., Ltd. (China)

- AEye, Inc. (U.S.)

- Seyond (China)

- Hesai Technology (China)

- Velodyne LiDAR, Inc. (U.S.)

- Aeva Inc. (U.S.)

- Luminar Technologies Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2024: Navistar partnered with Plus to bring autonomous trucks to the U.S. roads, a move that was bolstered by supportive regulatory frameworks and incentives aimed at promoting innovation in autonomous vehicle technology.

- January 2024: Aeva and Daimler Truck AG signed an agreement to supply long and ultra-long-range LiDAR for its series production autonomous commercial vehicle program. Under this agreement, Aeva will supply its latest Aeva Atla automotive grade 4D LiDAR technology to Daimler Truck and collaborate with Torc Robotics to enable SAE Level 4 autonomous vehicle capabilities, beginning with the Class 8 Freightliner Cascadia truck platform.

- July 2023: Vueron, a leading LiDAR perception software provider, chose Cognata, a renowned ADAS and AV simulation software provider, as its trusted simulation partner to accelerate advancements in LiDAR perception software for autonomous driving systems.

- April 2023: Ouster, Inc. announced the launch of Ouster Gemini, its cloud-backed digital LiDAR perception platform for crowd analytics, security, and intelligent transportation systems. Ouster Gemini offers the ability to detect, classify, and track moving objects in real-time using 3D data from a single or multiple-fused Ouster LiDAR sensors. Combined with a custom or third-party analytics solution, customers can gather critical insights and act on alerts to improve safety and security, enhance guest experience, boost revenue, and simplify operations.

- January 2023: Cepton introduced its new LiDAR, the Vista-X120 Plus. The company claims it to be the slimmest software definable, top-end automotive LiDAR for real-time adaptive 3D perception. Cepton says that the Vista-X120 Plus advances its vision for mass-market LiDAR adoption.

REPORT COVERAGE

The report provides a detailed market analysis, focusing on crucial aspects, such as leading companies, service types, and product applications. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 7.8% from 2024 to 2032 |

|

Unit |

Value (USD Million) & Volume (Units) |

|

Segmentation |

Level of Autonomy

|

|

Propulsion Type

|

|

|

Truck Type

|

|

|

LiDAR Type

|

|

|

Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 517 million in 2023 and projected to grow to USD 1,184.7 million in 2032.

The market is projected to grow at a CAGR of 7.8% and will exhibit steady growth during the forecast period (2024-2032).

In 2023, the U.S. market stood at USD 208.2 million.

Enhancing safety and operational efficiency in autonomous vehicles is driving the market.

Hesai Technology is the leading player in the global market.

The U.S. dominated the market share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us