Bovine Vaccines Market Size, Share & Industry Analysis, By Product (Inactivated, Live Attenuated, Recombinant, and Others), By Route of Administration (Oral, Parenteral, and Intranasal), By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

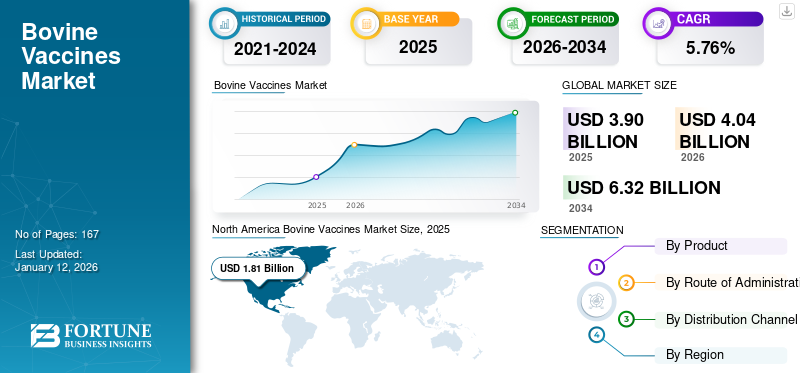

The global bovine vaccines market size was valued at USD 3.9 billion in 2025. The market is projected to grow from USD 4.04 billion in 2026 to USD 6.32 billion by 2034, exhibiting a CAGR of 5.76% during the forecast period.North America dominated the bovine vaccines market with a market share of 46.50% in 2025.

The bovine vaccines are widely used to protect bovines from infectious diseases. The rising prevalence of various diseases such as Foot and Mouth Disease (FMD), hemorrhagic septicemia, black quarter, brucellosis, and others in bovines increases the demand for effective immunization. This prevents the disease spread and maintains the quality of the meat and dairy products. The bovine vaccines market is expected to witness significant growth during the forecast period.

- For example, the World Organization for Animal Health reports that Foot and Mouth Disease (FMD) affects 77.0% of the global livestock population.

Furthermore, the rising global demand for dairy and meat products and growing awareness regarding animal health and preventive veterinary care are also significantly propelling the market growth.

- For instance, according to the data published by the World Wildlife Fund, millions of farmers worldwide tend to use approximately 270.0 million dairy cows to produce milk. This large number of cows for producing milk increases the demand for immunization to lower the risk of disease spread, boosting the market growth.

Moreover, the presence of key market players, such as Zoetis Services LLC, Elanco, and HIPRA, with strong initiatives for research & development and robust strategic activities between the companies and agricultural stakeholders, also accelerated the development of novel vaccine solutions.

Global Bovine Vaccines Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 3.9 billion

- 2026 Market Size: USD 4.04 billion

- 2034 Forecast Market Size: USD 6.32 billion

- CAGR: 5.76% from 2026–2034

Market Share:

- North America dominated the bovine vaccines market with a 46.50% share in 2025, driven by rising demand for dairy products, growing awareness of animal health, and robust R&D initiatives for veterinary vaccines.

- By product, the inactivated vaccines segment is expected to retain its largest market share owing to increasing product launches, higher efficacy, and approvals for preventing disease spread in cattle.

Key Country Highlights:

- United States: Rising demand for dairy and meat products, stringent food safety regulations, and increasing R&D activities for advanced bovine vaccines are driving market growth.

- Europe: The rising prevalence of zoonotic diseases and government-led vaccination programs for field animals are propelling demand for bovine vaccines.

- China: Growing focus on animal husbandry and increasing dairy production are key factors supporting bovine vaccine adoption to enhance livestock health and productivity.

- Japan: Rising awareness regarding preventive veterinary care and an increasing emphasis on livestock health management strategies are driving the demand for bovine vaccines.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Diseases and Demand for Dairy Products to Propel Market Growth

The rising prevalence of livestock diseases and the shift of consumer preferences toward dairy products have raised the need for healthy, productive cattle, necessitating effective vaccination to prevent the occurrence of diseases.

- For example, data from Improve International indicated that in 2021, approximately 30 out of every 100 cows were affected by mastitis, resulting in costs of around USD 12,771.4 per year for farmers, leading to premature culling and financial strain. The number of affected cattle led to the shift of focus of farmers for adequate vaccination to avoid economic losses.

Additionally, the growing awareness about animal health and welfare among farmers is propelling the adoption of vaccination programs and increasing investments in health management strategies, including immunization, boosting milk production and quality. This, in turn, bolsters the demand for the product and propels the bovine vaccine market growth.

MARKET RESTRAINTS

Limited Uptake of Immunization in Developing Countries Poses a Significant Obstacle to Market Growth

The increasing incidence of vaccine-preventable diseases underscores the limited adoption of immunization in developing countries, thereby restricting market growth. Also, insufficient healthcare infrastructure, low public awareness, and economic challenges hinder the widespread application of vaccines for both livestock and animals in middle-lower economic areas.

- For instance, data from the Food and Agriculture Organization reveals that livestock in developing nations experience a high number of preventable deaths each year. A meta-analysis shows that annually, approximately 20.0% of ruminants die prematurely, with 25.0% of these being young animals and 10.0% adults, and nearly half of these fatalities are attributed to infectious diseases.

- Major livestock epidemics include foot and mouth disease, Newcastle disease, African swine fever, classical swine fever, and contagious bovine pleuropneumonia.

MARKET OPPORTUNITIES

Research & Development Initiatives to Launch New Vaccines for Various Diseases Offer a Lucrative Growth Opportunity

The bovine vaccines market presents a lucrative growth opportunity driven by increasing research and development initiatives aimed at launching new vaccines for various diseases affecting cattle. The rising prevalence of livestock diseases can significantly impact meat and dairy production, thus increasing the demand for effective vaccines. Furthermore, innovations in biotechnology and immunology led to the development of more efficient and targeted vaccines, enhancing disease prevention and management in herds.

- For instance, in August 2024, Researchers from the University of Missouri developed a vaccine to protect cattle from a devastating tick-borne cattle disease known as bovine anaplasmosis. This development aims to secure cattle health and the agricultural economy.

MARKET CHALLENGES

Higher Development Cost and Regulatory Hurdles to Challenge Market Growth

One significant challenge for the bovine vaccines market growth is the regulatory barriers associated with long and costly approval processes for new vaccines, particularly genetically engineered products. Additionally, stringent regulatory approvals may extend the development timeline and delay the introduction of innovative vaccines. Also, the complexity and expense of navigating regulatory requirements can deter pharmaceutical companies from investing in the development of new vaccines tailored to specific regional needs, particularly in developing countries.

As a result, the availability of effective and affordable bovine vaccines is limited, which can aggravate health issues in cattle populations and negatively impact livestock productivity in the lower economic regions.

BOVINE VACCINES MARKET TRENDS

Development of mRNA Vaccines for Bovine Health is an Emerging Trend in the market

The development of the mRNA vaccine is revolutionizing the bovine vaccine market by offering a novel approach to combating diseases in cattle. These vaccines deliver genetic instructions to the host's cells, prompting them to produce specific proteins that elicit a robust immune response.

This technology allows for rapid development and adaptability in response to emerging pathogens, making it particularly valuable in managing diseases that can impact livestock health and productivity. Furthermore, mRNA vaccines can be designed to target multiple pathogens simultaneously, enhancing their efficacy and reducing the need for multiple vaccinations. These benefits associated with the new-tech vaccines are aimed at expanding bovine vaccination and protecting against diseases.

- For example, in February 2025, Elanco collaborated with Medgene to utilize its cutting-edge vaccine platform technology. This agreement focuses on the commercialization of a vaccine for Highly Pathogenic Avian Influenza (HPAI) intended for dairy cattle. Vaccination against the H5N1 avian flu with mRNA vaccines can protect against severe disease and death. Such initiatives contribute to the introduction of new bovine vaccines and influence global veterinary vaccine market trends.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The bovine vaccines market noticed a slower growth trajectory during the COVID-19 pandemic. The COVID-19 outbreak significantly impacted the market due to disruptions in supply chains, manufacturing, and distribution networks. Lockdowns and travel restrictions hampered the movement of raw materials and finished products, leading to production delays. Additionally, reduced veterinary services during the pandemic limited the administration of vaccines to livestock.

SEGMENTATION ANALYSIS

By Product

Rising Approvals and Product Launches for Inactivated Vaccines led to Segment Dominance

On the basis of product, the global market is segmented into inactivated, live attenuated, recombinant, and others.

The inactivated vaccines segment is expected to hold a significant global bovine vaccines market share in 2024. Increasing product launches of inactivated vaccines by key companies to prevent disease spread in cattle are driving segmental growth.

- For instance, in May 2024, Boehringer Ingelheim International GmbH launched BULTAVO 3, an inactivated vaccine. It is injected intramuscularly in cattle to protect them against Bluetongue Virus Serotype 3 (BTV-3).

The live attenuated segment is expected to secure a substantial share of the market. The benefits associated with the live attenuated vaccines and rising product launches are boosting the segment's growth in the market.

- For instance, in February 2025, Biovet Private Ltd received a license from the Central Drug Standards Control Organization (CDSCO) for the launch of BIOLUMPIVAXIN. It is a live-attenuated vaccine that protects dairy cattle and buffaloes from Lumpy Skin Disease (LSD).

The recombinant vaccines are anticipated to grow with a significant CAGR during the forecast period. The cost-effective production of higher-quality products has contributed to the high growth of the recombinant segment.

By Route of Administration

High Efficacy and Regulatory Approvals Boosted Parenteral Segment Growth

Based on route of administration, the global market is divided into parenteral, oral, and intranasal.

Higher efficacy in inducing immunity and rapid onset of action is contributing to the dominance of the parenteral segment in the global market in 2024. Additionally, key companies are also launching new parenteral vaccines supplementing the segment growth.

- For instance, in June 2023, Zoetis Services LLC launched a modified live vaccine named Protivity, which the European Union approved. It is used to protect healthy beef and dairy calves against respiratory disease caused by Mycoplasma bovis infection.

The intranasal segment is expected to grow significantly during the forecast period. Increasing product launches and approval due to ease of application is bolstering the segment's growth in the market.

- For instance, in February 2020, Merck & Co., Inc. introduced Nasalgen 3. It is a three-way intranasal vaccine that helps to prevent beef and dairy cattle from pneumonia-causing viral pathogens.

The oral segment is expected to grow with a substantial CAGR over the forecast period. This is augmented by the preference for these routes in situations where mass vaccination is needed, and administration can be easily done to large groups.

By Distribution Channel

Rising Awareness Programs to Boost Veterinary Hospitals' Growth

On the basis of distribution channel, the market is segmented into veterinary hospitals, veterinary clinics, pharmacies & drug stores, and others.

Veterinary hospitals segment is anticipated to hold the maximum share of the market during the forecast period. The government's rising awareness programs increase the vaccination rate amongst dairy cattle to prevent the spread of infectious diseases and decrease economic losses. This results in a higher demand for vaccination through hospitals.

- For instance, in March 2025, the Livestock Health & Disease Control Programme (LHDCP) initiated a vaccination drive against Foot and Mouth Disease (FMD), Brucellosis, Peste des Petits Ruminants (PPR), and Classical Swine Fever (CSF), which the Government of India funds for all States and Union Territories. Such programs increase the adoption of vaccines by dairy farmers and raise the distribution through hospitals to boost the segment's growth.

The pharmacies and drug stores segment in the bovine vaccine market is poised for considerable growth due to increasing awareness among livestock owners about disease prevention and management. The rise in veterinary health consciousness and the demand for high-quality bovine vaccines are driving sales in retail outlets. Additionally, the accessibility of vaccines through pharmacies enhances convenience for farmers and ranchers. This helps and supports preventive healthcare in the livestock industry.

The veterinary clinics are also expected to grow with considerable CAGR, owing to the rising number of veterinary practitioners to boost the immunization of cattle.

- For instance, in 2023, according to the Veterinary Council of India (VCI), there will be 81,938 Registered Veterinary Practitioners in India 2023. Such scenarios boost the treatment of dairy animals in these settings and propel market growth.

BOVINE VACCINES MARKET REGIONAL OUTLOOK

Geographically, the market is segmented into North America, Asia Pacific, Europe, Latin America, and Middle East & Africa.

North America

North America Bovine Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America's bovine vaccines market size was valued at USD 1.81 billion in 2025 and dominated the global market. The rising demand for dairy products and the growing awareness of animal health and welfare among farmers is propelling the adoption of vaccination programs across the region. Additionally, strong regulatory support and funding activities for veterinary vaccine R&D further stimulate market growth in the North America region.

U.S.

The U.S. dominated the North American region across the study period. Rising demand for dairy and meat products and stringent policies regarding food safety led to an increase in vaccinations among animal farmers to maintain animal health and product quality. Additionally, the increasing number of research and development activities for vaccine development boosts the country's growth.

- For instance, in March 2024, researchers from Louisiana State University developed a new vaccine against Bovine Respiratory Disease (BRD) to save the U.S. cattle industry from Bovine Herpes Virus Type 1 (BHV-1).

Europe

Europe is expected to grow significantly during the forecast period. The market growth in the region is driven by the rising prevalence of zoonotic diseases and increasing government activities to offer vaccination to field animals across the country.

- In February 2023, the Animal and Plant Health Agency initiated Phase 2 of field trials for a cattle vaccine and a new skin test for Bovine Tuberculosis (bTB) with an aim to assess the safety performance of the TB vaccines in farm animals. Such initiatives boost the demand for vaccines and drive the market growth.

Asia Pacific

The Asia Pacific market is expected to grow with a significant CAGR during the forecast period. The rising prevalence of bovine diseases and the increasing focus of farmers on animal husbandry are some of the prominent reasons for the bovine vaccine market growth.

Additionally, rising demand and production of dairy products in the region increases the adoption of vaccination for maintaining health and quality, eventually boosting the market's growth in the region.

- For instance, according to the Dairy and Products Annual Report 2023, in India, Buffalo milk production in 2024 was forecast to be 110.7 million metric tons, which represents an increase of nearly two percent from 2023. Also, buffalo held 32.0% of all species for milk production in India.

Latin America and the Middle East & Africa

The Middle East & Africa and Latin America markets are expected to witness moderate growth during the forecast period. The increasing number of diseases in livestock animals and the rising demand for effective immunization to protect from deadly and contagious diseases is propelling the demand for bovine vaccines in the regions.

Additionally, increasing government initiatives for the vaccination of livestock animals further bolsters the market's growth in the region.

- For instance, the Abu Dhabi Agriculture and Food Safety Authority (ADAFSA) has initiated its 16th annual vaccination campaign for 2024-2025, focusing on safeguarding livestock across the Emirate of Abu Dhabi. This campaign aimed to immunize 2,406,452 sheep, goats, and cattle against diseases included in the National Immunisation Program.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strong Product Portfolio and Extended Research Activities Boost Key Companies Growth

In the competitive landscape, several companies have established dominance through their robust product offerings and strategic decisions. Notable players in the market include Zoetis Services LLC, Merck & Co., Inc., HIPRA, and Elanco. Ongoing research and development for new product launches, along with a broad geographical presence, are anticipated to enhance these companies' market shares.

Other prominent players include Boehringer Ingelheim International GmbH, Virbac, Ceva, and others. These players are expected to expand their revenue share in the market with improved product offerings and development activities.

LIST OF KEY BOVINE VACCINES COMPANIES PROFILED

- Elanco (U.S.)

- HIPRA (Spain)

- Boehringer Ingelheim International GmbH (Germany)

- Virbac (France)

- Merck & Co., Inc. (U.S.)

- Zoetis Services LLC (U.S)

- Ceva (France)

- Indian Immunologicals Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- September 2024: Ceva announced the launch of BLUEVAC-3, a new bluetongue (BTV-3) vaccine in the U.K. It is an active immunization against BTV-3 for use in sheep and cattle.

- October 2024: Merck & Co., Inc. announced that the European Medicines Agency has approved BOVILIS ROTAVEC CORONA. This vaccine is intended for subcutaneous administration to pregnant cows and heifers to stimulate the production of antibodies against E. coli adhesins F5 (K99) and F41, as well as rotavirus and coronavirus.

- August 2024: Merck & Co., Inc. announced the approval from the Veterinary Medicines Directorate (VMD) for the first vaccine designed to protect cattle from cryptosporidiosis. This highly infectious disease significantly affects the gastrointestinal health of livestock.

- January 2024: Kyoto Biken Laboratories, Inc. announced that the United Arab Emirates (UAE) authority approved KYOTOBIKEN CATTLEWIN-5K, OVINE EPHEMERAL FEVER VACCINE, K-KB, KYOTOBIKEN CALFWIN 6 COMBO LIVE VACCINE for bovine respiratory diseases.

- September 2022: Boehringer Ingelheim International GmbH launched Fencovis, a new vaccine to prevent calf diarrhea caused by bovine coronavirus.

REPORT COVERAGE

The global bovine vaccines market report provides a detailed analysis of the market. The report focuses on key segmental analysis according to the products, route of administration, and distribution channels. Additionally, it offers insights into the market dynamics, such as driver restraints, opportunities, and market trends that impacted the market. Besides this, the global market report offers regulatory guidelines, vaccination guidelines for bovine, key industry developments, and new product launches. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 5.76% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 3.9 billion in 2025.

In 2024, the North America market stood at USD 1.81 billion.

By registering a CAGR of 5.76%, the market will exhibit steady growth during the forecast period (2026-2034).

Based on the products, the inactivated segment is expected to lead the market during the forecast period.

The rising prevalence of bovine diseases and increased awareness about animal health, along with the rising demand for dairy products, would drive the adoption of bovine vaccines.

Zoetis Services LLC, Merck & Co., Inc., and HIPRA are the top players in the market.

North America is expected to hold the largest share of the market.

The current market trends are the adoption of advanced vaccines and increased awareness amongst animal farmers.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us