Casing Centralizer Market Size, Share & Industry Analysis, By Type (Bow Spring { Hinged Welded Bow Spring Centralizer, Slip-On Welded Bow Spring Centralizer, Slip-On Welded Positive Casing Centralizer, Hinged Non-Welded Bow Spring Centralizer, and Others}, Rigid {Straight/Spiral Vane Solid Centralizer, Straight/Spiral Roller Solid Centralizer, Straight/Spiral Vane Aluminum Solid Centralizer, and Others}, and Others), By Material (Aluminum, Steel, and Others), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

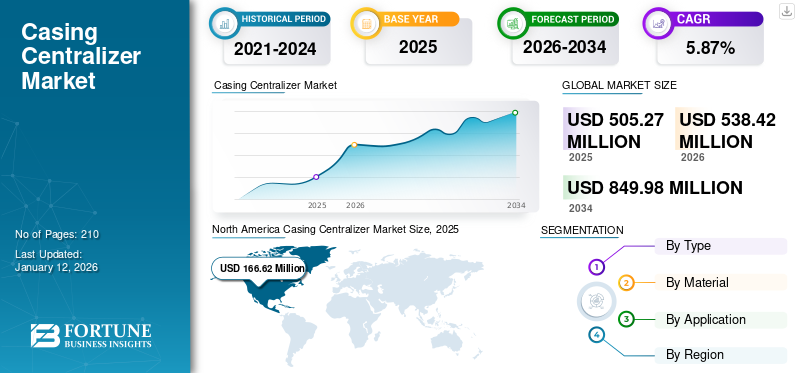

The global casing centralizer market size was valued at USD 505.27 million in 2025 and is projected to grow from USD 538.42 million in 2026 to USD 849.98 million by 2034, exhibiting a CAGR of 5.87% during the forecast period. The North America dominated the Casing Centralizer Market with a share of 32.98% in 2025.

Casing centralizers are important cementing tools that are used to position the casing uniformly inside the wellbore, offer uniform distribution of cement slurry, and reduce the casing between the wellbore and casing. The casing centralizer offers 360-degree annular space around the wellbore that improves cementing efficiency. These centralizers have excellent corrosion & abrasion resistance, are available in a wide range of structures & sizes, and have high centralizing performance. Casing centralizers are available in various types, namely bow spring centralizers, rigid centralizers, semi-rigid centralizers, and mold-on centralizers. The casing centralizers enhance the overall well integrity as they ensure a strong & leak-proof seal that prevents fluid leaks & maximizes the operational lifespan of wells.

Global Casing Centralizer Market Overview

Market Size:

- 2025 Value: USD 505.27 million

- 2026 Projected Value: USD 538.42 million

- 2034 Forecast Value: USD 849.98 million, with a CAGR of approximately 5.87% from 2026 to 2034

Market Share:

- Regional Leader: North America, holding approximately 32.98% of the global market in 2025

- End-User Leader: Onshore application segment dominates, reflecting its primary deployment in conventional and shale well projects

Industry Trends:

- Bow Spring Centralizers Lead: The bow spring segment holds the largest share by type, supported by its flexibility and adaptability in various wellbore conditions

- Material Diversity: Manufacturers leverage steel, aluminum, and other materials to balance cost, durability, and ease of handling

- Onshore Dominance: Onshore applications prevail due to established drilling activity and cost efficiencies in mature regions

Driving Factors:

- Growing upstream oil & gas drilling activities, especially in shale-rich North America, increasing reliance on centralizers for well integrity

- Rising global demand for oil and natural gas, prompting new drilling and well intervention efforts worldwide

- Onshore drilling expansions in mature fields, where centralizers ensure effective cement bonding and minimize casing damage

- Preference for bow-spring types, as they deliver excellent centralization performance and corrosion resistance across boreholes

- Material innovation and variety, leveraging steel and aluminum centralizers to optimize cost, weight, and durability based on drilling requirements

Halliburton is a prominent player in the casing centralizer market with diverse product offerings, including RED-X centralizers. The company focuses on offering casing centralizers for different well types and applications, including vertical and horizontal wells. The company provides RED-X classic centralizers that are available in both hinged and slip-on configurations for all standard casing & hole sizes. Halliburton’s casing centralizers have good restoring forces and wellbore standoffs that are widely preferred for vertical well operations.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Oil & Gas Drilling Operations Drives Market Growth

Oil & gas drilling operations are gaining huge popularity globally as they are essential for petroleum production, which is an important energy source. These operations involve drilling the oil wells and installing equipment to ensure safe production of oil & gas. Centralizers increase the amount of fluid turbulence, thereby preventing caking on wellbore walls. Also, the centralizers can be placed in restricted areas.

The countries with large numbers of crude oil and natural gas production activities have showcased increased demand for centralizers. For instance, according to the U.S. Energy Information Administration (EIA), in 2022, approximately 14.5% of U.S. crude oil was produced from the wells that are present in the Federal Offshore Gulf of Mexico, and 0.1% of crude oil was produced from Federal Offshore Pacific (California). The five major crude oil producing states that accounted for around 72% of total U.S. crude oil production in 2022 were Texas with 42.5%, New Mexico with 13.3%, North Dakota with 8.9% share, Colorado with 3.7% share, and Alaska accounting for 3.7% share.

In addition, in 2022, the five major crude oil producing countries in the world were the U.S. accounting for 14.7% of crude oil production followed by Saudi Arabia with a 13.2% share, Russia with a 12.7% share, Canada with 5.6% share, and Iraq with 5.5% share. Thus, a rise in crude oil production is anticipated to drive the demand for casing centralizers owing to their ability to facilitate efficient oil & gas drilling operations.

Increasing in Cementing Operations to Maintain Well Integrity is Driving Casing Centralizers Demand

The cementing operations in the oil & gas sector are on the rise, which involves pumping slurry into the well to seal the annulus between the casing and the formation. Casing centralizers play a vital role in cementing operations as they prevent the water and gas from reaching the oil-bearing strata. Hence, the use of casing centralizers is crucial and widely used for exploratory drilling of oil & gas wells.

Moreover, if the casing is not centered within the wellbore, then the risk of leaving behind contaminated drilling fluid or cement with an imperfect seal increases. Casing centralizers are suitable for vertical, horizontal, and deviated well sections. Also, they are available in hollow or solid blade options along with straight, right, or left-hand configurations.

The centralizers are made from thermoplastic materials that have no metal parts, are long-lasting, and are non-susceptible to corrosion. For instance, kwik-ZIP, the leading Australia-based centralizers and spacer manufacturing company, offers varied centralizers that are used across different industry sectors, including trenchless pipelines, production well drilling, Horizontal Directional Drilling (HDD), and other applications. Also, these centralizers can withstand harsh environments such as corrosive soils and water. In such environments, centralizers made from Glass-Reinforced Plastic (GRP) or fiberglass are majorly used instead of steel or aluminum casings. These factors contribute to the growing demand for casing centralizers.

MARKET RESTRAINTS

Increased Drag and Limited Effectiveness in Highly Deviated Wells to Hamper Market Growth

The casing centralizers face certain limitations owing to their inability to use highly deviated or heavy casing strings effectively. Also, the added bulk of centralizers raises the friction between the walls of wellbores, which leads to increased drag during casing installation, especially for tortuous or tight sections.

In addition, different centralizers have varying strengths, which impacts the efficiency of oil & gas drilling operations. For instance, the bow spring casing centralizers do not effectively support heavy casing in deviated wells, whereas the rigid centralizers lack the necessary centering in vertical walls. Thus, for ensuring optimal wellbore operations, it is essential to consider the wellbore geometry carefully. The accurate prediction of centralization achieved by centralizers can be challenging owing to wellbore irregularities, complex interaction between wellbore wall & centralizer, and variation in casing stiffness.

Furthermore, centralizers, especially polymer types, are susceptible to wear and tear when they come in contact with a wellbore. This hampers the effectiveness of the wellbore in keeping the casing centered. In harsh conditions, the risk of downhole breakage is high, which can create debris and obstruct the wellbore, thereby negatively impacting the lead to Non-Productive Time (NPT).

MARKET OPPORTUNITIES

Development of Efficient Designs Using Advanced Materials is Anticipated to Generate Excellent Opportunities

Rapid advancements and innovations in casing centralizers, along with the development of efficient designs and advanced materials, are leading to new growth opportunities in the market. For instance, composites and lightweight materials such as advanced alloys are used to manufacture centralizers that withstand harsh conditions while maintaining a low weight.

In addition, the customizable design & variable form that can fit different wellbore inclinations & diameters is gaining significant popularity. For instance, the slip-on welded straight cage rigid centralizer is used for highly deviated horizontal wells, where casing centralization plays a crucial role. Also, this centralizer offers superior toughness over other materials, and it is painted and coated with polyester powder.

The slip-on welded straight cage rigid centralizer can be placed directly on the pipe by slipping on, with or without setscrews, to eliminate the stop collar. NeOz Energy is one of the leading oil & gas manufacturing companies that specializes in high-quality casing centralizers for vertical and deviated drilling. The company specializes in the manufacturing of premium centralizers, namely Scratcho-N-Centralizer, Stello-N-Centralizer, and Twisto-N-Centralizer. For instance, the Twisto-N-Centralizer, designed by NeOz, is specially designed for extremely easy casing reciprocation and rotation with no weak points. This single-piece spiral construction serves as a canopy that gives the casing a complete 360-degree centering.

MARKET CHALLENGES

Restrictions on Drilling Activity Pose Significant Challenges for Emerging Industry Players

The oil and gas exploration activities are strictly monitored and regulated in certain countries with seasonal or permanent restrictions on drilling activity in order to protect the wildlife. Also, permanent restrictions on drilling activity in certain areas to protect the endangered species pose market challenges, which creates a hurdle for the casing centralizer market growth.

The oil & gas drilling activities are regulated via various laws & regulations such as the Petroleum and Natural Gas Rules, 1959, Oilfields (Regulation and Development) Act, 1948, and others. In addition, environmental concerns, namely greenhouse gas emissions, natural disasters, oil spills, workers' safety, blowouts, and well control, pose challenges for the casing centralizers market growth. Compliance with the laws & regulations requires the acquisition of permits to conduct regulated activities.

CASING CENTRALIZER MARKET TRENDS

Specialized Centralizer Designs for Complex Wells are Key Trends in the Market

The global oil & gas exploration and production activities are experiencing a remarkable transformation that has led to the development of specialized centralizers. These specialized centralizers are widely used for high-deviation horizontal wells, which have adjustable blade heights that can efficiently adjust to the changing wellbore diameters. These centralizers are ideal for highly deviated & horizontal wells. For instance, Oilmec Drilling Equipments Pvt. Ltd., the leading manufacturer of downhole, drilling & production equipment, manufactures solid rigid centralizers, which are fabricated using supreme quality material that ensures extra-strength and superior stiffness. These centralizers have optimal tensile & yield strength and are shock-resistant.

The specialized centralizers are highly customizable and offer optimal standoff and coverage. Halliburton, the leading manufacturer of casing centralizers, has designed Protech II centralizer blades, which are comprised of carbon fiber and ceramic fiber blend that adheres directly to pipe substrate or casing with chemical bonding, superior downhole impact resistance, high adhesion values, flexibility, and toughness. Also, compared to polymer & steel products, the Protech II centralizer offers substantial power generation and frictional force reduction owing to its coefficient of friction at 0.08 compared to polymer and steel products.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic significantly disrupted the oil and gas drilling operations owing to the widespread shutdown of well operations with reduced operation capacity due to safety protocols. The declining oil prices owing to oversupply and demand contraction impacted the new CAPEX programs, owing to which the company financials were impacted and there was a decline in casing centralizer market share.

Moreover, falling gas prices impacted many value chain players, owing to which force majeure clauses were invoked by the companies to get out of take-or-pay clauses, resulting in a 25-30 percent reduction in asset utilization. Without substantial investments, the reduced supply of oil & gas prices led to higher prices & market volatility, slowing down the economic recovery & risking energy security and international goals.

SEGMENTATION ANALYSIS

By Type

Bow Spring Centralizers Dominate Market Share Due to Reduced Friction, Improved Cementing, and High Durability

Based on type, the market is segmented into bow spring, rigid, and others. The bow spring centralizers are widely used in oil & gas well drilling operations as these centralizers improve cementing flow & reduce channeling by minimizing friction between well casing & wellbores. Bow Spring Centralizers Dominate Market with a share of 45.82% in 2026. Also, the bow spring centralizers offer uniform annular clearance, and they are well-suited for deviated as well as vertical drilling operations. For instance, the welded bow spring centralizers manufactured by Weatherford are designed to centralize casing during running and cementing operations of wellbores. In addition, these centralizers have spring-steel bows, are heat-treated, and are welded to unique rigid end collars.

The bow spring centralizers offer high standoff for efficient mud & cement displacement, and they are available at different heights to ensure optimum restoring forces. The welded bow spring centralizers are well-suited for vertical & horizontal wells, cased-hole & open-hole applications, casing or liner strings where reciprocation is beneficial, as well as for washed-out & under-reamed wells. The welded bow spring centralizers Dominate market by contributing 15.25% globally in 2026. The welded bow spring centralizers by Weatherford are available in different hole sizes that offer the best possible zonal isolation & minimize remedial cementing operations & costs. Also, there are various types of bow spring centralizers available, namely slip-on single-piece bow spring centralizers, hinged non-welded bow spring centralizers, hinged non-welded positive casing centralizer, hinged welded bow spring centralizer, slip-on welded bow spring centralizer, and slip-on welded positive casing centralizer. Straight/Spiral Vane Solid Centralizer Dominate with a share of 10.79% in 2026.

By Material

Steel Dominates Market Owing to Their Consistent Performance & Excellent Wear Resistance

Based on material, the market is segmented into aluminum, steel, and others. Steel is a widely preferred metal for manufacturing centralizers. Steel has excellent wear resistance durability, with an ability to withstand harsh downhole environments present in the oil & gas sector. The use of steel centralizers ensures consistent performance and long-term reliability, making them a preferred choice for proper casing alignment. The proper casing alignment prevents uneven grout & cementing operations around the wellbore. Steel Dominates Market with contribution of 63.64% globally in 2026.

Steel centralizers offer a high structural integrity that resists deformation even under stress & high-pressure conditions. Thus, the steel centralizers have less chance of break-down or degradation, leading to consistent centering of the casing. As these centralizers can be reused and have high longevity, they are cost-effective in the long run. The steel centralizers are widely adopted for various applications such as pump torque arrestors, water well casing, gravel-packed well screens, submersible pump installation, coal steam methane casing, downhole logging tools, drop pipe within water well casing, pump risers, and others.

To know how our report can help streamline your business, Speak to Analyst

By Application

Onshore Segment Dominates Market as Majority of Oil & Gas Well Drilling Operations are Performed Onshore

Based on application, the market is segmented into onshore and offshore. Onshore is a leading segment in the casing centralizers industry, as majority of the well drilling operations are performed onshore. According to the Energy Information Agency (EIA), globally, onshore oil production accounted for a share of 72%, whereas in the U.S., onshore oil production accounted for 85% in 2022. Also, as onshore oil & gas activities require high flexibility & scalability, the casing centralizers are widely used for onshore applications.

In addition, onshore drilling of oil & gas rigs is less expensive as it is easier to set up and maintain. The use of casing centralizers for onshore drilling operations is less risky, as the chances of oil spills are less. Also, the use of advanced techniques such as hydraulic fracturing has led to an increase in the production of onshore sites. Onshore drilling has a lower environmental impact as the process of drilling on land is less disruptive to ecosystem & marine life.

CASING CENTRALIZER MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Casing Centralizer Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Presence of Large Number of Oil & Gas Rigs Drives Market Growth

North America has the presence of a large number of oil & gas rigs, majorly onshore rigs that are concentrated in the U.S. and Canada. North America dominated the global market in 2025, with a market size of USD 166.62 billion. According to Baker Hughes, in 2023, the number of oil & gas rigs in North America was the highest, accounting for 866 rigs. Oil & gas rigs play a major role in the extraction of oil & gas in North America. Also, the U.S. and Canada are the leading producers of oil & gas in the world. For instance, in 2023, Canada produced 5.76 million barrels of oil per day.

In addition, Canada is the fourth-largest producer of crude oil & fifth-largest producer of natural gas in the world. Most of the country’s petroleum production is exported, with 98% of petroleum production being exported to the U.S. Thus, as the production of oil & gas increases, the demand for casing centralizers being used in North America is anticipated to increase.

Rise in Onshore Oil & Gas Rigs Drive Demand in the Country

The U.S. accounts for a significant portion of oil & gas production, and the country is the leading producer of oil & natural gas in the world. The U.S. market is projected to reach USD 118.42 billion by 2026. According to the Energy Information Agency (EIA), in 2023, the U.S. produced around 13.3 million barrels per day (b/d) on average, and natural gas production was around 128.8 billion cubic feet per day (Bcf/d) on average.

The number of oil & natural gas production wells in the U.S. at the end of 2023 was 918,068. Also, the share of horizontal wells in the last decade increased from 8% to 21% during 2013-2023. In the first half of 2023, the number of new wells increased by 12% compared to the same period in 2022.

Middle East & Africa

Presence of Large Number of Oil Reserves Drives Market Growth

The Middle East & Africa is a prominent oil-producing region in the world, with the countries, namely Iran, Saudi Arabia, Iraq, UAE, and others, accounting for a dominant share in global oil production. The Middle East accounts for a significant portion of global natural gas production and the region has approximately 40% of the world’s proven natural gas reserves. In 2022, the Middle East accounted for more than four in ten barrels of global oil exports. In the Middle East, the share of oil in the total energy supply was 41.95 in 2022, resulting in 8% of the global share.

The share of the Organization of the Petroleum Exporting Countries (OPEC) in 2023 accounted for 79.1%. The leading OPEC-producing countries were Venezuela accounting for a share of 24.4%, followed by Saudi Arabia with a share of 21.5%, Iran accounting for a share of 16.8%, Iraq accounting for a share of 11.7%, the UAE accounting for a share of 9.1%, followed by rest of the countries. Oilmec Middle East is one of the leading manufacturers of drilling & production equipment. The company offers a wide range of roller centralizers, steel welded spiral vane solid body rigid centralizers, zinc alloy spiral vane solid body rigid centralizers, and others.

Saudi Arabia

Presence of Large Number of Oil & Gas Companies with Increased Oil & Gas Production Drives Demand for Casing Centralizers

Saudi Arabia is the world’s third-largest crude oil producer and the top exporter. For instance, Saudi Aramco is one of the leading producers of oil & natural gas, with an average of 13.6 million barrels per day (mmbpd) of oil & natural gas production. Also, globally, Aramco has the largest proven oil reserves, with crude oil production accounting for 11.5 mbpd.

In addition, TotalEnergies SE is another multinational company with an extensive oil & gas footprint in Saudi Arabia. Also, Chevron Corporation operates a large number of joint ventures & subsidiary companies in Saudi Arabia, with a primary focus on hydrocarbon exploration. Other prominent players in the region are Shell plc, Medra Arabia, Arabian Petroleum Supply Company (APSCO), and others.

According to the Energy Information Agency (EIA), in 2023, Saudi Arabia accounted for around 40% of the Middle East’s oil consumption, and it is the fifth-highest liquid fuel-consuming country after the U.S., China, India, and Russia. Thus, a significant rise in production, consumption, and export of oil & natural gas has led to an increase in drilling operations, thereby driving the casing centralizers market demand.

Asia Pacific

Growing Energy Demand has Led to Increase in Oil & Gas Drilling Operations

Rapid urbanization & economic growth have led to an increase in energy demand in Asia Pacific countries. According to the International Energy Agency (IEA), oil products registered a share of 33% of total energy consumption, and natural gas accounted for a share of 9.7%. The top countries in total energy production in 2022 in the Asia Pacific region were China, India, Japan, Korea, and Indonesia, respectively. Also, the share of oil in the total energy supply was 23.3% in 2022. The China market is projected to reach USD 81.72 billion by 2026, and the India market is projected to reach USD 17.92 billion by 2026.

Europe

Rising Investments in Oil & Gas Exploration Activities

Europe is one of the leading regions in investments pertaining to the oil & gas sector owing to the growing focus on clean energy deployment. According to IEA, the investments in oil & gas reached USD 30 billion in 2023. According to the European Commission, the majority of the oil & gas production in Europe takes place offshore. Offshore oil & gas production is gaining huge prominence in Europe amidst growing energy security concerns. The rise in upstream Exploration and Production (E&P) has centered around the North Sea, with a majority of the investments being reported in this region. The UK market is projected to reach USD 19.92 billion by 2026, while the Germany market is projected to reach USD 8.93 billion by 2026.

Latin America

Adoption of Advanced Drilling Technologies to Boost Casing Centralizers Demand

The adoption of advanced drilling technologies, namely hydraulic fracturing, coiled tubing, horizontal drilling, modern drilling bits, multilateral drilling, and others, is leading to a rise in oil & gas exploration activities in this region. For instance, Venezuela is one of the largest oil producers, and offshore drilling is expanding in Latin America and the Caribbean owing to its expanding oil & gas sector. Hydraulic fracturing is the most widely used technique that stimulates oil & gas well production.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Lucrative Investments Presents Significant Growth Opportunities for Market Players

The global casing centralizer market is characterized by intense competition and is driven by rapid investments in the oil & gas sector, technological advancements in casing centralizers, innovation, and strategic initiatives. Major players such as Halliburton, Weatherford, Summit Casing Equipment, and NeOz Energy are competing through advanced predictive maintenance technologies, comprehensive service portfolios, and AI-driven solutions. For instance, in November 2024, the Government of Alberta, Canada, planned to invest USD 50 million in the development of the Alberta Drilling Accelerator. This will be a test site for developing drilling technologies to minimize emissions and deliver energy.

List of Key Casing Centralizer Companies Profiled

- Halliburton (U.S.)

- Weatherford (U.S.)

- Summit Casing Equipment (U.S.)

- NeOz Energy (India)

- Maxwell Oil Tools Ltd. (Italy)

- Equip Outlet Inc. (U.S.)

- NOV (U.S.)

- Centek (U.S.)

- Amroc Bremse (India)

- Avantgarde Oil Services Limited (Russia)

- kwik-ZIP (Australia)

- NCS Multistage (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Foresea, the leading provider of offshore drilling solutions, began the first automated oil well drilling operation in Brazil using technology from HMH, the Norwegian company. The maneuver, completed with full automation, took place in a well in the Santos Basin and was carried out by Foresea’s Norbe IX drillship. Foresea’s drillship is becoming popular in automated operations with the HMH system in the Brazilian offshore drilling industry.

- December 2024: SLB, the global technology company, launched an AI-driven well drilling tool named Neuro autonomous geosteering, which is an AI-driven tool that can drill more efficient and higher-performing wells.

- December 2024: Uzman Sondaj, a specialist in underground and underwater exploration with operations in Turkey, leveraged Atlas Copco's DrillAir range of portable air compressors that will lead to strong performance in drilling projects. These compressors offer flexibility with pressures from 13 to 40 bar, providing the adaptability needed for constantly changing site conditions.

- November 2024: Reconnaissance Energy Africa (ReconAfrica) completed the drilling operations at the Naingopo exploration well on Petroleum Exploration Licence 073, onshore Namibia. The well reached a total depth of 4,184m. The company is set to initiate a comprehensive logging and coring program to perform a Vertical Seismic Profile (VSP), after which the casing and cementing operations will begin.

- July 2024: Shell plc, the leading U.K.-based oil & gas company, embarked on drilling operations at a high-impact gas prospect in the North Sea. Shell expected operatorship of the P2437 license as part of the process of moving into the drilling phase, succeeding a positive well investment decision for Selene in July 2022 and the approval from the North Sea Transition Authority (NSTA).

Investment Analysis and Opportunities

The casing centralizer market presents several opportunities driven by rising global energy demands, technological advancements in drilling, and the expansion of drilling activities in both established and emerging markets.

- In July 2024, Egypt planned to drill 110 exploratory wells with a USD 1.2 billion investment in the fiscal year 2024/2025. This investment is anticipated to boost the country’s oil and gas production capabilities. Also, there are currently 145 active exploration agreements in oil and gas with 40 partners. Egypt is one of the top five countries in the Middle East & African continent with the highest primary energy production.

- In June 2024, the National Iranian Drilling Company (NIDC) planned to invest USD 800 million in drilling projects to purchase drilling rigs as well as drilling-related equipment & services. According to the National Iranian Oil Company (NIOC), NIDC completed the drilling of more than 5 thousand oil and gas wells in Iran's onshore and offshore sectors. Also, NIDC extracted more than 70 billion barrels of crude oil and gas condensate, along with 5 trillion cubic meters of natural gas from oil and gas fields.

REPORT COVERAGE

The global casing centralizer market research report provides a detailed analysis. It focuses on key market aspects such as major market players, leading types, material, and application. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.87% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

By Material

By Application

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was worth USD 505.27 million in 2025.

The market is likely to grow at a CAGR of 5.87% over the forecast period of 2026-2034.

By type, the bow spring segment accounted for the leading share in the global market.

The market size stood at USD 166.62 million in 2025.

Rapid investments in oil & gas drilling activities, as well as a rise in demand for oil & natural gas, are driving market growth.

Some of the top players in the market are Halliburton, Weatherford, Summiot Casing Equipment, NeOz Energy, and others.

The global market size is expected to reach USD 849.98 million by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us