China Electric Vehicle Battery Housing Market Size, Share & Industry Analysis, By Vehicle Type (Passenger Car and Commercial Vehicle), and By Material (Steel, Aluminum, and Composites), 2024 – 2032

KEY MARKET INSIGHTS

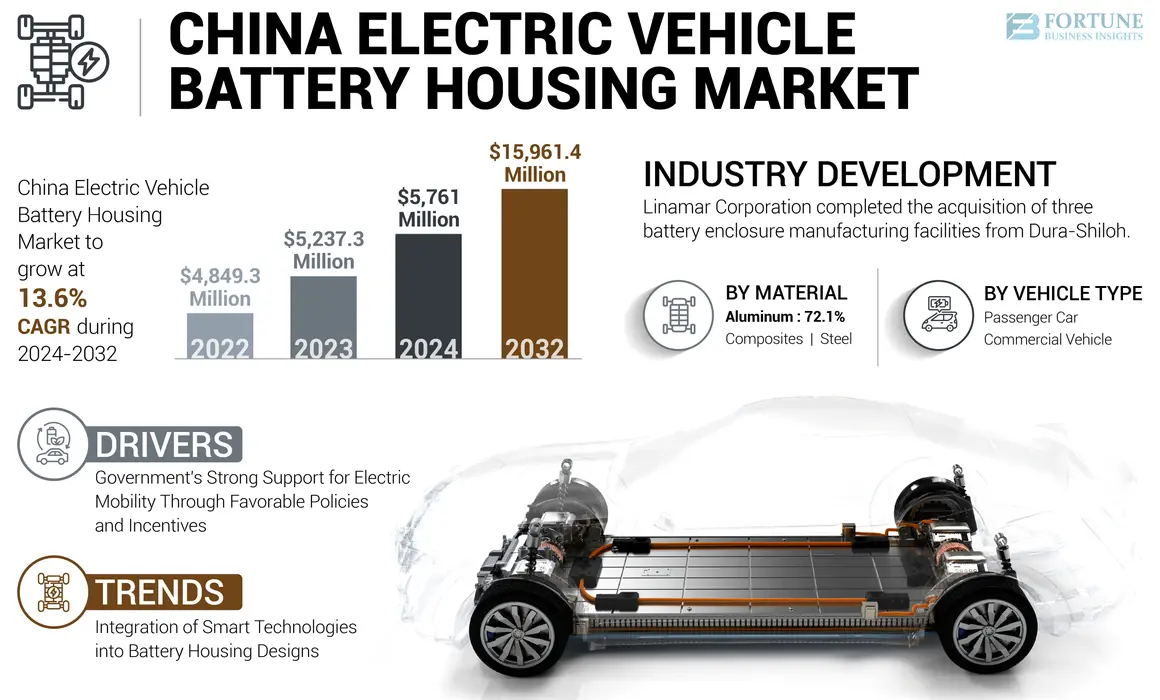

The China electric vehicle battery housing market size was valued at USD 5,237.3 million in 2023 and is projected to grow from USD 5,761 million in 2024 to USD 15,961.4 million by 2032, exhibiting a CAGR of 13.6% during the forecast period.

The China Electric Vehicle (EV) battery housing market is experiencing robust growth, driven by the country's aggressive push toward electric mobility and sustainable transportation. As one of the largest markets for electric vehicles globally, China benefits from supportive government policies, including subsidies and tax incentives that promote EV adoption. The market is characterized by a diverse range of manufacturers focusing on innovative battery housing solutions that enhance safety, thermal management, and structural integrity.  These companies are increasingly investing in advanced materials, such as aluminum and composites to improve performance while reducing weight. The expansion of the charging infrastructure and rising demand for New Energy Vehicles (NEVs) will further contribute to the market's growth, positioning China as a leader in the global EV battery housing market.

These companies are increasingly investing in advanced materials, such as aluminum and composites to improve performance while reducing weight. The expansion of the charging infrastructure and rising demand for New Energy Vehicles (NEVs) will further contribute to the market's growth, positioning China as a leader in the global EV battery housing market.

The COVID-19 pandemic significantly impacted China's EV battery housing market by disrupting supply chains and production capabilities. Lockdowns and restrictions led to shortages of critical materials and components, slowing down manufacturing processes. However, the pandemic also accelerated the shift toward electric vehicles as consumers sought sustainable alternatives amid growing environmental concerns. As a result, the long-term outlook for the EV battery housing market remains positive, with increasing investments in technology and infrastructure expected to drive recovery and growth.

China Electric Vehicle Battery Housing Market Trends

Integration of Smart Technologies into Battery Housing Designs to Emerge as Major Market Trend

Manufacturers are increasingly incorporating advanced monitoring systems and sensors within battery enclosures to enhance safety and performance. These smart battery housings can track temperature, pressure, and other critical parameters in real-time, allowing for the proactive management of battery health and performance. For example, companies like CATL are developing intelligent battery management systems that work in conjunction with their battery housings to optimize charging cycles and ensure safety during operation. This trend not only improves the reliability of EVs, but also aligns with the growing consumer demand for smarter, more efficient vehicles. As the market evolves, the integration of smart technologies is expected to become a standard feature in new EV models, further driving innovation in the battery housing sector.

Download Free sample to learn more about this report.

DRIVING FACTORS

Government's Strong Support for Electric Mobility Through Favorable Policies and Incentives to Drive Market Growth

The Chinese government has implemented various measures, including subsidies for EV purchases and investments in charging infrastructure, to promote electric vehicle adoption. For instance, the "New Energy Vehicle (NEV) Subsidy Policy" provides financial incentives for consumers purchasing electric vehicles, which will directly boost the demand for high-quality ion battery housings. Additionally, stringent emission regulations compel manufacturers to invest in advanced battery technologies that require robust housing solutions. Companies like BYD are capitalizing on these policies by developing innovative battery systems that necessitate advanced enclosures to ensure safety and efficiency. This supportive regulatory environment will not only drive the demand for EVs, but also stimulate growth of the battery housing market as manufacturers respond to evolving consumer preferences and regulatory requirements.

RESTRAINING FACTORS

Limited Recycling Infrastructure for Battery Components to Restrain Market Growth

As the adoption of electric vehicles increases, so does the need for effective end-of-life management of batteries and their housings. Currently, China's recycling capabilities for lithium ion batteries are still developing, leading to concerns about environmental sustainability and resource recovery. For example, while companies like Ganfeng Lithium are working on recycling initiatives, the overall infrastructure remains inadequate to handle the expected volume of used battery housings. This limitation poses challenges for manufacturers who must ensure compliance with environmental regulations while managing waste effectively. The lack of a robust recycling framework can hinder China electric vehicle battery housing market growth by increasing costs and complicating supply chains as manufacturers face difficulties sourcing recycled materials for new battery housings. Addressing this issue is critical for China for sustaining long-term growth in the EV battery housing market as environmental concerns continue to gain prominence.

China Electric Vehicle Battery Housing Market Segmentation Analysis

By Vehicle Type Analysis

Growing Consumer Shift Toward Electric Cars Helps Passenger Cars Segment Dominate Market

By Vehicle type is categorized as passenger cars and commercial vehicles.

The passenger car segment dominates the China EV battery housing market share, driven by the soaring demand for electric passenger vehicles. With the Chinese government actively promoting electric mobility through subsidies and incentives, consumers are increasingly opting for electric cars as a sustainable alternative to traditional vehicles. Major manufacturers, such as BYD and NIO are leading this charge, producing a range of electric models that require advanced battery housings to ensure safety and performance. For instance, BYD's Han EV employs sophisticated battery enclosures that enhance thermal management and structural integrity, which is crucial for high-performance applications. The growing consumer preference for electric passenger vehicles, coupled with innovations in design and technology, will propel this segment's growth. As the market matures and more affordable models become available, the demand for tailored battery housings that support larger battery capacities will continue to rise, solidifying the passenger car segment's leadership in the market.

The commercial vehicle segment is experiencing rapid growth in the China EV battery housing market, driven by increasing investments in electric logistics and public transportation. Companies are transitioning to electric buses and trucks to reduce operational costs and meet stringent emission regulations. For example, manufacturers like Yutong are developing electric buses that necessitate specialized battery housings designed for durability under heavy use. The Chinese government's commitment to electrifying public transport will further accelerate this trend as municipalities invest in electric fleets to improve air quality in urban areas. While still smaller than the passenger car segment, the commercial vehicle segment is expected to expand significantly as businesses recognize the long-term economic benefits of switching to electric solutions. This shift toward electrification in commercial transport is likely to create substantial opportunities for innovation in battery housing designs tailored to meet the unique demands of commercial applications.

By Material Analysis

Aluminum’s Lightweight Properties Increases Its Market Dominance

By material the segment is classified as steel, aluminum, and composites.

The aluminum segment has emerged as the dominant and fastest-growing segment in the China EV battery housing market due to its lightweight properties that significantly enhance vehicle efficiency by improving the driving range and reducing energy consumption. Its corrosion resistance and thermal conductivity make it ideal for high-performance applications. Notably, leading manufacturers like Tesla have adopted aluminum extensively in their battery enclosures, recognizing its advantages in weight reduction without compromising on safety standards. The aluminum segment is anticipated to grow rapidly as manufacturers are increasingly focusing on lightweight designs that contribute to overall vehicle efficiency.

Despite aluminum's advantages, steel remains a prominent option for EV battery housings due to its strength and cost-effectiveness. Steel provides excellent structural integrity and impact protection, making it suitable for various applications. Manufacturers like Ford are incorporating steel in their battery enclosures to strike a balance between cost and safety while meeting regulatory requirements. However, the weight of steel can negatively impact the overall vehicle efficiency.

Alternative materials, such as composites are gaining traction in the EV battery housing market due to their lightweight nature and superior strength-to-weight ratios. Although currently a smaller segment compared to steel and aluminum, this category is expected to expand as manufacturers are focusing on high-performance electric vehicles that require advanced materials for enhanced efficiency and durability. Companies are also exploring innovative composite solutions that can offer competitive advantages in terms of weight and structural integrity.

To know how our report can help streamline your business, Speak to Analyst

KEY INDUSTRY PLAYERS

Extensive Investments in R&D to Help CATL Dominate Market

Innovative battery technologies and strategic partnerships with major automotive manufacturers have helped CATL dominate in the China electric vehicle battery housing market share. The company’s product portfolio includes a range of advanced battery solutions, including lithium-ion batteries that are crucial for electric vehicles. Notably, CATL supplies battery systems to prominent EV brands, such as Tesla and NIO, showcasing its pivotal role in the industry. Its focus on lightweight materials for battery housings enhances vehicle efficiency, making it a preferred choice among automakers.

BYD Company Limited, also based in China, is recognized for its comprehensive approach to electric mobility, producing batteries and complete electric vehicles. The company has made significant strides in battery housing design, emphasizing safety and thermal management. BYD's commitment to innovation is evident in its diverse range of electric vehicles, including buses and passenger cars, which utilize advanced battery technologies to meet growing consumer demand.

List of Top China Electric Vehicle Battery Housing Companies

- CATL (Contemporary Amperex Technology Co., Limited) (China)

- BYD Company Limited (China)

- CALB (China Aviation Lithium Battery Co., Ltd.) (China)

- EVE Energy Co., Ltd. (China)

- Tianjin Lishen Battery Joint-Stock Co., Ltd. (China)

- Farasis Energy Co., Ltd. (China)

- Gotion High-Tech Co., Ltd. (China)

- SVOLT Energy Technology Co., Ltd. (China)

- Sunwoda Electronic Co., Ltd. (China)

- Hunan Shanshan Energy Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- July 2024: Serbia and China-based Minth Holdings Limited signed a Memorandum of Understanding (MoU) on investments in manufacturing facilities for the automotive industry, electric vehicles, and solar power plant equipment.

- August 2023: Linamar Corporation announced the completion of its acquisition of three battery enclosure manufacturing facilities from Dura-Shiloh. This acquisition, initially disclosed on May 30, 2023, involved an all-cash transaction valued at USD 325 million and was subject to customary regulatory approvals and closing conditions, all of which were eventually satisfied.

- October 2022: Gestamp Automoción showcased a range of innovative products and technologies at the IZB (International Suppliers Fair) 2022 held in Wolfsburg, Germany. The aim was to address the evolving challenges in the automotive industry, particularly in the context of Electric Vehicles (EVs). The company displayed various products, such as battery boxes, cell-to-pack concepts, and others.

- September 2022: Minth Group announced a collaboration with Renault Group to produce battery casings. The joint venture was expected to support the installation of two new production lines in Ruitz in 2023, with a manufacturing capacity of 300,000 battery casings per year by 2025 for electric models, including the future R5.

- June 2021: Novelis Inc. signed a Memorandum of Understanding (MOU) with Tsinghua University’s Suzhou Automotive Research Institute (TSARI) to collaborate on the development of aluminum solutions for the automotive industry. This collaboration would be focusing on Electric Vehicles (EVs). With this partnership, both the companies aim to develop aluminum battery enclosures for EVs.

REPORT COVERAGE

The report provides a detailed analysis of the market, focusing on key aspects, such as leading market players, competitive landscape, and vehicle types. Besides, it includes insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 13.6% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Vehicle Type

|

|

By Material

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 5,237.3 million in 2023.

The market is projected to record a CAGR of 13.6% over the forecast period.

By type, the passenger cars segment leads the market.

CATL, BYD Company Limited, Gotion High-Tech Co., Ltd., and Tianjin Lishen Battery Joint-Stock Co., Ltd, are some of the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us