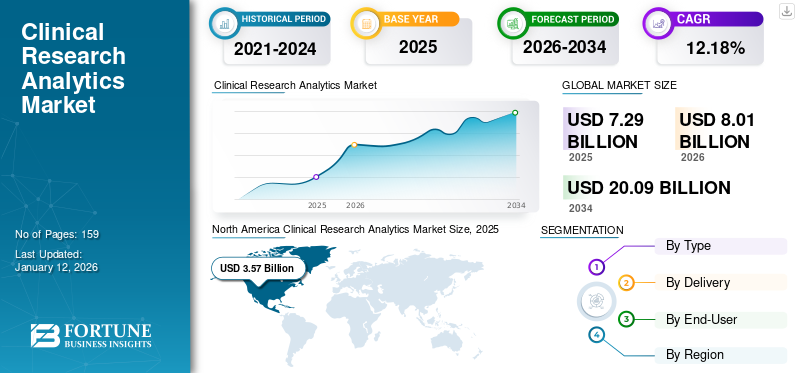

Clinical Research Analytics Market Size, Share & Industry Analysis, By Type (Software & Solution and Services), By Delivery (On-Premise and On-Demand), By End-User (Pharma & Biotech Companies, Contract Research Organizations, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global clinical research analytics market size was valued at USD 7.29 billion in 2025. The market is projected to grow from USD 8.01 billion in 2026 to USD 20.09 billion in 2034, exhibiting a CAGR of 12.18% during the forecast period. North America dominated the clinical research analytics market with a market share of 48.89% in 2025.

Clinical research analytics involves data analytics tools and technologies to enhance the planning, execution, and evaluation of clinical trials and research. With the growing volume of healthcare data and the need for faster and more efficient drug development, research analytics plays a crucial role in improving decision-making, patient safety, and trial outcomes. Additionally, rising demand for personalized medicine and data-driven research is driving the adoption of clinical research analytics tools, software, and services. The market has shown robust growth, with projections indicating a continued upward trajectory.

Also, the rising shift of pharmaceutical, biotechnology companies, and clinical research organizations to focus on the adoption of such advanced technologies for streamlining their workflows is augmenting market growth.

- For instance, in February 2024, PhaseV, a leader in software and machine learning for optimizing adaptive clinical trials, partnered with the global biometric clinical research organization (CRO) Quanticate. This collaboration introduced a new technology-driven service designed to help biopharmaceutical companies enhance the speed and quality of their clinical development programs, allowing for more advanced and efficient clinical trials. Such activities boost the global market growth.

Furthermore, key market players such as IQVIA, Medidata, Oracle, and others are offering advanced solutions with AI integration and maintaining their market positions by expanding their offerings and strategic initiatives.

Global Clinical Research Analytics Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 7.29 billion

- 2026 Market Size: USD 8.01 billion

- 2034 Forecast Market Size: USD 20.09 billion

- CAGR: 12.18% from 2026–2034

Market Share:

- North America dominated the clinical research analytics market with a 48.89% share in 2025, driven by rising expenditure on drug discovery, the presence of key players, and the increasing adoption of AI-integrated clinical workflow solutions.

- By component, software & solutions held the largest share in 2024 due to the growing demand for real-time insights, predictive modeling, and efficient clinical data management platforms offered by leading market players.

Key Country Highlights:

- United States: The adoption of AI-powered clinical research solutions by key companies and collaborative efforts with tech giants to automate complex clinical workflows are enhancing market growth.

- Europe: Growing government investments in health data infrastructure and increasing demand for automation in clinical trials are supporting market expansion across the region.

- China: The rising prevalence of chronic diseases and increasing demand for predictive analytics in drug development are propelling the adoption of clinical research analytics platforms.

- Japan: The focus on enhancing clinical trial efficiency through advanced data interoperability solutions and the integration of EHR and EDC systems is driving market growth.

MARKET DYNAMICS

MARKET DRIVERS

Rising Adoption of Artificial Intelligence and Machine Learning to Drive the Market Growth

The clinical research analytics market is experiencing significant growth, driven by the rising adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies. Many researchers are increasingly adopting these advanced technologies to extract valuable insights from vast datasets more efficiently and accurately. Moreover, AI and ML streamline and enhance the clinical trial process by optimizing patient recruitment, improvising trial design, and predicting outcomes, thereby reducing costs and time. Additionally, they facilitate real-time monitoring and adaptive trial methodologies, improving the overall quality of research.

However, many key companies are integrating their solutions with AI in order to accelerate decision-making across the full clinical trial process.

- For instance, in June 2024, Medidata introduced the Medidata Clinical Data Studio, a platform enhanced by AI capabilities. This innovative solution provides AI-driven data reconciliation and anomaly detection, along with self-service data listings and comprehensive risk-based quality management tools. It enables users to execute a holistic data and risk strategy supported by efficient workflows and visualizations. Furthermore, the platform empowers users with greater control over data quality, facilitating the delivery of safer clinical trials to patients at a quicker pace while improving the identification of safety signals and enhancing overall accuracy. These launches drive the clinical research analytics market growth.

MARKET RESTRAINTS

Data Security and Privacy Concerns to Restrict the Market Growth

As clinical trials generate vast amounts of sensitive data, ensuring data security and privacy is a significant concern. Increasing cybercrimes and data leaks are leading to reputational damage and loss of trust among patients.

- For instance, in February 2025, DM Clinical Research suffered a significant data breach that compromised more than 1.6 million personal and medical records. The breach affected 1,674,218 records, amounting to 2 terabytes of data. The leaked information included personal information such as names, birth dates, and contact information. Additionally, the documents contained medical histories, vaccination records, medication details, and notes on adverse reactions. Such breaches and data leaks, damage the patient trusts and hampers the market growth.

Thus, these conditions require strict protocols for managing and storing patient data and critical laws to avoid data breaches and penalties.

MARKET OPPORTUNITIES

Wearable Technology for Clinical Trial Design Offers a Strong Growth Opportunity to the Market

The rising cost and time associated with clinical trials increase the shift toward developing innovative solutions for faster and more cost-effective delivery. As the digital health and wearable devices industries grow, precise data measurement and analysis are becoming increasingly important. Smartphones and wearable devices eventually offer a paradigm virtual trial approach that analyzes participants' reported outcomes through app-based clinical questionnaires and physical activity data as logged by an app on the smartphone and by the wearable device's activity. This reduces healthcare costs, and also helps to improve patient experience and outcomes.

Moreover, many researchers and medtech device companies are engaging in developing digital health research using mobile and wearable devices for various diseases clinical trials, which is boosting the market growth during the forecast period.

- For instance, in September 2024, SAMSUNG launched Samsung Health Research Stack, an open-source project that supports digital health research using mobile and wearable devices in Android and Wear OS environments. The platform continuously measures, shares, and analyzes health-related data from users' daily lives.

- In addition, in January 2022, The University of Manchester launched a trial to test wearable technology, including smart rings and watches, on patients who have received cancer treatment. This technology supported the development of new cancer treatments by developing a digital platform for clinical trials in cancer. Such activities are expected to bolster the market growth during the forecast period.

MARKET CHALLENGES

Regulatory Complexities and Market Consolidation to Pose a Critical Challenge to Market Growth

The regulatory complexities and market consolidation present significant challenges for the clinical research analytics market. The diverse regulatory requirements across different regions hinder the clinical trial process due to complex regulations, leading to delays. Moreover, large pharmaceutical companies are shifting demand dynamics and R&D investments, impacting the demand for clinical research services. This shift could lead to fewer clinical trials being conducted in-house, which would directly affect the volume of analytics services required.

CLINICAL RESEARCH ANALYTICS MARKET TRENDS

Emphasis on Data Interoperability in Clinical Research is a Significant Market Trend

The rising number of clinical studies across the globe increases the demand for seamless data exchange across different systems. Data interoperability supports the integration of data from various health records, laboratories, and wearable devices to improve data consistency and accessibility. Thus, these advancements are gaining adoption among the pharmaceutical and biotech companies in order to streamline the clinical procedures.

Additionally, increasing strategic activities amongst the key players to improvise clinical processes with electronic health records (EHR) and electronic data capture (EDC) systems to improve data accuracy, workflow efficiency, and overall decision-making during clinical trials is offering a noticeable change in the market.

- For instance, in February 2025, IgniteData, a provider of EHR-to-EDC interoperability solutions for clinical trials, partnered with Yunu. This collaboration aimed to boost the seamless integration of imaging data into clinical trial workflows. This enables pharmaceutical sponsors to utilize IgniteData's Archer EHR-to-EDC application to enhance data accuracy, increase trial efficiency, and support better decision-making. Such factors offer a major shift during the forecast period.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic positively impacted the global market. This market growth was driven by the accelerated adoption of digital technologies during a pandemic to develop new drugs and vaccines to combat the deadly virus. Additionally, increased investment and rising research and development augmented the demand for clinical data management solutions to enhance clinical trial design, monitor ongoing trials, and maintain clinical data.

SEGMENTATION ANALYSIS

By Component

Strategic Activities to Launch Advanced Software & Solutions Propelled the Segment's Growth

Based on the components, the market is divided into software & solutions and services.

In 2024, the software & solutions segment dominated the market. This dominance is driven by its ability to process and analyze vast amounts of healthcare data efficiently. These tools facilitate real-time insights, predictive modeling, and decisions, improving patient outcomes and operational efficiency. Additionally, the rising new launches of software & solutions by key players are driving the growth of the segment in the market.

- For instance, in June 2024, IQVIA launched One Home for Sites, a technology platform designed to streamline the management of clinical research tasks. This platform provides a single sign-on and dashboard for clinical research sites, allowing them to access essential systems and functions related to all ongoing clinical trials. This platform aimed to enhance efficiency, enabling site staff to focus on patient recruitment and treatment and handle more trials concurrently.

The services segment is expected to grow substantially during the forecast period. Services help organizations design tailored analytics strategies aligned with their specific needs, while implementation services ensure that the software is effectively deployed and utilized.

- For instance, in October 2024, Oracle introduced Oracle Site Feasibility and Oracle Patient Recruitment Cloud Services. These new offerings in Oracle Life Sciences leverage top-tier security measures and ensure the secure management and storage of Protected Health Information in accordance with HIPAA regulations. Such launches promote the segment's growth in the market.

By Delivery

Rising Preference For Real-Time Data Access to Boost Dominance of On-Demand Segment

Based on the delivery, the market is bifurcated into on-premise and on-demand.

On-demand segment, often referred to as cloud-based analytics, is expected to hold largest global clinical research analytics market share in 2024 due to its flexibility and cost-effectiveness. These solutions facilitate real-time data access and collaboration, enhancing decision-making processes across various departments in healthcare systems. Additionally, the rising focus of key players to offer cloud-based solutions as per the organizational demand is expected to boost the market growth.

- For instance, in January 2025, EDETEK Inc. launched a new "R&D Cloud" software ecosystem. This delivers a scalable, flexible, and reliable environment for clinical development that seamlessly integrates the best clinical development capabilities into existing operational environments.

The on-premise segment is expected to grow with a moderate CAGR over the forecast period. This model allows for seamless integration with existing IT infrastructure, enabling organizations to tailor analytics tools to their specific workflows. Thus, healthcare organizations often prefer on-premise solutions to comply with stringent regulations regarding patient data privacy and security. Such scenarios increase the demand for on-premise delivery and, therefore, lead toward segment growth. Moreover, increasing collaborations for research and clinical trials to boost the growth of the segment in the market.

- For instance, in January 2025, Advarra launched a Study Collaboration solution with an aim to accelerate study startup by automating workflows, improving real-time visibility, and fostering seamless collaboration and engagement among research stakeholders.

By End-user

Growing Need to Manage Pharma & Biotech Companies’ Administrative Workload in a Structured Manner to Drive the Segment Growth

On the basis of end-users, the market is segmented into pharma & biotech companies, contract research organizations, and others.

The pharma & biotech companies held the dominant share of the market in 2024. The segmental growth is augmented by increasing research and development activities to launch novel drugs for untapped diseases. This increases the demand for clinical data analytics to leverage data-driven insights and enhance drug development processes. These companies utilize analytics to optimize trial design, improve patient recruitment, and ensure regulatory compliance. Additionally, with the help of analytics, these companies monitor ongoing trials and assess outcomes, ultimately aiming to accelerate time-to-market for new therapies.

Furthermore, increasing collaborations amongst the market players to offer analytical solutions for streamlining their clinical trial processes also boosts the segment's growth in the market.

- For instance, in January 2025, TME Pharma N.V. collaborated with Aimed Analytics, a leading medical data analytics firm, to enhance its capabilities in developing cancer therapies that target the tumor microenvironment. This partnership is aimed at utilizing artificial intelligence (AI) to streamline the drug development process, reducing the time, costs, and resources typically required for laboratory testing.

The contract research organizations are expected to grow significantly during the forecast period. The growth of the segment is driven by the delivery of efficient and effective research services by the CROs to the clients. The CROs leverage advanced analytics to optimize clinical trial design, enhance data management, and improve regulatory compliance. They utilize these insights to streamline operations, reduce costs, and accelerate drug development timelines. Such factors promote the adoption of clinical analytics services and software in these settings.

- In July 2023, Emmes Group, a contract research organization, partnered with Miimansa AI to transform clinical research through the use of artificial intelligence. This collaboration aimed to develop capabilities for swiftly and accurately processing large volumes of clinical data, as well as facilitating text-to-text transformations such as protocol authoring and medical writing. The goal is to reduce both the time and costs linked to manual data handling and analysis. Such collaboration led to increased segment growth.

The other segment comprises research centers and academic institutes that are anticipated to grow with a moderate CAGR during 2025-2032.

CLINICAL RESEARCH ANALYTICS MARKET REGIONAL OUTLOOK

By region, this market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Clinical Research Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 3.57 billion in 2025 and is anticipated to continue to dominate the global market over the study period. A favorable research atmosphere and rising expenditure on drug discovery and development are some of the factors promoting the market's growth in the region. In contrast, increasing technological advancements and the adoption of AI-integrated tools for maintaining clinical workflows are augmenting the North American market growth.

U.S.

The U.S. is expected to hold a dominant share in the North America region. Owing to the increasing adoption of AI-based technologies for clinical research and the presence of key market players with robust offerings, the market in the U.S. is anticipated to witness strong growth.

- For instance, in July 2025, IQVIA partnered with NVIDIA to harness the power of AI in the healthcare and life sciences sectors. This collaboration aimed to advance IQVIA's Healthcare-grade AI to automate the management of complex and time-consuming workflows across the therapeutic life cycle while ensuring precision, scalability, and reliability.

Europe

Europe is expected to grow with a considerable market share during the forecast period. The rising drug development, discovery activities, and increasing demand for automation in clinical workflows are augmenting regional growth. Moreover, rising government initiatives and funding activities for clinical studies also boost the growth of the market.

- For instance, in April 2025, the British government announced an investment of up to USD 767.0 million for a new health data research service to help boost scientific studies and decrease the time associated with carrying out clinical trials. The research service aimed to provide secure and easy-to-use data location, allowing researchers to avoid navigating various systems. Such activities boost the market growth in the region.

Asia Pacific

The Asia Pacific region is expected to grow with the fastest CAGR during the forecast period. The rising prevalence of chronic diseases results in a higher demand for innovative therapies to combat these diseases. This augments the growth of the market in the region. The presence of a vast patient pool and the increasing demand for the adoption of electronic health records (EHRS) for predictive analytics are some of the key factors driving the market growth in the region.

- For instance, in February 2025, Axtria Inc. launched Axtria Rapid CSR, an innovative use of Generative AI for the processing and automation of clinical study report (CSR) development. The Axtria Rapid CSR is trained and tested to generate accurate medical writing, particularly in the areas of safety and efficacy.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa regions accounted for a lesser revenue share of the market in 2024. However, rising clinical studies and collaboration in the major countries of these regions are expected to bolster the region's market growth in the future.

- For instance, in January 2025, IROS, an Abu Dhabi-based contract research organization, collaborated with Halia Therapeutics to conduct a clinical trial focused on obesity treatment. These collaborations for clinical trial initiation are expected to boost the adoption of clinical research analytics products and services, thus boosting market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Technological Advancements and Innovative Product Offerings by Key Players to Propel Market Progress

The market represents a semi-consolidated market structure featuring prominent players such as IQVIA, Mediata, Labcorp, and others. The substantial share of these companies in the market is due to their strong involvement in strategic activities and robust product and service offerings to enhance user experience, which is expected to enhance their market positions.

Other notable players in the global market include Paraxel International (MA) Corporation, ICON plc, and others. These companies are anticipated to prioritize the integration of AI and ML in their offerings and collaborations to boost their clinical research analytics market share during the forecast period.

LIST OF KEY CLINICAL RESEARCH ANALYTICS COMPANIES PROFILED

- IQVIA (U.S.)

- Medidata (U.S.)

- ICON plc (Ireland)

- Labcorp (U.S.)

- Parexel International (MA) Corporation. (U.S.)

- Saama (U.S.)

- Veeva Systems Inc. (U.S.)

- Oracle (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025- Inovalon launched Clinical Research Patient Finder, an AI-powered solution designed to accelerate patient recruitment for clinical trials by seamlessly integrating with electronic health records (EHRs).

- October 2024- Zymo Research Corporation collaborated with BluMaiden Biosciences with an aim to revolutionize clinical insights and decision-making by offering end-to-end clinical trial analytics and reporting services based on the human microbiome.

- March 2023- Cloudbyz launched Cloudbyz EDC 2.0, an innovative Electronic Data Capture (EDC) product. It offers a seamless, secure, and efficient cloud platform for capturing, managing, and analyzing clinical trial data.

- June 2021- IQVIA unveiled Clinical Data Analytics Solutions (CDAS). It is a new SaaS-based clinical data analytics platform that combines structured and unstructured data from clinical trials into a single, standardized setting for easier access and use.

- May 2021- Achiral Systems Pvt. Ltd announced the availability of the SyMetric Trial Analytics solution on the SAP Store. SyMetric Trial Analytics is a cloud solution from SAP that serves biopharmaceutical companies, medical device manufacturers, and cosmeceutical/nutraceutical manufacturers.

REPORT COVERAGE

The global clinical research analytics market report comprises of total global clinical research analytics market analysis that emphasizes key aspects such as an overview of cutting-edge technologies, the regulatory environment in major countries, and the challenges faced in adopting and implementing tech-based solutions. The report also provides notable industry developments, including mergers, partnerships, and acquisitions. Furthermore, it detailed regional analysis of various segments and the impact of COVID-19 on the market is covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.18% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Delivery

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 8.01 billion in 2026 and is projected to reach USD 20.09 billion by 2034.

In 2025, North America stood at USD 3.57 billion.

Registering a CAGR of 12.18%, the market will exhibit rapid growth over the forecast period.

Based on type segment, the Software & Solutions segment leads the market.

Rising adoption of artificial intelligence and machine learning are some of the key factors driving the market.

Oracle, IQVIA, and Labcorp are some of the major players in the global market.

North America dominated the market in terms of share in 2025.

Optimization of clinical workflows, decision support, and streamlining clinical data are the factors expected to drive the adoption of the products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us