Cloud Security Posture Management Market Size, Share & Industry Analysis, By Component (Solutions and Services), By Deployment Mode (Public Cloud, Private Cloud, and Hybrid), By Enterprise Type (Small and Medium Enterprises (SMEs) and Large Enterprises), By Cloud-Model (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), By Industry Vertical (BFSI, Retail, Healthcare, IT & Telecom, Government, Manufacturing, and Others) and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

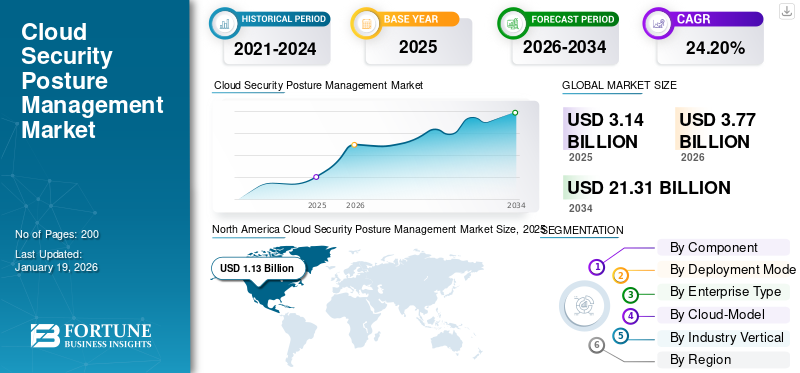

The global cloud security posture management market size was valued at USD 3.14 billion in 2025 and is projected to grow from USD 3.77 billion in 2026 to USD 21.31 billion by 2034, exhibiting a CAGR of 24.20% during the forecast period. North America dominated the market with a share of 36.10% in 2025.

The Cloud Security Posture Management (CSPM) market is a specialized segment within the broader cybersecurity market, focused on detecting and remediating misconfigurations, compliance gaps, and policy violations in cloud-based environments. CSPM tools are designed to provide continuous visibility and risk assessment across Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and increasingly Software-as-a-Service (SaaS) environments.

The CSPM market is being driven by several key factors, most notably the accelerated adoption of cloud technologies. As enterprises across industries migrate their applications and data to the cloud to achieve scalability, flexibility, and cost advantages, the need for robust security posture management has become critical.

To meet this market demand, technology providers are continually enhancing and expanding their CSPM solutions. Palo Alto Networks, for instance, offers one of the most complete CSPM solutions through its Prisma Cloud platform, which offers significant multi-cloud visibility and integrates natively with its broader Cloud-Native Application Platform (CNAPP) functionalities. Check Point Software offers CloudGuard, providing best-in-class real-time posture checking, policy enforcement, and coverage for serverless and containerized environments.

Top CSPM vendors such as Check Point, Cloudflare, CrowdStrike, and McAfee are staying ahead of the competition by delivering unified, AI-driven platforms that provide real-time visibility, automated compliance, and proactive threat prevention across multi-cloud environments.

IMPACT OF AI

Implementation of AI Capabilities to Fuel the Growth of the Market

Artificial Intelligence (AI) is radically changing the cloud security posture management (CSPM) market by increasing the efficiency, accuracy, and scalability of cloud security operations. Traditional CSPM solutions rely on static rules and manual workflows, which inhibit their ability to adapt to the increasingly complex and dynamic nature of present-day cloud environments.

AI-powered CSPM solutions also have the ability to automate threat detection and response, alleviating the burden on security practitioners and reducing the risk of human error. These features are especially beneficial in large multi-cloud regions, where organizations need to continuously monitor and analyze a huge amount of data. For instance,

- In July 2025, CardinalOps launched Cardinal AI, a new AI-powered suite designed to streamline Unified Exposure Management by automating risk assessments and mitigation workflows. The platform integrates the generative AI tool Wingman to analyze fragmented security data from VM, CSPM, EDR, and SIEM systems, providing actionable insights and compensating controls while maintaining human oversight.

MARKET DYNAMICS

Cloud Security Posture Management Market Trends

Rise of Autonomous Remediation in CSPM Is Emerging as a Key Trend in the Market

The cloud security posture management (CSPM) industry is on the verge of transitioning from detection solutions to intelligent, self-remediating systems. Modern CSPM platforms are evolving into auto-remediation engines that identify and report misconfigurations and apply changes in real-time, without human intervention. For instance,

- In April 2025, Gomboc.ai launched an AI-powered auto-remediation solution for Wiz, Orca & Prisma Cloud, which instantly converts CSPM alerts into ready-to-merge IaC fixes. The solution eliminates manual remediation work, reducing fix times from days to seconds by automatically generating compliant code patches.

To align with security-as-code principles, leading CSPM vendors are automating playbooks through integrations across various tools. For instance, when a CSPM platform detects a publicly accessible cloud storage instance, a remediation workflow can be initiated to restrict access, enable encryption, or quarantine the resource. At the same time, an event log can be used for an audit trail. This approach is particularly important within a DevSecOps framework, where the speed of deployment is as quick as the speed of security.

Market Drivers

Regulatory Compliance & Data Protection Requirements to Drive Market Growth

One of the foremost drivers of growth in the cloud security posture management (CSPM) market is the growing pressure on organizations to meet regulatory compliance and data protection obligations. As workloads transition to the cloud, organizations must continue to comply with global privacy and security frameworks, including the General Data Protection Regulation (GDPR) in the European Union, the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., and the Payment Card Industry Data Security Standard (PCI DSS). For instance,

- The EU Cloud Code of Conduct (CoC), endorsed by the EDPB, helps cloud service providers demonstrate GDPR Article 28 compliance, ensuring transparent data processing. For CSPM solutions, aligning with the CoC supports trust and accountability in cloud security posture management across diverse service layers.

CSPM strategies play a critical role in helping organizations sustain compliance by providing continuous visibility, automated risk detection, policy enforcement, and audit-ready reporting. This continuous assessment of compliance gives organizations the confidence that their sensitive data is secure while minimizing the risk of regulatory infractions and reputational damage.

Market Restraints

Risk of Data Breaches Restrain Adoption of Cloud Security Posture Management

The potential for data breaches in cloud environments remains a major constraint on the cloud security posture management market growth. Such incidents reduce trust in the ability of CSPM tools to improve cloud security, even though that is their primary function.

Additionally, serious data leaks that have come from managed services misconfiguring security settings and exposing sensitive data are well-publicized, leading organizations to become more skeptical about relying solely upon CSPM products to validate their security controls in the cloud environment. The threat landscape is ever-changing, with sophisticated attackers continuing to target cloud environments, which seems to give the perception that CSPM alone cannot lessen risk entirely, especially if implementations are insecure. As a result, organizations are likely to delay or limit their adoption of CSPM solutions.

Market Opportunities

Integration of CSPM with CNAPP & CIEM to Create Lucrative Market Opportunities

The convergence of CSPM, Cloud-Native Application Protection Platforms (CNAPP), and Cloud Infrastructure Entitlement Management (CIEM) is one of the most significant opportunities in cloud security today. As enterprises move toward multi-cloud, hybrid environments, they are experiencing challenges from security tool fragmentation.

Different security tools are used for workload protection (CWPP), posture management (CSPM), and identity governance (CIEM). With rising market demand, connecting these tools on a unified platform with broader visibility and control across the entire cloud estate has become imperative.

Leading vendors are responding by combining these capabilities into integrated CNAPP solutions, enabling global web access, compliance, and threat detection. For cross-cloud policy management, security teams can build consistent security rules across AWS, Azure, GCP, and private clouds, reducing complexity and improving governance.

SEGMENTATION ANALYSIS

By Component Insights

Solution Segment Dominates due to Rising Complexity of Multi-Cloud Environments

On the basis of component, the market is divided into solutions and services. The solutions segment captures the largest share of 75.17% in 2026, and is expected to experience the highest compound annual growth rate (CAGR) during the forecast period. The growth of this segment can be attributed to the increasing complexity of multi-cloud environments, which exposes enterprises to increased risk of misconfiguration, compliance violations, and a lack of visibility.

CSPM solutions provide real-time visibility, automated risk identification, policy enforcement, and compliance management, all of which are critical in mitigating data breach risks and meeting regulatory compliance. Organizations continue to adopt CSPM solutions due to these features that enable them to take a proactive approach to their security posture.

For instance,

- In March 2024, Bitdefender launched GravityZone CSPM+, a comprehensive cloud security solution that combines CSPM, CIEM, and threat detection for multi-cloud environments (AWS, Azure, and GCP). The platform automates misconfiguration detection, enforces Zero Trust policies, and simplifies compliance with pre-built templates for standards such as NIST and GDPR.

By Deployment Mode Insights

Public Cloud Segment Leads due to Lack of Technical Overhead

On the basis of deployment mode, the market is divided into public cloud, private cloud, and hybrid.

The public cloud segment holds the highest share with a share of 55.91% in 2026, the cloud security posture management (CSPM) market. The key drivers of this strong adoption include the declining upfront costs, easily-provisioned and scalable resources, flexible deployment models (real-time and on-demand), lack of technical overhead, and consumption-based pricing. As a result, demand for CSPM solutions that can continuously monitor workloads, enforce policies, and maintain compliance in public cloud is expected to remain strong.

Hybrid cloud is expected to record the highest CAGR in the CSPM market throughout the forecast period. As more companies use hybrid cloud capabilities to maintain on-premises infrastructure while accessing public and private cloud services, managing security and compliance across these multiple environments has become increasingly complex. This complexity creates a growing need for advanced CSPM solutions capable of delivering visibility, risk management, and remediation across both modern cloud-native and legacy systems.

By Enterprise Type Insights

Large Enterprises Segment to Dominate due to its Ability to offer Continuous Visibility

On the basis of enterprise type, the market is bifurcated into small and medium enterprises (SMEs) and large enterprises.

Large enterprises are expected to dominate the cloud security contributing 74.20% globally in 2026, posture management (CSPM) market, holding the highest market share during the forecast period. This is due to their complex and expensive IT stacks spanning multiple cloud platforms, which expose them to the greatest number of security and compliance risks. Large enterprises also tend to have bigger budgets and dedicated security teams, allowing them to use comprehensive CSPM solutions that offer continuous visibility, automated threat detection, remediation in real time, and alerting.

The small and medium-sized Enterprises (SMEs) segment is projected to grow at the highest CAGR in the CSPM market. Rapid digital transformation among SMEs, combined with their increased use of public cloud, hybrid cloud, and SaaS applications, is begetting a strong need for economical cloud security solutions.

By Cloud Model Insights

IaaS Segment to Dominate due to Enterprises’ Increasing Dependency on Scalable Cloud Infrastructure

On the basis of the cloud model, the market is divided into infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

The Infrastructure as a Service (IaaS) segment is anticipated to maintain the largest market share in the cloud security posture management (CSPM) market. The dominance is due to enterprises’ increasing reliance on scalable cloud infrastructure to support mission-critical applications and manage data-intensive workloads.

Software as a Service (SaaS) is expected to record the largest CAGR in the CSPM market during the forecast period. With digital transformation accelerating across businesses and the rising reliance on SaaS applications for productivity, collaboration, and business operations, often with no viable alternatives, organizations are encountering heightened challenges related to data security, access control, and visibility challenges.

By Industry Vertical Insights

To know how our report can help streamline your business, Speak to Analyst

BFSI Segment to Lead Due to Rising Uptake of Cloud Infrastructure

On the basis of industry vertical, the market is divided into BFSI, retail, healthcare, IT & Telecom, government, manufacturing, and others.

The Banking, Financial Services, and Insurance (BFSI) segment is expected to maintain the largest share of the CSPM market. Financial institutions handle a substantial volume of sensitive data and operate within heavily regulated compliance frameworks (PCI-DSS, GDPR, and SOX). The ongoing adoption of cloud infrastructures for digital banking, mobile services, and real-time transaction processing has increased the need to protect cloud environments against misconfigurations, unauthorized access, and data leaks.

The healthcare segment is projected to grow at the highest compound annual growth rate (CAGR) in the CSPM market. Cloud adoption in healthcare is being driven by the rapid digitization of services, the increased use of electronic health records (EHRs), and the use of telehealth platforms

CLOUD SECURITY POSTURE MANAGEMENT MARKET REGIONAL OUTLOOK

North America

North America Cloud Security Posture Management Market Size, 2025 USD Billion

To get more information on the regional analysis of this market, Download Free sample

North America holds the majority of the cloud security posture management market share due to its unparalleled digital maturity, evolving cyber risk profiles, and aggressive cloud-first strategies among enterprises. North America dominated the global market in 2025, with a market size of USD 1.13 billion.

The region holds the largest number of global enterprises, tech companies, and cloud service providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, which have built a mature and concentrated cloud landscape. With growing adoption by organizations across sectors to operate multiple clouds and hybrid clouds, CSPM becomes an imperative for new and advanced automated security solutions, preserving visibility, control, and risk posture.

In North America, in addition to overall technological health, the regulatory environment is much more stringent than in any other region. There are laws such as the Health Insurance Portability and Accountability Act (HIPAA), Gramm-Leach-Bliley Act (GLBA), California Consumer Privacy Act (CCPA), and Sarbanes-Oxley Act (SOX), impose strict requirements for data protection, privacy, and operational transparency.

The U.S. is dominant in the CSPM market due to its advanced digital infrastructure and the widespread adoption of public and hybrid cloud usage. With increasing instances of large-scale cyber incidents, the awareness on cloud risk posture and automated security monitoring has been heightened further. The U.S. market is projected to reach USD 1.14 billion by 2026.

Download Free sample to learn more about this report.

South America

South America's CSPM market is growing at a slow yet steady CAGR, as the region's distinct challenges create a different adoption timeframe than other markets. While many organizations are implementing digital transformation strategies, many remain hesitant to fully migrate to the cloud due to economic uncertainty and legacy infrastructure limitations in parts of the region.

The region demonstrates an interesting dichotomy; tech-savvy enterprises in Brazil, Argentina, and Chile are rapidly adopting cloud security solutions, yet many organizations still prioritize cybersecurity investments over CSPM-specific tools. Additionally, recent collaboration in the region also supports this trend. For instance,

- In December 2023, Upwind, a cloud security provider offering a runtime-powered CNAPP (including CSPM, CIEM, CWPP, and more), partnered with RealCloud, a leading Latin American tech solutions firm, to bring advanced cloud security capabilities to Latin America.

Europe

Europe is expected to experience significant growth in the cloud security posture management (CSPM) market due to regulatory, technological, and market-driven factors. The enforcement of the GDPR and NIS2 Directive, both of which impose strict cloud-based obligations, has prompted organizations to seek assured cloud security capabilities to confirm a robust CSPM enforcement. For instance,

- In October 2024, the European Commission adopted new cybersecurity rules under the NIS2 Directive, mandating stricter risk management and incident reporting requirements for cloud computing providers, data centers, and digital platforms. These rules effectively require CSPM-like controls, obligating entities to report "significant incidents" to national authorities in enhancing resilience for critical EU infrastructure.

The increasing movement toward multi-cloud and hybrid cloud capabilities due to initiatives such as GAIA-X and the EU Cloud Strategy highlights the importance of providing automated security posture management capabilities. Growing threats, including misconfigured cloud storage, increasing ransomware attacks, and growing complexity in multi-cloud environments collectively accelerate these market dynamics. The UK market is projected to reach USD 0.26 billion by 2026, while the Germany market is projected to reach USD 0.32 billion by 2026.

Middle East and Africa

The market in the Middle East & Africa is expected to grow at a steady CAGR due to unique regional dynamics. Unlike other markets, CSPM adoption is largely driven by unprecedented digital transformation projects, such as NEOM and large-scale smart projects, which create highly specific cloud security needs.

As organizations across MEA transition from traditional IT infrastructure to cloud-native systems, the need for innovative CSPM solutions arises from the very start of implementation. Geopolitical and societal tensions and the energy and financial sectors drive cybersecurity needs beyond compliance. The region is characterized by a mix of global cloud providers and emerging local platforms, resulting in diverse environments where CSPM must adapt to varying resource allocations and deployment scales. These drivers contribute to a unique, fast-tracked growth pattern for CSPM adoption across MEA.

Asia Pacific

The Asia Pacific region is expected to record the highest CAGR due to rapid digital transformation, growing cloud adoption, and evolving cyber-attacks. Government regulations across the region are also mandating stricter data protection laws (e.g., PDPA in Singapore, PDPB in India, and Data Security Law in China) that pressure enterprises to level up their cloud security. The Japan market is projected to reach USD 0.11 billion by 2026, the China market is projected to reach USD 0.30 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

The rapid rise of SMEs and start-ups embracing cloud-native technologies presents vast opportunities for security posture management. In addition, the sharp increase in awareness about cyber-attacks - ransomware, breaches, and supply chain attacks encouraged organizations to invest in AI-driven CSPM tools. Strategic partnerships and expansion of the largest CSPM players partnering with local cloud providers are improving growth in the market. For instance,

- In April 2025, CloudDefense.AI announced a strategic partnership with Wipro to deliver advanced cloud-native security solutions, combining Wipro's global consulting expertise with CloudDefense.AI’s CNAPP (Cloud-Native Application Protection Platform) capabilities. The collaboration aims to provide enterprises with unified threat detection, compliance automation, and AI-driven risk prioritization for cloud environments.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Market Players are Constantly Engaging in Strategic Alliances to Enhance Their Offerings

Top CSPM providers are aggressively investing in AI-driven risk prioritization, multi-cloud visibility, and automated remediation to stay competitive in the rapidly evolving cloud security market. With increasing adoption of cloud-native technologies and stricter compliance requirements, companies are focusing on strategic acquisitions, technology partnerships, and platform consolidation to enhance their offerings. Mergers, ecosystem integrations, and innovation in areas such as agentless scanning, IaC security, and threat exposure management remain critical as vendors compete to deliver comprehensive, scalable solutions capable of mitigating cloud misconfigurations and countering emerging attack vectors.

Major Players in the Cloud Security Posture Management Market

Check Point Software Technologies, Cloudflare, CrowdStrike, McAfee, Palo Alto Networks, NetApp, and Qualys are the key players in the market.

Long List of Companies Studied

- Check Point Software Technologies Ltd. (Israel)

- Cloudflare, Inc. (U.S.)

- CrowdStrike (U.S.)

- McAfee, LLC (U.S.)

- Microsoft Corporation (U.S.)

- NetApp, Inc. (U.S.)

- Palo Alto Networks (U.S.)

- Qualys, Inc. (U.S.)

- Lookout, Inc. (U.S.)

- SentinelOne (U.S.)

- Sophos Ltd (U.K.)

…and more

KEY INDUSTRY DEVELOPMENTS

- April 2024: Kondukto integrated with Microsoft Azure Defender for Cloud, expanding its CSPM capabilities for hybrid and multi-cloud environments. The platform offers unified vulnerability management across Azure, AWS, and GCP, available via Azure Marketplace. Additionally, Kondukto co-developed kntrl, an open-source eBPF-based tool to secure CI/CD pipelines against supply chain attacks.

- April 2024: IONIX expanded its Attack Surface Management platform with Cloud Cross-View (CCV), offering unified visibility across cloud (AWS/Azure/GCP) and on-premise environments to address CSPM blind spots. The solution correlates internal cloud asset data with external risk exposure, identifying shadow IT, misconfigurations, and supply chain vulnerabilities while validating CSPM findings through exploit simulation.

- June 2023: Check Point and TELUS partnered to launch TELUS Management CSPM in Canada, providing real-time monitoring, automated threat detection, and compliance reporting for standards such as PCI DSS and HIPAA. Powered by Check Point’s AI-driven threat prevention, the solution helps businesses secure cloud environments while ensuring regulatory adherence.

- May 2023: Aqua Security introduced Real-Time CSPM, a next-gen solution offering continuous visibility and AI-driven risk prioritization for multi-cloud environments. Unlike traditional point-in-time scans, it reduces noise by 99%, helping teams focus on critical threats. The solution integrates with Aqua’s CNAPP platform, linking cloud risks to code repositories for faster remediation.

- January 2023: Mondoo introduced a new open CSPM tool, leveraging security-as-code principles to help teams secure AWS, GCP, Azure, and VMware environments. The solution offers 100+ policies and 4,200+ checks, including CIS benchmarks, with CI/CD integration for pre-production testing.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The CSPM market offers high-growth investment potential fueled by accelerating cloud adoption, rising misconfiguration-related breaches, and stringent regulatory mandates such as NIST CSF 2.0 and ISO 27001:2022. This demand is translating into strong market opportunities for vendors offering AI-driven platforms with capabilities such as continuous compliance monitoring, multi-cloud visibility, and automated remediation, particularly across high-risk, regulated sectors such as financial services, healthcare, and government.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 24.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment Mode

By Enterprise Type

By Cloud-Model

By Industry Vertical

By Region

|

|

Companies Profiled in the Report |

• Check Point Software Technologies Ltd. (Israel) • Cloudflare, Inc. (U.S.) • CrowdStrike (U.S.) • McAfee, LLC (U.S.) • Microsoft Corporation (U.S.) • NetApp, Inc. (U.S.) • Palo Alto Networks (U.S.) • Qualys, Inc. (U.S.) • Lookout, Inc. (U.S.) • SentinelOne (U.S.) • Sophos Ltd (U.K) |

Frequently Asked Questions

The market is projected to reach USD 21.31 billion by 2034.

In 2025, the market was valued at USD 3.14 billion.

The market is projected to grow at a CAGR of 24.20% during the forecast period.

By industry vertical, the BFSI segment is expected to hold the highest share of the market.

Regulatory compliance & data protection requirements is a key factor driving market growth.

Check Point Software Technologies Ltd., Cloudflare, Inc., CrowdStrike, McAfee, LLC, Microsoft Corporation, NetApp, Inc. are the top players in the market.

North America holds the highest market share.

By cloud model, Software as a Service (SaaS) is expected to hold the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us