Coagulation Factors Market Size, Share & Industry Analysis, By Type (Factor IX, Factor VIII, Prothrombin Complex Concentrates, Fibrinogen Concentrates, and Others), By Application (Immunology & Neurology, Hematology, Critical Care, and Others), By End User (Hospitals & Clinics, Clinical Research Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

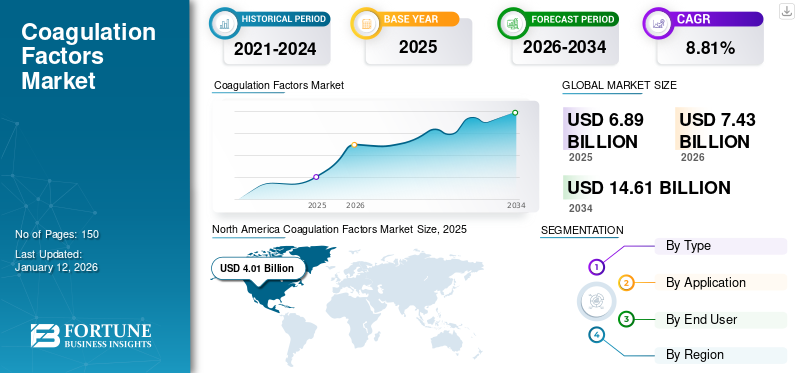

The global coagulation factors market size was valued at USD 6.89 billion in 2025. The market is projected to grow from USD 7.43 billion in 2026 to USD 14.61 billion by 2034, exhibiting a CAGR of 8.81% during the forecast period. North America dominated the coagulation factors market with a market share of 58.17% in 2025.

Coagulation factors are essential medications which play a crucial role, used in the treatment of bleeding disorders such as hemophilia A (Factor VIII deficiency) or hemophilia B (Factor IX deficiency). These medications contain blood clotting factors that are required for the blood to clot normally. The market is poised for substantial growth, driven by technological advancements, increasing prevalence of bleeding disorders, and strategic initiatives by key industry players. Market players such as CSL, Octapharma AG, Kedrion S.p.A. and Takeda Pharmaceuticals are actively investing in research and development, forming strategic collaborations, and pursuing mergers and acquisitions, in turn driving market growth.

Some of the other factors driving the market growth include development of hemostasis technology, which has led to the introduction of a wide range of products that can help clinicians provide adequate assistance to hemophilic patients. Moreover, the growing number of accidents and trauma cases is significantly contributing to the growth of the market during the forecast period.

- For instance, as per the data published by the Ministry of Road Transport and Highways of the Government of India, in India, over 461,312 road accidents took place in 2022. Compared to 2022, the number of crashes increased by 11.9%.

Global Coagulation Factors Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 6.89 billion

- 2026 Market Size: USD 7.43 billion

- 2034 Forecast Market Size: USD 14.61 billion

- CAGR: 8.81% from 2026–2034

Market Share:

- North America dominated the coagulation factors market with a 58.17% share in 2025, driven by the rising prevalence of bleeding disorders, strong plasma collection infrastructure, and technological advancements in treatment modalities.

- By application, the Hematology segment accounted for the largest market share in 2025, supported by advancements in hemostasis technologies and the growing burden of blood-related disorders like hemophilia A and B.

Key Country Highlights:

- United States: Increasing number of plasma collection centers and strong focus on technological advancements for treating bleeding disorders.

- Europe: Expansion of plasma fractionation facilities and strategic partnerships among key market players to boost production capacities.

- China: Growing number of domestic companies investing in plasma-based therapies and increasing demand for cost-effective coagulation products.

- Japan: Rising focus on innovative therapies and continuous regulatory support for plasma-derived coagulation factor products.

MARKET DYNAMICS

MARKET DRIVERS

Growing Incidence of Bleeding Disorders to Drive Market Growth

Growing number of bleeding disorders cases is one of the key factors driving the global coagulation factors market growth. There has been significant demand for plasma-derived therapies across the world, especially the demand for products such as coagulation factors to treat the bleeding disorders. Hemophilia A (factor VIII deficiency), hemophilia B (factor IX deficiency), and von Willebrand disease are the most common hereditary bleeding disorders. With, the rising number of cases, the demand for coagulation products is expected to increase eventually.

- According to data published by the Centers for Disease Control & Prevention (CDC), an estimated 33,000 males in the U.S. are living with hemophilia, i.e. over 4 in 10 males.

- Similarly, as per the National Bleeding Disorders Foundation, Von Willebrand Disease (VWD) affects around 1% of the U.S. population.

MARKET RESTRAINTS

Stringent Government Regulations to Limit Market Expansion

Compliance with stringent regulatory requirements can be challenging for manufacturers, affecting market growth. Government bodies in the U.S., China, and other emerging countries ensure that plasma collected and distributed meet strict criteria for quality, safety, and potency. Thus, rigorous regulations and the lengthy product approval process may hinder the growth of the market to some extent.

- For instance, in the U.S., the Food and Drug Administration (FDA) oversees the collection, processing, and distribution of blood and plasma products by private companies under two national laws: The Public Health Service (PHS) Act and the Federal Food, Drug, and Cosmetic (FD&C) Act.

MARKET OPPORTUNITIES

Growing Investments in Research & Development to Positively Impact Market Growth

In recent years, the demand for advanced therapies has been growing resulting in shifting the focus of operating players on investing more on research & development. The rising prevalence of various life-threatening conditions and the need for cost-effective therapeutics and diagnostics, is anticipated to drive demand, creating new opportunities for market players. The expansion of indications for currently available product reflects ongoing research & investment in this field. Additionally, opening of new facilities has further contributed to market growth opportunities.

- In December 2022, CSL Behring (CSL) announced the opening a new plasma fractionation facility in Australia. This facility is designed to support the treatment of immune system problems, hemophilia, burns, and other life-threatening medical conditions.

COAGULATIONS FACTOR MARKET TRENDS

Launch of New and Innovative Technologies is a Key Market Trend

Introduction of new and innovative technologies in the development has revolutionized the field. Notable advancements include targeted delivery systems and longer-acting factors. Additionally, advances in plasma fractionation technologies has significantly contributed to market growth.

Furthermore, the integration of artificial intelligence (AI) and the Internet of Things (IoT) is transforming the market by enhancing efficiency, performance, and cost-effectiveness. The adoption of digital tools and platforms is streamlining operations, improving supply chain management, and enhancing customer engagement.

MARKET CHALLENGES

High Initial Investment Costs to Deter Industry Development

The high cost of initial investments in technology and infrastructure can acts as a significant barrier for new entrants. Plasma-derived products require complex and resource-intensive processes, making them expensive to manufacturers. Along with that, stringent quality control measures and he need for specialized facilities further increase the cost of production. Additionally, issues related to high treatment costs and limited reimbursement coverage can negatively impact market growth, thus hindering the growth development of the market.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

High Prevalence of Hemophilia A Disorder Boosted Factor VIII Segment Growth

In terms of type, the market is classified into factor IX, factor VIII, prothrombin complex concentrates, fibrinogen concentrates, and others.

The factor VIII segment accounted for a majority share of the global coagulation factors market. Key factors driving the segment growth include rising number of hemophilia A cases coupled with advancements in the disease care. Additionally, the growing need for regular treatment and prophylactic measures further supplements segment growth.

- For instance, according to the data published by Hemophilia Federation of America in 2025, the number of individuals suffering from hemophilia A is more than 1.1 million around the world.

The fibrinogen concentrates segment held the second-largest market share in 2024. Increasing number of regulatory approvals for fibrinogen concentrates is one of the key drivers of the segment growth.

- In September 2024, Octapharma USA, Inc. received the U.S. FDA’s extended approval for Fibryga, Fibrinogen (Human) Lyophilized Powder as fibrinogen replacement in bleeding patients.

The market for factor IX, prothrombin complex concentrates, and other product types is also anticipated to witness a substantial growth in the coming years, owing to the several factors such as new product developments and strong investment in R&D.

By Application

Technological Advancements in Hemostasis Boosted Segment Hematology Growth

On the basis of application, the market is divided into immunology & neurology, hematology, critical care, and others.

The hematology segment accounted for the largest share of the market in 2024 due to advancements in various hemostasis technologies, which have led to their widespread global adoption. Furthermore, the high burden of blood-related disorders, such as congenital bleeding disorders and hemophilia A and B, across the globe is driving segmental growth during the forecast period. Moreover, the increasing regulatory approvals and the launch of plasma-derived products for the treatment of blood-related disorders are some of the additional factors anticipated to drive the growth of the segment from 2025-2032.

- According to the data published by the Perth Blood Institute on the occasion of the World Haemophilia Day 2024, the institute reported that the prevalence of haemophilia is around 1 in 6,000 to 10,000 males worldwide.

The critical care segment is expected to grow moderately throughout the forecast period. The segment's growth is augmented by the rising cases of trauma cases and accidents worldwide, leading to increasing demand for plasma-derived products such as coagulation factors.

By End User

Increasing Patient Count in Hospitals & Clinics for Bleeding Disorders to Boosted Segment’s Dominance

Based on end-user, the market is segmented into hospitals & clinics, clinical research laboratories, and others.

The hospitals & clinics segment held a majority coagulation factors market share in 2024. The rising shift of patients toward hospitals for the treatment of bleeding associated diseases has resulted in increased hospital admissions, contributing to the segment's dominance. Additionally, increasing collaboration between key companies and hospitals is expected to propel the segment's growth.

- For instance, in July 2024, Kedrion S.p.A. announced the distribution of medicines to Portuguese hospitals produced by fractionating plasma donated by Portuguese citizens. The fractionalize was carried out by the Portuguese Institute of Blood and Transplantation (IPST).

The clinical research laboratories segment is expected to grow at a moderate CAGR throughout the forecast period. The growth is due to the increasing demand for plasma therapy in the treatment of rare diseases and the growing R&D initiatives aimed at developing new plasma-derived products, including coagulations factors, for clinical applications.

Coagulation Factors Market Regional Outlook

By geography, the market is segmented into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Coagulation Factors Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2025, North America held a dominating position in the global market, accounting for around 58.17% market share and generating revenue of USD 4.01 billion. The region's growth is augmented by high demand for coagulation products for R&D activities and therapeutics, rising product approvals, and a rise in plasma collection activities.

U.S.

The U.S. captured the major share of the North America market in 2024. The country is considered to be the highly adaptive to technological advancements. The increasing number of plasma collection centers across the U.S. and the rising prevalence of chronic conditions such as Von Willebrand Disease are some of the factors driving the growth of the coagulation factors market in the country.

- For instance, in March 2023, BioLife Plasma Services, a division of the global biopharmaceutical company Takeda, announced the opening of its 200th plasma donation center in the U.S., with new locations in West Springfield, Massachusetts, and Pearland, Texas.

Europe

Europe held the second-largest share of the global market in 2024 attributed to the strategies adopted by key players, such as the development of plasma fractionation centers, mergers and partnerships, and new product launches. An increasing number of domestic companies expanding plasma fractionation facilities to develop life-saving medicines are some of the major factors responsible for the regional growth.

- For instance, in March 2023, CSL Behring (CSL) opened a plasma fractionation facility in Marburg, Germany, increasing its capacity to covert donated human plasma into life-saving medicines.

Asia Pacific

The market in the Asia Pacific region is projected to witness a strong growth rate during the forecast period. The growing number of mergers and acquisitions by key players aiming to expand its production capacity for human plasma-based products are fueling market growth in the region.

- For instance, in May 2023, Plasma Gen Biosciences opened a new, state-of-the-art manufacturing facility for blood plasma products in Bangalore to fulfill the growing demand for plasma-based products including coagulation factors at affordable prices.

Lain America and Middle East & Africa

The market in the Latin America and Middle East & Africa regions are expected to witness considerable growth in the coming years. Increasing healthcare expenditures and improvements in healthcare infrastructure are anticipated to drive market growth in these regions.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Companies Focus on New Product Launches and Capacity Expansion to Boost their Market Share

The global coagulation factors market is comprised of several global as well as regional players. However, key players such as CSL, Octapharma AG, Kedrion S.p.A. and Takeda Pharmaceuticals captured a significant share of the global market in 2024. Key factors contributing to the dominance of these companies include a strong focus on capacity expansion, new product launches, and strategic collaborations and partnerships with other companies.

- For instance, in December 2023, Octapharma AG received the U.S. FDA approval for its plasma-derived von Willebrand Factor (VWF)/Factor VIII (FVIII) product.

Other major players in the coagulations factors market include LFB, Bayer AG, Sanofi, and Pfizer Inc. These companies are continuously focusing on launching advanced products to boost their market share.

LIST OF KEY COAGULATION FACTORS COMPANIES PROFILED

- CSL (Australia)

- Takeda Pharmaceutical Company Limited (Japan)

- Kedrion S.p.A. (Italy)

- Octapharma AG (Switzerland)

- LFB (France)

- Bayer AG (Germany)

KEY INDUSTRY DEVELOPMENTS

- March 2025: The U.S. FDA approved Qfitlia (fitusiran) for Hemophilia A or B, with or without factor inhibitors.

- June 2024: Plasmagen Biosciences Private Limited introduced Haemocomplettan P (Human Fibrinogen Concentrate) to address hemorrhagic cases.

- March 2023: Takeda Pharmaceutical Company Limited invested around 100 billion JPY (USD 760.7 million) to establish a new manufacturing facility for plasma-derived therapies in Japan.

- February 2023: Sanofi received the U.S. FDA approval for ALTUVIIIO, a new factor VIII therapy for hemophilia.

- December 2022: Kedrion S.p.A. acquired UNICAplasma s.r.o and UNICAplasma Morava s.r.o., to operate five plasma collection centers in the Czech Republic with an aim to collect high-quality plasma for the production of plasma-derived therapies used to prevent and treat rare and debilitating conditions.

TRADE PROTECTIONISM

Trade protectionism can impact the coagulation factors market by affecting the supply chain and pricing of raw materials and finished products. Tariffs and import restrictions may lead to increased production costs, influencing the availability and affordability of coagulation therapies. Manufacturers must navigate these challenges by exploring local production options and diversifying their supply chains to mitigate potential risks.

REPORT COVERAGE

The global coagulation factors market research analysis provides market size and forecast by all the segments included in the report. This comprehensive market report analysis delves into various facets of the market, including trends, challenges, key players, regional insights, and market segmentation. The global market report also offers information on the key industry developments, new product launches, and details on partnerships, mergers & acquisitions in key countries. It also provides detail information on competitive landscape and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 8.81% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.89 billion in 2025 and is projected to reach USD 14.61 billion by 2034.

In 2025, the market value stood at USD 6.89 billion.

The market is expected to exhibit a CAGR of 8.81% during the forecast period of 2026-2034.

The factor VIII segment led the market by type.

One of the key factors driving the market is the increasing usage of advanced products in bleeding disorders.

CSL, Takeda Pharmaceutical Company Limited, Kedrion Biopharma Inc., and Octapharma AG are some of the top players in the market.

North America dominated the market in 2025.

Rising incidence of bleeding disorders such as hemophilia and von Willebrand disease, and increasing need advanced therapies are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us