Consumer Grade Breast Pumps Market Size, Share & Industry Analysis, By Product (Wearable and Non-wearable), By Type (Manual and Automatic), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

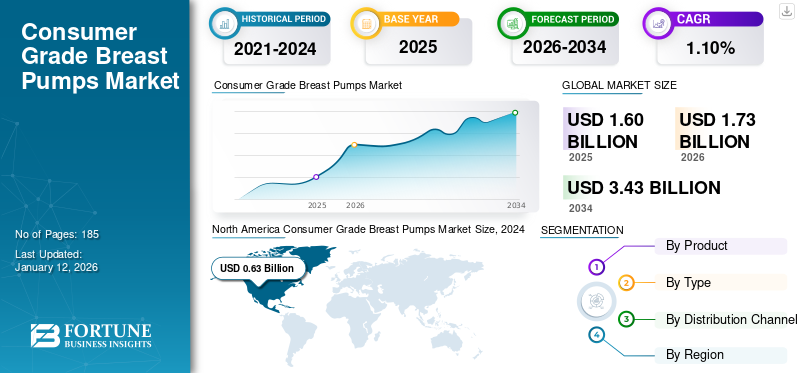

The global consumer-grade breast pumps market size was valued at USD 1.60 billion in 2025. The market is projected to grow from USD 1.73 billion in 2026 to USD 3.43 billion by 2034, exhibiting a CAGR of 1.10% during the forecast period. North America dominated the consumer-grade breast pumps market with a market share of 71.52% in 2025.

Consumer-grade breast pumps are devices designed for individual mothers’ use to express milk for feeding. The devices are available for purchase and are suitable for personal use by working mothers returning to work. The growing number of working women globally is one of the major factors supporting the growth of the market.

- According to 2023 statistics published by the Federal Statistical Office of Germany, there were nearly 46.9 women for 100 persons in employment in Germany in 2023.

There are several prominent players, such as Elvie, Momcozy, and others, along with emerging players, operating in the market, offering a wide range of products with innovative features. The growing focus of these companies to introduce products with novel features to cater to the rising demand for consumer-grade breast pumps is anticipated to drive the adoption of these products.

Global Consumer Grade Breast Pumps Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.60 billion

- 2026 Market Size: USD 1.73 billion

- 2034 Forecast Market Size: USD 3.43 billion

- CAGR: 1.10% from 2026–2034

Market Share:

- Region: North America dominated the market with a 71.52% share in 2025. This is due to increased awareness of the benefits of breast pumps, rising adoption of these products among women, and an increasing number of homecare settings in the region.

- By Product: The Non-wearable segment held the largest market share in 2024. The segment's growth is supported by the increased availability of non-wearable electric breast pumps and rising awareness campaigns by companies and organizations.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific region, Japan is seeing market growth due to rising disposable incomes and increasing awareness of FemTech products, including advanced breast pumps.

- United States: The market is driven by supportive policies, such as the Affordable Care Act, which has increased health insurance claims for breast pumps. The U.S. is also a hub for product innovation, with companies continuously launching new and technologically advanced models.

- China: As a key market in the Asia Pacific, growth is fueled by rising disposable incomes and a growing awareness of modern parenting and a desire for products that support working mothers.

- Europe: The market is advanced by a high number of working women, particularly in countries like Germany, where women account for nearly 46.9% of the employed population. Companies are also launching global campaigns from European bases to increase awareness of the technological benefits of their products.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Number of Working Women to Boost Adoption of Consumer Grade Breast Pumps in Market

The features such as portability, compact size, and convenience, among others, of the consumer grade breast pumps are vital factors leading to rising demand for these products among women, especially working mothers.

Additionally, the increasing focus of companies to introduce innovative products is another significant factor supporting the growing adoption of pumps, thus fostering market growth.

- According to a 2024 survey published by Mamava Inc., nearly 46% of the respondents among seven million women surveyed by Mamava Inc. and Medela use a breast pump in addition to direct feeding through breasts.

All these factors, coupled with the growing support of government bodies across the countries and healthcare payors to increase the reimbursement for the products, are expected to drive the adoption of consumer grade breast pumps among the population.

MARKET RESTRAINTS

Adverse Effects of Consumer Grade Breast Pumps to Hamper their Growing Adoption

The rising awareness regarding the benefits and convenience of breast pump use is resulting in the growing adoption of the product among the population. However, certain adverse effects associated with the use of electrical breast pumps, such as breast engorgement and possible damage to the nipples due to incorrect size and fit, are a few of the significant factors limiting the adoption of these products in the market. Additionally, the growing concerns over product recall in the market is another crucial factor anticipated to hinder the adoption of the product among mothers and working women.

- In January 2023, Momcozy wearable breast pump was issued a medical license to sell in Canada, that were sold without proper authorization in the country.

Thus, the safety concerns of the product are supposed to restrict the global consumer grade breast pumps market growth.

MARKET OPPORTUNITIES

Rising Use of Online Channels and Platforms Among Manufacturers to Create a Huge Market Opportunity

The increasing use of online platforms and sales channels among manufacturers in the market for the distribution of breast pumps and increasing awareness regarding the use of these products in the current digital age can present a lucrative opportunity for the market players to increase their global consumer grade breast pumps market share.

The strategic collaborations among the key players to broaden the brand presence and the rising efforts of the companies to develop innovative products are further supporting market growth.

- In December 2024, Momcozy won the gold award for the ‘Best Breast Pump’ at the Mother & Baby Awards, 2025.

Thus, the R&D focus of the companies to develop new features in the products is expected to open up market opportunities for players to flourish in the global market.

MARKET CHALLENGES

High Cost: The growing technological advancements in breast pumps among manufacturers are leading to high-priced products with various innovative features available in the market. The high cost of the product is one of the significant challenges limiting market growth.

Limited Awareness in Emerging Countries: There is limited awareness regarding the benefits of consumer grade breast pumps among the population, especially in developing nations such as India and Brazil, among others, which is a barrier to the growth of the market.

Regulatory Challenges: The rising focus on the safety concerns of the product is resulting in stringent regulations restricting the number of emerging players and new product launches in the market.

Also, the competitive landscape is another challenge, making it difficult for new entrants to gain visibility and traction in the market.

CONSUMER GRADE BREAST PUMPS MARKET TRENDS

Growing Technological Advancements in Consumer Grade Products are an Emerging Trend in Market

The increasing demand for electrical breast pumps with technological advancements and innovative features is contributing to the rising adoption of these products in the market. The rising focus of companies to cater to the growing product demand by developing and introducing innovative products is expected to support the trend of technological advancements in the future.

- In March 2021, Koninklijke Philips N.V. launched the Philips Avent double electric breast pump with an innovative natural motion technology that mimics the baby’s wave-like tongue motion.

Several other players in the market are constantly focusing on the development of products with various novel features, including Bluetooth connectivity and mobile-app integration, among others, which will spur the market trend during the forecast period.

OTHER TRENDS

Growing Government Initiatives: There has been increasing support from government bodies and insurance providers to support the rising adoption of these products among consumers.

- According to a 2021 study published by Consumer Reports, the Affordable Care Act has contributed to an increase in the number of health insurance claims for the pumps.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product

Non-wearable Segment Dominated the Market Due to Its Wide Availability

Based on the product, the market is bifurcated into wearable and non-wearable.

The non-wearable segment accounted for the largest share of the market in 2024. The increased availability of non-wearable types of electrical breast pumps in the market, along with rising initiatives for increasing awareness regarding these products by companies and organizations, are some of the significant factors contributing to the segmental growth.

The wearable segment is projected to grow at the highest rate during the forecast period. The growing technological advancements by companies are one of the essential factors for the growth of the segment.

According to an article published by Everyday Health Inc., more than 1,200 moms prefer electric automatic breast pumps owing to convenience and user-friendly features.

By Type

Automatic Segment Led the Market Owing to Its Convenience and Advantages

Based on type, the market is divided into manual and automatic.

The automatic segment dominated the market in 2024. Different features, including compact size, portability, and the convenience of automatic breast pumps, are some of the primary reasons for their increasing adoption in the market, thus bolstering segment growth. Also, the growing focus of the prominent players in the market to expand their product portfolio with the introduction of new products is another major factor contributing to segment growth.

- In August 2020, Medela launched the Pump in Style with MAXFlow Technology breast pump, a double electric, personal-use pump in the U.S. and Canada.

The manual segment is projected to grow at a steady rate during the forecast period. The rising adoption of these products, owing to their lightweight and lower price, among others, is one of the major factors supporting the growth of the segment in the market.

By Distribution Channel

Retail Pharmacies Dominated Owing to Increasing Adoption of Products Among Homecare Settings

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies.

The retail pharmacies segment held the largest global consumer grade breast pumps market share in 2024. The growing adoption of breast pumps among homecare settings due to the rising number of working mothers and increasing awareness regarding the benefits of these products is one of the vital factors contributing to the growth of the segment.

The hospital pharmacies segment is expected to grow at a slower rate during the forecast period. The increasing number of visits to hospitals and the rising number of hospitals globally are some of the main factors fueling the growth of the segment.

The online pharmacies segment is projected to register the highest growth rate during the forecast period. The increasing use of online platforms among consumers, owing to the convenience of buying, availability of a wide range of products, prices at a discounted rate, and others is leading to the growth of the segment.

Consumer Grade Breast Pumps Market Regional Outlook

On the basis of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Consumer Grade Breast Pumps Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a value of USD 0.75 billion in 2026. The increased awareness regarding the benefits of consumer grade breast pumps, the rising adoption of the products among women, and the increasing number of homecare settings in the region are some of the major factors supporting the growth of the market.

The U.S. held the maximum share of the North American market in 2024. The rising focus of companies to introduce innovative products in the U.S. and cater to the demand among the population is one of the prominent factors leading to the growth of the country's market.

- Momcozy announced its launch of the Air 1 Ultra-Slim breast pump in the U.S. in the first quarter of 2025.

Europe

Europe is projected to register steady growth during the forecast period. The presence of established players and several emerging players in the region is one of the crucial factors driving the demand for the product. Also, the strong focus of these companies on increasing brand awareness among the population boosts the market growth in the region.

- In March 2022, Elvie launched a global campaign, ‘Smart Bodies, ’ with an aim to increase awareness regarding the technological advancements and benefits of the company’s products for women’s health.

Asia Pacific

Asia Pacific is anticipated to grow at a faster CAGR during the forecast period. The increasing disposable income in countries such as India, China, and others, and rising awareness regarding FemTech products, including breast pumps, are a few of the significant factors driving the market growth in the region.

Latin America

The Latin America market is projected to grow at a normal rate during the forecast period. The increasing number of working women in countries such as Brazil, Argentina, Mexico, and others is one of the significant factors fueling the demand and adoption of these products in the market.

- According to 2023 statistics published by the World Bank, the labor force participation rate among females was around 47.3% in Mexico in 2023.

Middle East & Africa

The Middle East & Africa region is estimated to grow at a slower rate during the forecast period. The growing awareness regarding breast pumps among the population, along with increasing adoption in the countries, are some of the main factors contributing to market growth in the region.

- Since February 2023, Annabella, one of the leading breast pump manufacturers, has sold around 4,000 breast pumps in Israel.

COMPETITIVE LANDSCAPE

Key Industry Players

Rising Focus of the Companies to Introduce Innovative Products Has Enhanced Their Market Penetration

The global market is fragmented, with numerous players operating with a wide range of product offerings. Some of the prominent players include Elvie, Momcozy, and others. The rising emphasis of these companies on developing and introducing innovative products and improving performance and efficiency to cater to the growing demand is supporting the brand presence in the global market.

- In March 2022, Elvie launched Elvie Stride Plus, a hands-free, electric breast pump with a 3-in-1 carry bag.

Other players, such as Koninklijke Philips N.V., Lansinoh Laboratories, Inc., Freemie, and others, are growing strategic collaborations and initiatives to support the increased market share of the companies.

- In January 2022, Freemie launched a new, slimmer, and lighter product line at CES 2022 with an aim to increase the brand's presence in the market.

LIST OF KEY CONSUMER GRADE BREAST PUMP COMPANIES PROFILED

- Chiaro Technology Limited (U.K.)

- Medela (Switzerland)

- Freemie (U.S.)

- Willow (U.S.)

- Lansinoh Laboratories, Inc. (U.S.)

- Spectra Baby USA (U.S.)

- Momcozy (U.S.)

- BabyBuddha Products (U.S.)

- Evenflo (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2024 - Momcozy launched the MomcozyV1 Pro Breast Pump, redefining the standard for high-suction pumps.

- August 2024 - Willow launched a campaign, ‘Pumping is Breastfeeding,’ to expand the breastfeeding and adoption of breast pumps among mothers and working women in the market.

- May 2024 – BabyBuddha Products launched its Baby Buddha 2.0 model to support breastfeeding mothers.

- April 2024 - Chiaro Technology Ltd. (Elvie) raised funding of USD 10.4 million. Earlier in 2022, the company raised USD 20.0 million from the same internal investor for the business expansion.

- June 2023 - MomMed launched the S21 breast pump in the U.K. to expand its business and presence across the country.

REPORT COVERAGE

The global consumer grade breast pumps market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and trends expected to drive the market in the forecast period. It offers insights on industry developments, new product launches, and details on partnerships, mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 1.10% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Type

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.73 billion in 2026 and is projected to reach USD 3.43 billion by 2034.

In 2024, North America led the global market.

The market is expected to exhibit a CAGR of 1.10% during the forecast period of 2026-2034.

The automatic segment led the market by type.

The increasing number of working women is boosting market expansion.

Chiaro Technology Limited, Willow, and Momcozy are some of the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us