Continuous Emission Monitoring Systems Market Size, Share & Industry Analysis By Technology (Direct Extractive CEMS, Dilution Extractive CEMS, and In-situ CEMS), By Installation Type (New Installations, Retrofit Installations/Upgrades, and Replacement Installations), By Application (Power Generation, Oil & Gas, Chemicals & Petrochemicals, Cement, Pulp & Paper, Waste Incineration, Metals & Mining, Pharmaceutical, Food & Beverage, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

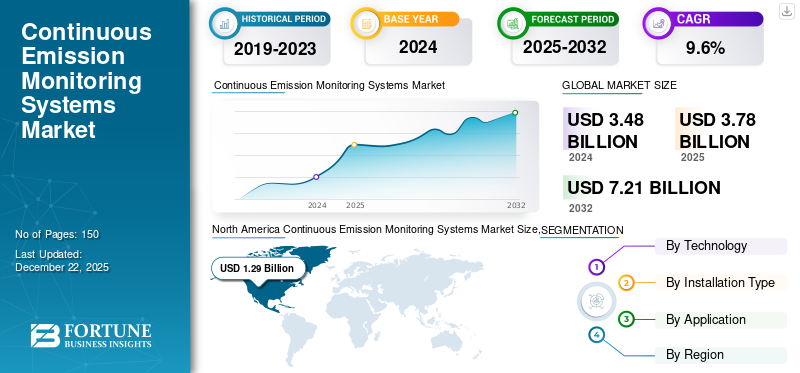

The global continuous emission monitoring systems market size was valued at USD 3.78 billion in 2025. The market is projected to grow from USD 4.12 billion in 2026 to USD 8.45 billion by 2034, exhibiting a CAGR of 9.40% during the forecast period. North America dominated the global market with a share of 37.00% in 2025.

Continuous Emission Monitoring Systems (CEMS) comprise integrated systems designed to collect, continuously analyze, and record data on pollutant concentrations released from industrial exhaust stacks and flue gas sources. These systems are essential for regulatory compliance, providing the real time monitoring of gases such as SO₂, NOx, CO₂, CO, and O₂, to ensure adherence to environmental standards. It is crucial in emission control strategies across industries such as power generation, oil & gas, chemicals & petrochemicals, cement, pulp & paper, waste incineration, metals & mining, pharmaceutical, food & beverage, and wastewater treatment, supporting environmental transparency and operational efficiency. ABB, Siemens, Emerson Electric Co., Teledyne Technologies, Horiba, Thermo Fisher Scientific Inc., AMETEK Inc., Fuji Electric Co., Ltd., IMR Environmental Equipment, Inc., and SICK AG are key players.

The COVID-19 pandemic disrupted the CEMS market by slowing down manufacturing, installations, and retrofitting activities due to operational shutdowns. However, the shift toward stricter environmental regulations and the rising demand for remote monitoring solutions led to a resurgence in CEMS adoption, particularly in digital and real-time monitoring technologies.

IMPACT OF RECIPROCAL TARIFFS

The implementation of reciprocal tariffs has the potential to significantly impact the market by increasing the cost of raw materials and finished products. Manufacturers in regions impacted by tariffs may experience higher production costs, which could lead to increased prices for continuous emission monitoring systems units. These cost hikes are likely to be transferred to end-users, raising the overall expenditure on emission monitoring systems. Additionally, supply chain disruptions caused by trade barriers may delay the delivery of critical components, further hindering market growth. These tariff-induced cost pressures could result in delayed project timelines and affect the adoption rate of continuous emission monitoring systems in price-sensitive markets, particularly in developing regions. For instance,

- The U.S. tariffs on Chinese exports stand at 51.1% as of May 2025.

Impact of Artificial Intelligence (AI)

Advancements in the continuous emission monitoring system market, including machine learning and deep learning, are significantly enhancing the capabilities of continuous emission monitoring systems through real time data processing, anomaly detection, and predictive maintenance. For instance,

- The Delhi Pollution Control Committee has outlined plans to leverage AI for analyzing pollution data from existing monitoring portals, enabling the prediction of pollution trends and optimizing decision-making.

AI also plays a crucial role in detecting sensor calibration issues and errors, ensuring the accuracy of emission measurements. At the same time, predictive maintenance models help forecast potential equipment failures, reducing downtime. Additionally, AI optimizes system performance by adjusting sampling rates and calibration schedules, minimizing energy consumption and wear on equipment. Moreover, AI-driven predictive modeling and anomaly detection support emission forecasting and regulatory compliance, streamlining operational processes and mitigating the risk of regulatory violations.

CONTINUOUS EMISSION MONITORING SYSTEMS MARKET TRENDS

Hybrid Monitoring Solutions Emerge as a Key Driver for Market Expansion

A growing trend in the market is the adoption of hybrid monitoring approaches, where industries combine continuous systems with occasional, manual, or portable monitoring options. This strategy helps facilities comply with regulations while reducing operational costs, particularly in sectors where full-time monitoring is financially burdensome or not mandated by law. Hybrid systems are commonly used in facilities with diverse process needs, smaller emission sources, or irregular operations where a permanent continuous emission monitoring system may not be necessary. For example,

- In February 2023, Latvian company InPass developed a portable communication controller for the UP-CEMS project to monitor ship emissions more efficiently, providing a lightweight, user-friendly alternative to traditional continuous emission monitoring systems.

Therefore, companies can maintain compliance, reduce costs, and enhance flexibility by using portable or semi-continuous devices at specific emission points and retaining automated continuous emission monitoring systems on essential stacks.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Stringent Environmental Regulations and Sustainability Initiatives to Propel the Market Expansion

Governments worldwide are strengthening environmental standards, making regulatory compliance a critical factor for the continuous emission monitoring systems market growth. In regions such as the U.S., Europe, China, and India, air quality regulations have shifted from occasional inspections to continuous, automated monitoring of industrial emissions.

- Regulations such as the U.S. EPA’s 40 CFR Part 75, the EU’s Industrial Emissions Directive (IED) and China’s Air Pollution Prevention and Control Action Plan mandate real-time emission measurements and the submission of verified data to authorities.

Non-compliance with these regulations can result in severe penalties, including substantial fines, production reductions, and even operational shutdowns. As a result, industries are increasingly adopting certified continuous emission monitoring systems that meet rigorous standards of accuracy and reliability to ensure compliance with environmental regulations and mitigate the risks of legal consequences.

Market Restraints

Competitions from New and Alternative Monitoring Technologies May Hinder the Market Growth

The rise of cutting edge remote monitoring technologies, such as satellite-based sensing, is influencing the expansion of the market. These systems use specialized satellite tools to measure atmospheric pollutants across large regions in near real-time, enabling more efficient emissions tracking. For example,

- In July 2025, Chinese researchers developed a satellite-based Pollution-Carbon Synergy Model (PCSM) that accurately estimates coal plant CO₂ emissions, reducing errors from 45.8% to 13%.

Additionally, drone-mounted sensors are gaining traction, offering precise emissions assessments in hard-to-reach areas and for short-term monitoring needs.

- In September 2024, Delhi launched a pilot project using drones to identify pollution sources in high-risk areas, which could expand citywide if successful, demonstrating the potential of drones in local environmental oversight.

Market Opportunities

Municipal and Urban Transformation Initiatives to Drive the Market Growth

Municipalities and urban administrations are increasingly prioritizing air pollution management due to public health concerns, growing population densities, and pressure to meet environmental standards. This shift is driving investments in both fixed and mobile emission monitoring systems. For example,

- In June 2025, Indonesia’s Environment Ministry mandated the installation of continuous emission monitoring systems on approximately 4,000 chimneys in Greater Jakarta's industrial areas to combat air pollution, with legal penalties for non-compliance.

- Additionally, in May 2024, Thermo Fisher Scientific began manufacturing Air Quality Monitoring System analyzers in India to support the country’s clean air initiatives and localization efforts.

These systems provide continuous, real-time data, enabling city authorities to implement effective pollution control measures and ensure compliance with national and international air quality standards.

SEGMENTATION ANALYSIS

By Technology

Direct Extractive CEMS Leads Driven by High Adoption in Heavy Industries

The market is divided into direct extractive CEMS, dilution extractive CEMS, and in-situ CEMS based on technology.

The direct extractive CEMS segment holds the largest market share of 52.87% in 2026, primarily due to its widespread adoption in heavy industries that require accurate and continuous monitoring of multiple gas parameters under extreme operating conditions. These systems can handle high temperatures, complex flue gas compositions, and elevated particulate concentrations, making them the preferred solution for regulatory-grade emission monitoring. For instance,

- NTPC Limited, India's largest power utility, has implemented Direct Extractive CEMS across several thermal power plants to comply with the Central Pollution Control Board's (CPCB) emission mandates.

The in-situ CEMS segment is expected to record the highest CAGR over the forecast period, driven by its low maintenance needs, faster response times, and compatibility with modern, decentralized, and space-constrained industrial configurations. These systems eliminate sample extraction and conditioning, making them ideal for dynamic and space-constrained environments. For instance,

- Chevron Corporation has adopted in-situ CEMS across select upstream operations in the Permian Basin to ensure real-time monitoring with minimal maintenance interruptions.

By Installation Type

New Installations Capture the Largest Market Share Owing to the Expanding Industrial Infrastructure

Based on installation type, the market is divided into new installations, retrofit installations/upgrades, and replacement installations.

The new installations segment accounts for the largest continuous emission monitoring systems market share, driven by the rapid expansion of industrial infrastructure in emerging economies. New facilities in sectors such as power generation, cement, and petrochemicals are being established under increasingly stringent environmental regulations. These projects incorporate advanced CEMS technologies from the design stage to ensure long-term regulatory compliance and operational efficiency. For instance,

- Indonesia’s Jawa 9 & 10 coal plant has installed advanced extractive CEMS to comply with updated air quality standards under Regulation No. P.15/MENLHK/2019.

The retrofit installations/upgrades segment is register the highest share of 39.55% in 2026. This trend is marked in developed regions where mature industrial sectors prioritize the modernization of legacy emission monitoring systems. Key growth drivers include the accelerating shift toward digital transformation, the need for higher measurement accuracy, and the adoption of remote monitoring technologies to enhance regulatory compliance and operational efficiency. For instance,

- Duke Energy is upgrading its CEMS fleet with advanced digital systems across coal and gas plants to meet evolving EPA regulations and support its carbon reduction goals.

By Application

To know how our report can help streamline your business, Speak to Analyst

Power Generation Segment Dominates with Continuous Emission Monitoring Needs

By application, the market is segmented into power generation, oil & gas, chemicals & petrochemicals, cement, pulp & paper, waste incineration, metals & mining, pharmaceutical, food & beverage, and others.

The power generation segment leads the market share of 29.41% in 2026, driven by high pollutant output and stringent emissions regulations. Utilities must ensure ongoing compliance with SOx, NOx, and CO₂ emission standards, making these solutions essential for operational and regulatory frameworks.

The others segment is projected to experience the highest CAGR, fueled by urbanization and the broadening of environmental regulations to include smaller and municipal-scale facilities. Additionally, the growing adoption of IoT and automation technologies in these facilities is driving operational efficiency and ensuring better compliance with environmental standards.

CONTINUOUS EMISSION MONITORING SYSTEMS MARKET REGIONAL OUTLOOK

By region, the market has been studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America dominated the market with a valuation of USD 1.4 billion in 2025 and USD 1.52 billion in 2026, continues to lead the market, owing to early regulatory enforcement, especially by the U.S. Environmental Protection Agency (EPA) under the Clean Air Act (40 CFR Part 60 and 75). The region has a well-developed industrial base spanning sectors such as power generation, oil & gas, and chemicals, all subject to stringent continuous emissions monitoring requirements. This leadership position is further reinforced by continued investments in retrofitting and upgrading aging infrastructure. The U.S. market is projected to reach USD 0.9 billion by 2026. For instance,

- Duke Energy is upgrading CEMS systems across its coal and gas power plants in the U.S. to meet evolving EPA standards and support its goal of net-zero carbon emissions by 2050.

North America Continuous Emission Monitoring Systems Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific is projected to register the highest CAGR over the forecast period, driven by rapid industrialization, increasing urbanization, and progressively stricter environmental regulations. Countries such as China, India, Japan, and Indonesia are implementing nationwide programs aimed at air pollution reduction, thereby mandating real-time emissions monitoring in new and existing facilities. The Japan market is projected to reach USD 0.22 billion by 2026, the China market is projected to reach USD 0.26 billion by 2026, and the India market is projected to reach USD 0.17 billion by 2026. For instance,

- Reliance Industries in India has deployed extractive CEMS solutions at its Jamnagar refinery to monitor NOx, SO₂, and particulate matter, aligning with India’s CPCB (Central Pollution Control Board) directives under the National Clean Air Programme (NCAP).

Europe

Europe holds the second-largest market share due to its mature regulatory landscape and rigorous enforcement of environmental protection laws. The EU's Industrial Emissions Directive (IED) and national frameworks mandate continuous air pollutant monitoring across key industrial sectors. The UK market is projected to reach USD 0.36 billion by 2026, and the Germany market is projected to reach USD 0.3 billion by 2026. For instance,

- Enforcement by agencies such as Germany's Umweltbundesamt or the U.K.'s Environment Agency ensures high compliance, sustaining demand for CEMS.

Middle East and Africa and South America

The market in these regions is projected to grow steadily, primarily due to limited regulatory enforcement and fragmented environmental compliance frameworks across the region. Although several countries have introduced emission control regulations, the inconsistent implementation and weak institutional monitoring capabilities have significantly reduced the urgency for industrial operators to adopt continuous emissions monitoring systems.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen their Market Positions

Prominent players enhance their product portfolios to enhance their market positions by offering advancements in sensor technologies, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and enhance their market share in a rapidly evolving landscape.

Long List of Continuous Emission Monitoring Systems Companies Studied

- ABB (Switzerland)

- Siemens (Germany)

- Emerson Electric Co. (U.S.)

- Teledyne Technologies (U.S.)

- Horiba (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- AMETEK, Inc. (U.S.)

- Fuji Electric Co., Ltd. (Japan)

- SICK AG (Germany)

- IMR Environmental Equipment, Inc. (U.S.)

- Kanomax USA, Inc. (U.S.)

- METTLER TOLEDO (U.S.)

- MRU Instruments (Germany)

- Process Insights, Inc. (U.S.)

- Envea (France)

- Keller Group plc (U.K.)

- Endress+Hauser Group Services AG (Switzerland)

- RKI Instruments (U.S.)

- Acoem (France)

KEY INDUSTRY DEVELOPMENTS

- In June 2025, Kongsberg Maritime launched a Continuous Emissions Monitoring System that provides real-time tracking of CO₂, CH₄, SOx, NOx, and CO directly from ship exhaust gases. This system aims to help the maritime industry reduce its carbon footprint and comply with increasingly stringent emission regulations.

- In May 2025, Siemens and German clean-tech company TURN2X formed a global partnership to scale up the production of renewable natural gas (RNG). Siemens will provide automation, digitalization, and energy management solutions to optimize TURN2X's operations, supporting the transition to sustainable energy by producing carbon-neutral methane.

- In May 2025, the Finnish Meteorological Institute (FMI) introduced two innovative satellite-based methods aimed at enhancing the tracking of greenhouse gas and air pollution emissions from urban areas, power plants, and industrial sites. These methods provide more accurate and real-time emissions data, supporting better environmental management and policy development.

- In May 2025, Teledyne FLIR OEM announced a collaboration with AerialOGI to launch the AerialOGI-N, an advanced optical gas imaging camera module capable of detecting and quantifying methane and other greenhouse gas emissions in real-time. The module, featuring Teledyne FLIR's high-resolution Neutrino LC OGI camera core, can be used with drones and handheld platforms for enhanced emissions monitoring.

- In August 2024, BASF Catalysts India (BCIL) opened a new R&D laboratory in Tamil Nadu, India, focused on the development of emissions control catalysts for the local automotive market. This facility will support the advancement of cleaner technologies and contribute to reducing emissions from India's automotive sector.

REPORT COVERAGE

The market report focuses on key aspects such as leading companies, product/service types, and product applications. Besides, the report offers insights into the market trend analysis and highlights vital developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 9.40% from 2026 to 2034 |

|

|

Segmentation |

By Technology

By Installation Type

By Application

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 8.45 billion by 2034.

In 2025, the market size stood at USD 3.78 billion.

The market is projected to grow at a CAGR of 9.40% during the forecast period.

By application, the power generation segment is leading the market.

Stringent environmental regulations and sustainability initiatives are key factors propelling market growth.

Thermo Fisher Scientific, Siemens AG, Emerson Electric Co., ABB Ltd., and AMETEK Inc. are the top players in the continuous emission monitoring systems market.

North America dominated the global market with a share of 37.00% in 2025.

Asia Pacific is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us