Corrugated Box Making Machine Market Size, Share & Industry Analysis, By Technology Type (Manual, Semi-Automatic, and Automatic), By Machine Type (Standalone and Integrated), By End-user (Packaging, Food & Beverages, Retail & E-commerce, Electrical & Electronics, Pharmaceuticals, and Others (Textiles)), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

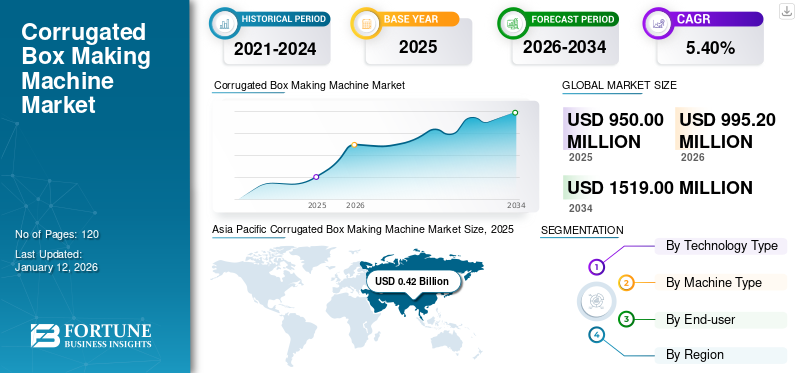

The global corrugated box making machine market size was valued at USD 0.95 billion in 2025 and is projected to grow from USD 0.99 billion in 2026 to USD 1.51 billion by 2034, exhibiting a CAGR of 5.40% during the forecast period. The Asia Pacific dominated global market with a share of 44.90% in 2025.

A corrugated box making machine is a type of equipment used to manufacture corrugated boxes. These machines are increasingly used in the packaging industry to produce various forms and sizes of corrugated boxes. Corrugated boards have been used in a wide range of applications for packaging on account of various benefits, including durability, affordability, and eco-friendliness. The corrugator machine typically consists of several sub-machines designed to perform tasks, such as printing, pasting, fluting, sheeting, cutting, and embossing. All these sub-machines work together to convert sheets of paper into corrugated boxes.

The corrugated box making machine market is mainly driven by rapid technological advancements, rising e-commerce, and market expansion in emerging economies. For instance, in India, the demand for corrugated boxes and other packaging materials increased by 30% in July 2023 compared to April 2023. China's corrugated industry is also witnessing rising demand for corrugated boxes, particularly in industries, including food & beverages and electrical & electronics. Corrugated box making plants have increased their production to address the rise in demand, thereby boosting the need for corrugated box machines.

The COVID-19 pandemic had a mixed impact on the market. During the first few months, the market experienced severe disruptions in the global supply chain owing to the lockdowns and constraints on movement, hampering corrugated box manufacturing and trade. The decline in orders amid weak domestic and global demand led to the decreased demand for corrugated box making machines. However, the market gradually recovered as the pandemic increased reliance on e-commerce and broader emphasis on packaging.

IMPACT OF TECHNOLOGY ON MARKET

Rapid Technological Advancements to Drive Market Growth

The corrugated box making machine market growth is driven by technological developments. A strong focus is on integrating Artificial Intelligence (AI) and Machine Learning into corrugators to improve productivity and accuracy, which is not possible with manual machines. AI-powered machines can decrease human error significantly, ensuring consistent quality across batches, an important factor in meeting packaging standards.

Cost savings are another advantage that can be achieved with advanced machines. Automated machines reduce the requirement for large labor forces, thereby lowering operational expenses over time. Moreover, it also offers scalability, allowing companies to easily adjust the production process, which is extremely important for fluctuating market demands.

CORRUGATED BOX MAKING MACHINE MARKET TRENDS

MARKET DYNAMICS

Rapid Automation in Packaging Industry to Augment Market Growth

The packaging industry is at the forefront of rapid automation, driven by factors such as labor shortages, global supply chain disruptions, and high inflation. Manufacturers are increasingly shifting to packaging automation to improve profitability and relieve pressures on their business and employees. With increasing demand for efficient and sustainable packaging, automation in corrugated box production technology is pushing the industry forward.

Innovations such as automated production lines, material and design improvements, data analytics, and sustainability initiatives are paving the way for more efficient, customizable, and eco-friendly packaging solutions. These advancements are anticipated to shape the future of corrugated box production, supporting businesses, protecting goods, and decreasing environmental impact. Automation plays a pivotal role in improving productivity and efficiency, boosting the demand for fully automatic corrugated box machines capable of high-volume production with less manual intervention.

Download Free sample to learn more about this report.

Market Drivers

Exponential Growth of E-commerce Sector to Drive Market Growth

E-commerce businesses across the world are experiencing an upsurge in demand. According to the U.S. Census Bureau, the retail e-commerce sales in the first quarter of 2024 was around USD 289.2 billion, a significant increase of 2.1% compared to the fourth quarter of 2023. Factors including increasing smartphone and internet penetration along with the convenience of shopping from anywhere and anytime have augmented the e-commerce sector.

The rapid expansion has significantly increased the need for corrugated packaging. As more consumers shop online, the demand for cardboard boxes for shipping and packaging continues to rise, driving the market for corrugated box-making machines. Corrugated packaging is gaining remarkable traction in the e-commerce sector as corrugated boxes offer effortless handling and storage, making it suitable for both e-commerce companies and consumers. Hence, the demand for corrugated boxes in the e-commerce sector is a key driver of market growth.

Market Restraints

Increasing Raw Material Costs and Supply Chain Disruptions to Limit Market Growth

The corrugated box industry faces a significant challenge in rising raw material prices. A drop in raw material supply, coupled with increased demand for corrugated boxes, has led to substantial price hikes. This, in turn, increases production costs for corrugated box manufacturers, limiting their ability to invest in box making machines.

In addition, supply chain disruptions on account of the geopolitical tensions and natural disasters are anticipated to impact the availability of essential components to manufacture corrugated box-making machinery. All these factors are expected to hinder the corrugated box making machine industry.

Market Opportunity

Growing Preference for Eco-friendly Packaging Materials to Offer Ample Growth Opportunities

With a growing preference for eco-friendly products, customers are demanding more sustainable packaging materials. Numerous consumer goods businesses are adapting their packaging strategies to meet their greenhouse gas emission targets, either by lowering packaging or changing packaging materials. Presently, eco-friendly consumers are increasingly choosing brands that focus on environmentally friendly practices, making sustainable packaging a vital aspect for business success. As concerns over climate change and plastic pollution rise worldwide, sustainable packaging offers an effective solution. By using recyclable and biodegradable materials, companies can significantly lower their environmental footprint. Hence, increasing preference for eco-friendly packaging materials by customers and businesses alike has augmented the demand for corrugated boxes as they are cost-effective and recyclable.

SEGMENTATION ANALYSIS

By Technology Type

Automatic Segment to Lead due to Rising Adoption of Automation

Based on technology type, the market is segmented into manual, semi-automatic, and automatic. The automatic segment is predicted to hold the highest corrugated box making machine market share and record the highest CAGR during the forecast period due to the increasing adoption of automation by the packaging industry. Automatic machines offer higher processing speeds and throughput compared to semi-automatic and manual machinery, facilitating large-scale facilities to produce larger volumes of corrugated boxes in less time. Moreover, automatic machines reduce the need for manual labor, leading to cost savings, especially in regions where labor costs are significantly high. The segment is likely to capture 53.76% of the market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

Semi-automatic machines are more affordable compared to automatic machines and are highly suitable for businesses seeking for initial investment while producing different sizes and forms of boxes for packaging. These machines are designed for medium to high-volume packaging applications. The segment is set to grow with a CAGR of 4.96% during the forecast period (2025-2032).

By Machine Type

Customization Capabilities Offered by Integrated Corrugators to Increase their Adoption

Based on machine type, the market is divided into integrated and standalone.

The integrated segment is expected to grow with the highest CAGR during the forecast period due to their customization capabilities, high efficiency, consistency, and quality. Integrated machines are easy to operate as they come pre-programmed, requiring typically only one operator to set up the machine as per the box specifications, with no manual settings needed. Integrated machines combine several tasks including printing, slotting, feeding, pasting, fluting, sheeting, and cutting into a single system, resulting in increased productivity. Owing to all these advantages, the adoption of integrated machines is expected to increase rapidly during the forecast period. The segment is estimated to hold 65.18% of the market share in 2026.

The standalone machines are a viable option for smaller businesses with limited budgets as these machines are relatively inexpensive compared to integrated machines. This segment is anticipated to register a CAGR of 4.06% during the forecast period (2025-2032).

By End-user

Retail & E-commerce Sector to Depict Highest CAGR owing to Increased Demand for Sturdy and Secure Packaging

Based on end-user, the market is divided into packaging, food & beverages, retail & e-commerce, electrical & electronics, pharmaceuticals, and others.

The retail & e-commerce sector is predicted to grow with the highest CAGR during the forecast period. Corrugated packaging offers a more sustainable alternative to traditional packaging materials, making it an eco-friendly choice, aligning with the growing demand for green packaging. Automated corrugators produce boxes at lower costs compared to other methods, assisting retailers and e-commerce companies optimize their packaging expenses effectively.

The packaging segment is predicted to hold the highest market share during the forecast period. Corrugated box making machines are usually adopted by corrugated box making plants, which possess the expertise needed for high-quality packaging that can be challenging to replicate in-house. Hence, many businesses outsource boxes from these plants to solely focus on their core businesses. The segment held 52.24% of the market share in 2026.

CORRUGATED BOX MAKING MACHINE MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

ASIA PACIFIC

Asia Pacific Corrugated Box Making Machine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest market share valued at USD 0.42 billion in 2025 and USD 0.44 billion in 2026 and is expected to showcase the highest growth rate during the forecast period owing to the presence of major players, the rising e-commerce sector, expansion of the retail sector, and robust consumption of processed food and beverages in this region. Japan is estimated to be valued at USD 0.04 billion in 2026. Asia pacific is the largest market for e-commerce packaging. This dominance is majorly attributed to the presence of China, which represents the world’s largest market for e-commerce packaging. China is forecasted to reach USD 0.20 billion in 2026.

India to Showcase Highest Growth Rate Due to Robust Growth in Packaging Sector

India is expected to depict the highest growth rate in Asia Pacific on account of the favorable demographics, increasing disposable income, and growing consumer awareness. The packaging industry is the 5th largest sector in the Indian economy, driving technology and innovation growth in sectors, such as food & beverages and e-commerce. In the fiscal year 2021-22, India exported USD 3179.24 million worth of paperboard, newsprint, and paper, compared to USD 1940.94 million in the previous fiscal year. India is likely to hit USD 0.11 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is the second leading region estimated to be worth USD 0.24 billion in 2026, exhibiting a CAGR of 5.47% during the forecast period (2025-2032). The market in North America is driven by rapid technological advancements, modernization of the packaging sector, and increased demand for packaging solutions. According to “The Global Buying Green Report 2021” by Trivium Packaging, in the U.S., the willingness to pay more for sustainable packaging has increased significantly. Hence, the increasing focus on eco-friendly packaging and the growing importance of automation is driving the corrugator machine adoption in the region. The U.S. market is foreseen to grow with a value of USD 0.15 billion in 2026.

Europe

Europe is the third largest market set to be valued at USD 0.18 billion in 2026. The food and beverage industry, which is the largest manufacturing sector in Europe employs around 4.25 million people. It processes over 70% of the EU's agricultural produce and offers safe and quality food to consumers, while being the largest global exporter of food and drink products. The U.K. market continues to grow, projected to hold USD 0.01 billion in 2026. In Europe, the food & beverages sector growth and growing consumer awareness regarding sustainable packaging augments the demand for corrugated boxes. This, in turn, increases the investment in corrugated box making machinery. Germany is expected to reach USD 0.03 billion in 2026, while France is predicted to stand at USD 0.02 billion in 2025.

Middle East & Africa

In the Middle East & Africa, the growth of the e-commerce industry is a key factor driving the demand for corrugated box making machines. The region’s booming e-commerce industry is due to its prime location, business-friendly regulations, and top-notch facilities. In addition, with the proliferation of the internet and smartphones and an increasing demand for convenient shopping experiences, is skyrocketing, further boosting the demand for corrugated packaging and driving the corrugated box-making machines market. The GCC market is expected to gain USD 0.01 billion in 2025.

South America

South America is the fourth largest market anticipated to reach a market value of USD 0.07 billion in 2025. The South American market is primarily driven by strong corrugated box production in Brazil in recent years. Countries in this region are increasingly adopting mechanized manufacturing practices to improve efficiency and productivity.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Strengthening their Market Position by Offering Sustainable Solutions

The global market for corrugated box making machine is consolidated by leading players such as Shengli Carton Equipment Manufacturing Co.,Ltd, Foshan Fuli Packaging Machinery Co.,Ltd, QINGDAO AOPACK ON DEMAND PACKAGING Co., Ltd., BOBST, Mitsubishi Heavy Industries (MHI) Group, Natraj Corrugating Machinery.co, BHS Corrugated Maschinen- und Anlagenbau GmbH, Shanghai Printyoung International Industry Co., Ltd., Acme Machinery India Pvt. Ltd., and TCY Machinery Mfg. Co., Ltd, among others. These companies are expanding their operations by adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships. In an era of environmental awareness among consumers, there is a significant demand for sustainable alternatives other than non-biodegradable packaging solutions. To address this changing consumer behavior, key players are developing machines that can produce sustainable corrugated packaging boxes using recyclable materials. This not only addresses global environmental initiatives but also the preferences of eco-conscious consumers.

List of Key Corrugated Box Making Machine Companies:

- Shengli Carton Equipment Manufacturing Co.,Ltd. (China)

- Foshan Fuli Packaging Machinery Co.,Ltd. (China)

- QINGDAO AOPACK ON DEMAND PACKAGING Co., Ltd. (China)

- BOBST Group SA (Switzerland)

- Mitsubishi Heavy Industries (MHI) Group (Japan)

- Natraj Corrugating Machinery.co (India)

- BHS Corrugated Maschinen- und Anlagenbau GmbH (Germany)

- Shanghai Printyoung International Industry Co., Ltd. (China)

- Acme Machinery India Pvt. Ltd. (India)

- TCY Machinery Mfg. Co., Ltd. (Taiwan)

- Sai Engineering (India)

- Barry-Wehmiller Companies (U.S.)

- Senior Machines (India)

- Hebei Trugen Packaging Machinery Manufacturing Co., Ltd. (China)

- Champion Corrugated Co., LTD. (Taiwan)

- Fosber S.p.A. (Italy)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: BOBST announced the launch of the latest version of flatbed die-cutter, the MASTERCUT 165 PER. This machine is designed to handle corrugated boards and folding cartons.

- October 2024: BOBST announced the expansion in India to cater to the corrugated packaging industries by starting a new manufacturing plant. This expansion is the company’s part of the strategy to localize production and strengthen its presence in India.

- September 2023: International Paper, an American pulp and paper company announced the opening of a new corrugated packaging facility to expand their production capacity in the U.S. These new facilities produce corrugated packaging solutions for e-commerce, food & beverage, and shipping customers.

- October 2023: BHS Corrugated Maschinen- und Anlagenbau GmbH, a leader in solutions for the corrugated industry, partnered with Highcon Systems Ltd., a machine industry innovator, to drive the digital transformation of the corrugated packaging market. By integrating Highcon’s digital die-cutting equipment into BHS’ Box Plant 2025 strategy, the partnership aimed to enhance automation in the corrugation packaging industry.

- March 2023: BHS Corrugated Maschinen- und Anlagenbau GmbH announced the first manufacturing unit in India. This new site includes a corrugation rolls manufacturing unit and SF-I assembling unit.

REPORT COVERAGE

The report offers qualitative and quantitative insights into the market and a detailed analysis of the size & growth rate for all possible segments. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The report offers key insights, such as the implementation of automation in specific market segments, recent industry developments, such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro & micro economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 5.40% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion) |

|

|

Segmentation |

By Technology Type

By Machine Type

By End-user

By Region

|

|

|

Companies Profiled in the Report |

Shengli Carton Equipment Manufacturing Co.,Ltd. (China), Foshan Fuli Packaging Machinery Co.,Ltd. (China), QINGDAO AOPACK ON DEMAND PACKAGING Co., Ltd. (China), BOBST Group SA (Switzerland), Mitsubishi Heavy Industries (MHI) Group (Japan), Natraj Corrugating Machinery.co (India), BHS Corrugated Maschinen- und Anlagenbau GmbH (Germany), Shanghai Printyoung International Industry Co., Ltd. (China), Acme Machinery India Pvt. Ltd. (India), and TCY Machinery Mfg. Co., Ltd. (Taiwan). |

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 0.95 billion in 2025.

The market is expected to reach USD 1.51 billion by 2034.

The market is projected to grow at a CAGR of 5.40% during the forecast period (2026-2034).

The automatic segment is expected to lead the market during the forecast period.

Rapid technological advancements, rising e-commerce, and market expansion in emerging economies, are the key factors driving market growth.

Shengli Carton Equipment Manufacturing Co.,Ltd, Foshan Fuli Packaging Machinery Co.,Ltd, QINGDAO AOPACK ON DEMAND PACKAGING Co., Ltd., BOBST, Mitsubishi Heavy Industries (MHI) Group, and Natraj Corrugating Machinery.co are the leading companies in this market.

Asia Pacific led the market in 2024 by holding the largest share.

Integration of Artficial Intelliegence (AI) and Machine Learning are key trends in the market.

Based on end-user, the packaging segment is projected to lead the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us