Cyber Security Managed Services Market Size, Share & COVID-19 Impact Analysis, By Service (Managed Detection and Response (MDR), Incident Management, Managed Vulnerability, Identity and Access Solutions, and Others (End Point Management and Data Encryption)), By Enterprise Type (Small & Medium Size Enterprise and Large Enterprise), By Industry (BFSI, IT & Telecom, Retail, Healthcare, Government, Manufacturing, Travel & Transportation, Energy and Utilities, and Others), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

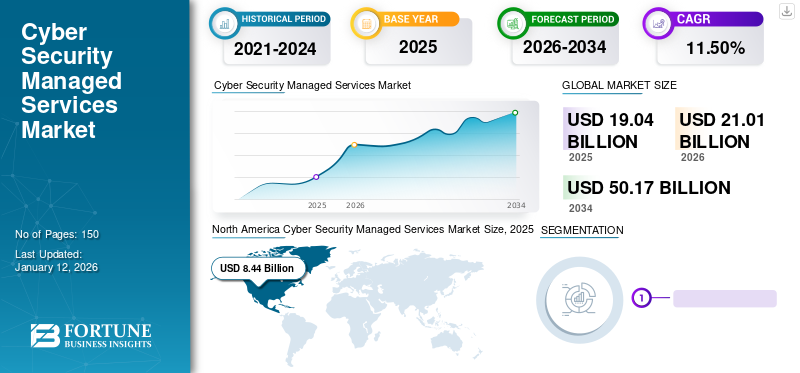

The global cyber security managed services market size was valued at USD 19.04 billion in 2025 and is projected to grow from USD 21.01 billion in 2026 to USD 50.17 billion by 2034, exhibiting a CAGR of 11.50% during the forecast period. North America dominated the global market with a share of 44.40% in 2025.

Cyber security managed services are a service model that cybersecurity service providers provide to monitor and manage security devices, systems, and Software-as-a-Service (SaaS) applications. It reviews structured and unstructured databases to predict and offer information based on hidden patterns, correlation, and fluctuating trends in the market.

It consists of services such as managed detection and response, incident management, managed vulnerability, identity, and access solutions or compliance knowledge without needing an expensive security operations center. It also helps to prevent breaches over automated incident response, decrease alert fatigue for in-house resources, remove complexity in security, and offer compliance governance.

Furthermore, with increasing cyberattacks, such as ransomware and data breaches, organizations are shifting toward security services to increase protection by deploying security gateways over the cloud or on-premise infrastructure. For instance,

- In May 2023, Keysight Technologies, Inc. launched a cybersecurity partnership platform for managed security service providers to improve the security posture of organizations. This program will help managed security service providers improve their security posture using Keysight Threat Simulator.

In our market study, we have studied cyber security managed services offered by market players such as Atos SE, IBM Corporation, TATA Consultancy Services Limited, Secureworks, Inc., Trustwave Holdings, Inc., Check Point Software Technologies Ltd., and others.

COVID-19 IMPACT

Growing Investment and Demand for Security Related Managed Services amid Pandemic Strengthened Market Growth

COVID-19 has shifted business operations to remote working, which caused a significant impact on both IT infrastructure requirements and the attack surface. This significantly stressed security teams to support general IT operations and technologies to adapt to changing risks. For instance,

- According to the Nuspire threat report, there were 26,156,165 exploitation events, 1,597,858 malware events, and 1,620,910 botnet events in 2020.

Hackmageddon stated that the total number of major global attacks reported in the news was higher almost every month of 2020.

Owing to this situation, companies considered choosing cyber security managed services, positively influencing the market growth. Additionally, rapidly growing technological advancements have attracted new variations of attacks. Traditional cyber security managed services are not able to distress these attacks. MSSPs enhanced their security services to minimize these attacks and improve the organization's resilience. For instance,

- In March 2020, K7 Computing, an India-based cyber security firm, provided its cyber security products free-of-cost in security protections for consumers and organizations. This product was availed on laptops, desktops, smartphones, and endpoint protection in organizations.

Furthermore, there has been a rise in investments in the managed security service offerings sector. This rise in investments was driven by the inclination of companies toward becoming cyber-resilient in the upcoming years. Implementing a zero-trust strategy among businesses has proven to propel the cyber security managed services market growth.

LATEST TRENDS

Download Free sample to learn more about this report.

Implementation of Zero Strategy Trend Prevailing in Global Market

There have been significant changes in cyber security practices due to pandemic disruptions. Zero Trust is accelerating as an effective cybersecurity strategy for businesses globally. This security model accepts breaches and validates the security status of the endpoint, network, identity, and other resources based on all data and signals. It depends on contextual real-time policy enforcement to attain the least privileged permission and reduce cyber threats. Developing technologies enable rapid prevention and detection of attacks using large datasets and behavior analytics.

Companies have been implementing the Zero Trust model as it helps them manage most attacks and changes to the environment, especially with respect to Internet of Things (IoT) security. The below statistics showcase the benefits of the Zero Trust strategy model.

Thus, continuous investments and implementing a Zero Trust strategy among providers are estimated to drive the global managed security services market in the coming years.

CYBER SECURITY MANAGED SERVICES MARKET GROWTH FACTORS

Increasing BYOD Method and Cyber Security Risks to Drive Market Growth

With the advent of digitalization and rapid technological changes, businesses around the world are implementing new trends, such as Bring Your Own Devices (BYOD) and Choose Your Own Device (CYOD), for their employees on laptops, tablets, smartphones, and more. These employees use smartphones, tablets, laptops, and other personal devices privately on networks to establish connections that can be easily compromised.

These personal devices are used for corporate information, increasing the potential for cyberattacks and threatening an organization's security posture.

These devices are often used for personal business purposes and can be exposed to external malware and other cyber security attacks. The increased malware risk of BYOD users is a huge concern for cyber security experts. There is an increasing need for qualified professionals to monitor these devices 24/7 to detect security breaches.

Organizations employ cyber security managed services to mitigate the threat landscape to protect an organization from potential harm. For instance,

- In April 2023, Lookout Inc. launched Lookout Mobile Endpoint Security, a mobile Endpoint Detection and Response (EDR) for Managed Security Service Providers (MSSPs). This solution will enable MSSPs to deliver a complete program for protecting data, identifying risks, and protecting their customers’ mobile devices. This solution can help organizations reduce the risk of a data breach through ransomware, mobile phishing, and device and app vulnerability exploitation.

Hence, adoption of BYOD and WFH by the organizations and consumers drives the market growth.

RESTRAINING FACTORS

Lower Budget and Expert Limitations for SMEs to Restrain Market Growth

The need for advanced services and online security threats are growing significantly. Traditional network security services cannot protect organizations from the cloud, extended network, and endpoint security threats. Cyber security threats have increased in the regions, and Small & Medium-Sized Businesses (SMBs) have become easy targets due to lack of awareness and resources. The absence of experts and specialists in further developing and advancing security services is a significant inhibitor. For instance,

- According to a study by Trellix, a cyber security firm, around 60% of SMBs are unaware of the risk cyberattacks pose, and nearly 40% do not consider strengthening cybersecurity significant. Moreover, SMBs in India faced an average of 37 cyber security occurrences per day, amounting to a loss of a little over 7% in revenue over the last 12 months.

Additionally, implementing internet security services & solutions and the high cost of updating hinder small & medium enterprises' adoption of managed security services.

SEGMENTATION

By Service Analysis

Surging Demand for Security Systems and Public Safety will Drive Market Growth

The Managed Vulnerability segment is projected to dominate the market with a share of 28.71% in 2026. The market is segmented by service into Managed Detection and Response (MDR), incident management, managed vulnerability, identity and access solution, and others (end point management, data encryption).

Managed Detection and Response (MDR) holds the highest CAGR during the forecast period. Cyberthreats have become complex and well-known for their stealth and ability to penetrate challenging defenses. Various threat actors use Artificial Intelligence (AI) tools to design engineering websites, such as phishing emails, thus making them even more dangerous. MDR is a cybersecurity service that completely improves the organization’s security by taking on advanced cyber threats and eliminating them. Various organizations collaborate with an MDR service provider to enhance organizational security and get a better ROI on their security investments. For instance,

- In March 2023, NTT launched its Managed Detection and Response (MDR) security service to help businesses achieve performance through advanced cyber resilience. This service is developed on Microsoft Sentinel, a next-gen Security Information and Event Management (SIEM) platform, which enables organizations to collect information across all users, apps, devices, and infrastructure, both on-premise and multi-cloud environments.

By Enterprise Type Analysis

Increasing Adoption of Managed Security Services by Large Enterprises to Lead the Market Growth

Enterprises are rapidly changing, requiring cyber resilience in their digital journeys to protect their businesses. Based on enterprise type, the market is segmented into Small & Medium Enterprise (SME) and large enterprise.

The Large Enterprises segment is expected to lead the market, contributing 60.90% globally in 2026. The large enterprise segment captures a large market share, as they are the early adopters of managed security services due to their distributed and complex IT infrastructure. It provides a secure and builds resilient security programs and maintains confidence in their readiness.

The adoption of managed security services by SMEs is gradually increasing, as they are often targeted due to ransomware, phishing, Denial-of-Service, and other threats as their security setups are simple and easy to breach. Large companies invest and launch managed security services in various regions, propelling large enterprises' growth. For instance,

- In January 2023, Hughes Network Systems, LLC, an EchoStar company, announced the expansion of its managed cybersecurity services suite by introducing Managed Detection and Response (MDR). The new services will bring network security expertise from Hughes and enterprise-grade protections for small & medium enterprises

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Surging Demand for Digital Privacy Systems and Robust Security across IT & Telecom to Drive the Market Forward

Based on industry, the market is segmented into BFSI, IT & telecom, retail, healthcare, government, manufacturing, travel & transportation, energy and utilities, and others.

The IT & Telecom segment will account for 21.55% market share in 2026. The IT & telecom segment is expected to grow at the highest CAGR during the forecast period. This growth stems from the rising demand for digital privacy systems and strong security across the IT & telecom industry. Telecommunication enterprises are mainly prone to security breaches. They face extended attacks, in some cases, from external governments. Thus, the need for cyber security managed services is growing, which is considered for the IT & telecom industry. For instance,

- In February 2023, Mobily, a Saudi Arabian telecommunications services company, collaborated with Cisco Systems to leverage the managed Security Services to the company's infrastructure and offering. The collaboration will maximize Mobily's cybersecurity capabilities through enhanced monitoring, incident response, and identity and access management to accelerate the company's operation quality.

The healthcare segment held the major market share in 2024 due to increasing adoption of security services to lessen the evolving cyber threats and protect patient data. The healthcare segment is collaborating with various key players by integrating the services to help strengthen overall network security and protect electronic health records in various ways. For instance,

- In June 2023, Claroty, a physical and cyber systems protector, announced a partnership with Siemens Healthineers, a medical technology managed security services provider, by integrating Siemens ActSafe Cybersecurity Solution with Claroty’s Medigate software platform.

REGIONAL INSIGHTS

North America Cyber Security Managed Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Geographically, the market is categorized into five key regions, North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America dominated the market with a valuation of USD 8.44 billion in 2025 and USD 9.37 billion in 2026. North America dominated the global cyber security managed services market share in 2024. The rapid development of managed security services with the adoption of machine learning and artificial intelligence capabilities is expected to drive the market in the region. AI helps in delivering the additional insights and enhance the services. The U.S. market is projected to reach USD 6.08 billion by 2026. For instance,

- In April 2023, BlackBerry Limited announced a partnership with Solutions Granted, a solution-based IT by integrating BlackBerry’s Cylance AI-powered portfolio with Solutions Granted solutions by enabling secure environments and meeting the growing demand for cybersecurity services among Small & Medium-sized Businesses (SMBs).

Asia Pacific

Asia Pacific is expected to grow with a remarkable CAGR during the forecast period, owing to increasing investments by the government, key players, and foreign investments in various blockchain projects and others. MSS and shared services are adopted across verticals and industries for partial or complete workloads. The offerings by the market players help in creating attractive benefits and flexibility, thereby experiencing significant surge in demand for these services. The U.K. market is projected to reach USD 1.15 billion by 2026, while the Germany market is projected to reach USD 1.13 billion by 2026. The Japan market is projected to reach USD 0.87 billion by 2026, the China market is projected to reach USD 0.99 billion by 2026, and the India market is projected to reach USD 0.52 billion by 2026.

Additionally, increasing adoption of software-defined IT infrastructure and collaboration, partnership, and service upgrades is pushing the market growth in Europe. For instance,

- In April 2023, Viatel Technology Group announced a partnership with ArmorPoint, LLC, a global Managed Security Service Provider (MSSP), to integrate Viatel’s security, cloud, networking solutions, and services with ArmorPoint’s managed cybersecurity solutions into the Europe market.

The market growth of cyber security managed services in the Middle East and South America is mainly driven due to increasing economic importance of security, which strengthened the national cyber security investment of the countries in the region. Oman, Qatar, the UAE, Bahrain, and others are moving toward digitization in the security and observation area, which is projected to grow the market.

KEY INDUSTRY PLAYERS

Strategic Acquisition by the Key Players to Boost Market Expansion

Key players of cyber security managed services, such as BDO Global, Atos SE, Wipro, Secureworks, Inc., IBM Corporation, Tata Consultancy Services Limited, Trustwave Holdings, Inc., and others, are focused on expanding their presence by launching specific solutions and services to attract a large customer base, thereby increasing sales. Moreover, key players are focused on increasing market share and reach customers through strategic acquisitions.

List of Key Companies in Cyber Security Managed Services Market:

- BDO Global (Belgium)

- Secureworks, Inc. (U.S.)

- Atos SE (France)

- Wipro (India)

- IBM Corporation (U.S.)

- Tata Consultancy Services Limited (India)

- Trustwave Holdings, Inc. (U.S.)

- Thrive (U.S.)

- SecurityHQ (U.K.)

- ECI (U.S.)

- Check Point Software Technologies Ltd. (Israel)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: Check Point Software Technologies announced a partnership with Ivanti, an IT security software company, to integrate Ivanti’s patch management solution into Check Point’s Harmony Endpoint protection solution. Integrating the solutions will provide vulnerability and patch management capabilities to address cyberattacks that exploit system vulnerabilities.

- May 2023: Claroty Ltd., an industrial cybersecurity startup, announced the expansion of its FOCUS Partner Program by collaborating with IBM Corp., eSentire Inc, and NTT Data Corp. This program is designed to provide partners with tools, skills, and processes to operate across the enterprise security services lifecycle.

- April 2023: Tata Consultancy Services (TCS) collaborated with Bane NOR, a Norwegian government agency for developing and operating the Norwegian railway network, to allow secure access to digital systems. In Norway and across Europe, TCS teams will deliver access management, Identity Governance, and Administration (IGA), identity lifecycle management, and application management operations in a managed services model for better user experience and enable risk and compliance-driven access controls across its infrastructure.

- April 2023: Thrive acquired Storagepipe, a managed service, data protection, and cybersecurity provider in Canada. With the acquisition, Thrive will expand its global presence and allow Storagepipe customers to leverage Thrive’s managed cloud and cybersecurity services.

- March 2023: Trustwave Government Solutions (TGS), a subsidiary of Trustwave Holdings, Inc. and a Managed Detection and Response (MDR) provider, announced a partnership with Palo AltoNetworks. The partnership will enable TGS to combine the Palo Alto Networks Cortex XMDR with their managed services offerings to streamline Security Operations Center (SOC) operations and mitigate cyber threats.

REPORT COVERAGE

An Infographic Representation of Cyber Security Managed Services Market

To get information on various segments, share your queries with us

The research report includes prominent regions across the globe to get a better knowledge of the cyber security managed services industry. Furthermore, it provides insights into the most recent industry and market trends and an analysis of technologies adopted quickly on a global scale. It also emphasizes some of the growth-stimulating restrictions and elements, allowing the reader to obtain a thorough understanding of the industry.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.50% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Service, Enterprise Type, Industry, and Region |

|

By Service |

|

|

By Enterprise Type |

|

|

By Industry |

|

|

By Region |

|

Frequently Asked Questions

The market is projected to reach USD 50.17 billion by 2034.

In 2025, the market was valued at USD 19.04 billion.

The market is projected to grow at a CAGR of 11.50% during the forecast period.

The Managed Detection and Response (MDR) segment will lead the market.

Increasing BYOD method and cyber security risks are the key factors driving the market growth.

BDO Global, Secureworks, Inc., Atos SE, Wipro, IBM Corporation, Tata Consultancy Services Limited, Trustwave Holdings, Inc., Thrive, SecurityHQ, ECI, and Check Point Software Technologies Ltd. are the top players in the market.

North America is expected to hold the highest market share.

By industry, healthcare is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic