Diethylene Glycol Market Size, Share & Industry Analysis, By End-use (Polyurethane Synthesis, Polyester Resin Synthesis, Solvent, Antifreeze Blending, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

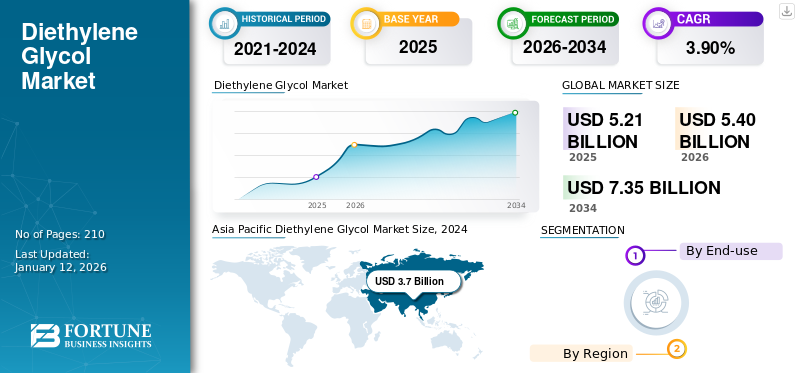

The global diethylene glycol market size was valued at USD 5.21 billion in 2025. The market is projected to grow from USD 5.40 billion in 2026 to USD 7.35 billion by 2034, exhibiting a CAGR of 3.90% during the forecast period. Asia Pacific dominated the diethylene glycol market with a market share of 74% in 2025.

Diethylene Glycol (DEG) is a colorless, odorless, and water-soluble organic compound that is widely used as a solvent, plasticizer, and chemical intermediate. A key factor driving its demand is the rapid expansion of the global polyester industry, where DEG is used to produce unsaturated polyester resins found in coatings, adhesives, and composite materials. As sectors such as packaging, construction, and automotive increasingly rely on polyester-based products, the need for DEG continues to grow. In addition to this, the product's applications in brake fluids, hydraulic systems, and cosmetics contribute to its rising demand, particularly in developing regions undergoing industrialization and urban growth. These diverse applications ensure sustained demand across multiple industries. The major companies operating in the market include Mitsubishi Chemical Group Corporation, SABIC, BASF, Sinopec, Reliance, and Shell, among others.

Diethylene Glycol Market Trends

Rising Adoption of Sustainable Bio-based Raw Materials to Create New Market Trends

Bio-based diethylene glycol is produced using renewable raw materials such as sugarcane, corn, and byproducts from biodiesel production, such as glycerol. In Brazil and India, where sugarcane is abundant, the cost of producing bio-based DEG is becoming competitive with petroleum-based alternatives. New technologies have improved the efficiency of converting bio-ethanol into DEG, making the process more viable at scale. Companies such as Braskem and Sojitz are already investing in commercial plants to expand production of renewable ethylene glycol, including diethylene glycol. Supported by environmental regulations, green certifications, and growing demand for eco-friendly products, bio-based DEG has strong market potential. Thus, it could play a major role in replacing traditional DEG, particularly as industries seek more sustainable chemical solutions. Although some advanced methods using agricultural waste are still costly, they offer better sustainability by reducing land use and emissions.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Critical Role of Unsaturated Polyester Resins in FRP Production to Drive Market Growth

The polyester resin is a key driver of the diethylene glycol market growth, as it is essential in producing unsaturated polyester resins. These materials are widely used in construction, automotive, and maritime industries due to their strength, flexibility, and cost-efficiency. The rapid growth of polyester production, especially in developing regions such as China and India, is fueled by rising demand for lightweight and recyclable materials. Infrastructure development and increased use of thermosetting resin, particularly DEG, in the automotive industry further support this trend. As polyester applications expand across industries, DEG remains a critical raw material, reinforcing its growing importance in the global chemical supply chain.

Market Restraints

Highly Toxic Nature of Product to Restrict Market Growth

Diethylene glycol is highly toxic to humans, mainly because the body breaks it down into harmful substances that severely damage the kidneys and nervous system. Even small amounts can cause serious health issues, including kidney failure, brain swelling, and nerve damage. Symptoms such as vomiting, stomach pain, and confusion may appear soon after exposure but can be followed by more severe effects days later. There is no specific antidote for DEG poisoning, and detecting it early is difficult due to the lack of quick, reliable tests. In addition to this, deadly pharmaceutical contamination highlights the danger of DEG in consumer products. These serious health risks and the challenges in treating exposure have led to stricter regulations and are major reasons that are likely to limit product demand, restricting market growth.

Market Opportunities

Rapid Industrialization in Emerging Economies to Create New Market Growth Opportunities

Rapid industrialization, particularly in emerging economies such as China, India, and Southeast Asia, is a critical driver of diethylene glycol demand. As these regions undergo significant infrastructure expansion, urban development, and manufacturing growth, the need for DEG-based products such as unsaturated polyester resins, plasticizers, and solvents is anticipated to increase. DEG is essential in producing resins used for construction materials, paints, adhesives, and automotive components, sectors that thrive during the industrial boom. In addition to this, industrialization boosts local consumption of cooling systems, lubricants, and brake fluids, where DEG serves as a key formulation agent. With governments in these economies investing heavily in transport, energy, and housing projects, there is an increase in demand for cost-effective, high-performance chemicals. Thus, industrial growth in developing countries will not only increase product consumption in the short term but also encourage local production, supporting long-term development and creating new market growth opportunities in tandem.

Market Challenges

Raw Material Price Volatility Due to Its Strong Correlation with Crude Oil Poses Challenges

Fluctuating prices of ethylene oxide, the main raw material used in producing diethylene glycol, is likely to present a major challenge for manufacturers. Since ethylene oxide prices are closely tied to global oil and energy markets, sudden cost increases can significantly raise production expenses. For instance, when crude oil prices across the globe rise, they put additional pressure on manufacturers’ profit margins. These unpredictable changes make it difficult to plan production and pricing strategies and may lead to a reduced output during high-cost periods. To manage this risk, some companies are investing in developing more resilient operations or seeking alternative suppliers. However, price instability remains a serious challenge for long-term market growth and stability.

Segmentation Analysis

By End-use

Polyester Resin Synthesis Segment Held Dominant Share Due to Its Use in Fiber Composites

On the basis of end-use, the market is segmented into polyurethane synthesis, polyester resin synthesis, solvent, antifreeze blending, and others.

The polyester resin synthesis segment accounted for the largest diethylene glycol market share in 2024. It is driven by strong demand in the construction, marine, and automotive sectors, where these resins are used to make lightweight, durable composites. Rapid infrastructure growth in emerging markets, especially across Asia-Pacific, has significantly increased the need for these materials. As a result, chemical companies are expanding resin production and developing new formulations. This segment’s broad industrial use and ties to global development projects make it a significant growth driver for product consumption worldwide.

Diethylene glycol is valued for its ability to lower freezing points and improve heat transfer, making it ideal for use in engine coolants. Demand is rising due to the global expansion of the vehicle fleet, especially in regions with extreme weather. Stricter automotive safety and performance standards are also increasing the need for advanced coolant solutions. As a result, DEG remains a key component in modern antifreeze blending.

Diethylene Glycol Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Diethylene Glycol Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 3.87 billion in 2025 and USD 4.02 billion in 2026. In Asia Pacific, demand for diethylene glycol is mainly driven by strong growth in the infrastructure and automotive industries. China and India use DEG to help make polyester resin, which is found in automotive components, coatings, and building materials. As more people move to cities and spend on these goods, the need for these products increases. Infrastructure projects also create demand for paints, glues, and coatings that rely on DEG. The region’s low production costs and large population make it the largest market for DEG, with manufacturing and export opportunities continuing to expand.

North America

In North America, DEG is widely used in the construction and automotive industries. U.S. being one of the largest producer of automobile utilizes DEG in brake fluids, coolants, and adhesives that are essential for vehicle performance and maintenance. Rising interest in electric vehicles resulting into high demand for efficient cooling systems is expected to drive product demand. Moreover, growing demand of DEG as plasticizer & solvent from synthetic fiber’s manufacturers to produce high-performance textiles is further expected to influence US market size.

The region also invests heavily in research and innovation in various sectors leading to several new consumptions for diethylene glycol in industrial applications. North America’s focus on quality, safety, and technology makes it a steady and valuable market for DEG-related products, driving market growth in tandem.

Europe

In Europe, environmental goals and sustainability rules are shaping demand for the product. The chemical is used in materials that meet strict building and packaging standards, such as energy-saving panels and lightweight plastic bottles. While diethylene glycol has limited use in personal care items due to safety concerns, it is still important in construction, automotive, and industrial products. The push for green technologies has led to steady use of DEG in safe, regulated applications. European manufacturers also focus on recyclable and low-emission materials, keeping DEG relevant in sectors including construction and packaging, where such standards are critical.

Latin America

Latin America’s demand for diethylene glycol is mainly tied to construction and infrastructure development, especially in fast-growing countries such Brazil and Mexico. DEG is used to produce glues, paints, and coatings that support housing and commercial buildings. The region is likely to witness steady growth as economies modernize. Investments in industry and infrastructure are expected to create more opportunities for market growth during the forecast period.

Middle East & Africa

In the Middle East & Africa, product demand is increasing due to industrial growth and government efforts to diversify economies beyond oil. Saudi Arabia is investing in chemical manufacturing, where DEG plays a key role in making paints and coatings. In Africa, rising urban development is driving the need for affordable building materials that contain DEG. While the market here is still developing, the region’s access to raw materials and expanding infrastructure make it a promising area for future growth, especially as more countries build up their manufacturing capabilities.

Trade Protectionism & Regulatory Challenges

Ongoing Tariff War to Complicate Supply Chains and Disrupt Trade Practices

Ongoing tariff war is anticipated to disrupt the global market by increasing costs and complicating supply chains. Tariffs on raw materials and finished products will raise production expenses and create pricing instability, especially for manufacturers dependent on international trade. Exporters in the Asia Pacific region may face reduced access to key markets, while local producers in protected regions gain short-term advantages. However, retaliation and shifting trade policies are likely to limit long-term growth and create uncertainty. These challenges may also push companies to localize supply chains, adapt sourcing strategies, and explore regional production, potentially leading to lasting changes in how DEG is produced and traded globally.

Competitive Landscape

Key Industry Players

Key Players Compete Over Pricing and Product Grade to Gain Higher Market Share

The global diethylene glycol market faces moderate to high competitive rivalry, dominated by major players such as Mitsubishi Chemical Group Corporation, SABIC, BASF, Sinopec, Reliance, and Shell that control the majority of global production. These companies benefit from integrated operations, allowing cost efficiency and protection from raw material price swings. Competition is especially strong in Asia Pacific due to high demand and expanding capacities. In order to stay competitive, firms focus on product innovation, high-purity DEG grades, and long-term contracts. Regulatory pressures and environmental concerns are pushing companies toward low-VOC and bio-based alternatives.

List of Key Diethylene Glycol Players Profiled

- Mitsubishi Chemical Group Corporation (Japan)

- Reliance Industries Limited (India)

- Shell (U.K.)

- SABIC (Saudi Arabia)

- NIPPON SHOKUBAI CO., LTD. (Japan)

- BASF (Germany)

- China Petrochemical Corporation (Sinopec) (China)

- PETRONAS (Malaysia)

- MEGlobal (Kuwait)

- Junsei Chemical Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- January 2024 – SABIC announced its decision to invest USD 6.5 billion to establish a petrochemical complex in China's Fujian province. This petrochemical complex will have the capability of producing ethylene glycol along with polyethylene, polypropylene and polycarbonate, among others.

- December 2023 – SABIC announced that they have signed a MoU with Scientific Design (SD) and Linde Engineering. As part of this collaboration, these companies will explore the opportunities to decarbonize ethylene oxide and ethylene glycol production.

REPORT COVERAGE

The market research report provides a detailed analysis and focuses on crucial aspects such as leading companies, applications, and products. The report also offers market insights into key trends and highlights vital industry developments. In addition, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

CAGR |

CAGR of 3.90% during 2026-2034 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By End-use

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 5.40 billion in 2026 and is projected to reach USD 7.35 billion by 2034.

In Asia Pacific, the market value stood at USD 3.87 billion in 2025.

Registering a significant CAGR of 3.90%, the market will exhibit considerable growth in the forecast period (2026-2034).

By end-use, the polyester resins synthesis segment led the market in 2025.

Critical role of unsaturated polyester resins in FRP production to drive market growth.

Asia Pacific held the dominant share of the market in 2025.

Mitsubishi Chemical Group Corporation, SABIC, BASF, Sinopec, Reliance, and Shell are the leading players in the market.

Rising adoption of sustainable bio-based raw materials is expected to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us