Digital Thread Market Size, Share & Industry Analysis, By Technology (Product Lifecycle Management (PLM), Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), Application Lifecycle Management (ALM), Material Requirements Planning (MRP), Enterprise Resource Planning (ERP), and Others), By Module (Data Management & Integration, Connectivity and Interoperability, and Others), By Deployment (On-Premises and Cloud-Based), By End-User (Automotive, Energy and Utilities, Consumer Electronics, Industrial, Medical Devices and Pharmaceuticals, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

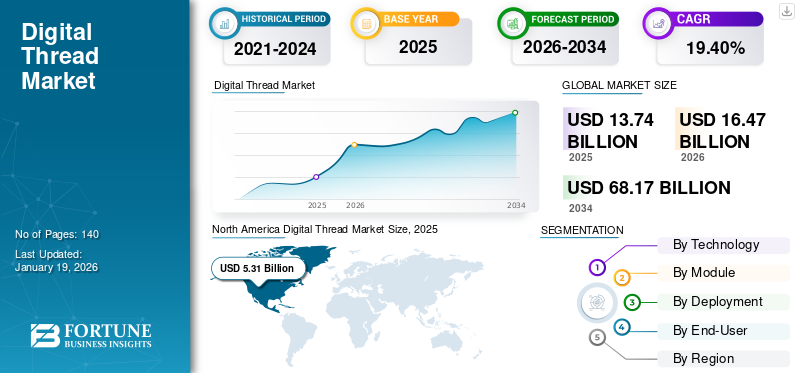

The global digital thread market size was valued at USD 13.74 billion in 2025 and is projected to grow from USD 16.47 billion in 2026 to USD 68.17 billion by 2034, exhibiting a CAGR of 19.40% during the forecast period. North America dominated the market with a share of 38.60% in 2025.

A digital thread represents data flow concerning a product's performance and application from the design stages to manufacturing, sales, usage, and eventual disposal or recycling. Thus, the demand for improved product traceability and enhanced operational efficiency drives manufacturers to adopt digital thread solutions. The rising focus on predictive maintenance and digital twins further increases the deployment of digital thread technologies in various growing sectors, increasing the market share. Simultaneously, the World Economic Forum estimates that smart manufacturing technologies, digital twins, and threads will contribute USD 3.7 trillion to the global economy by 2025.

As firms take on higher and innovative projects, the digital thread becomes a key enabler for data-driven decisions, greatly boosting market growth. The growing implementation of Industry 4.0 technologies is substantially impacting market growth. These elements are helping expand the market share. The major players in this market are Siemens AG, PTC, Inc., Dassault Systèmes, IBM Corporation, SAP SE, Rockwell Automation, Inc., Autodesk Inc., Oracle Corporation, Aveva Group Limited, and Accenture.

COVID-19 pandemic initially slowed the growth of the market, as global economic contraction in 2020 limited corporate budgets and delayed digital transformation investments. However, there was a notable shift toward accelerated digital adoption, which overall boosted the medium to long-term outlook.

IMPACT OF GENERATIVE AI

Integration of Generative AI with Digital Thread by Enhancing Capabilities to Fuel Market Growth

Generative AI improves the capabilities of the digital thread by facilitating refined data analysis, automation, and decision-making throughout the complete product life cycle. These thread links different phases of a product's journey, from design and production to operation and maintenance, by unifying data, processes, and systems. Generative AI boosts these threads by allowing real time data collection and tracking, optimizing performance, and forecasting potential failures.

IMPACT OF RECIPROCAL TARIFFS

Tariff Hikes Leads to Increase in Costs and IT Delays

These tariffs directly raise prices for imported hardware, inflating production costs across digital infrastructure. Unpredictable tariff policies cause rapid sourcing shifts, challenging real-time supply chain visibility. Companies that do not have digital thread integration are struggling to track cost bills for materials changes and hence are facing margin erosion. The rising costs and economic uncertainty due to these tariffs also diminish global IT budgets, resulting in delays in digital initiatives. International Data Corporation (IDC) states that tariffs could cut 2025 IT spending growth by 1.5-2%.

Digital Thread Market Trends

Rising Need of Automation in Manufacturing to Emerge as a Key Market Trend

The current shift towards automation in manufacturing presents significant insights for the digital thread market. As manufacturers continue to embrace automation, the need for integrated systems that can provide real-time visibility into data becomes vital. Digital thread solutions can improve the communication between automated systems, ensuring information flows smoothly along the production line. Businesses that create these technologies specifically designed for automated manufacturing settings can take advantage of this rising demand, hence driving the digital thread market share.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Increasing Demand for Integrated Lifecycle Management to Aid Market Growth

The growing demand for comprehensive lifecycle management in different sectors is a significant factor propelling the digital thread market. Companies seek efficient processes to enables real time data exchange and teamwork across the entire product lifecycle, from design and production to maintenance and removal. This need for unified management solutions promotes the uptake of these thread technologies, enabling organizations to boost operational efficiency and enhance decision-making. Thus, driving the digital thread market growth.

Market Restraints

Data Security and Privacy Concerns to Hinder Market Expansions

The widespread implementation of digital thread systems could heighten the likelihood of cyberattacks, especially as an increasing amount of sensitive information is exchanged through digital channels. The National Institute of Standards and Technology (NIST) reports that around 50% companies worldwide experience data breaches, prompting concerns about the security of thread systems in essential sectors.

Market Opportunities

Building Digital Threads with Enterprise iPaaS to Create Lucrative Market Opportunities

Digital threads within an Integration Platform as a Service (iPaaS) allow companies to connect data and processes throughout the product lifecycle, including design, manufacturing, deployment, and customer support. Through the implementation of iPaaS, firms can view their operations in a holistic and linked mode, making better decisions, improving the quality of products, and reducing operational activities timeline. Such an opportunity by companies enables them to streamline their operations, reduce costs, and improve customer experiences, thus setting them apart as leaders in the industry.

SEGMENTATION ANALYSIS

By Technology

Rising Need to Effectively Integrate the Entire Product Development Process by PLM Technology Boosted Market Demand

Based on technology, the market is segmented into Product Lifecycle Management (PLM), Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), Application Lifecycle Management (ALM), Material Requirements Planning (MRP), Enterprise Resource Planning (ERP), Manufacturing Execution System (MES), and others.

The Product Lifecycle Management (PLM) segment dominated the market with a share of 20.18% in 2026. The growth of this segment is due to the rising demand for comprehensive traceability, visibility, and integration throughout the entire product development process. Firms are looking to enhance product performance and reduce lifecycle expenses; they are utilizing PLM systems for simulation, digital twin modeling, and collaboration among teams globally.

The Computer-Aided Manufacturing (CAM) segment will see the highest CAGR throughout the forecast period. The significant growth is primarily fueled by the growing incorporation of CAM technologies into the digital thread frameworks. The escalating implementation of smart factories and Industry 4.0 methodologies boosts the demand for digitally connected CAM systems.

By Module

Increasing Usage of Data Collection for Enhanced Performance and Product Capability Aided Segment Growth

Based on module, the market is segmented into data management & integration, connectivity and interoperability, data collection, and analytics and visualization.

The category of data collection produced the highest revenue, leading to its highest share of 34.90% in 2026. This dominance is due to its initiatives in digital transformation, which gather precise and frequent data from all data collection processes. Many end-users typically collect connected assets' operational and performance data using embedded systems, IoT sensors, and edge devices, focusing on compliance monitoring, predictive maintenance, and improved product quality, which results in extensive data requirements.

The analytics and visualization segment is anticipated to register the highest CAGR during the forecast period. Companies leverage analytics to make fast, informed decisions based on connected manufacturing data. Also, the rise in self-service BI tools and user-friendly dashboards is increasing the demand in the market.

By Deployment

Cloud-Based Deployment Dominated Market with its Cost-Effective Capabilities

Based on deployment, the market is categorized into on-premises and cloud-based.

The cloud-based segment lead the market with a share of 64.44% in 2026 and is further expected to grow at the highest CAGR during the forecast period. Businesses in diverse sectors progressively embrace cloud platforms to facilitate smooth data integration, scalability, and real-time collaboration throughout product lifecycles. Cloud-based digital thread solutions remove the need for important initial infrastructure expenses while providing convenience and centralized data management. The increasing need for remote operations, activated by global supply chain challenges and hybrid work settings, is pushing companies to adopt cloud-based tools.

On-premises installations provide enhanced customization and performance tuning, allowing organizations to adapt digital thread functionalities to their unique engineering and production settings.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Segment Dominated the Market with Rising Demand for Cost and Time-Efficient Approach

Based on the end-user, the market is categorized into automotive, energy and utilities, consumer electronics, industrial, medical devices and pharmaceuticals, aerospace and defence, and others.

In terms of share, the consumer electronics segment was the largest in the market in 2024. The consumer electronics sector is extremely competitive and demands its swift market entry. By adopting a digital thread, consumer electronics brands and manufacturers can enhance their speed to market, lower expenses, and foster better collaboration among teams. According to research from Deloitte, businesses that have embraced a digital thread approach have experienced a reduction in development time of as much as 50% and an increase in overall efficiency by 30%.

The medical devices and pharmaceuticals segment is expected to witness the highest CAGR during the forecast period. As medical and pharmaceutical companies operate within a severe composite regulatory environment, digital threads protect traceability, safeguard adherence to regulations, and improve operational efficiency. By linking data throughout the entire product lifecycle from drug discovery to manufacturing and distribution, these threads improve quality management and decrease mistakes in research and development.

DIGITAL THREAD MARKET REGIONAL OUTLOOK

Based on region, the market is divided into North America, South America, Asia Pacific, Europe, and Middle East & Africa.

North America

North America Digital Thread Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America dominated the market with a valuation of USD 5.31 billion in 2025 and USD 6.32 billion in 2026. This is due to the region’s proactive adoption of advanced manufacturing technologies and a strong focus on digital transformation throughout various industries. The increasing emphasis on smart factories and supportive government measures such as the Science Act encourage innovation in digital engineering and real-time data integration. The presence of major technology providers and a strong R&D architecture further promotes the implementation of digital threads frameworks in the region.

In the U.S., the market is driven by the rising integration of smart manufacturing systems and the escalating demand for real time data synchronization in intricate supply chains. The U.S. market is projected to reach USD 4.51 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Asia Pacific digital thread market is expected to witness the highest growth rate, propelled by swift industrialization, increasing investments in digital transformation, and supportive government measures promoting smart manufacturing and Industry 4.0. Nations including China, Japan, and India are at the forefront of embracing digital thread technologies in this region. Moreover, cheap labor and a wide network also accelerate the growth in this region. The Japan market is projected to reach USD 1.16 billion by 2026, the China market is projected to reach USD 1.73 billion by 2026, and the India market is projected to reach USD 0.74 billion by 2026.

South America

The market in South America is undergoing stable growth due to recent technological shifts in the resource extraction and energy transition, as well as the initial demand to manage complex supply chains and workforce needs.

Europe

The region has a solid industrial base, especially in the aerospace, automotive, and precision engineering sectors, contributing significantly to the market's growth. “Horizon Europe” is a government program which will drive the adoption of digital thread technologies to increase productivity and innovation. The increasing need for real-time data synchronization and lifecycle traceability in regulated sectors drives faster regional adoption. The UK market is projected to reach USD 0.66 billion by 2026, while the Germany market is projected to reach USD 0.61 billion by 2026.

Middle East & Africa

The Middle East & Africa region has a smaller market presence. Expanding cross-border data flows and government initiatives have created a positive impact in the market, while economic variation could be challenging.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players to Use Merger & Acquisition, Partnership, and Product Development Strategies to Expand Business Reach

Key players operating in this market are providing a digital thread to enable users to improve product quality, faster time-to-market, and enhanced customer experiences. They are focusing on signing acquisition agreements with small and local firms to increase their business operations. Moreover, partnerships and key investments will boost the demand for this technology.

List of Digital Thread Companies Profiled

- Siemens AG (Germany)

- PTC, Inc. (U.S.)

- Dassault Systèmes (France)

- IBM Corporation (U.S.)

- SAP SE (Germany)

- Rockwell Automation, Inc. (U.S.)

- Autodesk Inc. (U.S.)

- Oracle Corporation (U.S.)

- Aveva Group Limited (U.K.)

- Accenture (Ireland)

- General Electric Company (U.S.)

- Ansys, Inc. (U.S.)

- Tata Consultancy Services Limited (India)

- Hexagon AB (Sweden)

- Cognizant Deployment Solutions Corporation (U.S.)

- DXC Deployment Company (U.S.)

- Bosch Global Software Technologies Private Limited (India)

- Bentley Systemes, Incorporated (U.S.)

- Matterport Inc. (U.S.)

- Prostep Inc (U.S.)

- Altair Engineering Inc. (U.S.)

- Capgemini SE (France)

…and more.

KEY INDUSTRY DEVELOPMENTS

- May 2025: IBM upgraded its enterprise AI capabilities by introducing new hybrid technologies to upgrade integration and scalability through various environments. The innovations feature AI agents that can be created in less time, utilizing enterprise data. These advancements aim to back the market by aiding data orchestration and AI-powered automation throughout the product lifecycle.

- March 2025: SAP SE announced its strategic intention to redesign the manufacturing sector using flexible, AI-powered technologies. This underlines SAP’s commitment to transforming the digital thread environment by combining vital data across several functions and incorporating generative and agentic AI.

- March 2025: Aras, a player in product lifecycle management (PLM) and digital thread solutions, introduced Aras InnovatorEdge, a low-code API management framework integrated into its primary Aras Innovator platform. This latest solution streamlines the process of creating and integrating APIs, minimizing the requirement for coding and development skills.

- August 2024: SAP SE introduced new cloud functionalities for its SAP Product Lifecycle Management (SAP PLM) solutions through a collaborative innovation effort with Hilti AG, a global supplier of products and services within the construction sector.

- February 2024: Autodesk, Inc. announced Autodesk Informed Design, a cloud-based system that integrates manufacturing and design workflows to accelerate the construction process and building design.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market offers substantial ROI potential, particularly in companies enabling AI-driven predictive analytics, cloud-based PLM, and cross-industry interoperability. According to an industry analyst, by 2028, 80% of digital threads will originate from PLM, with greater investments being made to position PLM as the foundational platform for these threads, a rise from the current 45%. Users should target companies offering modular and scalable solutions and opportunities to invest in firms specializing in digital transformation.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/types, and leading product applications. Besides, it offers insights into the digital thread industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

By Module

By Deployment

By End-User

By Region

|

|

Companies Profiled in the Report |

Siemens AG (Germany) PTC, Inc. (U.S.) Dassault Systèmes (France) IBM Corporation (U.S.) SAP SE (Germany) Rockwell Automation, Inc. (U.S.) Autodesk Inc. (U.S.) Oracle Corporation (U.S.) Aveva Group Limited (U.K.) Accenture (Ireland) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 68.17 billion by 2034.

In 2026, the market was valued at USD 16.47 billion.

The market is projected to record a CAGR of 19.40% during the forecast period.

By technology, the product lifecycle management (PLM) segment led the market in 2024.

Increasing demand for integrated lifecycle management to aid market growth.

Siemens AG, PTC, Inc., Dassault Systèmes, IBM Corporation, SAP SE, Rockwell Automation, Inc., Autodesk Inc., Oracle Corporation, Aveva Group Limited, and Accenture are the top players in the market.

North America dominated the market with a share of 38.60% in 2025.

By end-user, the medical devices and pharmaceuticals segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us