Dosing Pump Market Size, Share & Industry Analysis, By Type (Diaphragm Pump, Peristaltic Pump, Solenoid Pump, Plunger Pump, Hydraulic Pump, and Others), By Flow Rate (Upto 50 (L/min), 51 to 100 (L/min), and More than 100 (L/min)), By End-user (Oil & Gas, Water & Wastewater, Pharmaceuticals, Chemicals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

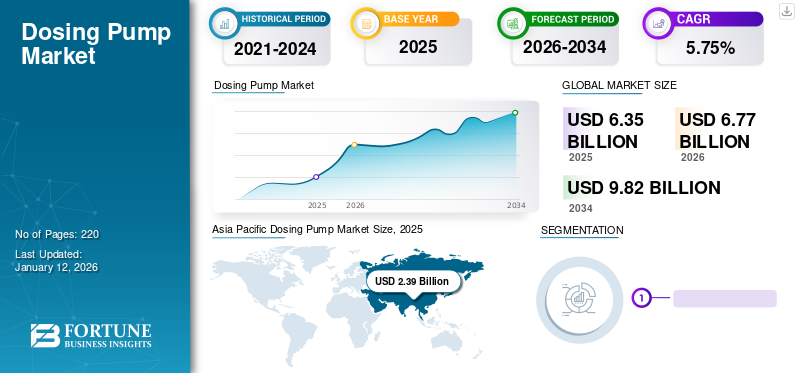

The global dosing pump market size was valued at USD 6.35 billion in 2025. The market is projected to grow from USD 6.77 billion in 2026 to USD 9.82 billion by 2034, exhibiting a CAGR of 4.75% during the forecast period. Asia Pacific dominated the global market with a share of 37.62% in 2025.

Dosing pumps are the types of positive displacement pump used in industrial plants, manufacturing facilities, water treatment facilities, food processing facilities, and other industry verticals.

Global Dosing Pump Market Overview

Market Size:

- 2025 Value: USD 6.35 billion

- 2026 Value: USD 6.77 billion

- 2034 Forecast Value: USD 9.82 billion

- CAGR (2026–2034): 4.75%

Market Share:

- Regional Leader: Asia Pacific held the largest market share in 2025 at 37.62%, driven by rapid industrialization and urbanization in countries like China and India.

- Fastest-Growing Region: North America is experiencing significant growth, particularly in the United States, where the market is projected to grow at a CAGR of 7.08% during the forecast period.

- End-User Leader: The Water & Wastewater Treatment sector led the market in 2024, accounting for 36% of the market share.

Industry Trends:

- Automation and Smart Dosing: Increasing integration of dosing pumps with digital controllers for precise dosing, real-time monitoring, and feedback control loops.

- Sustainable Practices: Growing emphasis on energy-efficient and environmentally friendly dosing solutions to comply with stringent regulations.

- Industry-Specific Applications: Rising demand for dosing pumps in specialized applications such as pharmaceutical production, food & beverage processing, and chemical manufacturing.

Driving Factors:

- Regulatory Compliance: Stringent regulations in water & wastewater management are driving the adoption of dosing pumps.

- Industrial Growth: Expansion of manufacturing industries and increased oil & gas capacities are contributing to market growth.

- Technological Advancements: Innovations in pump design and control systems are enhancing the efficiency and accuracy of dosing operations.

- Emerging Economies: Rapid industrialization in developing countries is boosting the demand for dosing pumps across various sectors.

The demand for dosing pumps is primarily driven by strict regulations in water & wastewater management, the growth of the manufacturing industry, increase in oil & gas capacities, and healthy growth in the pharmaceutical and food & beverage industries, mostly in developing countries.

The COVID-19 pandemic has affected the economic growth of various countries around the globe. Various countries have taken several major steps to avoid the spread of the COVID-19 virus. A few of the measures include partial or complete lockdown, travel restrictions, the closure of commercial and industrial spaces, and shortage of workers, among many others. This measure has led to distancing and shortage of workforce, impacting the supplier's ability to manufacture and deliver goods on time, which has left the manufacturers unable to fulfill their obligations toward customers on time.

Moreover, various industry verticals that use dosing pumps for several operations were suspended, resulting in a massive gap between supply and demand. Subsequently, the supply chain disruptions arising from the COVID-19 pandemic have also increased inflation and led to volatility in raw materials and energy, resulting in the failure of several projects and manufacturers' ability to secure new contracts, thus leading to a decline in revenues.

Dosing Pump Market Trends

Adoption of Digital Technologies to Deliver Accurate Metering Stimulated Market Opportunities

Dosing pumps are mainly used for various chemical treatments in the primary and secondary processes such as disinfection, coagulation, flocculation, and others. The chemicals industry is undergoing a digital adoption wherein many market players have started significantly investing in their digital and analytics capabilities to increase their resilience in the pumps industry. Key companies providing chemical application components also enhance their product capabilities with digitalization.

For instance, Grundfos, a leading diaphragm dosing pump for water & chemical applications, provides a digital dosing pump coupled with the iSOLUTIONS offering, which results in the delivery of accurate metering, proven reliability, ease of installation & calibration. In addition, the innovative digital dosing technologies (DDA, DDC, and DDE) have heralded new intelligent chemical dosing by offering intelligent flow control, improving cost efficiencies while continuing to support high precision processes.

Download Free sample to learn more about this report.

Dosing Pump Market Growth Factors

Rising Industrial Applications Are Boosting the Demand for Dosing Pumps

Dosing pumps can provide precise & accurate dosing of fluids, which is essential in industries, such as water treatment, chemical processing, and pharmaceuticals and is mostly integrated into an existing structure. Dosing pumps are used in various industrial sectors and have the same application and process. Moreover, for water purification and the food & processing industry, pumps are used in industrial installations, factories, agriculture, medical laboratories, and mining activities. These pumps frequently add a caustic chemical or an acid to a water storage tank to neutralize the pH. Such applications in the market are boosting the demand for dosing pumps in the industry.

For instance, on February 12, 2024, the New Qdos H-FLO chemical metering and dosing pump offered higher flow rates for various dosing applications.

Increasing Fluid Process Demand from Multiple Industries & Product Enhancement Favor the Market Growth

Across industries, the process sector, with its wide use of fluid-hydraulic equipment and high energy consumption, has enormous potential for the application of these pumps. As smart fluids for hydraulics become more commercially viable, first movers among end-users and equipment OEMs can take advantage of their advantageous positions to move ahead of the competition, resulting in enhanced product offerings.

For instance, traditional wastewater & chemical treatment plants were processed manually based on the flow rate observations & measurements, which can cause under or over-dosing of chemicals. However, with innovative technology, such as pump-intelligent Variable Frequency Drive (VFD) & wastewater treatment, chemical facilities can improve chemical dosing accuracy in their treatment processes.

Moreover, technological advancements have made it possible to monitor and control pumps remotely through a desktop or smartphone, making it easy to adjust dosing rates and troubleshoot issues. Thereby, the increase in product capability and rise in demand from the process sector will aid the market growth in the coming years.

RESTRAINING FACTORS

Complexity of Dosing Pump to Hinder Market Growth

The dosing pump requirements in various industries vary according to their application and needs. Even some pumps may be complex for operations, making them difficult for some industry verticals. For context, the pressure at discharge and flow rate are generally adjusted according to the requirement. This results in the design & performance of the pump regarding the end-user industry. Hence, to cater to the end-use industry requirement, pump manufacturers provide tailor-made products, making it difficult for the manufacturer to produce the product at an economic scale. Moreover, several major players operating in the global market generally offer a regional, domestic level with a small-scale production unit. They cannot provide customized products on a large scale.

Dosing Pump Market Segmentation Analysis

By Type Analysis

Peristaltic Pump Segment Holds a Dominant Market Share due to its Flexibility and Acceptance in Critical Applications

Based on type, the market is divided into diaphragm pump, peristaltic pump, solenoid pump, plunger pump, hydraulic pump, and others.

Peristaltic pump segment dominates the global market with a share of 41.21% in 2026 due to their reliability in handling delicate and viscous fluids without causing damage or shear. Additionally, their ability to handle a wide range of flow rates and easily adjust to accommodate changes in the process will likely result in the dominance of this market during the forecast period.

Furthermore, diaphragm pump is one of the fastest-growing types of pumps and is likely to experience significant demand in the coming years. Factors such as their ability to withstand high-pressure applications, to be used for metering & dosing, and their relatively low maintenance & long lifespan will likely result in their adoption.

Followed by the diaphragm pump segment, the solenoid pump and plunger pump segments hold a substantial share in the global market owing to their self-priming capability, high capability of flow rate, reliability, and low power consumption. Other pumps generally include air-operated and high-pressure motor pumps, which also experience significant demand.

By Flow Rate Analysis

Pumps with Flow Rates of Upto 50 (L/min) will dominate the Market Due to Widespread Adoption in Growing Industries

Based on flow rate, the market is trifurcated into upto 50 (L/min), 51 to 100 (L/min), and more than 100 (L/min).

Pumps with upto 50 L/min capacity are widely used in water & wastewater and chemical industries accounting for 69.72% market share in 2026. With the growing water management activity to provide more clean water in developing economies, up to 50 L/min flow rate pumps will likely dominate the dosing pump market share during the forecast period.

Furthermore, diaphragm pumps with 51 to 100 L/min flow rates are primarily offered with electric and pneumatic drive controls. They are widely used in fluid-handling of metallic, non-metallic, and conductive materials. Based on this factor, the 51 to 100 L/min flow rate pumps are experiencing significant demand.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Oil & Gas Segment to Dominate the Market Due to Pivotal Role of Dosing Pumps

Based on end-user, the market is segmented into oil & gas, water & wastewater, pharmaceuticals, chemicals, and others.

In the entire oil & gas value chain, pumps are pivotal in transporting crude along the complete supply chain. Most maintenance, monitoring, and control efforts are linked to pumps and their associated core and auxiliary processes. The growing need for efficient, precise & accurate dosing of fluids is likely to result in the extensive penetration of these pumps in the oil & gas industry.

The increase in data automation tools and digital technology, such as Supervisory Control and Data Acquisition (SCADA), in pumps for water & wastewater treatment helps water management operators to control & monitor peak flow times. The high water quality and wastewater management in developed and developing countries increase the demand for pumps for the water & wastewater industries during the forecast period.

Furthermore, in the chemicals industry, these pumps generally help improve output and reduce the process's downtime. Diaphragm pumps and peristaltic pumps are widely used for end-to-end chemical processing applications due to their ability to handle delicate fluids even at higher temperatures. Subsequently, the pharmaceutical industry is one of the most highly regulated industries, especially in fluid processes. Dosing pumps are widely used to transport fluids such as water, buffer, and so on through tubing and safely deliver them to where they are required, and in most cases, this is usually a piece of process equipment. The increase in the production of generic medicines and growth in pharmaceuticals are likely to result in substantial growth of pumps in pharmaceutical industries.

Other industries, such as food & beverages, pulp & paper, and packaging, also hold significant demand for pumps for their fluid processes.

REGIONAL INSIGHTS

The global market has been analyzed across five regions, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Dosing Pump Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is dominated the market with a valuation of USD 2.39 billion in 2025 and USD 2.56 billion in 2026.. The market dominance is attributed to substantial economic growth, which surged the demand for water management. Countries, such as China, India, Taiwan, and South Korea, are leading markets for the chemical industry. For context, as per the BASF report, China is one of the most significant chemical sector contributors and will experience a growth rate of 6.3% in the forthcoming years.The Japan market is projected to reach USD 0.51 billion by 2026, the China market is projected to reach USD 1.43 billion by 2026, and the India market is projected to reach USD 0.25 billion by 2026.

North America is also one of the fastest-growing regions due to recent developments and technological advancements. The U.S. holds the maximum share in the region. This is due to the rising demand for dose pumps in the industrial sectors. The United States market is projected to reach USD 2.13 billion by 2026.

Followed by Asia Pacific, North America, and Europe hold significant market shares. Industries, such as water & wastewater management, prominently use pumps for their fluid applications. As per the report on America’s infrastructure, the U.S. has more than 16,000 water & wastewater plants in operation. Moreover, in Canada, almost 85% of the population is served by municipal water systems. Subsequently, major European countries are experiencing an increase in water treatment plants due to increased demand for clean water across multiple sectors.The United Kingdom market is projected to reach USD 0.25 billion by 2026, while the Germany market is projected to reach USD 0.39 billion by 2026.

Furthermore, Latin America and the Middle East & Africa are the world’s leading oil & gas producers. Brazil stands in the eighth position for oil production, which surges the demand for these pumps across these regions.

List of Key Companies in Dosing Pump Market

Key Participants are concentrating on Enhancing their Product Capability to Deliver Efficient Products

The market for dosing-type pumps is fragmented, with several key players operating globally. The market includes around 5-6 key players with a presence and operations worldwide. Several key players are working in the market and bringing product enhancements to deliver efficient products, as long as they maintain their market position.

In January 2022, Dosatron added the D25+care dosing pump to its D25 product segment. The introduction of the dosing pump acts as a top generation of the D25 product segment and provides accurate dosing treatment in drinking water.

List of Key Companies Profiled:

- KNAUER Wissenschaftliche Geräte GmbH (Germany)

- ProMinent (Germany)

- Verder Liquid B.V. (U.K.)

- Seko (Italy)

- Watson-Marlow Fluid Technology Solutions (U.K.)

- Grundfos (Denmark)

- Netzsch Pumps (Germany)

- Nikkiso Co. Ltd. (Japan)

- SPX Flow (U.S.)

- Blue White Pumps (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2022 – ProMinent has delivered its diaphragm metering pump technology to a large-scale chlorination plant in Israel. The pump technology was installed quickly to protect the water surface from contamination & prevent water pollution.

- April 2022 – SEKO launched its WareDose ware wash dosing pump systems. The system has been upgraded and is now equipped with a Wi-fi hub that helps operators monitor their systems through smartphones anytime.

- September 2022 – Veder Liquids announced the launch of its Verderflex Ds500 dosing pump. The pumps are specifically designed to challenge the traditional technological process of chemical dosing in municipality & industrial pump applications.

- May 2022 – Mammoth Water District has replaced solenoid pumps with peristaltic dosing pumps. The group has selected U.S.-based Blue White’s FLEXFLO Peristaltic Pumps. The replacement of pumps enables them to get assistance in the water treatment in the district/town along with precise accuracy and excellent reliability.

- January 2021 – Idex Corporation agreed to acquire Abel Pumps, L.P., and some of its affiliates for USD 103. 5 million from Hillenbrand, Inc. The acquisition will lead Abel Pump to join Idex’s fluid & metering business technology segment.

REPORT COVERAGE

The market research report presents a comprehensive industry assessment by offering valuable insights, facts, industry-related information, and historical data. Several research methodologies and approaches are adopted to make meaningful assumptions and views to formulate the report.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.75% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Flow Rate

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 6.35 billion in 2025.

The global market is projected to grow at a CAGR of 4.75% over the forecast period.

The market size of the Asia Pacific stood at USD 2.39 billion in 2025.

Peristaltic pumps to dominate the global market based on type.

The global market is expected to reach USD 9.82 billion by 2032.

The key market drivers are fluid processes in multiple end-user sectors and dosing pump durability.

The top players in the market are Watson Marlow, Grundfos, SPX Flow, Seko, and Haosh Pumps.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us