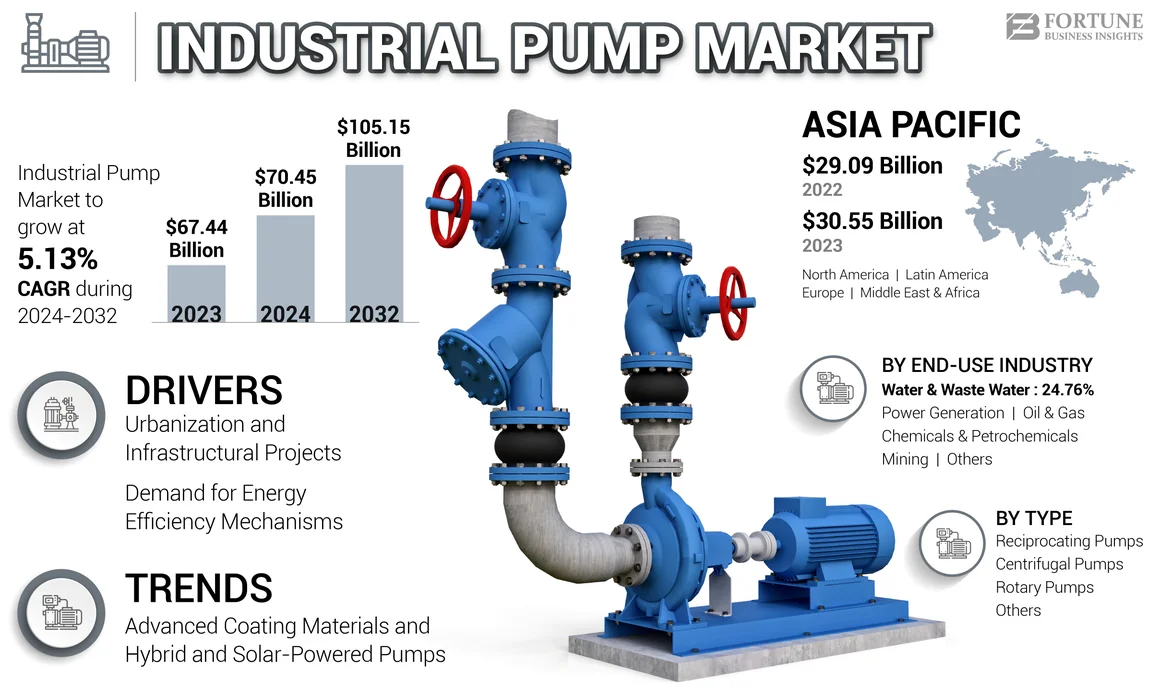

Industrial Pump Market Size, Share & Industry Analysis, By Type (Centrifugal Pumps, Reciprocating Pumps, Rotary Pumps, and Others), By End-use Industry (Water & Waste Water, Power Generation, Oil & Gas, Chemicals & Petrochemicals, Mining, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

The global industrial pump market size was valued at USD 67.44 billion in 2023. The market is projected to grow from USD 70.45 billion in 2024 to USD 105.15 billion by 2032, exhibiting a CAGR of 5.13% during the forecast period. Asia Pacific dominated the global market with a share of 45.3% in 2023.

An industrial pump is a mechanical device that converts mechanical energy from its motor to hydraulic energy as it transfers fluid. This energy transfer allows the machine to move fluid from one place to another. The product is a critical component of various industries, facilitating the movement of fluids across sectors such as oil and gas, water and wastewater treatment, chemicals, and power generation.

The global market is undergoing significant transformation, driven by technological advancements, regulatory pressures, and evolving market needs in both developed and developing countries. In developed economies, such as the U.S. and members of the European Union, there is a strong emphasis on sustainability and energy efficiency.

Flowserve Corporation is one of the most influential players in the market, with a global presence and a broad portfolio of products, including centrifugal pumps, reciprocating pumps, diaphragm pumps, and others, which makes it highly competitive in multiple industries.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Urbanization and Infrastructural Projects to Boost the Product Demand

The growth of infrastructure projects, especially in emerging economies, significantly boosts the demand for industrial pumps, particularly as governments worldwide increase their investments in essential systems. These infrastructure projects include sectors such as water supply and wastewater treatment, oil and gas, and construction.

According to the Global Infrastructure Outlook, global infrastructure spending is expected to reach USD 94 trillion by 2040, with a significant share of investment to be allocated to water management, transportation, and energy sectors. For instance, in the U.S., the Infrastructure Investment and Jobs Act aims to allocate over USD 1 trillion for infrastructure improvements, including a significant investment in water infrastructure.

This surge in funding necessitates the procurement of advanced pumping systems to support the construction and upgradation of water supply networks and sewage treatment facilities, ensuring that they can effectively manage the increasing urban population and environmental challenges.

High Demand for Energy Efficiency Mechanisms in Industries to Drive the Market

Energy efficiency demand is significantly driving the global industrial pump market growth as industries seek to reduce operational costs, comply with regulatory standards, and meet corporate sustainability goals. As organizations face rising energy prices and increased scrutiny of environmental impacts, the focus on energy-efficient pumping solutions has intensified.

According to the U.S. Department of Energy, pumps account for nearly 20% of industrial energy use, making them a critical area for improvement. Upgrading to energy-efficient pump systems leads to substantial savings, which sometimes extend up to 50% in energy costs, enhancing the overall operational efficiency and competitiveness.

Many countries have established stringent energy efficiency standards and incentives aimed at reducing carbon footprints. For instance, the European Union's Ecodesign Directive mandates that certain pump types meet specific energy performance criteria. This regulatory framework encourages manufacturers to innovate and produce pumps that comply with these standards and also exceed them, fostering a market for advanced, energy-efficient solutions.

MARKET RESTRAINTS

High Initial Pump Cost to Hamper the Market Growth

High initial costs associated with industrial pumps serve as a significant barrier to market growth, particularly for companies looking to invest in advanced technologies. Many pumps, especially those that are energy-efficient or equipped with smart features, require substantial upfront capital. This financial burden can deter businesses, particularly small and medium-sized enterprises (SMEs), from upgrading outdated systems or investing in new pumping solutions. As a result, the adoption of innovative technologies may lag, preventing companies from realizing the operational efficiencies and long-term savings that modern pumps can offer.

Budget constraints faced by many organizations compound high-cost pumping solutions. As industries with tight margins, decision-makers often prioritize short-term cost savings over long-term investments. This leads to a preference for less efficient, lower-cost alternatives that may not meet current energy efficiency standards or operational needs. Consequently, companies may miss out on opportunities to enhance productivity and reduce energy consumption, which results in limiting their competitiveness in a market that increasingly values sustainability and efficiency.

MARKET OPPORTUNITIES

Increased Demand for Automation in the Market Fostering Future Opportunities

The industrial sector is undergoing a significant transformation driven by the increased demand for automation, and this trend is profoundly influencing the market. Companies are increasingly adopting automated systems to enhance operational efficiency, reduce labor costs, and improve reliability. Automation allows for real-time monitoring and control of pump operations, leading to better performance management and reduced downtime.

In September 2022, Siemens announced a USD 300 million investment in its digital infrastructure and automation technologies, aiming to enhance smart manufacturing capabilities across its global facilities. This investment includes upgrading pumping systems in manufacturing plants to integrate IoT and automation, facilitating real-time monitoring and predictive maintenance.

In June 2022, Schneider Electric committed USD 1.5 billion to expand its EcoStruxure platform, which focuses on automation and sustainability across various sectors, including water management. This initiative includes deploying automated pump systems globally to optimize energy efficiency in water treatment and distribution networks.

MARKET CHALLENGES

Technological Complexity and Integration of Smart Solution May Create Challenges for Market Expansion

As pumps become increasingly integrated with advanced technologies such as Internet of Things (IoT) sensors, AI-based predictive maintenance, and automation, manufacturers are facing difficulties in designing and implementing these sophisticated systems.

However, integrating such technologies into industrial pumps presents challenges related to system complexity, data integration, and customer adoption, particularly in industries where technical expertise is limited. Moreover, operators must be trained to handle these complex systems, which increases the implementation time and costs for businesses, especially in regions with a lack of skilled workforce.

For instance, according to a 2023 study by the International Labour Organization (ILO), while the adoption of smart technologies is on the rise globally, 57% of industries in developing countries reported slow adoption of digital solutions due to high upfront costs and the technical complexity of integration.

INDUSTRIAL PUMP MARKET TRENDS

Advanced Coating Materials and Hybrid and Solar-Powered Pumps are the Latest Trends in the Market

The market is experiencing a significant transformation through the adoption of advanced materials and specialized coatings. These innovations enhance the durability and efficiency of pumps, particularly in harsh operating environments. For instance, in 2023, Flowserve launched a new Flowserve Chem-Master series. This series is specifically engineered to meet the rigorous demands associated with handling corrosive and hazardous materials, featuring advanced materials, enhanced sealing technologies, and IoT capabilities for improved monitoring and efficiency.

The push for sustainability and renewable energy is leading to the development of hybrid and solar-powered pumping systems, particularly suitable for remote and off-grid applications. For instance, in 2023, Grundfos introduced the latest range of solar-powered pumps- the Grundfos SQFlex series, designed for agricultural irrigation. These pumps enable farmers in rural areas to harness renewable energy, reducing their reliance on traditional power sources and lowering operational costs. By using solar energy, these systems contribute to sustainable farming practices while addressing the challenges posed by energy access in remote locations.

Download Free sample to learn more about this report.

Impact of COVID-19

COVID-19 Disrupted Production in Industrial Pump Manufacturing Hubs Due to Shortage of Raw Material & Industries Closure

The COVID-19 pandemic significantly impacted the market, leading to widespread supply chain disruptions that affected the availability of raw materials and components essential for manufacturing. Lockdowns in key manufacturing hubs, particularly in Asia, resulted in delayed shipments and increased lead times, with companies such as Flowserve and Grundfos reporting challenges in sourcing components due to factory closures. The demand for industrial pumps also varied by sector during the pandemic. While the oil and gas industry faced a decline in product demand, sectors such as pharmaceuticals and water management saw high demand. For example, Xylem focused on providing solutions for water and wastewater management, addressing urgent needs in municipalities and healthcare facilities.

SEGMENTATION ANALYSIS

By Type

Centrifugal Pump Segment Dominates the Market Due to its High Reliability and Low cost of Maintenance

Based on type, the global market is segmented into centrifugal pumps, reciprocating pumps, rotary pumps, and others.

The centrifugal pumps segment holds the largest share in the global market and is expected to dominate the market over the forecast period. These pumps are utilized more prevalently compared to other categories due to their advantages in terms of reliability, discharge, cost, and ease of setup and maintenance. Typical applications involve water supply and circulation, irrigation, and the transfer of chemicals in petrochemical plants.

The reciprocating pump segment holds the second leading market share. These pumps are used across numerous industries, including oil & gas, chemical processing industry, automotive, medical, and others.

By End-Use Industry

To know how our report can help streamline your business, Speak to Analyst

Water Segment Dominates the Market due to Growing Demand for Efficient Water Management

Based on the end-use industry, the market is segmented into water & wastewater, power generation, oil & gas, chemicals & petrochemicals, mining, and others.

The water & wastewater segment is the largest shareholder of the market, as industrial pumps play a vital role in the water and wastewater industry. The pumps are responsible for the efficient and effective movement of water for a wide range of applications. From sewage treatment plants to irrigation systems, these powerful tools are an essential component of modern infrastructure.

The chemicals & petrochemicals segment is the second-leading segment, as the pumps play a vital role in ensuring the safe and efficient handling of chemicals and fluids. Chemical process pumps are specifically engineered to manage and transport chemicals, corrosive liquids, and other hazardous substances.

INDUSTRIAL PUMP MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Industrial Pump Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Expansion of Various Industrial Sectors Drives the Product Demand

The Asia Pacific market dominates the market due to the expansion of various sectors such as oil and gas, water and wastewater management, chemicals, and food and beverages. A key factor influencing the market is the surge in infrastructure development across countries such as India, China, and Indonesia.

For instance, the construction industry in India, which broadly consists of sub-segments such as water supply, sanitation, urban transport, and others, is one of the largest markets for construction equipment (CE), with an industry size of around USD 10 billion and has the potential of transforming into a manufacturing and export hub.

China

China’s Dominance in Battery Manufacturing and Technological Innovation Drives Market Growth

The China market is one of the largest and fastest-growing markets in the world. The country’s focus on infrastructure development, industrial automation, and environmental sustainability also plays a key role in market expansion.

In 2024, Chinese media reported that China’s National Development and Reform Commission (NDRC) allocated nearly USD 7 billion (50 billion yuan) from the first batch of ultra-long special treasury bonds to support large-scale equipment renewals and has fast-tracked new project approvals, which involves small and large scale industrial pumps.

North America

Sustainability Initiatives and Infrastructure Investments Influence the North American Market

In North America, the growth of the industrial pump market was moderate, supported by sustainability initiatives and infrastructure investments. For instance, the city of Flint, Michigan, is undergoing a major overhaul of its water infrastructure as part of a USD 100 million initiative to replace lead pipes and improve water quality. This includes the upgradation of pumping systems to ensure reliable and safe water delivery. The project is expected to be completed by 2025, significantly enhancing the city’s water supply reliability.

U.S.

Integration of IoT Technology into Industrial Pumps Drives the Product Demand in the U.S.

The U.S. market is a significant segment of the manufacturing and infrastructure sectors, serving industries such as oil and gas, chemicals, water and wastewater treatment, food and beverage, pharmaceuticals, and power generation. Moreover, the integration of IoT technology into industrial pumps is driving the adoption of "smart pumps" that provide real-time data on performance metrics such as pressure, temperature, and flow. This allows for predictive maintenance, energy efficiency improvements, and remote monitoring. According to the U.S. Department of Energy, smart pumps can lead to 15-20% energy savings in industrial settings.

Europe

Stringent Regulations and Sustainability Initiatives Influence the European Market

Europe is leading in sustainable practices in the global market. The European Union's Green Deal aims to make Europe climate-neutral by 2050, and part of this initiative includes substantial investments in energy-efficient technologies. Countries such as Germany and the Netherlands are at the forefront, with projects focused on enhancing wastewater treatment facilities. For instance, the Amsterdam Water Supply is investing around USD 100 million in modernizing its pumping stations and wastewater treatment facilities. These aspects are driving the European industrial pump market.

Latin America

Latin America is Witnessing Considerable Investment in the Infrastructure Sector

The region has witnessed a surge in infrastructure investments, particularly in water and wastewater management. In 2021, a significant project called the "Water for All" program was launched in Brazil to invest USD 10 billion over five years to improve water supply and sanitation systems across the country. This initiative is expected to drive the demand for industrial pumps, particularly in urban areas with aging infrastructure.

Middle East & Africa

Increasing Exploration Activities of Oil and Gas Driving Demand in this Region

The Middle East & Africa market is expected to grow at a fast pace over the forecast period, as the oil and gas sector is a primary driver of the market in the Middle East, and its economy is widely dependent on the oil and gas sector. Numerous development projects have been announced, and some are in the development phase, adding to the growth of the market in this region. For instance, in April 2023, Saudi Aramco announced a USD 50 billion investment to enhance its refining and petrochemical capabilities.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players Are Investing Heavily In Advanced Technologies

The global market competes with a broad spectrum of companies/brands that manufacture, engineer, construct, and handle the distribution of industrial pumps and related products. The market is restricted by fierce price competition among service providers and the absence of distinct product/service features. Continuous R&D efforts are focused on developing energy-efficient, durable, and smart pump solutions. Companies are investing in technologies such as artificial intelligence and IoT to enhance pump performance and reliability.

For instance, in July 2024, Flowserve Corporation acquired the intellectual property and in-process R&D rights associated with cryogenic Liquefied Natural Gas (LNG) submerged pump technology from NexGen Cryogenic Solutions, Inc. This acquisition will expand the company’s LNG product portfolio and complement its existing valves, pumps, and mechanical seals offering.

List of the Key Players of Industrial Pump Market Profiled

- ITT Inc. (U.S.)

- Flowserve Corporation (U.S.)

- KSB Company (Germany)

- Ebara Corp (Japan)

- Schlumberger (U.S.)

- Dover Corporation (U.S.)

- Sulzer (Switzerland)

- Wilo (Germany)

- Weir Oil and Gas (U.K.)

- Grundfos (Denmark)

- Xylem Inc. (U.S.)

- Fives (France)

- Pentair (U.S.)

- SHI Cryogenics Group (U.S.)

- Nikkiso, Co. Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- September 2024- KSB Group announced the launch of a new generation of submersible motor pumps called AmaRex Pro, driven by high-efficiency motors of the IE5 class, for wastewater treatment. Their open two-vane D-max impellers are engineered for optimal hydraulic efficiency and outstanding resistance to clogging. Additionally, an advanced integrated motor control system automatically identifies any instances of clogging and activates an independent pump-dragging process to address the issue.

- September 2024- Grundfos launched a new and innovative pumping solution, Textile Vertical, designed to help industries achieve energy efficiency and net-zero emission goals at the Industry End-Use Industry Fair 2024 in India. This solution is tailored for Zero Liquid Discharge (ZLD) applications, as it addresses the unique challenges faced by the textile industry in managing water resources and effluents.

- July 2024- ITT Inc. announced a strategic commercial agreement through its Svanehj business for green energy transition. Svanehøj is a designer and manufacturer of specialized cryogenic deep wells and submersible pumps for the marine sector.

- April 2024- Dover Corporation established Pump Solutions Group (PSG) within its Fluid Solutions platform, joining major brands such as Almatec and Mouvex to form a cohesive pump organization with a variety of pumps. PSG aims to form collaborations within the group's manufacturing footprint, distribution, and supply chains and to look to improve its geographic sales reach, which is now over 50% international, by leveraging its greater critical mass.

- October 2022- EBARA Corporation of Japan successfully acquired 100% equity in Hayward Gordon L.P. This strategic move aims to enhance EBARA's product offerings by incorporating Hayward Gordon's robust line of heavy-duty process pumps and mixers. The acquisition is also intended to bolster Hayward Gordon's manufacturing capabilities, improve the sales networks of both companies, and strengthen their presence in the North American market.

Investment Analysis and Opportunities

- Investments in IoT-enabled pumps can create opportunities in predictive maintenance, remote monitoring, and real time performance optimization. For instance, In March 2024, ITT Inc., a global leader in industrial technologies, announced a significant multi-million-dollar investment aimed at developing advanced digitally enabled pumps. The company is focusing on integrating smart technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning, into its pump systems to drive the future of industrial applications, improve efficiency, and reduce operational costs across key sectors.

- In November 2023, Wilo SE, a leading pump manufacturer, entered into a strategic partnership with Siemens to develop AI-powered and digitally optimized pumps. The collaboration focuses on integrating automation, AI, and cloud technologies to create self-optimizing pumping systems that can be used across multiple industries.

- Partnerships and investments in innovations in the industrial pump market can lead to the creation of enhanced product service offerings and expanded geographical reach.

REPORT COVERAGE

The report delivers a detailed insight into the market and focuses on key aspects such as leading companies in the market. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.13% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size stood at USD 67.44 billion in 2023.

The market is likely to grow at a CAGR of 5.13% over the forecast period.

The water & waste water treatment segment is leading in the market.

The Asia Pacific market size stood at USD 30.55 billion in 2023.

Increasing infrastructural projects and high demand for energy efficiency mechanisms in industries are the key factors driving market growth.

Some of the top players in the market are ITT Inc., Flowserve Corporation, KSB Company, and others.

The global market size is expected to reach USD 105.15 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us