e-Fuse Market Size, Share & Industry Analysis, By Type (Auto Retry and Latched), By Voltage (Low and High), By Application (Consumer Electronics, Automotive and Transportation, Aerospace and Defense, IT and Telecommunications, Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

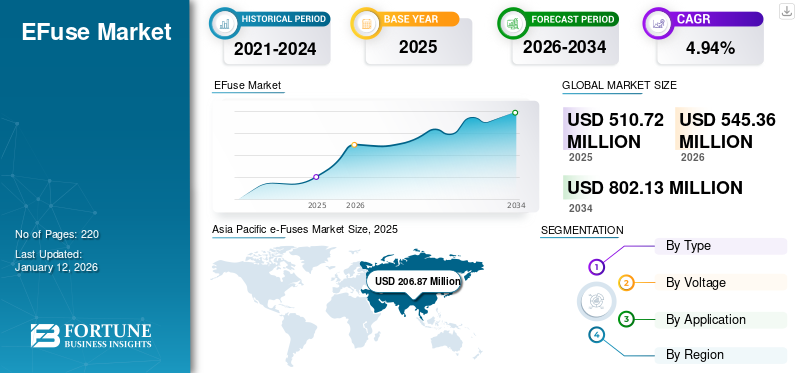

The global e-Fuse market size was valued at USD 510.72 million in 2025 and is projected to be worth USD 545.36 million in 2026 and expected to reach USD 802.13 million by 2034, exhibiting a CAGR of 4.94% during the forecast period. Asia Pacific dominated the e-fuse market with a market share of 40.51% in 2025.

e-fuses provide better protection than traditional fuses, offering resettable protection against overvoltage, overcurrent, short circuits, and thermal faults. Growing use in sensitive electronics and high-end devices where traditional fuses are inadequate. Growing preference for programmable, compact, and intelligent protection solutions is driving their market share.

Analog devices and Toshiba are known for high-performance, reliable solutions that meet the evolving needs of electronics and automotive sectors. Analog devices and Toshiba supply e-Fuses for industrial equipment, automation, robotics and programmable power supplies. Their solutions meet industrial grade reliability and longevity requirements.

MARKET DYNAMICS

MARKET GROWTH/DRIVERS

Increasing Demand for Advanced Circuit Protection to Drive Market Growth

The growing demand for advanced circuit protection solutions is a major driver for the market. Traditional fuses often fail to meet the protection needs of modern electronic systems, as they are bulky, slow to respond, and require replacement after a fault occurs.

e-Fuses offer several advanced features such as programmable current limits, overvoltage, overcurrent, short circuit, and thermal protection. These features make e-Fuses highly suitable for next generation electronics, including smartphones, laptops, electric vehicles (EVs), servers and data center equipment, and industrial automation systems.

In March 2025, Texas Instruments (TI) declared modern power-management chips to help the swiftly growing power needs of the latest data centers. As the adoption of high-performance computing and artificial intelligence (AI) grows, data centers need more power-dense and effective solutions, further leading to the demand for e-fuses globally.

Expansion of Consumer Electronics to Boost Market Growth

The rapid growth of the consumer electronics sector is significantly driving the demand for e-Fuses. With the increasing adoption of devices such as smartphones, laptops and tablets, wearable devices, gaming consoles, and home appliances there is a rising need for compact, efficient, and reliable circuit protection solutions. Modern consumer devices are becoming smaller and more power dense, requiring advanced protection technologies that traditional fuses cannot provide. E-Fuses are ideal for these applications as they offer programmable and precise protection, resettable operation, and space saving compact design.

MARKET RESTRAINTS

High Initial Cost Compared to Traditional Fuses to Restrain Market Growth

One of the major factors limiting the growth of the market is its high initial cost compared to conventional circuit protection devices such as traditional glass/ceramic fuses, polymer based resettable fuses. While e-Fuses offer advanced features such as programmability, resettable protection, and diagnostics, they generally have higher upfront costs. This makes them less attractive for: low-cost consumer electronics, cost sensitive industries, and simple, low power applications.

MARKET OPPORTUNITIES

Rising Adoption of Electric Vehicles to Drive Market Growth

The rapid growth of the electric vehicle market is a major driver for the market. EVs require advanced, reliable, and programmable circuit protection for several critical applications comprising battery management systems, onboard chargers, power distribution units, DC-DC converters, and EV charging infrastructure.

In July 2025, Diodes Incorporated revealed its newest automotive-compliant power solution, the AP61402Q, a 5.5 V, 4 A synchronous buck converter created to provide high efficiency, low quiescent current, and compact form factor for advanced automotive systems.

MARKET CHALLENGES

Design Complexity to Restrain Market Growth

One of the key challenges restraining the growth of the market is the design complexity associated with integrating e-Fuses into electronic systems. Unlike traditional fuses that are simple plug and play components, e-Fuses often require: precise circuit design adjustments, programming of protection parameters such as current limits and response times, and integration with power management systems and monitoring software.

This complexity demands technical experts from engineers and involves additional design time and cost, especially for small or mid-sized manufacturers with limited resources.

Download Free sample to learn more about this report.

e-FUSE MARKET TRENDS

Regional Growth Divergence to Drive Market Trends

The region benefits from rapid industrialization, electrification, EV expansion, and consumer electronics growth. Government led smart grid, infrastructure, and renewable energy initiatives further drive demand. The e-Fuse market growth is driven by smart grids upgrades, EV charging infrastructure, data centers, and strong regulatory standards.

North America is experiencing strong demand due to advanced technologies, growing data center and telecom investments, and strict safety regulations. The rise of EV infrastructure and smart energy systems is also fueling e-Fuse adoption.

IMPACT OF TARIFFS

Tariffs on semiconductor components, electronic parts, or finished electronic products can directly increase the cost of manufacturing and importing e-Fuses. Many e-Fuses and their components are produced in Asia Pacific countries, and tariffs on imports to North America or Europe raise prices significantly. Trade restrictions or tariffs between major markets such as China, U.S., and Europe disrupt supply chains. OEMs face delays, increased lead times, or difficulty in sourcing e-Fuse components.

Higher import and production costs are often passed down the supply chain, raising the prices of end-products that use e-Fuses such as consumer electronics, electric vehicles, and industrial equipment.

SEGMENTATION ANALYSIS

By Type

Growing Requirement for Smart & Reliable Solutions to Lead Auto Retry Majority Share

Based on type, auto retry and latched are probable segments.

The auto retry holds the largest e-Fuse market with a share of 59.95% in 2026, and is expected to dominate over the forecast period. The auto retry e-Fuses are designed to automatically attempt to restore normal operation after a fault condition such as overcurrent, overvoltage, or thermal shutdown. With the growing need for smart, reliable and maintenance free protection solutions, the auto retry segment is emerging as the dominant segment in the market.

Latched is the second dominating segment in the market, growing at the rate of 5.20% in the forecast period due to an increasing demand for permanent fault isolation and enhanced safety in various critical applications. Unlike auto-retry effuses, latched e-Fuses remain off after a fault until the system is manually reset or power is cycled.

By Voltage

Increasing Demand for Electric Vehicles to Heighten High Segment Growth

Based on voltage, the market is segmented as low and high.

The low voltage segment dominates the market with a share of 64.36% in 2026, due to growing demand for smartphones, laptops, tablets, wearables, and gaming devices is fueling the need for low voltage e-Fuses.

High voltage is forecasted to grow at the CAGR of 6.12% in the coming years owing to EVs and hybrid vehicles requiring high voltage and high current protection for components such as battery packs, onboard chargers, DC-DC converter, and power distribution systems.

By Application

To know how our report can help streamline your business, Speak to Analyst

Rising Demand for Compact and Portable Devices to Propel Consumer Electronics Share

Based on application, the market is segmented as consumer electronics, automotive and transportation, aerospace and defense, IT and telecommunications, healthcare, and others

Consumer electronics hold a significant growth with a share of 33.51% in 2026, owing the growing demand, increasing sales of smartphones, tablets, laptops, wearables, and gaining consoles that require compact, space saving protection solutions. e-Fuses offer small form factors ideal for these miniaturized devices.

Automotive and transportation is projected to penetrate at the fastest rate in the market showcasing a CAGR of 6.62% in the forecast period. The growth is mainly attributed to the growing necessity of fuses in modern vehicles to have numerous electronics control units for infotainment systems, advanced driver assistance systems (ADAS), lighting and comfort features and connectivity modules.

e-Fuse MARKET REGIONAL OUTLOOK

The market has been studied regionally across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific e-Fuses Market Size, 2025 (USD Million) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the dominating region in the market which contributes to USD 206.87million in 2025. The Asia Pacific market is witnessing strong growth, driven by the rapid expansion of consumer electronics. Rising demand for smartphones, laptops, tablets, and smart devices in countries such as China, India, Japan, and South Korea is boosting the need for advanced circuit protection solutions such as e-Fuses. These devices require compact, reliable, and efficient protection against overcurrent and voltage fluctuations, making e-Fuses essential in their design. In 2025, The Japan market is projected to reach USD 36.6 billion by 2026, the China market is projected to reach USD 82 billion by 2026, and the India market is projected to reach USD 48.64 billion by 2026.

North America

North America valued at USD 118.44 million in 2026 and growing at the CAGR of 5.65% in the forecast period is propelled due to the high concentration of data centers and cloud service providers. These facilities require advanced programmable, and resettable protection to prevent equipment failure and downtime, boosting demand for e-Fuses. Rapid growth in electric vehicles and investments in EV charging infrastructure across the U.S. and Canada are driving demand for high performance e-Fuses. In the region, the U.S. is estimated to reach USD 98.57 million in 2026 supported by the growing investment in industrial automation, robotics, and smart manufacturing which are increasing the use of advanced power systems that need reliable circuit protection.

Europe

Europe is the third leading region in the market valued at USD 105.26 million and growing at the CAGR of 4.50% in the forthcoming years. Rapid expansion of solar energy, wind farms, and energy storage systems in Europe requires reliable circuit protection for inverters, battery packs, and grid systems. The increasing integration of renewable energy sources such as wind and solar power across Europe is expected to drive the demand for electronic fuses. As the region focuses on decarbonization and energy transition, there is significant growth in the renewable energy installations. These renewable energy systems require advanced circuit protection solutions to handle fluctuating voltages, current surges, and grid stability issues. Backed by these factors, countries including the U.K. are expected to record the valuation of USD 13.74 million, Germany to record USD 24 million, and France to record USD 16.73 million in 2026.

Middle East & Africa

The Middle East & Africa market in 2025 is set to record USD 53.16 million as its valuation. The massive development of 5G base stations, small cells, and edge data centers demands high reliability power protection devices. e-Fuses provide rapid fault isolation, programmable current limits, and remote diagnostics critical features for telecom reliability. Data consumption is soaring 5G base stations globally exceeded 5 million units in 2024, and over 8,000 new edge centers were added. These setups involve dense electronics and high-power loads, requiring of e-Fuses to prevent downtime in mission critical networks.

Latin America

Ongoing infrastructure development and rapid industrial growth in Latin America are key drivers of the region’s e-Fuse market. Investments in power grids, renewable energy projects, telecommunication, and transportation systems are increasing the demand for advanced circuit protection solutions such as e-Fuses. Additionally, the rising focus on industrial automation, manufacturing modernization, and the adoption of industry 4.0 technologies are further accelerating the need for reliable and compact protection devices.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Suppliers Investing to Make More Effective e-Fuses, Driving Market Growth

The global market is mostly fragmented, with key players operating in the industry. Globally, Toshiba is dominating the market. In July 2024, Toshiba Electronic Devices & Storage Corporation (“Toshiba”) introduced a series of eight compact, high-voltage electronic fuses (e-Fuse ICs) known as the TCKE9 Series, designed to offer various functions for safeguarding power supply lines.

List of the Key e-Fuse Companies Profiled

- Little-Fuse, Inc. (U.S.)

- Toshiba Corporation (Japan)

- Analog Devices (U.S.)

- Texas Instruments Incorporated (U.S.)

- Analog Devices Inc. (U.S.)

- Diodes Incorporated (U.S.)

- Silergy Corp. (China)

- Qorvo Inc. (U.S.)

- Semtech (U.S.)

- Infineon Technologies AG (Germany)

- Monolithic Power Systems, Inc. (U.S.)

- Microchip Technology (U.S.)

- Vishay Intertechnology, Inc. (U.S.)

- Alpha and Omega Semiconductor (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In March 2025, Vishay Intertechnology will present its cutting-edge solutions that drive the future of energy technology at ELECRAMA 2025.Vishay Intertechnology, Inc. announced that at the Applied Power Electronics Conference and Exposition (APEC) 2025, the company will be showcasing its broad portfolio of passive and semiconductor solutions that address the latest trends in power electronics from energy harvesting, electric vehicle (EV) powertrains, and battery technologies to high efficiency power conversion for data centers.

- In October 2024, Analog devices launched an embedded software development environment. CodeFusion Studio and ADI's new Developer Portal are introductory components of a new suite of developer-centric offerings, which connect cross-device, cross-market hardware, software and services.

- June 2024- Infineon Technologies AG launched the 600 V CoolMOS S7TA Superjunction MOSFET for automotive power management applications. Created to meet the certain needs of automotive electronics, the S7TA features an incorporated temperature sensor that remarkably enhances the correctness of junction temperature sensing, building on the advances made by its partner for industrial applications (CoolMOS S7T).

- In October 2022, Semtech Corporation, a top worldwide supplier of high-performance analog and mixed-signal semiconductors and advanced algorithms, declared the release of the e-Fuse HotSwitch platform.

- In February 2021, Toshiba Electronic Devices & Storage Corporation ("Toshiba") included a modern e-Fuse IC, “TCKE712BNL,” to its list of e-Fuse ICs for persistent use that hold up functions to prevent power line circuits.

INVESTMENT ANALYSIS AND OPPORTUNITIES

- In August 2024- Texas Instruments (TI) and the U.S. Department of Commerce registered a void Preliminary Memorandum of Terms for up to USD 1.6 billion in advanced direct funding under the CHIPS and Science Act to assist three 300mm wafer fabs already in the process of construction in Texas and Utah.

REPORT COVERAGE

The global e-Fuse market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations offering the e-Fuse. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.94% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Voltage

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 510.72 Million in 2025.

The market is likely to grow at a CAGR of 4.94% over the forecast period.

The consumer electronics segment is expected to lead the market in the forecast period.

The market size of Asia Pacific stood at USD 206.87 Million in 2025.

Increasing demand for advanced circuit protection to drive the market growth

Little-Fuse Inc., Analog Devices, and Diodes Incorporated are some of the market's top players.

The global market size is expected to reach USD 802.13 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us