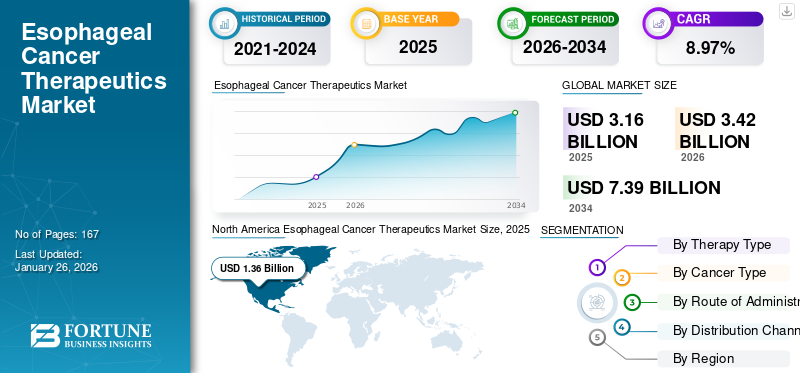

Esophageal Cancer Therapeutics Market Size, Share & Industry Analysis, By Therapy Type (Chemotherapy, Immunotherapy, Targeted Therapy, and Others), By Cancer Type (Squamous Cell Esophageal Cancer, Adenocarcinoma, and Others) By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global esophageal cancer therapeutics market size was valued at USD 3.16 billion in 2025. The market is projected to grow from USD 3.42 billion in 2026 to USD 7.39 billion by 2034, exhibiting a CAGR of 8.97% during the forecast period. North America dominated the esophageal cancer therapeutics market with a market share of 43.12% in 2025.

The increasing prevalence of esophageal cancer globally magnifies the need for targeted therapies. The market has witnessed improved survival outcomes in recent years due to continuous research and development, along with innovation in therapeutic alternatives. The rising pool of patients heightens the global market demand leading to growth. Furthermore, strong research pipelines, expanding clinical trials, and strategic partnerships among global pharmaceutical companies are reinforcing global market growth. Overall, the market is poised for expansion over the next decade.

- In April 2025, Castle Biosciences, Inc. collaborated with the Esophageal Cancer Action Network (ECAN), the American Foregut Society (AFS), and The Gut Doctor Podcast LLC to promote esophageal cancer prevention, education, and advocacy.

Moreover, the increasing prevalence of esophageal cancer, regulatory approvals from the U.S. FDA and EMA, strategic collaboration, and rising investment are anticipated to augment the demand for therapeutics for esophageal cancer to boost the growth of the market.

Additionally, the key industry players, such as Merck & Co., Inc., Bristol-Myers Squibb, and Astellas Pharma Inc., and Pfizer Inc. operating in the market, are focusing on developing various pipeline candidates to support the rising demand for effective therapeutics for diverse disease indications with the help of bispecific antibodies.

MARKET DYNAMICS

MARKET DRIVERS

Rising Cancer Burden Coupled with Advancements in Antibody Engineering Is Accelerating Adoption of Bispecific Antibodies

The primary driver of the global esophageal cancer therapeutics market growth is the rising incidence of the disease globally, particularly in high-burden regions such as East Asia. This is supported by the increasing prevalence of risk factors such as obesity, smoking, GERD, and Barrett’s esophagus, which contribute to higher patient numbers requiring esophageal cancer treatment. Additionally, advancements in immuno-oncology therapies such as Keytruda and Tevimbra have shown improved overall survival, driving physician adoption.

Growing regulatory approvals and favorable reimbursement in major markets are further boosting uptake. Collectively, these factors are expanding the patient base and treatment options, sustaining robust market growth.

- For instance, in 2022, the World Cancer Research Fund reported the highest number of new cases for esophageal cancer with 224,012 new cases in China, 70,637 in India, and 25,232 in Bangladesh 2022.

MARKET RESTRAINTS

High Clinical Trial Failure Rates to Impede Growth of Market

One of the key restraints is the high clinical trial failure rates, which limit access and adoption. These failures create uncertainty for both developers and investors. Despite significant R&D investments, many novel drug combinations have not demonstrated meaningful improvements in survival outcomes, delaying patient access to innovative options. These failures also discourage smaller biotech players due to high financial risks and increase payer skepticism about covering costly new therapies. Such outcomes limit the pace of therapeutic advancement in a market with already high unmet medical needs.

- For instance, in January 2025, Merck & Co., Inc., in collaboration with Eisai Co., Ltd. announced that they did not receive approval for the Keytruda-Lenvima regimen, used in combination with chemotherapy, didn’t significantly improve the life span of patients with newly diagnosed, advanced HER2-negative gastroesophageal adenocarcinoma. Such developments burden the company with additional costs and may hamper the market growth.

MARKET OPPORTUNITIES

Rising Investment Opportunities for Research Advancement to Offer Prominent Opportunity for Market Growth

The market is poised to benefit significantly from increasing investment in research and clinical development, creating a strong opportunity for growth. Global pharmaceutical companies and biotech firms are actively funding large-scale trials to explore novel immunotherapies, targeted agents, and antibody-drug conjugates aimed at improving survival outcomes in both squamous cell esophageal cancer and adenocarcinoma. Government and nonprofit initiatives, such as cancer moonshot programs in the U.S. and oncology R&D collaborations in Asia and Europe, are also channeling resources toward esophageal cancer, an area of high unmet need.

- For instance, in December 2022, the University of Colorado Anschutz Medical Campus received USD 20.0 million philanthropic investment. The investment aimed to advance esophageal and gastric cancer research, clinical trials, screening, surveillance, and treatments—such developments to offer lucrative growth opportunities.

ESOPHAGEAL CANCER THERAPEUTICS MARKET TRENDS

Rapid Shift Toward Injectable Immunotherapy Formulations is One of Significant Market Trend

A prominent market trend in the esophageal cancer therapeutics domain is the development and approval of subcutaneous / non-infusion immunotherapy formulations to enhance patient convenience, reduce clinic time, and improve adherence. This shift toward more patient-friendly delivery formats reflects a broader industry push to lower treatment burden and differentiate products in a competitive immuno-oncology space.

- For instance, in September 2025, Merck & Co., Inc., received approval from the U.S. FDA for KEYTRUDA QLEX (pembrolizumab and berahyaluronidase alfa-pmph) injection for subcutaneous administration in adults across most solid tumor indications for KEYTRUDA (pembrolizumab).

MARKET CHALLENGES

Adverse Effects and Tolerability Issues Pose a Critical Challenge to Market Growth

A significant challenge in the market is the high incidence of adverse effects associated with chemotherapy and immunotherapies, which often limits treatment continuity. While immuno-oncology drugs, such as checkpoint inhibitors, such as Keytruda, Opdivo, and Tevimbra, have improved survival outcomes, they are linked to immune-related toxicities, including pneumonitis, colitis, and hepatitis, requiring treatment interruption or discontinuation in some patients. Similarly, traditional chemotherapy regimens cause severe side effects including neutropenia, nausea, and fatigue, reducing patient adherence and impacting quality of life. These tolerability challenges make oncologists more cautious in prescribing advanced therapies, particularly for elderly or comorbid patients, thereby restraining broader market uptake.

- For example, as per the data published by U.S.FDA, TEVIMBRA, may exhibit adverse reactions such as pneumonitis, immune-mediated colitis, immune-mediated, hepatitis, immune-mediated endocrinopathies, immune-mediated nephritis with renal dysfunction, immune-mediated dermatologic adverse reactions, and solid organ transplant rejection.

Download Free sample to learn more about this report.

Segmentation Analysis

By Therapy Type

Increasing Adoption of Immunotherapy as a Treatment for Esophageal Cancer Contributed to Segmental Growth

Based on the therapy type, the market is divided into chemotherapy, immunotherapy, targeted therapy, and others.

To know how our report can help streamline your business, Speak to Analyst

The immunotherapy segment accounted for the dominating global esophageal cancer therapeutics market share in 33.60% 2026. The segment acts as a backbone for treatment for esophageal cancer and is widely used in combination with chemotherapy. Due to such wider application, number of approvals, and enhanced adoption, the immunotherapy segment is anticipated to grow.

- For instance, in September 2020, Merck & Co., Inc. showcased data from the pivotal Phase 3 KEYNOTE-590 trial evaluating KEYTRUDA, Merck’s anti-PD-1 therapy, in combination with platinum-based chemotherapy (cisplatin plus 5-fluorouracil [5-FU]) for the first-line treatment of patients with locally advanced or metastatic esophageal and gastroesophageal junction (GEJ) cancer.

By Cancer Type

Increasing Prevalence of Squamous Cell Esophageal Cancer to Fuel Segmental Growth

By cancer type, the market is further segmented into squamous cell esophageal cancer, adenocarcinoma, and others.

The squamous cell esophageal cancer segment captured the largest share of the market in 50.12% 2026. In 2025, the segment is anticipated to dominate with a 50.4% share. The high share of the segment is due to its rising prevalence of the squamous cancer type globally. Underscoring the unmet need for therapeutics, many key players are focusing on advancing their immunotherapies for the disease indication, with many pipeline candidates for future growth. As a result, SCC is emerging as the dominant cancer subtype driving demand in the esophageal cancer therapeutics market.

- For instance, in May 2025, Merck & Co., Inc., dosed their first patient in the IDeate-Esophageal01 Phase 3 trial evaluating the efficacy and safety of investigational ifinatamab deruxtecan (I-DXd) versus investigator’s choice of chemotherapy in patients with unresectable advanced or metastatic esophageal squamous cell esophageal cancer (ESCC) with disease progression following treatment with a platinum-containing systemic therapy and an immune checkpoint inhibitor.

The adenocarcinoma segment is expected to grow at a CAGR of 10.06% over the forecast period.

By Route of Administration

Widely Used Chemotherapies are Administered Parenterally which Supplemented Segment Growth

On the basis of the route of administration, the market is segmented into oral and parenteral.

The parenteral segment held the dominating position in 53.46% 2026. By route of administration, the parenteral segment held a share of 53.3% in 2024. The dominance of the segment is attributed to several advantages of the parenteral route of administration, such as systemic administration and enhanced efficiency. Moreover, ongoing R&D highlights their potential for efficient treatment. Major players are focusing their resources on commercializing these advantages with new product offerings. Also, widely used chemotherapies are administered parenterally. Such factors drive the growth of the segment.

- For instance, in November 2024, A study published in the AACR journal Clinical Cancer Research titled ‘New Treatment Strategies for Esophageal Cancer’ showed that adding tislelizumab to standard-of-care chemotherapy and radiation shrank unresectable esophageal tumors enough to make them eligible for surgical resection, which, in turn, led to longer patient survival. Tislelizumab is administered parenterally.

The segment of oral route of administration is set to flourish with a growth rate of 9.12% growth across the global esophageal cancer therapeutics market forecast period.

By Distribution Channel

Close Monitoring for Esophageal Cancer Therapeutics at Hospitals to Position Hospital Pharmacies in a Leading Position

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies & drug stores, and others.

In 2026, the global market 68.05% was dominated by hospital pharmacies in terms of distribution channel. Most of the therapies are administered parenterally that require close clinical monitoring and are given in inpatient or outpatient hospital settings. Moreover, many esophageal cancer patients present with advanced disease, requiring hospitalization or supportive care alongside drug therapy, which further strengthens the hospital channel’s role. These are some of the key factors supporting the dominance of this segment. Furthermore, the segment is set to hold 67.8% share in 2025.

- For instance, in September 2025, OhioHealth Van Wert Hospital completed a USD 3.15 million expansion of its pharmacy, nearly doubling its size and strengthening the hospital’s ability to deliver safe, efficient, and advanced care for patients.

In addition, retail pharmacies & drug stores as a distribution channel are projected to grow at a CAGR of 7.7% during the study period.

Esophageal Cancer Therapeutics Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

NORTH AMERICA

North America Esophageal Cancer Therapeutics Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025 valuing at USD 1.36 billion and also took the leading share in 2026, with USD 1.48 billion. The market in North America is expected to grow strongly due to early adoption of immunology drugs, strong regulatory support, and favorable reimbursement frameworks. The region also witnessed rising approval for cancer therapeutics such as Keytruda and Opdivo for esophageal cancer across different lines of therapy, expanding treatment options. Collectively, these factors make North America the largest and most lucrative regional market. In 2026, the U.S. market is estimated to reach USD 1.36 billion.

- For instance, in February 2025, Cyted HealthSearch received USD 44.0 million in Series B financing to accelerate its commercial expansion in the U.S.

The U.S. is poised for growth in the market due to robust reimbursement frameworks that support high-cost treatments. The rising incidence of adenocarcinoma linked to obesity, GERD, and Barrett’s esophagus is expanding the patient pool, while advanced diagnostic infrastructure enables earlier intervention.

EUROPE & ASIA PACIFIC

Other regions, such as Europe, are anticipated to witness a notable growth in the coming years. During the forecast period, the European region is projected to record a growth rate of 8.9%, which is the second highest among all the regions and touch the valuation of USD 0.75 billion in 2025. This is primarily due to increasing clinical adoption of checkpoint inhibitors and harmonized regulatory pathways through the EMA. Rising cases of both adenocarcinoma and squamous cell esophageal cancer across Western and Eastern Europe are expanding the patient base. Backed by these factors, countries including the U.K. anticipate to record a valuation of USD 0.15 billion, Germany to record USD 0.16 billion in 2026. and France to record USD 0.13 billion in 2025. The market in Asia Pacific is estimated to reach USD 0.66 billion in 2025 and secure the position of the third largest region (in terms of market value). In the region, China is estimated to reach USD 0.33 billion in 2026.

LATIN AMERICA & MIDDLE EAST & AFRICA

Over the forecast period, Latin America and Middle East & Africa regions would witness a moderate growth in this marketspace. The Latin America market in 2025 is set to record USD 0.17 billion as its valuation. Rising awareness of gastrointestinal cancers is expected to drive market growth in these regions further. In the Middle East & Africa, GCC is set to attain the value of USD 0.08 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

A Wide Range of Product Offerings, coupled with a Strong Distribution Network of Key Companies, supported their Leading Position

The global esophageal cancer therapeutics market shows a semi-concentrated structure with numerous small- to mid-size companies actively operating across the globe. These players are actively involved in product innovation, strategic partnerships, and geographic expansion.

Merck & Co., Inc., Astellas Pharma Inc., and AstraZeneca are some of the dominating players in the market. A comprehensive range of esophageal cancer therapeutics drugs, global presence through a strong distribution network, and collaborations with research and academic institutes are a few characteristics of these players that support their dominance.

Apart from this, other prominent players in the esophageal cancer market growth include Cstone Pharmaceuticals, Novartis AG, and others. These companies are undertaking various strategic initiatives, such as investments in R&D and partnerships with pharmaceutical companies, to enhance their market presence.

LIST OF KEY ESOPHAGEAL CANCER THERAPEUTICS COMPANIES PROFILED

- Merck & Co., Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Astellas Pharma Inc. (Japan)

- AstraZeneca (U.S.)

- Genentech, Inc. (U.S.)

- Takeda Pharmaceutical (Japan)

- Pfizer Inc. (U.S.)

- CStone Pharmaceuticals (China)

- Novartis AG (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- July 2025: CivicaScript, LLC, launched generic capecitabine. Capecitabine is a nucleoside metabolic inhibitor indicated for certain types of colorectal, breast, gastric, esophageal, gastroesophageal junction, or pancreatic cancer.

- March 2025: BeiGene, Ltd. received approval from the U.S. FDA for TEVIMBRA (tislelizumab-jsgr), indicated in combination with platinum-containing chemotherapy, for the first-line treatment of adults with unresectable or metastatic esophageal squamous cell esophageal cancer (ESCC) whose tumors express PD-L1.

- September 2024: Astellas Pharma Inc. received approval from the European Commission (EC) for VYLOYTM (zolbetuximab) in combination with fluoropyrimidine- and platinum-containing chemotherapy for the first- line treatment of adult patients with locally advanced unresectable or metastatic human epidermal growth factor receptor 2 (HER2)- negative gastric or gastroesophageal junction (GEJ) adenocarcinoma whose tumors are claudin (CLDN) 18.2 positive.

- June 2025: Glenmark Pharmaceuticals Ltd launched Tevimbra (tislelizumab) in India to offer immuno-oncology treatment for lung and esophageal cancer following approval by the Central Drugs Standard Control Organization (CDSCO).

- December 2022: Genentech Inc. received approval from the U.S. FDA for updated labeling for capecitabine tablets (Xeloda, Genentech, Inc.) under Project Renewal, an Oncology Center of Excellence (OCE) initiative. The drug is administered orally.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.97% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Therapy Type, Cancer Type, Route of Administration, Distribution Channel, and Region |

|

By Therapy Type |

· Chemotherapy · Immunotherapy · Targeted Therapy · Others |

|

By Cancer Type |

· Squamous Cell Esophageal Cancer · Adenocarcinoma · Others |

|

By Route of Administration |

· Oral · Parenteral |

|

By Distribution Channel |

· Hospital Pharmacies · Retail Pharmacies & Drug Stores · Others |

|

By Region |

· North America (By Therapy Type, Cancer Type, Route of Administration, Distribution Channel, and Country) o U.S. o Canada · Europe (By Therapy Type, Cancer Type, Route of Administration, Distribution Channel, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Therapy Type, Cancer Type, Route of Administration, Distribution Channel, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Therapy Type, Cancer Type, Route of Administration, Distribution Channel, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Therapy Type, Cancer Type, Route of Administration, Distribution Channel, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.16 billion in 2025 and is projected to reach USD 7.39 billion by 2034.

In 2025, the market value stood at USD 1.36 billion.

The market is expected to exhibit a CAGR of 8.97% during the forecast period of 2026-2034.

The immunotherapy segment led the market by therapy type.

The key factors driving the market are the expanding research and development initiatives, rising prevalence and new product launches.

Merck & Co., Inc., Bristol-Myers Squibb. and Astellas Pharma Inc., are some of the prominent players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us