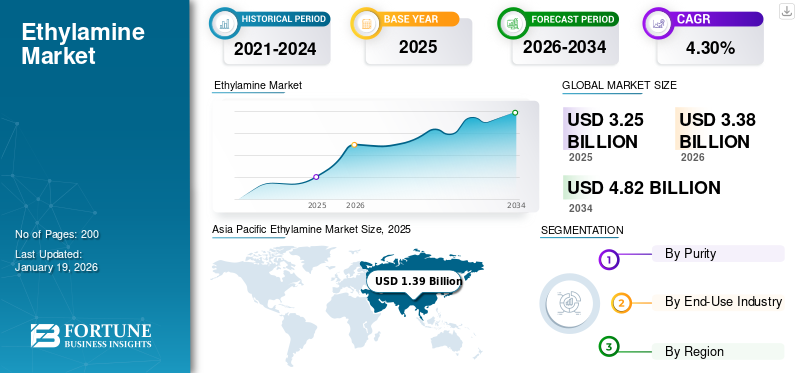

Asia Pacific accounted for a market size of USD 1.39 billion in 2025 and is projected to reach USD 1.45 billion in 2026, representing a 43% market share in 2025. driven by rapid industrialization, expanding pharmaceutical manufacturing, and increasing agricultural modernization. Countries such as China, India, Japan, and South Korea lead global demand due to their large-scale production of pharmaceuticals, agrochemicals, and rubber-based goods. The region benefits from cost-competitive manufacturing, growing urban populations, and improving healthcare infrastructure.

Ethylamine Market Size, Share & Industry Analysis, By Purity (99.9%, 99.5%, and 99.0%), By End-Use Industry (Agrochemicals, Rubber & Plastics, Textiles, Healthcare & Pharmaceuticals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global ethylamine market size was valued at USD 3.29 billion in 2025. The market is projected to grow from USD 3.38 billion in 2026 to USD 4.82 billion by 2034, exhibiting a CAGR of 4.30% during the forecast period. Asia Pacific dominated the ethylamine market with a market share of 43% in 2025.

Ethylamine is a clear, colorless, and flammable organic compound with a strong ammonia-like odor. It is classified as a primary amine with the chemical formula C₂H₅NH₂ and is structurally derived from ammonia by replacing one hydrogen atom with an ethyl group. Due to its high solubility in water and various biological solvents, it is widely used in industrial processes. Additionally, it plays an important role in the synthesis of pharmaceutical compounds, rubber processing chemicals, and dyes. The global market is witnessing steady growth opportunities, driven by its expanding applications across key industries, such as agriculture, pharmaceuticals, and rubber manufacturing. Rising demand from the healthcare & pharmaceuticals industry, chemical industry, and plastics industry will significantly drive the market growth.

Key players in the market include BASF, Huntsman International LLC., Balaji Amines, Sigma Aldrich, and Eastman Chemical Company.

ETHYLAMINE MARKET TRENDS

Rising Shift toward Sustainable Chemical Manufacturing to Favor Market Growth

A growing global focus on sustainability is pushing manufacturers to adopt greener and more environmentally friendly production processes, including in the market. This trend is fueled by increasing regulatory pressure, consumer awareness, and corporate environmental goals. Ethylamine producers are actively exploring the use of bio-based feedstocks and energy-efficient synthesis methods to reduce carbon emissions and minimize the generation of hazardous byproducts. As the chemical industry moves toward sustainable economic practices, ethyl-based amine producers are investing in eco-friendly innovations to gain a competitive edge. This is expected to boost the ethylamine market growth in the coming years.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Agrochemical Industry is Fueling Market Growth

Ethylamine is widely used in the agricultural sector as a building block for synthesizing pesticides, herbicides, and fungicides. As global food demand rises in tandem with a growing population, the need for high-efficiency crop protection solutions has intensified. Ethylamine-based agrochemicals are essential for enhancing crop yield, preventing pest infestation, and improving farm productivity. With increasing concerns over food security, especially in developing economies, the adoption of advanced agrochemical formulations is gaining traction. Moreover, as agricultural technology evolves with precision farming and targeted application of chemicals, is reinforcing the demand for reliable compounds such as ethylamine. This positions ethyl-based amine as an important growth driver in the agrochemical industry.

MARKET RESTRAINTS

Health and Environmental Risks Could Limit Market Growth

The product is classified as a hazardous chemical due to its flammability, volatility, and toxicological effects on human health and the environment. Exposure to the product can lead to skin and respiratory irritation, eye damage, and central nervous system effects. Its strong odor and reactive nature make handling, storage, and transportation challenging, particularly under high-temperature conditions. Furthermore, accidental spills or leakages may lead to soil and water contamination, prompting regulatory actions and environmental remediation liabilities. These health and ecological risks have raised concerns among end-users and regulatory bodies, leading to tighter controls and usage limitations.

MARKET OPPORTUNITIES

Expansion of the Specialty Chemical Industry Poses a Strong Market Opportunity

Ethylamine’s versatility and reactivity make it a valuable building block in the specialty chemicals segment, particularly for the production of corrosion inhibitors, emulsifiers, and surfactants. These chemicals are gaining traction across a wide array of industries such as pharmaceuticals, agrochemicals, oil and gas, water treatment, personal care, and textiles. As the markets shift toward high-performance and efficiency-driven specialty chemicals, they will be used for customized product development. Additionally, the chemical industry’s resilience to price fluctuations and ability to make higher profit margins enhance its attractiveness as a growth avenue.

- As per the India Brand Equity Foundation (IBEF), India ranks as the 6th largest manufacturer of chemicals in the world and 3rd in Asia, with the industry valued at USD 220.0 billion in 2024 and projected to reach USD 300.0 billion by 2030, contributing 7% to India’s GDP. This growth trajectory offers a major opportunity for product adoption within India’s expanding chemical industry.

MARKET CHALLENGES

Raw Material Supply Chain Vulnerability Could Pose a Major Challenge to Market

Ethylamine production is heavily dependent on petrochemical-derived inputs such as ethanol and ammonia, which are susceptible to global supply chain disruptions. Events such as geopolitical conflicts, natural disasters, or trade restrictions can severely impact the availability and pricing of these raw materials. Moreover, dependence on a limited number of suppliers or regions further intensifies this vulnerability. This makes it difficult for manufacturers to maintain steady production volumes or plan long-term investments confidently.

TRADE PROTECTIONISM

Trade protectionism has become a major issue impacting the global market. For example, administrative barriers and anti-dumping duties in various nations may affect the import and export dynamics of amine and its byproducts. Moreover, geopolitical tensions and trade wars can disrupt the smooth flow of materials and goods, leading to volatility in the market.

Download Free sample to learn more about this report.

Segmentation Analysis

By Purity

99.5% Segment Dominated Due to Versatile Industrial Applications

Based on purity, the market is classified into 99.9%, 99.5%, and 99.0%.

The 99.5% segment held the highest ethylamine market share in 2024. The grade serves as a versatile intermediate across multiple industries, including agrochemicals, dyes, and rubber processing. This grade creates a balance between quality and cost, making it suitable for applications where moderate impurity levels are acceptable without compromising final product effectiveness. In agriculture, 99.5% purity is commonly used in the making of pesticides, herbicides, and fungicides, supporting crop yield and pest control efficiency. It is also used in the manufacturing of corrosion inhibitors, emulsifiers, and surfactants for various industrial uses.

Ethylamine, with 99.9% purity, also holds a significant share in the market. This variant is mostly used in pharmaceutical and biotechnology applications where stringent quality standards are required. This ultra-pure form ensures minimal contamination, making it ideal for the synthesis of active pharmaceutical materials, laboratory reagents, and research-grade compounds. Its high level of purity helps maintain the integrity of end products, especially in critical drug formulations where even trace impurities can affect efficacy and safety. Industries involved in fine chemical synthesis, medical diagnostics, and specialty coatings also prefer 99.9% purity for its consistent performance and regulatory compliance.

Ethylamine with 99.0% purity is generally utilized in applications where ultra-high purity is not a critical requirement. It is particularly common in bulk chemical synthesis, textile processing, and the production of certain rubber accelerators and resins. As the most cost-effective grade, the product having purity 99.0% is ideal for large-scale industrial processes that prioritize volume and basic chemical functionality over purity precision. This grade provides sufficient chemical reactivity for many end uses without incurring the higher costs associated with purer forms. This grade is especially favored by manufacturers in developing regions, where budget constraints and limited regulatory demands make lower-purity variants more viable.

By End-Use Industry

Agrochemicals Segment Held Largest Share Due to Increasing Product Use in Pesticides and Herbicides

Based on end-use industry, the market is classified into agrochemicals, rubber & plastics, textiles, healthcare & pharmaceuticals, and others.

The agrochemicals segment accounted for the largest share in 2024. In this end-use industry, ethyl-based amine is used as a key intermediate in the production of herbicides, fungicides, and pesticides. Its chemical properties allow it to act as a building block in producing various crop protection agents that enhance agricultural productivity and help safeguard yields from pests and diseases. With the global shift toward sustainable farming practices, amine-based agrochemicals are evolving to be more efficient and environmentally friendly, supporting the demand for advanced formulations in modern agriculture.

In the rubber and plastics industry, the amine is extensively used as a precursor in the production of rubber accelerators, plasticizers, and vulcanization agents. These chemicals improve the elasticity, durability, and heat resistance of rubber products and plastics, making them essential for automotive components, footwear, and industrial goods. Amine-based intermediates significantly contribute to the performance and longevity of products such as tires, conveyor belts, and molded plastic items. The growth of the automotive sector and rising consumer demand for lightweight, durable materials continue to drive the product consumption in this segment.

Healthcare and pharmaceuticals represent a critical end-use industry for the product, given its role as an essential intermediate in synthesizing various active pharmaceutical ingredients. It is widely used in producing antihistamines, anesthetics, antiseptics, and several other drug classes that require amine-based compounds for therapeutic efficacy. The expanding global healthcare infrastructure, aging populations, and increasing frequency of chronic diseases are driving demand for pharmaceutical formulations containing amine derivatives.

Ethylamine Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Ethylamine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America holds a significant share of the market due to its well-established pharmaceutical, agrochemical, and specialty chemical industries. The U.S. and Canada benefit from advanced manufacturing infrastructure, stringent regulatory frameworks, and strong R&D capabilities. Market growth is driven by the healthcare sector’s continuous need for high-purity ethylamine in drug synthesis and the growing adoption of agrochemicals to support large-scale, commercial farming operations.

Europe

Europe is a significant market, supported by its diversified chemical manufacturing landscape and stringent environmental regulations. Countries such as Germany, France, and the U.K. are leaders in pharmaceutical production, driving demand for high-purity products used in active APIs and specialty chemical intermediates. The European Union’s strict chemical safety policies encourage cleaner production practices and higher-quality standards. Additionally, rising investments in green chemistry and circular economy initiatives are shaping the region’s market dynamics.

Latin America

The product consumption is on the rise due to the growing demand for agrochemicals in key agricultural economies in Latin America, such as Brazil and Argentina. Furthermore, the expansion of pharmaceutical manufacturing and industrial diversification is opening up new avenues for the product utilization across the region.

Middle East & Africa

In the Middle East & Africa, the oil and gas industry is a major consumer of the product, which is used as a corrosion inhibitor for infrastructure maintenance and protection. With expanding oil and gas exploration and production operations, especially in the region, the demand for the product in industrial maintenance is growing. Additionally, nations in the Middle East & Africa region are making investments in diversifying their industrial base, with a strong emphasis on chemical production. Industrial diversification is driving the adoption of the product in various sectors such as rubber chemicals and plastics, contributing to broader market growth across the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Focus on Innovation to Strengthen Their Market Presence

The market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include BASF, Huntsman International LLC., Balaji Amines, Sigma Aldrich, and Eastman Chemical Company. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY ETHYLAMINE COMPANIES PROFILED

- BASF (Germany)

- Sigma Aldrich (Germany)

- Huntsman International LLC. (U.S)

- Balaji Amines (India)

- Alkyl Amines Chemicals Limited (India)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- Eastman Chemical Company (S.)

- Ascensus (U.S)

- Galaxy Laboratories (India)

- Otto Chemie Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- September 2024: BASF inaugurated a new world-scale production plant for alkyl ethanolamines at its Antwerp Verbund site. This new investment will help the company to expand its production capacity for alkyl ethanolamines, including dimethyl ethanolamine (DMEOA) and methyl diethanolamine (MDEOA), by nearly 30 percent to over 140,000 tons per year.

- December 2023: BASF SE announced the completion of its capacity expansion for key specialty amines in the U.S. The strategic move enhances the company’s ability to produce increased volumes of polyetheramines and amine catalysts marketed under the Baxxodur and LupragenTM brands.

- February 2022: Eastman Chemical Company completed the expansion of its tertiary amine production capacity, DIMLA 1214, at its manufacturing sites in Ghent, Belgium, and Pace, Florida. The expansion aims to meet customer demand across diverse markets, reinforcing Eastman’s position in the global amines sector.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.30% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kilotons) |

|

Segmentation |

By Purity

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.25 billion in 2025 and is projected to reach USD 4.82 billion by 2034.

In 2025, the market value stood at USD 1.39 billion.

The market is expected to exhibit a CAGR of 4.30% during the forecast period of 2026-2034.

By purity, the 99.5% segment led the market in 2024.

Increasing use of pesticides, herbicides, and fungicides in the agriculture sector is a key factor driving the market.

BASF, Huntsman International LLC, Balaji Amines, Sigma Aldrich, and Eastman Chemical Company are some of the leading players in the market.

Asia Pacific dominated the ethylamine market with a market share of 43% in 2025.

The growth of the agrochemical industry in various countries such as China, India, and the U.S. is expected to favor product adoption.

Seeking Comprehensive Intelligence on Different Markets?Get in Touch with Our Experts

Speak to an Expert

Download Free Sample

Chemicals & Materials

Clients

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us