Europe Artificial Intelligence Market Size, Share & Industry Analysis, By Component (Hardware, Software, & Services), By Deployment (On-premise & Cloud), By Enterprise Type (Large Enterprises and Small & Medium-sized Enterprises), By Technology (ML, NLP, Computer Vision, Robotics & Automation, and Expert Systems), By Function (HR, Marketing & Sales, Product/Service Deployment, Service Operation, Risk, & Supply-chain Management), By Industry (Healthcare, Automotive, BFSI, Retail, Manufacturing, Agri, Government, IT & Telecom, Energy & Utilities, and Education) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

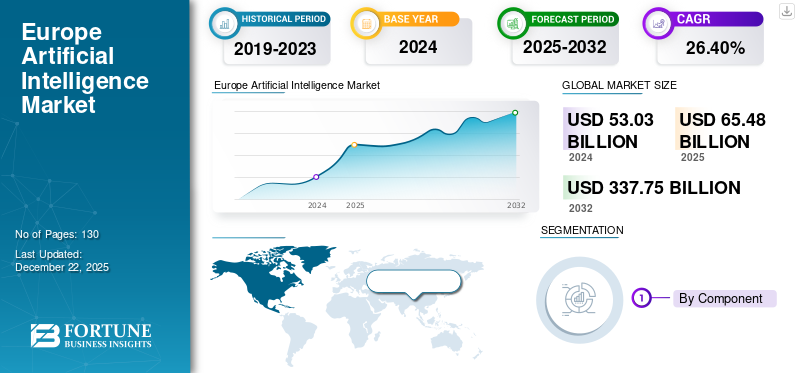

Europe Artificial Intelligence market size was valued at USD 53.03 billion in 2024. The market is projected to grow from USD 65.48 billion in 2025 to USD 337.75 billion by 2032, exhibiting a growth at a CAGR of 26.40% during the forecast period.

With a strategic emphasis on digital sovereignty, ethical AI, and innovation-driven growth, Europe is emerging as a global force in artificial intelligence development and adoption. The region has moved beyond early experimentation and is now embedding AI at scale across critical sectors such as healthcare, financial services, mobility, and industrial manufacturing. Backed by a solid regulatory framework, cutting-edge research institutions, and substantial public-private investment, Europe is cultivating a distinctly responsible and human-centric AI ecosystem. In 2025, the region accelerated the commercialization of AI technologies and strengthened its position as a leader in AI governance, infrastructure, and cross-border collaboration.

Impact of Generative AI

The generative AI movement is reshaping the European AI landscape, stimulating creativity and innovation in content generation, automation, and human-computer interaction. It is being adopted at an accelerating rate across both the public and private sectors in areas such as media, healthcare, and customer service, where end users can derive benefits from improved decision-making and enhanced personalization of experiences. Europe's focus on transparency and ethical AI may also shape the development of safe and open generative models that align with regulation and enhance Europe's position as a responsible leader in the adoption of AI. For instance,

- In March 2025, Meta launched its Meta AI generative assistant across 41 European countries, more than a year after its U.S. debut. Due to strict EU data regulations, the assistant would offer text-only responses (unlike image generation in the U.S.) and was not trained on EU user data.

Impact of Reciprocal Tariffs

Reciprocal tariffs can disrupt the European AI market by increasing the cost of essential imports such as AI chips and cloud services. For instance,

- If the EU imposes a 20% tariff on U.S.-made AI hardware in response to trade barriers, French AI startups relying on those chips may face higher costs and project delays.

This could slow innovation in the short term while pushing Europe to invest more in local AI infrastructure and reduce dependency on foreign technology.

Europe Artificial Intelligence Market Trends

Widespread Adoption of AI Across Industries Boosts Market Growth

A major trend in the market is the extensive implementation of AI features in marketing, logistics, and cybersecurity programs. For instance,

- Over 13% of European Union businesses with at least 10 employees had adopted artificial intelligence technology in 2024, reflecting a 5.5 %increase from 2023, according to Eurostat.

AI video advertising helps businesses cut costs and speed up marketing campaign delivery. At the same time, logistics companies use AI agents for real-time decision-making to optimize supply chains and boost efficiency. AI also enhances threat detection and response in cybersecurity, though it also presents new challenges.

Key takeaways

- The European Artificial Intelligence market is projected to be worth USD 337.75 billion in 2032.

- By component, the software segment accounted for around 49.8% of the European Artificial Intelligence Market share in 2024.

- By deployment, the cloud segment is projected to grow at a CAGR of 27.8% during the forecast period.

- As per enterprise type, the large enterprises segmentation accounted for around 59.7% of the market in 2024.

- By function, the risk segment is projected to grow at a CAGR of 29.2% in the forecast period.

- By technology, Machine Learning accounted for around 40.2% of the market in 2024.

- As per the industry, the healthcare segment is projected to grow at a CAGR of 34.0% during the forecast period.

- The Artificial Intelligence Market in the U.K. was worth USD 13.15 billion in 2024.

- By region, France is projected to grow at a CAGR of 30.4% during the forecast period.

Europe Artificial Intelligence Market Growth Factors

Rising Availability of Structured and Unstructured Data to Boost Market Growth

The increasing availability of structured and unstructured data across industries is a significant factor speeding up the implementation of AI technologies in Europe. As businesses digitally transform, vast amounts of data are generated from customers, connected devices, social media, and business processes. The sheer volume of data necessitates sophisticated AI tools that can identify patterns and derive insights for predictive analysis. Organizations are increasingly utilizing AI to support critical decision-making, boost efficiency, and gain a competitive edge.

Europe Artificial Intelligence Market Restraints

Data Privacy and Regulatory Challenges to Hinder Market Growth

The stringent regulatory environment in the region, particularly under the General Data Protection Regulation, is a key restraint on the Europe Artificial Intelligence market growth. For instance,

- The EU AI Act is the first global legal framework for artificial intelligence, designed to ensure AI is safe, ethical, and trustworthy in Europe. It classifies AI systems into four risk levels: unacceptable, which are banned; high risk, which must meet strict transparency, human oversight, and data quality standards; limited risk, which requires clear disclosure; and minimal risk, which faces no additional rules.

Additionally, the cost of maintaining and upgrading AI systems poses a continuous financial burden. This creates a gap between big companies that can afford it and smaller ones, slowing market penetration.

Europe Artificial Intelligence Market Segmentation Analysis

By Component

Based on component, the market is divided into hardware, software, and services.

The software segment is expected to hold the largest Europe Artificial Intelligence market share. This is due to the high demand for AI algorithms, machine learning, natural language processing, and AI software solutions from various industries. For instance,

- In June 2025, Nvidia partnered with Perplexity and Mistral AI to boost Europe’s AI infrastructure and develop localized AI models in multiple European languages. Mistral launched Mistral Compute, an AI platform powered by 18,000 Nvidia chips in France, to enhance Europe’s AI independence.

European companies focus on AI software solutions that are scalable and customizable to process data and automate workflows.

The hardware segment is expected to grow with the highest CAGR in the market during the forecast period due to the growing investments in infrastructure designed specifically for AI applications, such as specialized AI chips, GPUs, and edge computing devices. The continent’s efforts to build sovereign AI and data centers, coupled with the advancement of energy-efficient hardware, are accelerating hardware adoption in the region.

By Deployment

Based on deployment, the market is bifurcated into on-premise and cloud.

The cloud segment holds the largest share of the market due to its scalability, flexibility, and cost-effectiveness. Organizations across the continent are implementing cloud-based AI solutions to tap into immense computational power without needing extensive in-house infrastructure. They also facilitate the implementation of AI services and the cooperation of teams that are distributed across different locations. Additionally, recent investment in the region also supports this trend. For instance,

- In July 2025, Oracle announced it to invest USD 3.51 billion over five years to expand AI and cloud infrastructure in Germany and the Netherlands, allocating USD 2.34 billion to Germany and USD 1.17 billion to the Netherlands. This expansion aims to support enterprises and public sectors with advanced, sovereign cloud and AI services, boosting local innovation and compliance with EU data regulations.

By Enterprise Type

Based on enterprise type, the market is segmented into Large enterprises and SMEs.

Large enterprises are expected to hold the majority share, as they have been investing in digital transformation for a long time. Many of these corporations operate in multiple countries, requiring AI systems to manage their activities and processes. Their priorities extend beyond mere cost efficiency to encompass strategic initiatives such as sustainability, ethical AI application, and staying competitive.

- According to the European Commission, in 2024, AI adoption was significantly more common among larger enterprises in the EU, with about 41% of companies employing 250 or more people using the technology. In comparison, only 21% of medium-sized firms and 11% of small businesses had adopted AI during the same period.

Small and medium-sized enterprises (SMEs) in Europe are expected to grow with the highest CAGR due to the growing availability of AI solutions that cater to specific niche needs and comply with local regulations. European SMEs are leveraging AI to enhance business agility, improve customer personalization, and strengthen supply chains’ resiliency, often supported by EU-funded programs and initiatives.

By Function

Based on function, the market is segmented into human resources, marketing & sales, product/service deployment, service operation, risk, supply chain management, and others.

The service operation segment is expected to secure the largest share due to regional support for the automation of public services, manufacturing, and customer experience. The market for AI will likely witness enterprises, particularly in utilities, telecommunications, and mobility, adopting AI to streamline service delivery, manage multilingual service systems, and address employment shortages with supporting service continuity. For instance,

- The European Commission launched GPT@EC in October 2024, a secure AI tool designed to boost staff productivity by assisting with tasks such as drafting and summarizing documents. Developed in-house, it limits data exposure by avoiding third-party platforms.

The risk function segment is expected to register the largest compound annual growth rate (CAGR) within Europe’s AI market, driven by increased regulatory scrutiny, rising cybersecurity threats, and growing demand for compliance and fraud prevention in the financial sector.

By Technology

Based on technology, the market is segmented into machine learning, natural language processing, computer vision, robotics and automation, and expert systems.

Machine learning is the foremost technology in the European artificial intelligence space. It represents the largest share of the market and will also have the highest compound annual growth rate (CAGR) in the next few years. The dominance of this segment is attributed to its versatility across various sectors, including healthcare, finance, manufacturing, and public services, where it underpins the majority of available use cases (e.g., predictive maintenance, personalized healthcare, and fraud detection). For instance,

- According to Itransition, European banks that shifted from traditional statistical methods to machine learning saw sales of new products rise by up to 10% and experienced a decrease in customer churn by 20%. This transition has notably improved their sales performance and customer retention.

European organizations are adopting machine learning to improve operational efficiency while adhering to strict regulatory and ethical considerations.

By Industry

Based on industry, the market is segmented into healthcare, automotive, retail, BFSI, manufacturing, agriculture, government and public sector, IT & Telecom, energy and utilities, and education.

The BFSI (Banking, Financial Services, and Insurance) segment will capture the largest share of the Europe artificial intelligence market, supported by strong financial infrastructure, growing demand for automation, and stringent regulatory compliance. For instance,

- According to the European Banking Federation, within the next five years, it is projected that 83% of financial services firms will have adopted AI technologies, placing the industry among the most rapidly impacted by AI integration.

Financial institutions are increasingly using AI for fraud detection, credit scoring, risk assessment, and customer service automation to improve security and operational efficiency.

The healthcare segment is expected to achieve the highest compound annual growth rate (CAGR) as AI helps improve patient outcomes through advanced diagnostics, remote monitoring, and automated data analysis, addressing challenges such as aging populations and increasing healthcare costs. This makes AI solutions crucial for efficient, scalable medical care.

By Country

Based on country, the market is segmented into the U.K., Germany, France, Italy, Spain, Russia, Benelux, Nordics, and the Rest of Europe.

The U.K. is anticipated to maintain the largest share of the market, largely due to a robust tech ecosystem, established academic institutions, and solid government support to develop the ecosystem for AI. For instance,

- In July 2025, OpenAI and the U.K. government signed a strategic partnership to expand OpenAI's London office and invest in AI infrastructure, including Growth Zones and data centres. The collaboration aims to boost public services, drive economic growth, and enhance AI security research.

France, on the other hand, is expected to grow with the highest CAGR, supported by significant investments from both the private and public sectors in AI development, and a comprehensive national strategy for AI. Most recently, growth has also been driven by the rapid expansion of AI startups in mobility, healthcare, and smart manufacturing.

List of Key Companies in the Europe Artificial Intelligence Market

The Europe artificial intelligence market is increasingly shaped by a new generation of innovative companies that are challenging global incumbents and defining Europe’s distinct AI identity. Notable among these is Evolution AI, which specializes in intelligent document processing for financial institutions, offering scalable and secure automation solutions that align with Europe's stringent data privacy standards. Wavye, based in the U.K., is making significant strides in applying AI to autonomous driving technologies, focusing on vision-based systems that are both cost-efficient and safety-oriented.

Meanwhile, Mistral AI, headquartered in France, is rapidly gaining recognition for its work in open-weight generative AI models, positioning itself as a European alternative to U.S.-dominated foundation model providers. These AI companies, along with a growing cohort of AI startups and research-driven spinouts, represent Europe’s push toward technological sovereignty, ethical AI, and specialized, domain-focused innovation. Their rise reflects a shift from reliance on imported platforms to a more self-sustaining and globally competitive AI ecosystem.

LIST OF KEY COMPANIES PROFILED

- Evolution AI (U.K.)

- Wayve (U.K.)

- ai (U.K.)

- Synthesia (U.K)

- Aleph Alpha (Germany)

- Instinctools (Germany)

- Mistral AI (France)

- Dataiku (France)

- Cardo AI (Italy)

- iGenius (Italy)

- Maxilect (Russia)

- Concetto Labs (Russia)

- SimbirSoft (Russia)

KEY INDUSTRY DEVELOPMENTS

- August 2025: Germany and NVIDIA are partnering to build Europe’s first industrial AI cloud, launching the continent’s most ambitious AI manufacturing project. Set to deploy 10,000 NVIDIA GPUs, this AI factory would accelerate manufacturing processes such as design, engineering, simulation, and robotics.

- February 2024: The European Union’s InvestAI initiative is a USD 51.91 billion public investment aimed at boosting AI innovation across Europe by mobilizing a total of USD 207.65 billion with private sector contributions. It focuses on creating AI gigafactories equipped with cutting-edge chips to train advanced AI models for critical sectors such as healthcare and industry.

REPORT COVERAGE

The Europe artificial intelligence market report delivers an in-depth evaluation of the industry landscape, highlighting key trends, drivers, and strategic developments such as partnerships, investments, and technology advancements. It explores the increasing integration of AI across diverse sectors such as finance, healthcare, and manufacturing, alongside a rising focus on AI-driven automation and decision-making tools. The report also examines the impact of generative AI, the expansion of AI research hubs, and the surge in demand for AI-powered analytics and personalized solutions.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 26.40% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Hardware · Processors (GPU, FPGA, ASIC, and CPU) · Memory Systems · Storage Devices · Software · Services · AI Strategy Advisory/Consulting Services · System Integration and Deployment · AI Model Development · Process Automation and Optimization · AI Training · AI-powered Customer Experience · Support & Maintenance |

|

By Deployment · On-premise · Cloud · Public Cloud · Private Cloud · Hybrid Cloud |

|

|

By Enterprise Type · Large Enterprises · Small and Mid-sized Enterprises (SMEs) |

|

|

By Technology · Machine Learning · Supervised Learning · Unsupervised Learning · Reinforcement Learning · Natural Language Processing (NLP) · Speech Recognition · Text Analytics · Language Translation · Computer Vision · Image Recognition · Object Detection · Robotics and Automation · Expert Systems · Rule-based Expert System · Knowledge-based System |

|

|

By Function · Human Resources · Marketing & Sales · Product/Service Deployment · Service Operation · Risk · Supply-Chain Management · Others (Strategy and Corporate Finance) |

|

|

By Industry · Healthcare · Diagnostic AI · Clinical AI · Hospital Management System · Automotive · Autonomous Vehicle · AI in Mobility-as-a-Service · BFSI · Fraud Detection · Risk Management · Algorithmic Trading · Retail · Customer Analytics · AI-powered Marketing and Sales · Supply Chain Automation · Manufacturing · Predictive Maintenance · AI-driven Robotics and Automation · Agriculture · Smart Farming · Yield Monitoring and Optimization · Crop Disease Detection · Government and Public Sector · Smart City Initiatives · Law Enforcement AI · Disaster Management · IT & Telecom · Network Optimization · AI Chatbots · Intelligent Call Routing · Energy & Utilities · Grid Management · AI in Renewable Energy Management · Education · Adaptive Learning Platform · AI-assisted Learning Tools |

|

|

By Country · U.K. · Germany · France · Italy · Spain · Russia · Benelux · Nordics · Rest of Europe |

Frequently Asked Questions

Fortune Business Insights says that the Europe Artificial Intelligence market was worth USD 53.03 billion in 2024.

The market is expected to exhibit a CAGR of 26.40% during the forecast period (2025-2032).

By industry, the BFSI industry is set to lead the market.

Evolution AI, Wayve, Data.ai, and Cardo AI are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us