Europe Cloud Computing Market Size, Share & Analysis, By Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

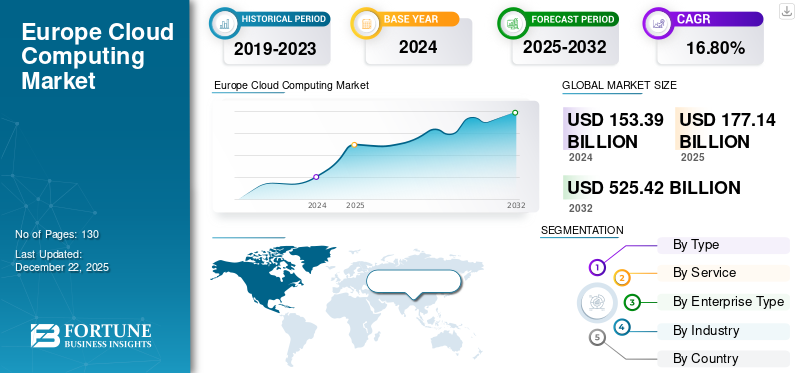

Europe cloud computing market size was valued at USD 153.39 billion in 2024. The market is projected to grow from USD 177.14 billion in 2025 to USD 525.42 billion by 2032, exhibiting a CAGR of 16.80% over the forecast period.

Europe has witnessed significant growth in cloud computing adoption, driven by increasing digital transformation initiatives across various industries. With businesses recognizing the critical role of cloud solutions in enhancing efficiency and innovation, cloud penetration has steadily expanded across the region. By 2025, a majority of enterprises across key European countries will have integrated cloud services into their operations, reflecting a broad shift toward scalable and flexible IT infrastructure.

- According to the European Commission, cloud computing adoption in Europe has grown by approximately 4 % points between 2021 and 2023.

Europe Cloud Computing Market Trends

Surge in AI Demand and Edge Expansion to be Key Driver for Market Growth

The growing integration of AI technologies is driving a fundamental shift in cloud computing needs across Europe. Organizations are increasingly relying on advanced cloud and edge infrastructures that can handle the low-latency, high-speed processing AI applications requirement. This has prompted a strong focus on expanding edge computing capabilities, bringing data processing closer to where it’s generated to support real-time decision-making.

- As per Medium, the percentage of European companies actively using AI increased from around 33% in 2023 to 42% in 2024, with widespread adoption expected across nearly all businesses by 2030 if this trend continues.

Key takeaways

- The Europe Cloud Computing Market is projected to be worth USD 525.42 billion in 2032.

- In the by type segmentation, public cloud accounted for around 58.4% of the Europe Cloud Computing Market in 2024.

- In the by service segmentation, Infrastructure as a Service (IaaS) is projected to grow at a CAGR of 18.6% in the forecast period.

- In the by enterprise type segmentation, Large Enterprises accounted for around 57.3% of the market in 2024.

- The Cloud Computing Market in Germany was worth USD 41.10 billion in 2024.

- In the by region segmentation, Spain is projected to grow at a CAGR of 21.6% in the forecast period.

Europe Cloud Computing Growth Factors

Data Sovereignty & Digital Sovereignty Initiatives to Boost Market Growth

Data sovereignty, the principle that data should be stored, processed, and governed according to local laws and values, is an important and growing impetus for cloud adoption in the region in Europe. European governments and enterprises alike desire ever more control over where their data is stored, processed, and who has access to it. The desire for means of control has increased in light of foreign surveillance that has affected a number of European countries, as well as inconsistent regional data transfer requirements.

- According to Cloud Security Alliance, Cloud providers in Europe risk fines of up to 6% of global turnover for major DSA violations, while minor breaches such as false disclosures can lead to fines of up to 1%, highlighting the importance of regulatory compliance.

Europe Cloud Computing Market Restraints

Dominance by U.S. Hyperscalers Restraint Market Growth

The European cloud market is heavily dominated by U.S.-based hyperscalers such as AWS, Microsoft Azure, and Google Cloud. Their scale, global reach, and advanced service offerings create high entry barriers for European providers, limiting local competition and reducing market diversity. This dominance can discourage innovation and make it challenging for regional players to gain meaningful traction.

- According to CRN, in Q2 2025, AWS, Google Cloud, and Microsoft collectively captured 63% of the global enterprise cloud infrastructure services market.

- According to the French digital industry association, American companies account for 80% of the European Union’s annual professional cloud computing expenditure, totaling USD 301 billion.

Europe Cloud Computing Market Segmentation Analysis

By Type

Based on type, the market is divided into public cloud, private cloud, and hybrid cloud.

Public cloud holds the largest Europe cloud computing market share due to widespread enterprise use and well-established infrastructure. However, the hybrid cloud segment is projected to experience the fastest growth during the forecast period.

By Service

Based on service, the market is trifurcated into infrastructure as a service(IaaS), platform as a service(PaaS), and software as a service(SaaS).

SaaS continues to dominate the market, driven by rising demand for cost-effective, subscription-based software solutions that support remote collaboration, customer relationship management, and enterprise resource planning.

Meanwhile, the infrastructure as a service (IaaS) segment is experiencing the fastest Europe cloud computing market growth, fueled by increasing digital infrastructure investments, especially among startups, tech firms, and public sector institutions seeking to scale quickly without heavy upfront costs.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

In Europe, cloud adoption is deeply ingrained among large enterprises, which continue to prioritize investment in scalable infrastructure and advanced cloud-native solutions to support their digital ambitions. At the same time, small and medium-sized enterprises (SMEs) are embracing cloud technologies at a swift pace, encouraged by increasingly accessible, flexible, and cost-effective cloud services.

- According to the European Commission, in 2023, 42.5% of EU enterprises purchased cloud computing services, primarily for email, file storage, and office software.

By Industry

Based on industry, the market is segmented into BFSI, IT and telecommunications, government, consumer goods and retail, healthcare, manufacturing, and others.

The IT and telecommunications sector continues to lead cloud adoption in Europe, utilizing advanced cloud infrastructures to enhance data processing, upgrade networks, and drive innovation in digital services.

At the same time, the healthcare sector is emerging as one of the fastest-growing adopters, fueled by rising needs for secure data management, telehealth solutions, and regulatory compliance.

By Country

Based on country, the market is segmented into U.K., Germany, France, Italy, Spain, Russia, Benelux, Nordics, and Rest of Europe.

Germany leads the market, driven by its advanced industrial base, strong digital infrastructure, and high adoption rates among enterprises across sectors such as manufacturing and automotive. The country’s focus on Industry 4.0 initiatives and investment in cloud-native technologies have solidified its position as the region’s largest cloud market.

- A survey reveals that 97% of German companies with 50 or more employees depend on cloud computing.

Meanwhile, Spain is emerging as the fastest-growing market in Europe, with the highest compound annual growth rate (CAGR). Such a rise is fueled by increasing digitalization efforts, supportive government policies, and growing adoption of cloud services among small and medium-sized enterprises.

List of Key Companies in Europe Cloud Computing Market

Krystal Hosting, IONOS, and Hetzner Online are among the prominent players in the market, recognized for their strong regional presence and commitment to data sovereignty, energy efficiency, and transparent pricing. These companies cater primarily to small and medium-sized enterprises (SMEs), developers, and organizations seeking localized cloud infrastructure that complies with strict European data protection regulations.

Other notable players include Scaleway, Clever Cloud, and a range of smaller but agile providers that are investing in innovative solutions such as green data centers, edge computing, and sovereign cloud environments. These companies are actively pursuing strategies such as expanding their server networks across Europe, developing industry-specific cloud tools, and enhancing customer support capabilities.

LIST OF KEY COMPANIES PROFILED

- Krystal Hosting Ltd (U.K.)

- DataBuzz (U.K.)

- IONOS Inc. (Germany)

- Deutsche Telekom AG (Germany)

- Hetzner Online Gmbh (Germany)

- Scaleway SAS (France)

- Clever Cloud (France)

- Retelit S.p.A (Italy)

- WIIT Group (Italy)

- Gigas Hosting S.A. (Spain)

- Coderland (Spain)

KEY INDUSTRY DEVELOPMENTS

- August 2025: Amazon Web Services (AWS) announced that its European Sovereign Cloud, set to launch by the end of 2025, will be operated exclusively by EU citizens based in the EU, ensuring compliance with EU laws and digital sovereignty needs.

- July 2025: Microsoft has reached an agreement with CISPE, allowing European cloud providers to offer Microsoft software such as Windows Server and SQL Server on a pay-as-you-go basis. This follows a USD 21.7 million settlement resolving antitrust disputes over Microsoft’s Azure practices. CISPE members can now host Microsoft workloads on European infrastructure without sharing customer data.

REPORT COVERAGE

The Europe cloud computing market report provides a comprehensive analysis of the regional landscape. It highlights market dynamics, regulatory developments, and key strategic initiatives such as mergers, partnerships, and data sovereignty efforts. Additionally, it offers insights into emerging trends such as the shift toward green cloud infrastructure, the rise of sovereign cloud solutions, and the growing influence of AI and edge computing. The impact of these factors on the demand for cloud services is assessed in detail, along with the competitive positioning of both global hyperscalers and regional cloud providers.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 16.80% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Service

|

|

|

By Enterprise Type

|

|

|

By Industry

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 153.39 billion in 2024.

The market is expected to exhibit a CAGR of 16.80% during the forecast period.

By industry, the IT and telecommunications is set to lead the market.

Krystal Hosting, IONOS Inc., and Hetzner Online are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us