Europe Orthopedic Devices Market Size, Share & Industry Analysis, By Product Type (Joint Reconstruction Devices [Knee, Hip, and Extremities], Spinal Devices [Spinal Fusion Devices, and Spinal Non-Fusion Devices], Trauma Devices, Arthroscopy Devices, Orthobiologic, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Country/Sub-region Forecast, 2025-2032

KEY MARKET INSIGHTS

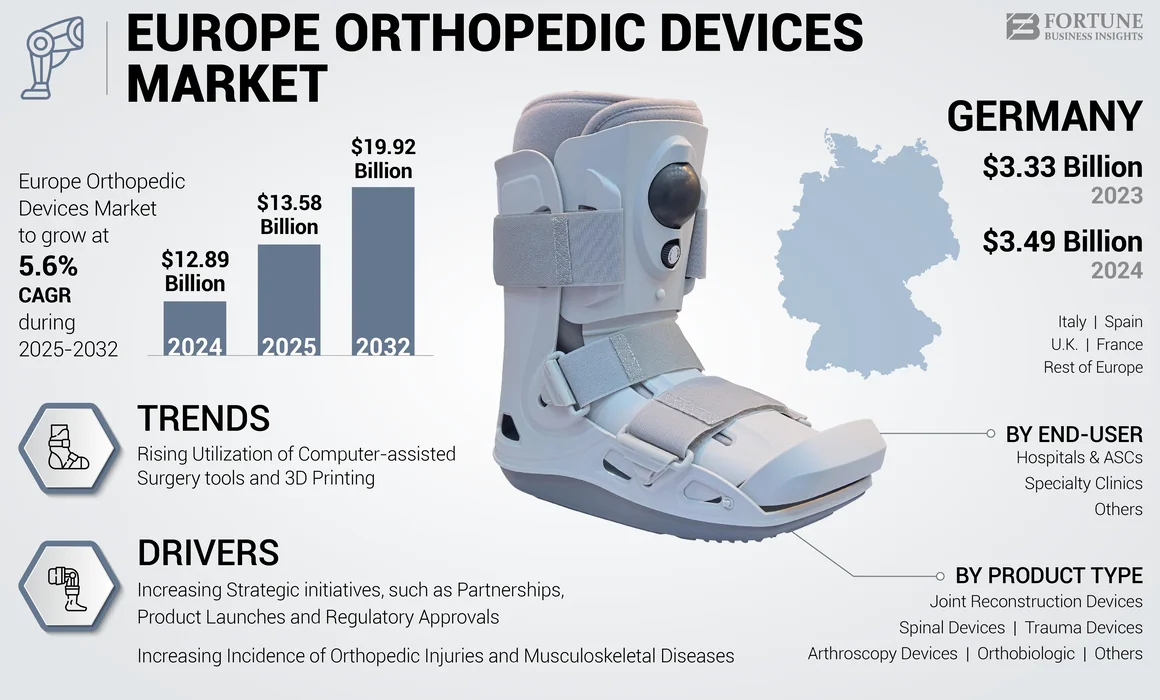

The Europe orthopedic devices market size was valued at USD 12.89 billion in 2024. The market is projected to grow from USD 13.58 billion in 2025 to USD 19.92 billion by 2032, exhibiting a CAGR of 5.6% during the forecast period.

Orthopedic devices are medical instruments created to address or prevent musculoskeletal injuries or ailments arising from trauma, congenital issues, and degenerative diseases. These devices support or replace muscles, cartilage, joints, or bones, and they also facilitate the healing process following surgical procedures.

The market’s growth in Europe is influenced by several factors, including the rising elderly population, increasing rates of osteoporosis and musculoskeletal disorders, and higher occurrence of sports and traumatic injuries.

- For example, as per the data provided by the Office for National Statistics in March 2025, the population aged 90 years and over in the U.K. reached 611,719 in 2023, reflecting a 0.3% increase from 2022.

The market consists of several key players, such as Medtronic, Johnson & Johnson Services, Inc., Zimmer Biomet, FIGS, INC., and Auxein, among others. The majority of market players are focusing on showcasing their products at medical conferences to create product awareness in the market.

- For instance, in March 2025, Johnson & Johnson Services, Inc. launched a VELYS robotic-assisted solution in the European market.

The growing focus of market players on the development and launch of orthoses for the treatment of joint-related disorders are some of the additional factors supplementing market growth.

MARKET DYNAMICS

Market Drivers

Increasing Incidence of Orthopedic Injuries and Musculoskeletal Diseases to Drive Market Expansion

A rapid rise in the incidence of musculoskeletal diseases and orthopedic injuries resulting in restricted movement and excruciating physical discomfort is the primary factor anticipated to drive product demand throughout the forecast period.

- For instance, as per the data provided by Versus Arthritis in November 2024, approximately one-third of the U.K. population, equating to more than 20 million individuals, were affected by a musculoskeletal condition in 2022.

A significant increase in the prevalence of osteoporosis, marked by the physical deterioration of bone tissues and a low bone-to-mass density ratio, is anticipated to drive the demand for orthopedic devices in the coming years.

Increasing Strategic initiatives, such as Partnerships, Product Launches, and Regulatory Approvals to Boost Market Growth

The increasing regulatory approvals and product launches are driving the orthopedic devices market in Europe by fostering innovation, enhancing competition, and addressing the growing demand for effective orthopedic solutions.

- For example, in November 2024, Zimmer Biomet received the CE Mark for its Persona revision knee system. With this approval, the company started providing Persona revision knee systems in the European market for knee arthroplasty.

The growing focus of market players on strategic partnerships to expand product offerings in the market is supplementing market growth.

- For example, in January 2025, Osteotec Limited, the manufacturer and distributor of specialized medical devices, announced an exclusive distribution agreement with Highridge Medical to distribute spine surgery solutions in the U.K.

Market Restraints

Post-Surgical Complications and High Cost of Surgical Implantation May Hinder Market Growth

Although orthopedic injuries are becoming more common and the elderly population is growing worldwide, the high costs associated with the procedure and complications after surgery are hindering market expansion.

- For example, the average cost of total hip replacement in the U.K. Kinvara Private Hospital Ltd is USD 16,819.9, whereas arthroscopic knee surgery costs around USD 5,459.8.

- The cost of fracture repair in the U.K. can range from USD 1,277.1 to USD 7,662.8, depending on the complexity of the injury.

There are also several risks associated with these procedures. Some risks and complications related to orthopedic surgical operations include blood accumulation, nerve paralysis, postoperative infections, joint dislocation, venous thrombosis, and limited range of motion. These complications could limit the Europe orthopedic devices market growth to a certain extent.

Market Opportunities

Strategic Investments and Showcasing of Medical Devices in National Conferences to Present Significant Growth Opportunities

Orthopedic device manufacturers are currently shifting their strategies from incremental innovation to breakthrough technologies, with a strong emphasis on strategic investments, a trend likely to upsurge the growth of the orthopedic devices market across Europe.

- For instance, in February 2023, Invibio Biomaterial Solutions, part of Victrex plc, opened a new orthopedic medical device product development and manufacturing center in the U.K., helping the company expand its orthoses portfolio.

Market players are also emphasizing attending annual meetings and conferences to showcase their orthopedic device portfolios, with an aim to create product awareness in the European market. This creates new opportunities for market players to expand their presence across European countries.

- For example, in May 2024, Siora Surgical Pvt. Ltd. showcased its orthopedic products to create product awareness in the European market at the European Federation of National Associations of Orthopaedics and Traumatology (EFORT) annual congress 2024, a leading orthopedic and traumatology event held in Hamburg, Germany.

Market Challenges

Stringent Regulatory Scenario for New Orthopedic Devices to Challenge Market Growth

Stringent regulatory requirements can delay the approval process for new orthopedic products, as manufacturers must navigate complex pathways set by organizations such as EMA in Europe.

Furthermore, there is an increase in product recalls and suspension of orthoses due to safety concerns, material failures, or regulatory issues.

- For example, in July 2021, the CE mark was suspended for all MAGEC systems manufactured by NuVasive Specialized Orthopedics, Inc. The U.K. regulatory body, the Medicines and Healthcare Products Regulatory Agency advised healthcare professionals to avoid using this device in surgical procedures.

- Also, in March 2020, NuVasive Specialized Orthopedics, Inc. (NSO) voluntarily suspended the supply of MAGEC systems in the U.K. This was at the request of the MHRA, awaiting the results of an MHRA investigation. This suspension was conveyed through the Medical Device Alert from the MHRA and a Field Safety Notice (FSN) released by NSO on April 1, 2020.

Several companies are facing delays in launching new products due to the increasing requirement for extensive clinical trials and adherence to revised regulations.

EUROPE ORTHOPEDIC DEVICES MARKET TRENDS

Rising Utilization of Computer-assisted Surgery Tools and 3D Printing to Boost Industry Development

The orthopedic devices market is evolving rapidly, fueled by technological advancements, changes in demographics, and an emphasis on patient-centered care. As these trends progress, the market is anticipated to expand, providing enhanced solutions for individuals with orthopedic requirements.

The growing adoption of high-tech products in minimally invasive procedures, such as robotic systems and computer-assisted surgical tools, has led to a shift toward minimally invasive orthopedic procedures. Minimally invasive techniques have been observed to be both economical and accurate, offering the added advantages of rapid recovery and shorter hospital stays.

- For example, systems such as Stryker's MAKO robotic system allow surgeons to conduct more accurate and less invasive surgeries, resulting in faster recovery durations.

Furthermore, the companies began offering 3D printing technology that enables the customization of orthopedic implants and prosthetics, resulting in improved fit and functionality. As a result, numerous market players are focusing on receiving regulatory approvals for the launch of technologically advanced devices that produce 3D-printed implants.

- For instance, in June 2021, ZygoFix completed the certification process and obtained the CE mark for its zLOCK spinal fusion system for the lumbar spine following the demonstration of its safety and effectiveness in clinical trials. The zLOCK system's tiny 3D-printed implant employs the spine's structure for stability, in contrast to conventional external screw-based stabilization. Its distinctive characteristics merge stiff and flexible components that allow the implant to endure forces exerted through the spine while adapting to the specific anatomy of each patient during insertion.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic had a negative impact on the market in 2020 due to the cancellation of joint replacements, spinal surgeries, and other orthopedic surgeries across European countries.

However, the market witnessed significant growth in 2021, driven by the resumption of orthopedic surgeries and increasing regulatory approvals for the launch of orthopedic products.

- For example, in May 2021, EDGe Surgical received CE Mark certification for its EDG ortho 65mm electronic depth gauge. This device is used to enhance accuracy and safety in determining the appropriate screw length for implantation during orthopedic fracture surgeries.

In FY 2022 and 2023, the market benefited from increased strategic efforts by market players, including acquisitions, partnerships, and new product launches, which collectively contributed to positive market growth. Furthermore, the market is expected to grow at a stagnant CAGR in the coming years due to the increasing number of orthopedic procedures across the globe.

SEGMENTATION ANALYSIS

By Product Type

Joint Reconstruction Devices Segment Led due to Increasing Product Launches

Based on product type, the market is categorized into joint reconstruction devices, spinal devices, trauma devices, arthroscopy devices, orthobiologic, and others. The joint reconstruction devices segment is further divided into knee, hip, and extremities. Additionally, the spinal devices segment is further categorized into spinal fusion devices and spinal non-fusion devices.

The joint reconstruction devices segment held the dominant share of the market in 2024 and is expected to grow at a considerable CAGR during the forecast period. The increasing launch of joint reconstruction devices in the European market is the major factor boosting the growth of the segment.

- For instance, in December 2024, Osteotec, the manufacturer and distributor of medical devices, announced the re-launch of the Osteotec silicone finger implant in the European market after the successful completion of the CE mark of this device.

The arthroscopy devices segment is projected to grow at the highest CAGR during the forecast period. The growing focus of market players on the launch of orthopedic products at medical conferences is boosting the growth of the segment from 2025-2032.

- For instance, in November 2024, Auxein launched a range of innovative arthroscopy products at MEDICA 2024, held in Düsseldorf, Germany.

The trauma devices segment is expected to grow at a moderate CAGR during the forecast period. The growing aging population, rising cases of traumatic injuries, and increasing product launches are some of the major factors boosting the growth of the segment during the forecast period.

- For instance, in June 2021, Zimmer Biomet announced the launch of bactiguard-coated trauma implants in the European market.

The spinal devices segment is expected to grow at a stagnant CAGR during the forecast period. The growing focus of market players on receiving regulatory approvals for the launch of spinal devices in the European market is one of the key factors driving the growth of the segment.

The orthobiologic segment is expected to grow at a considerable CAGR during the forecast period. The growing aging population suffering from several joint-related complications opting for orthobiologic therapy is the major factor driving the growth of the segment from 2025-2032.

By End-user

Hospitals & ASCs Segment Led Fueled by Rising Orthopedic Surgeries

Based on end-user, the market is divided into hospitals & ASCs, specialty clinics, and others.

The hospitals & ASCs segment dominated the market, accounting for the major proportion of the Europe orthopedic devices market share in 2024. The highest share of the segment is attributed to the growing number of orthopedic surgeries being performed in hospitals and ASCs, which require different types of orthopedic solutions.

- For example, as per the data provided by NHS England in December 2024, around 68,335 hip replacement procedures and 74,082 knee replacement procedures were carried out in the U.K. in 2022.

The specialty clinics segment is expected to grow at the highest CAGR from 2025-2032 attributed to the increasing opening of specialty clinics in the European region. Moreover, increasing outpatient procedures is supplementing segmental growth.

- For example, in May 2024, the North West London Elective Orthopedic Center located at Central Middlesex Hospital was officially inaugurated.

- Likewise, in April 2023, the U.K.'s inaugural Veterans' Orthopedic Center at a specialized orthopedic hospital in Shropshire was officially inaugurated.

The others segment is expected to grow at a stagnant CAGR during the forecast period, owing to the increasing usage of orthopedic products at research institutes for study purposes.

ORTHOPEDIC DEVICES MARKET COUNTRY/SUB-REGION OUTLOOK

Germany

Germany dominated the market in 2024 and was valued at USD 3.49 billion in the Europe orthopedic devices market. This country held the largest market share due to the expanding healthcare sector, high burden of road accidents, and sports injuries. The country is projected to dominate the market in the upcoming years owing to the growing focus of market players on the development of innovative medical devices.

- For instance, as per the data provided by the Deutscher Ärzteverlag GmbH in January 2024, approximately 2.3 million traffic accidents occurred in Germany in 2021.

France

The orthopedic devices market in France is expected to grow at the second-largest CAGR during the forecast period. The growing aging population in France is one of the main factors boosting market growth in this country. As people age, they are more likely to experience conditions such as arthritis, osteoporosis, fractures, and other degenerative joint diseases, which often require these devices for management or surgical correction.

- For instance, as per the data provided by Pension Policy International in October 2024, more than one in five inhabitants (21.5%) or 14.7 million people in France aged 65 years and above. By the end of 2070, people aged 65 and above will represent 29.0% of the French population.

U.K.

The market in the U.K. is expected to grow at the highest CAGR during the forecast period. The high burden of joint-related disorders across the U.K. is one of the major factors contributing to market growth in this country.

- For instance, as per the data provided by Versus Arthritis in November 2024, around 10.0 million people in the U.K. had osteoarthritis (OA) in 2022.

Rest of Europe

The orthopedic devices market in the rest of Europe accounted for the second largest share in 2024, owing to the growing aging population and increasing cases of musculoskeletal disorders.

COMPETITIVE LANDSCAPE

Key Industry Players

Increasing Focus of Market Players on Product Launches and Regulatory Approvals to Enhance their Product Offerings

The Europe orthopedic devices market consists of key companies such as Medtronic, Johnson & Johnson Services, Inc., and Zimmer Biomet, offering a wide range of orthopedic products. The growing focus of companies on strategic partnerships to enhance their footprints in the market is one of the major reasons for companies' significant share in the European market.

- In September 2024, Medtronic announced its partnership with Siemens Healthineers AG at the North American Spine Society (NASS) 39th Annual Meeting held in Chicago, U.S. During the conference, the company announced the launch of the AiBLE spine surgery ecosystem for the European and North American markets.

Moreover, other players, such as Bioretec Ltd., ZygoFix, Stryker, and Auxein are pursuing strategic initiatives, such as regulatory approvals and product launches to strengthen their market position.

- For example, in February 2025, Bioretec Ltd. announced that it had achieved a pivotal milestone with the successful completion of its CE mark approval process for the RemeOs Trauma Screw product portfolio. With the CE mark, Bioretec immediately started selling products in the European market through its distribution network.

List of Key Orthopedic Devices Companies in Europe

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Bioretec Ltd. (Finland)

- Zimmer Biomet (U.S.)

- ZygoFix (Israel)

- Stryker (U.S.)

- Auxein (India)

- Exactech, Inc. (U.S.)

- SeaSpine Holdings Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2024 - Octane Medical Group, through its new venture Octane Biotherapeutics (BioTx), acquired 100.0% shares of the global orthobiologics business from its long-term partner, B. Braun SE. The acquisition, consisting of the two companies TETEC AG in Germany and Aesculap Biologics, LLC. in the U.S., positioned Octane as an international leader in regenerative medicine.

- March 2022 - Exactech, a company specializing in the development and production of cutting-edge implants, instrumentation, and intelligent technologies for joint replacement procedures, announced that its Equinoxe Humeral Reconstruction Prosthesis is available for clinical use in European countries.

- October 2021 - Integrity Implants Inc. received CE mark certification for its flagship FlareHawk expandable lumbar interbody fusion device.

- September 2021 - SeaSpine Holdings Corporation, a global medical technology company focused on surgical solutions for the treatment of spinal disorders, received simultaneous CE Mark certification for its Cranial Module and Percutaneous Spine Module for the 7D FLASH navigation system.

- May 2021 - Spinal Stabilization Technologies, Ltd. announced it had received the CE Mark for its PerQdisc nucleus replacement system for degenerative disc disease.

REPORT COVERAGE

The Europe orthopedic devices market research market report provides key aspects such as competitive landscape, product type, end-user, and region. In addition to the size, it offers insights into the market drivers, market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to this, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.6% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Product Type

|

|

By End-user

|

|

|

By Country/Sub-region

|

Frequently Asked Questions

Fortune Business Insights says that the Europe market stood at USD 12.89 billion in 2024 and is projected to reach USD 19.92 billion by 2032.

The market will exhibit steady growth at a CAGR of 5.6% during the forecast period (2025-2032).

In 2024, the market value stood at USD 3.49 billion.

By product type, the joint reconstruction devices segment led the market.

The rising occurrence of traumatic injuries and orthopedic disorders are the key driving factors of the market.

Medtronic, Johnson & Johnson Services, Inc., Zimmer Biomet, and Stryker are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us