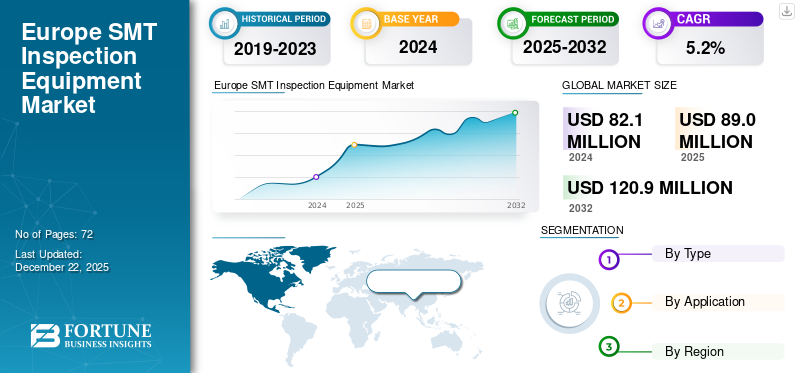

Europe SMT Inspection Equipment Market Size, Share & Industry Analysis, By Type (Automated Optical Inspection, Solder Paste Inspection, and Automated X-Ray Inspection), By Application (Consumer and Industrial Electronics, Telecommunication Equipment, Automotive, LED and Display, Medical Devices, Aerospace and Defense, and Others), and Country Forecast, 2025 – 2032

KEY MARKET INSIGHTS

The Europe SMT Inspection Equipment Market size was valued at USD 82.1 million in 2024. The market is projected to grow from USD 89.0 million in 2025 to USD 120.9 million by 2032, exhibiting a CAGR of 5.2% during the forecast period.

SMT inspection equipment is majorly used in the semiconductor industry to inspect printed circuit boards during and after the SMT assembly process. SMT inspection tasks include solder pasting checks, component placement checks, and joint inspection in diverse semiconductor facilities such as electronics manufacturing services, PCB assembly facilities, and others.

Increasing demand for high-reliability electronics devices, trend toward electronic miniaturization, demand for high-density circuit designs, supportive European regulations such as ISO 26262 (Functional Safety for Automotive Equipment) and EN 60601 (Medical Electrical Equipment) have all heightened the need for SMT Inspection Equipment across Europe.

Strong demand for electronics from prominent industries in Europe, such as Aerospace and Defense, industrial electronics, automotive, medical, and healthcare sectors, and telecommunication infrastructure, will further support the market growth. The electronics manufacturing process and PCB assembly industry are expected to see steady growth over the forecast period as a result of strategic amendments and significant financial support from the government. For instance, in April 2024, the European government announced a Call-to-Action for the Electronics manufacturing industry that included an electronics manufacturing strategy, the introduction of the Strategic Electronics Manufacturing Act (SEMA), and others.

Key players in the market, such as Koh Young Technology Inc., Viscom SE, CyberOptics Corporation, PEMTRON, account for a significant revenue share as a result of technology integration, robust dealer and distributor network, and considerable R&D investment. Several such factors to improve the SMT inspection equipment market share in the European region.

The COVID-19 pandemic had a significant impact on the market due to supply chain disruptions, temporary shutdowns, and limited raw material availability, among other factors. However, increasing demand for electronics across sectors, such as healthcare, automotive, telecommunication, and industrial electronics, has resulted in significant market growth during the post-pandemic period.

IMPACT OF GENERATIVE AI

Integration of AI to Enhance the Efficiency of SMT Inspection Machines

Gen AI, technology integration supports the root-cause analysis to identify defect patterns and optimize PCB production efficiency. Generative AI is further enabling predictive inspection-as-a-service, making it efficient for OEMs and end-users to minimize their operational cost in the long run. Vendors and other industry stakeholders that embed generative models into their solutions will expand their market offering by providing scalable and highly reliable inspection systems aligned with Europe's Industry 4.0 roadmap.

IMPACT OF TARIFFS

Rising Equipment Cost and Supplier Reassessment to Disrupt the Market in the Short Term

Reciprocal tariffs on the European market are pressurizing the SMT inspection equipment market due to increased raw material costs, equipment manufacturing, and a disrupted supply chain. Due to the rising cost of equipment, EMS providers are postponing or limiting their planned inspection upgrades. However, the rising domestic manufacturers, traders, etc., are gaining market traction in the European region. In order to counter U.S. tariffs, the European Union has announced retaliatory tariffs of up to 25% on equipment, including industrial machinery.

Europe SMT Inspection Equipment Market Trends

Demand for Automated X-ray Inspection Equipment is a Prominent Trend in the Market

The demand for AXI machines is prominently driven by structural changes in electronics design across automotive, power electronics, and EV infrastructure segments. The growing need for power-dense and safety-critical electronics such as battery management systems (BMS), inverters, and radar/LiDAR modules requires X-ray-level inspection resolution to detect voids, hidden bridging issues, and others. Key players in the market are strengthening their portfolio by diversifying investments into new technology. For instance, in February 2025, Viscom introduced its iX7059 PCB Inspection XL at IPC APEX, which is designed for large, complex assemblies such as server and 5G electronics.

MARKET DYNAMICS

Market Drivers

High-Reliable Electronics across Industrial Sectors to Drive Market Growth

The European SMT inspection equipment market is significantly propelled by the need to ensure consistent quality, regulatory adherence, and production reliability in industries. As component packaging become increasingly complex and reliability standards becomes more stringent, investment in advanced inspection systems is expected to grow across the European region. Sectors such as automotive safety systems, aerospace and defense, industrial automation, and medical electronics are generating strong demand for defect-free PCB assemblies. Electronic miniaturization, high-density circuit designs, and others, are driving the market demand for high-resolution defect-detection machines. According to data from ZVEI (German Electrical and Electronic Manufacturers’ Association), the production of electronics for transportation and medical sectors in Europe has shown steady growth, with the automotive electronics segment accounting for over 30% of total electronics output in Germany.

Market Restraints

High Capital Investment to Limit the Market Growth Particularly for SMEs

Inspection Equipment enables high capital investment at the initial stage for equipment cost, installation, training, and integration with existing SMT inspection lines. Small and medium-scale manufacturers operate under tight budgets and cost-sensitive procurement policies, limiting their investments. Although advanced inspection equipment offers several benefits, the overall operational cost limits the growth of SMT machines across the region.

Market Opportunities

Advanced Automotive Electronics Manufacturing Creates Lucrative Opportunities for the Market

Growing demand for Electric Vehicles across regions, and supportive government policies contributes to the Europe SMT Inspection Equipment Market growth. According to the IEA, in Europe, new electric car registrations reached approximately 3.2 million in 2023, increasing by almost 20% as compared to 2022. Automotive PCBs critical for systems such as battery management, ADAS, infotainment, and powertrain are growing in complexity. According to Fortune Business Insights, the global automotive PCB market is valued at USD 9.52 billion in 2024, projected to reach USD 15.10 billion by 2032. Electric vehicles require high-precision inspection solutions to identify micro-defects and ensure reliable automotive electronics.

SEGMENTATION ANALYSIS

By Type

Industrial Automation and Miniaturization of Electronics to result in Automated Optical Inspection (AOI) Equipment Dominance

By type, the market is segmented into Automated Optical Inspection (AOI), Solder Paste Inspection (SPI), and Automated X-Ray Inspection (AXI).

Automated Optical Inspection Equipment dominated the market with a highest revenue share in 2024 as a result of increasing miniaturization of electronics, and inclination toward automated machines to boost inspection quality and productivity. Early-stage detection and identification of a wide range of issues, in addition to being a cost-effective and reliable solution for end users, results in the segment’s dominance.

Solder Paste Inspection is expected to witness the highest growth rate during the forecast period as a result of precise quality checks, increasing automation, and reduction in rework costs.

Automated X-ray Inspection is expected to witness moderate growth over the forecast period due to growing demand from critical sectors including defense, automotive, and medical.

By Application

To know how our report can help streamline your business, Speak to Analyst

Rising Industry 4.0 Adoption and Electronics to Drive the Consumer and Industrial Electronics Market

The market, by application, is segmented into consumer and industrial electronics, telecommunications equipment, automotive, LED and display, medical devices, aerospace and defense, and others. Other segments include renewable energy products such as inverters, energy storage systems, and research laboratories.

Consumer and industrial electronics dominate with the highest Europe SMT inspection equipment market share, followed by the automotive sector. Growing adoption of Industry 4.0, automation, and robotics across industrial facilities is driving the segmental growth.

Adoption of AI technology and IOT devices in the medical and healthcare sector is expected to boost the medical devices segment growth, making it the fastest-growing segment among other sectors.

Strong presence of military and aircraft, adoption of telecommunication infrastructure, LEDs, Displays, and others, including renewable energy electronics to bolster the segment growth.

EUROPE SMT INSPECTION EQUIPMENT MARKET COUNTRY OUTLOOK

Germany

Growing demand for electric vehicles, integrated electric aircraft, industrial automation, robots, and healthcare electronics is driving the market demand for SMT Inspection equipment. Increasing demand for miniaturized and diagnostic equipment across industries, including consumer electronics, telecommunication infrastructure, renewable sectors, and electric mobility, is expected to propel the market growth for SMT Inspection equipment across the region.

Download Free sample to learn more about this report.

Germany leads the European market for SMT Inspection Equipment and remains the highest growing as a result of the increasing demand for the automotive and industrial electronics market.

The U.K., Italy, Austria, Poland, and the rest of the European countries are generating market opportunities for SMT Inspection equipment, supported by increasing investment in PCB assembly and manufacturing plants. For instance, in September 2025, the European Commission approved a chip assembly and testing plant in Poland.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

New Product Launches and Expansion Strategies to Bolster the Market Revenue Share for the Key Players

Key players in the market are expanding their presence through expansion and new product launches in the European market. With AI-enabled and 3D technology product offerings, players in the market are further penetrating their market share across the region. Local and regional players such as GÖPEL Electronic GmbH and Omron Corporation are expanding their products through strong dealer and distributor networks across diverse geographies.

Major Players in the SMT Inspection Equipment Market

To know how our report can help streamline your business, Speak to Analyst

The market is highly consolidated, with the top 5 players accounting for about two-thirds of the market revenue share in the European region. The top 5 Players in the market include Koh Young Technology Inc., Cyberoptics Corporation, Viscom SE, PEMTRON, and Omron Corporation.

Long List of Companies Studied (including but not limited to)

- Koh Young Technology Inc. (South Korea)

- Viscom SE (Germany)

- Mirtec Co., Ltd. (South Korea)

- Saki Corporation (Japan)

- Test Research Inc. (Taiwan)

- PARMI Co. Ltd. (South Korea)

- Nordson Corporation (CyberOptics Corporation) (U.S.)

- PEMTRON (South Korea)

- Aleader Europe Ltd. (Israel)

- Shenzhen Magic-ray Technology Co., Ltd. (China)

- Guangzhou Leichen Intelligent Equipment Co., Ltd. (China)

- KLA Corporation (U.S.)

- Omron Corporation (Japan)

- Marantz Electronics (Japan)

- Sentry (U.S.)

- SINERGO (Italy)

- GÖPEL electronic GmbH (Germany)

- ViTrox Corporation (Malaysia)

- YAMAHA (Japan)

- CORE-emt A/S (Denmark)

- and Others

KEY INDUSTRY DEVELOPMENTS

- March 2025: Viscom SE expanded their distribution network in Central Europe through a new partnership with PBT Rožnov, who is a major provider of electronics manufacturing solutions in the Czech Republic.

- September 2024: Test Research, Inc. (TRI) launched Core Features 3D AOI, TR7700QC SII which is equipped with necessary inspection functionalities that are specifically tailored for the electronics manufacturing industry.

- August 2024: Nordson completed its acquisition of CyberOptics in November 2022, fully integrating the company by August 2024, significantly enhancing its 3D optical sensing and inspection portfolio.

- May 2024: Test Research, Inc. (TRI), which offers PCB assembly and advanced packaging testing and inspection solutions, such as SPI, AOI, AXI, opened a new R&D and manufacturing facility in Taiwan in order to amplify their production capacity.

- November 2023: Koh Young, major player of True 3D measurement-based inspection solutions, showcased extensive innovations at Productronica in Munich, unveiling its new SPI (aSPIre 3, KY8030 3) and AOI (Zenith series) systems along with semiconductor inspection lines

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, type and leading application of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.2% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

By Application

By Country

|

|

Companies Profiled in the Report |

Koh Young Technology Inc. (South Korea) Viscom SE (Germany) Mirtec Co., Ltd. (South Korea) Saki Corporation (Japan) Test Research Inc. (Taiwan) PARMI Co. Ltd. (South Korea) Nordson Corporation (CyberOptics Corporation) (U.S.) PEMTRON (South Korea) Aleader Europe Ltd. (Israel) Shenzhen Magic-ray Technology Co., Ltd. (China) Guangzhou Leichen Intelligent Equipment Co., Ltd. (China)) Omron Corporation (Japan) |

Frequently Asked Questions

The market is projected to reach USD 120.9 million by 2032.

In 2024, the market was valued at USD 82.1 million.

The market is projected to grow at a CAGR of 5.2% during the forecast period.

The consumer and industrial electronics segment is expected to lead the market.

High-Reliable Electronics across Industrial Sectors to Drive European market growth.

Koh Young Technology Inc., Cyberoptics Corporation, Viscom SE, PEMTRON, are the top players in the market.

Germany is expected to hold the highest market share.

By application, the medical devices segment is expected to witness the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us