Cargo Container X-ray Inspection Systems Market Size, Share & Industry Analysis, By Type (Stationary Type and Mobile Type), By Application (Airports, Seaports, and Border Crossings/Roadways), and Regional Forecast, 2026-2034

Cargo Container X-ray Inspection Systems Market Size and Future Outlook

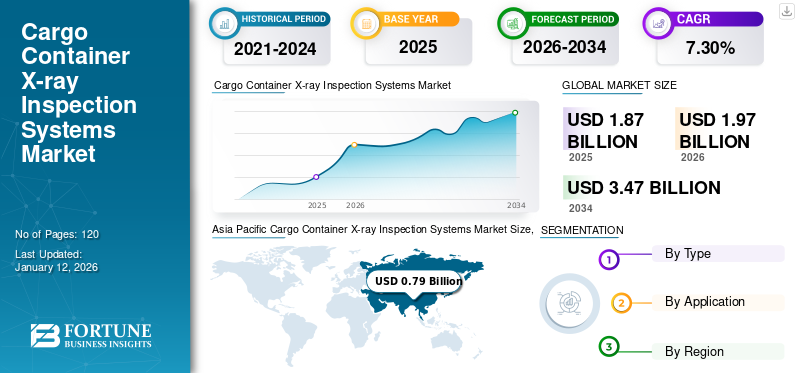

The global cargo container X-ray inspection systems market was valued at USD 1.87 billion in 2025. The market is projected to grow from USD 1.97 billion in 2026 to USD 3.47 billion by 2034, exhibiting a CAGR of 7.30% during the forecast period. The North America dominated global market with a share of 44.30% in 2025. The cargo container x-ray inspection systems market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.25 Bn by 2032.

X-ray cargo container inspection systems are cutting-edge security technologies designed to scan and analyze the contents of large cargo containers. This system is non-invasive and efficient, reducing manual inspections and saving time. The market scope includes the total revenue generated from the sales of X-ray inspection systems. The market is anticipated to experience steady growth due to technological advancements, increasing global trade and cargo volume, and regulatory mandates for cargo screening. In the year 2020, a significant decline in GDP was registered due to the global economic downfall. A growing economy often leads to an increase in international trade and transport, which directly impacts the need for cargo inspection systems. Shipping companies have been expanding their fleets to address the growing demand for containerized cargo. With the expansion of container fleets, the volume of goods being transported globally increases. This directly leads to a higher number of containers needing inspection at ports, airports, and customer facilities, driving demand for X-ray inspection systems. Some of the key players operating in the market are OSI Systems, Inc., Leidos, Smiths Group plc, LINEV Systems, and Nuctech Technology Co., Ltd. among others. Top players often focus on product innovation and customization to cater to the diverse customer demands.

The onset of the COVID-19 pandemic significantly affected the market growth in the first and second quarters of 2020. Events such as COVID-19 can disrupt global supply chains, hindering global trade, and impacting the market growth. The volatility of supply chains posed a significant challenge for monetary policymakers. In addition, supply chain disruptions contribute to an increase in global inflation.

IMPACT OF TECHNOLOGY ON MARKET

Increasing Automation In Container X-ray Scanning System to Augment Market Growth

Various organizations from all industry verticals are shifting their business toward digital platforms, and due to that, the use of industrial automation is also increasing in every sector. The maritime cargo and port industry is also influenced by the implementation of industrial automation and digital technology in a positive manner. Automation in security reduces the time required for scanning & inspection of containers. It ultimately reduces the operational cost of the process.

Cargo X-ray scanning systems utilize various advanced technologies such as Artificial Intelligence (AI), cloud computing, and robotics in operation. This automated X-ray machine can scan 10 times more containers per hour than the traditional method. Also, the analysis obtained by scanning containers using AI reduces human error and improves accuracy. The use of cloud computing in the automated X-ray machine directly saves results on the global server of the service provider company. Owing to its numerous benefits, various countries are focusing on the installation of mobile and automated container X-ray scanning machines in their maritime ports. For instance,

- In April 2021, the United States Customs & Border Protection Department collaborated with Smith Detections, which provides security scanning and threat detection technology.

MARKET DYNAMICS

Market Trends

Increase in Incidents of Smuggling Activity to Propel Market Growth

In the last few decades, the incidents of human trafficking have increased in major ports in the world. Also, the smuggling cases of drugs and illegal arms & ammunition had registered in various ports throughout the globe. These unlawful activities are majorly done via marine transport with the help of cargo containers and cargo ships. Also, it is found that various terrorist attacks had been conducted by using these illegally transported weapons, which is creating major threats to ports and national security. The rise in smuggling incidents is expected to expand the market growth by highlighting the need for advanced, reliable, and efficient inspection solutions to ensure border security and compliance.

The emerging techniques of international crimes using the containerized trade method for the smuggling of drugs have created a major challenge in front of enforcement agencies all over the world. During the past year, nearly 3,500 kg of heroin has been seized by authorities from cargo containers in India. Also, the Sri Lanka customs department at Colombo port seized 300 kg of harmful drugs, such as cocaine and heroin, from the four freight containers that had been destined for various Indian ports. The drugs had been smuggled in the containers of scrap metal. Hence, the increasing sophistication of smuggling techniques drives the demand for cutting-edge X-ray inspection systems.

Market Drivers

Increased Global Trade to Boost Market Growth

According to the UN Trade & Development, world trade registered a positive trend in Q1 2024, with the goods trade value rising by around 1% quarter-over-quarter and services by 1.5%. This global trade surge is augmented by a positive trade outlook for the U.S. and developing economies, particularly in the Asia Pacific region. As global trade continues to expand, there is a need for efficient and high-throughput security measures to ensure smooth trade operations while maintaining strict safety standards.

According to the Baltic and International Maritime Council (BIMCO), a global trade association, the global container fleet is forecast to increase 9.9% YoY by 2024 and 5.5% YoY by 2025. The container fleet will, therefore, grow by 25% from 2023 to 2025, the highest growth rate in the three years from 2011 to 2013. The growth of the container fleet has facilitated the higher demand for cargo inspection systems to screen a larger number of containers efficiently. Expanding fleets necessitate upgrades in port and customs facilities to manage the increased cargo efficiently. This includes investing in high-throughput X-ray inspection systems, which can screen multiple containers simultaneously.

The growth in fleet size also raises the risks of illicit activities, such as terrorism and smuggling. To address these concerns, governments mandate stricter screening protocols, thus further boosting the adoption of X-ray inspection systems to meet regulatory compliance.

Market Restraints

Complex Cross-border Regulations to Hamper Market Growth

Transporting cargo containers across international borders requires navigating intricate customs processes that vary greatly from one nation to another. Adhering to various regulations can be challenging, resulting in delays and extra costs. The imposition of trade barriers, such as tariffs and quotas, can further complicate the logistics involved in transporting containers. These barriers may elevate costs and hinder the efficiency of containerized shipping, particularly in regions facing political instability. Additionally, in numerous regions, the transportation infrastructure, including roads, railways, and ports, is outdated and incapable of accommodating the increasing volume of containerized goods. Poor infrastructure can result in delays, higher maintenance expenses, and inefficiencies in the handling and movement of containers. All these factors are anticipated to slow down the cargo container X-ray inspection systems market growth.

Market Opportunities

Stringent Regulations for Stricter Cargo Screening to Offer Ample Growth Opportunities

The general framework of the aviation security standards or measures is established within the Chicago Convention, specifically Annex 17, under the auspices of the International Civil Aviation Organization(ICAO). Annex 17 to the Convention contains several standards and recommended practices dealing with passenger and baggage security, cargo security, and aircraft and in-flight security. One of the main aims is to prevent explosives and incendiary devices from being placed onboard aircraft, either by concealment in otherwise legitimate shipments or by gaining access to aircraft via cargo handling areas. In June 2011, the European Union (EU) and the U.S. announced a joint statement on supply chain security.

World Customs Organization (WCO) mandates the deployment of scanning/NII equipment to assist customs administrations when considering the purchase and deployment of container inspection equipment by detailing the relevant technical, administrative, and safety issues involved. The integration of such scanners into existing customs controls while utilizing risk management techniques, is of crucial importance to the effective deployment of this equipment. Owing to such guidelines and regulations, key players are expected to get ample growth opportunities during the forecast period.

SEGMENTATION ANALYSIS

By Type Analysis

Increasing Requirement of Improving Security Measures on Ports and Border Crossings to Augment Market Growth for Stationery

Based on type, the market is classified into stationary type and mobile type.

The stationary type segment led the market accounting for 65.99% market share in 2026. Stationary cargo container X-ray inspection systems are advanced security screening devices used to inspect the contents of cargo containers without physically opening them. These systems utilize X-ray technology to create detailed images of the container's contents, allowing authorities to identify any potential threats, such as contraband or illegal items. These types of inspection systems are typically installed in fixed locations, such as ports or border crossings, where cargo containers pass through. These X-ray inspection systems help customs and security officials assess the contents of containers quickly and efficiently, ensuring compliance with regulations and enhancing security measures. These systems play a crucial role in maintaining the integrity of supply chains and preventing illicit activities.

The mobile X-ray inspection system is built for user-friendly operation and can be transported from one site to another. It demands a minimum footprint and external infrastructure while still fulfilling international security screening requirements.

By Application

Increasing Illegal Activities at Seaports to Fuel Market Growth

Based on application, the market is segmented into airports, seaports, and border crossings/roadways.

Seaports segment dominated the market accounting for 69.04% market share in 2026. At seaports, cargo container X-ray inspection systems are strategically placed at key points in the cargo handling process to ensure effective screening of incoming and outgoing containers, which has aided the rise in market share. By incorporating X-ray inspection systems into the port security infrastructure, authorities can efficiently screen a large volume of containers while minimizing disruptions to the flow of goods. It enhances security measures, helps prevent illegal activities, and ensures compliance with trade regulations.

To know how our report can help streamline your business, Speak to Analyst

Moreover, the X-ray inspection system is often integrated with other port management and security systems to streamline the overall process and enhance information sharing. The port authorities continuously monitor the cargo handling process to identify and respond to any security concerns or irregularities.

X-ray inspection systems are also used for the cargo containers that are shipped using air transport. Due to the limitations of the aircraft in terms of loading weight capacity and high cost incurred for transportation, aircraft are not preferred for the transportation of cargo and other goods unless there are critical requirements, or the shipments pose serious security threats. However, stringent and tight security measures at the airports are the reason the particular segment contributes to a fair market share across the globe.

CARGO CONTAINER X-RAY INSPECTION SYSTEMS MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America

Asia Pacific Cargo Container X-ray Inspection Systems Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America held the dominant share in 2026 valuing at USD 0.87 Billion and also took the leading share in 2025 with 0.83 Billion. The rapid growth of the shipping and transportation industry in the region augments the adoption of X-ray inspection systems for security purposes. In the first quarter of 2024, the cargo container volume at 14 major North American ports monitored by CBRE saw a year-over-year rise of 15%. In addition, the development of the market is driven by rising criminal activities in the region. This, in turn, increases demand for X-ray inspection systems in the private sector as well as the public sector, which is contributing to the region’s growth. The U.S. market is expected to reach USD 0.82 billion by 2026.

Download Free sample to learn more about this report.

U.S. Set to Dominate Market Due to Robust Economic Progress

The U.S. cargo container x-ray inspection systems market is estimated to exhibit substantial growth during the forecast period. The market's growth is majorly attributed to the robust economic progress of the U.S. According to the United States Department of Transportation, In 2023, approximately 55.5 million tons of freight, worth over USD 18.7 trillion, were transported daily across the U.S. transportation system.

In addition, government regulations regarding the safety of property and increasing awareness about safety among airports, seaborne, and border crossings increase the demand for X-ray inspection systems for security.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The cargo container X-ray inspection systems market in the Asia Pacific region has been experiencing significant growth in recent years. The increasing trade activities, stringent security regulations, and a growing focus on preventing illicit activities, such as smuggling and terrorism, have contributed to the rising demand for advanced inspection technologies. Countries in the region, particularly major trading nations, such as China, Japan, and India, have been investing heavily in upgrading their security infrastructure at ports and border crossings. This has led to higher adoption of sophisticated cargo container X-ray inspection systems to ensure the efficient and thorough screening of goods.

Asia Pacific cargo container X-ray inspection systems market share is dominated by China. According to the official statistics, China's ports experienced consistent growth in cargo and container throughput in 2023. The total cargo throughput at the ports reached 16.97 billion tonnes during this timeframe, reflecting an 8.2% increase compared to the previous year. In particular, the foreign trade cargo throughput at the ports grew by 9.5% from the prior year, totaling 5.05 billion tonnes, as reported by the ministry. Additionally, during the same period, China's ports processed 310.34 million twenty-foot equivalent units (TEUs) of containers, representing a year-on-year rise of 4.9%. With its vast import-export activities, China handles a significant volume of global container traffic, making cargo inspection systems essential to facilitate trade and security. The Japan market is expected to reach USD 0.08 billion by 2026, the China market is expected to reach USD 0.36 billion by 2026, and the India market is expected to reach USD 0.05 billion by 2026.

Europe

Major players in the region manufacturing X-ray inspection systems for cargo and border crossing increasingly adopt acquisition and partnership as key developmental strategies to enhance their product portfolio and sales channels across multiple locations. EU ports are essential facilities that enable the movement of products throughout the continent and contribute to the efficient operation of the European market. In 2022, the major EU ports managed 96 million twenty-foot equivalent units (TEUs), which marked a 4.0% decline from 2021. Focusing on loaded containers, there was a more significant drop of 6.6% in 2022, while the handling of empty containers witnessed a notable increase of 9.1%. The UK market is expected to reach USD 0.08 billion by 2026, while the Germany market is expected to reach USD 0.06 billion by 2026.

Although most of the trade passing through EU ports is lawful, these ports are also used by criminals to transport illegal items into the EU. They are susceptible to infiltration by organized crime networks. Given that numerous public and private entities have access to port facilities and information, there are numerous opportunities for infiltration and the facilitation of illicit shipments. Owing to these concerns, the Europe cargo container X-ray inspection systems market share is expected to increase globally.

Middle East & Africa

The Middle East & Africa region is expected to contribute to the market growth, given their focus on enhancing security measures, especially in transportation and logistics. The demand for cargo container X-ray inspection systems was on the rise in this region due to increased security concerns. Factors such as the need to combat smuggling, ensure trade compliance, and strengthen border security augmented the adoption of advanced inspection technologies.

Additionally, the growth of trade and commerce in the region is expected to fuel the demand for efficient and effective cargo inspection systems. The progress of cargo container X-ray inspection systems in Middle Eastern countries is driven by a combination of security priorities, regulatory compliance, the dynamics of international trade, technological advancements, border control efforts, public safety initiatives, operational efficiency goals, and collaborative approaches among nations. Countries in the Middle East often invest in advanced technologies to counter smuggling. Still, with the continuous growth of international trade and the importance of efficient cargo screening, the demand for advanced inspection systems is expected to increase.

Latin America

In Latin America, the growth of cargo container X-ray inspection systems has been influenced by various factors, reflecting both regional and global trends. As Latin American countries actively participate in international trade, there's a growing need for efficient cargo inspection systems to facilitate the movement of goods while ensuring security. The expansion of trade routes and the rise in containerized shipments contribute to the demand for advanced inspection technologies.

Similar to other regions, Latin American countries face security challenges related to smuggling, illegal trade, and potential terrorist activities. Governments in the region are implementing stricter security regulations, driving the adoption of cargo container X-ray inspection systems to enhance border and port security. The continuous improvement in X-ray inspection technology, including higher resolution imaging and advanced detection capabilities, makes these systems more effective in identifying hidden threats. Latin American countries are likely to embrace these technological advancements to strengthen their cargo inspection capabilities.

Ongoing advancements in X-ray inspection technology, such as improved imaging capabilities and automated detection algorithms, make stationary systems more effective in identifying hidden threats. Latin American countries may leverage these technological advancements to enhance their cargo inspection capabilities.

KEY INDUSTRY PLAYERS

Key Players Focused on Strengthening their Market Position with Continuous Developments

The cargo container x-ray inspection systems market is fairly distributed with well-established players, such as OSI Systems, Inc., Smiths Group plc, Leidos, Nuctech Technology Co., Ltd., and others. These key players have a worldwide presence across the regions, including the European countries, Asia Pacific, North America, and the Middle East & Africa.

Other major players in the market include LINEV Systems, CGN Begood Technology Co., Ltd., Astrophysics Inc., VMI Security, HTDS, and regional and local players. These players are maintaining their position in their respective markets and are trying to establish strong distribution channels to solidify their position.

List of Key Companies Studied:

- OSI Systems, Inc. (U.S.)

- Leidos (U.S.)

- Smiths Group plc (U.K.)

- LINEV Systems (U.S.)

- Nuctech Technology Co., Ltd. (China)

- CGN Begood Technology Co., Ltd. (China)

- Astrophysics Inc. (U.S.)

- VMI Security (Brazil)

- HTDS (France)

- Wuhan AI Wei Technology Co., Ltd. (China)

- Beijing Vacuum Electronic Technology Co., Ltd. (China)

- Excillum (Sweden)

- Gilardoni S.p.A. (Italy)

- METTLER TOLEDO (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: OSI Systems, Inc. announced that its Security division secured a contract worth around USD 10 million from a global customs agency to deliver a dual-energy X-ray inspection system for cargo and vehicles, which includes several years of ongoing maintenance, service, and support.

- September 2022: Smiths Group plc partnered with Navratna Defence PSU Bharat Electronics Limited to develop high-energy X-ray screening technologies in India.

- July 2022: OSI Systems, Inc. was awarded an order by an international customer to supply units of its Eagle P60 high energy drive through cargo vehicle inspection portal and follow-on maintenance service and support worth USD 6 million.

- April 2022: The Australian Border Force announced the development of X-ray inspection technology for container scanning at the port to combat external inspection delays.

- March 2022: Astrophysics Inc. strengthens its market position in the U.S. by deploying HXC-LaneScan worth USD 82 million to the U.S. Department of Homeland Security, Customs and Border Protection (CBP).

REPORT COVERAGE

The cargo container X-ray inspection systems market analysis report provides an in-depth analysis of the industry dynamics and competitive landscape. The report also provides market estimation and forecast based on technology, end user, and regions. It provides various key insights into recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

|

|

Key Market Players Profiled in the Report |

OSI Systems, Inc. (U.S.), Leidos (U.S.), Smiths Group plc (United Kingdom),LINEV Systems (U.S.),Nuctech Technology Co., Ltd. (China), CGN Begood Technology Co., Ltd. (China), Astrophysics Inc. (U.S.), VMI Security (Brazil), HTDS (France), Beijing Vacuum Electronic Technology Co., Ltd. (China) |

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 1.97 billion in 2026.

In 2034, the market is expected to record a valuation of USD 3.47 billion.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.30% during the forecast period.

The market is anticipated to experience steady growth on account of technological advancements, increasing global trade and cargo volume, and regulatory mandates for cargo screening

OSI Systems, Inc., Smiths Group plc, Leidos, and Nuctech Technology Co., Ltd. are the leading companies in this market.

North America is expected to hold the largest share during the forecast period due to the rapid growth of the shipping and transportation industry in the region.

Stationary type is anticipated to dominate the market due to its advanced security screening methods.

Based on application, seaports are projected to lead the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us