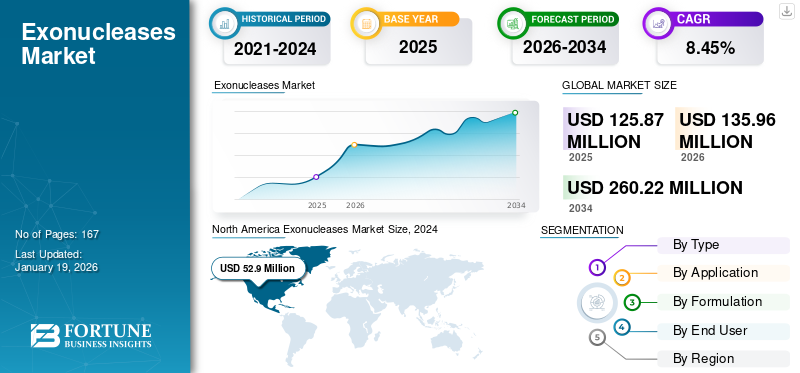

Exonucleases Market Size, Share & Industry Analysis, By Type (Exonucleases I, Exonucleases II, Exonucleases III, and Others), By Application (Genomics & Genetic Engineering, Drug Discovery & Research, and Others), By Formulation (Standard and Thermolabile), By End User (Pharmaceutical and Biotechnology Companies, Academic & Research Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global exonucleases market size was valued at USD 125.9 million in 2025. The market is projected to grow from USD 135.96 million in 2026 to USD 260.22 million by 2034, exhibiting a CAGR of 8.45% during the forecast period. North america dominated the exonucleases market with a market share of 44.74% in 2025.

Exonucleases refer to the enzymes that remove DNA and RNA from one end of the strand in the either direction. They have a variety of applications in modern molecular biology including cleaning up PCR reactions, preparing samples for sequencing and others. The market for exonuclease enzymes is rapidly expanding, with genomics research, next-generation sequencing (NGS), CRISPR applications, and precision medicine being the key application areas. Additionally, the rise of high-throughput, automated, and GMP-compliant workflows is increasing demand for both standard research-grade and clinical-grade versions.

Furthermore, the market encompasses several major players with Thermo Fisher Scientific, Inc., Takara Bio Inc., and New England Biolabs at the forefront. Broad portfolio with innovative product launch, and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Expansion of Molecular Biology & Genomics to Propel the Market Growth

The most prominent driver for the market is the increasing expansion of genomics and molecular biology, which boosts the demand for exonuclease enzymes. The increasing utilization of CRISPR technology, next-generation sequencing technologies, molecular diagnostics, synthetic biology, and precision medicine fuels the demand for exonucleases in various workflows including DNA manipulation, sequencing preparation, and genetic engineering.

Moreover, increasing number of clinical trials focused on the development of genetic therapies and gene editing technologies is driving the demand for these enzymes, as they are critical for the creation of new treatments.

- The U.S. FDA cleared the U.S. based, KSQ Therapeutics in September 2024, to begin a Phase 1/2 clinical study of KSQ-004EX, a CRISPR-Cas9–engineered TIL candidate targeting advanced solid tumors.

MARKET RESTRAINTS

Technical Limitations Associated to Restrict Market Expansion

Technical limitations associated with the use of exonuclease enzymes include risks of specificity & off-target activity, stability of enzymes, possibility of non-specific degradation, limitations in controlling the extent of degradation, and others. Some products can cause unintended degradation of target sequences especially those having wide substrate ranges. This slows the adoption of these products. Additionally, limited thermostability of some products hinders their usage in workflows, requiring long reaction times or high-temperature steps. All these factors hamper the exonucleases market growth to certain extent.

- For example, standard Exonuclease I manufactured by New England Biolabs offers best results at 37 °C in the recommended NEBuffer.

MARKET OPPORTUNITIES

Focus on Custom Enzyme Formulations to Create Lucrative Growth Opportunities

Custom-engineered and high-stability exonuclease products are gaining traction in recent years. This enables automation and high-throughput compatibility in various applications. This is likely to create market growth opportunity for exonuclease manufacturers. With advancements in drug discovery & development, there is a significant demand for customized formulations in specific workflows especially in infectious disease and oncology pipelines.

- For instance, Creative Biolabs is actively involved in offering site-specific endonuclease engineering services to its customers.

EXONUCLEASES MARKET TRENDS

Shift towards High-Purity and GMP-Grade Exonuclease is a One of the Significant Market Trends

In recent years, exonucleases are being increasingly used in cell & gene therapy and advanced biologics products manufacturing. Thus, demand for high-purity and GMP-grade exonuclease is rapidly increasing among the end users. This trend is primarily driven by stringent regulatory requirements needing regulatory compliance along with rapidly expanding pipeline of cell & gene therapies from clinical trials into commercial scale.

- For instance, GMP-grade T5 Exonuclease has been introduced by New England Biolabs, which is intended to help biopharmaceutical manufacturers.

MARKET CHALLENGES

High Cost of Products to Hamper Market Growth

One of the significant factors challenging the market growth is high costs of these enzymes coupled with supply chain & logistic constraints. The enzymes used in therapeutic applications and diagnostic purposes are clinical- and GMP-grade exonucleases. These products are significantly more expensive than research-grade versions. This results in slower adoption in cost-sensitive markets especially in emerging countries.

- For instance, according to New England Biolabs, the price of NEB T5 Exonuclease (Research Grade) is USD 78.00. However, the price of GMP-grade T5 Exonuclease is comparatively higher and is based on higher manufacturing & validation costs, and documentation costs associated with GMP-grade production.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

High Demand for Exonucleases II Contributed to Its Segmental Growth

On the basis of type, the market is classified into exonucleases I, exonucleases II, exonucleases III, and others.

The exonucleases II segment accounted for the most significant exonucleases market share in 2024. The growing demand for these products owing to their wide usage in a broad range of molecular biology applications has resulted in the dominance of this segment in the market. Also, these products offer versatility, precision, and compatibility and have a large number of providers that operate in the market.

- For instance, Thermo Fisher Scientific Inc. and New England Biolabs are some of the major player in the market that offers a wide range of exonuclease II enzymes.

By Application

Increasing Focus on Genomics Research Fuels Growth of Genomics & Genetic Engineering Segment

In terms of application, the market is categorized into genomics & genetic engineering, drug discovery & research, and others.

The genomics & genetic engineering segment captured the largest share of the market in 2024. Exonucleases play an important role in genomics & genetic engineering as these enzymes offer precise, directional nucleic acid degradation useful for various workflows. The significant investments in genomics, advancements in the gene editing technologies, and a supportive regulatory environment are the key factors driving the segmental growth.

- For instance, in September 2024, the National Institutes of Health (NIH) awarded USD 5.4 million for the establishment of new network of genomics.

Drug discovery & research segment is expected to grow at a considerable CAGR over the forecast period.

By Formulation

Widespread Usage Supplemented Segment Growth of Standard Exonucleases

Based on formulation, the market is segmented into standard and thermolabile.

The standard segment held the dominating position in 2024. Several advantages such as cost-effectiveness, stability at room temperature, and broader applications in various cellular process are bolstering their usage.

- For instance, New England Biolabs is a one of the key players in the market which offers a wide variety of standard exonucleases. The company has stated various advantages of these products.

The segment of thermolabile is set to flourish with a strong growth across the forecast period.

By End User

Active Involvement in Genome-based Research Activities by Pharmaceutical & Biotechnology Companies Propelled Segment Growth

Based on end-user, the market is segmented into academic & research institutes, pharmaceutical and biotechnology companies, and others.

In 2024, the global market was dominated by pharmaceutical and biotechnological companies in terms of end-user. Emphasis on innovative cell & gene therapy development, expansion of synthetic biology applications, and increasing integration of NGS technologies in drug discovery, biomarker validation, and companion diagnostics are some of key factors supporting the dominance of this segment.

- For instance, Alnylam Pharmaceuticals is involved in RNA interference (RNAi) therapeutics. The company has developed several approved drugs using this approach which includes natural cellular machinery, including exonucleases, to degrade specific mRNA molecules, thus silencing target genes.

In addition, academic & research institutes end users are projected to grow at a robust CAGR during the study period.

Exonucleases Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Exonucleases Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America dominated the market with a valuation of USD 56.31 billion in 2025 and USD 60.42 billion in 2026. The factors fostering the dominance of the region include access to innovative product pipelines & advanced reagents through the presence of well-established market players, active involvement of research community in genomics research, and presence of large-scale contract research organizations, among others.

- For instance, in June 2024, Thermo Fisher Scientific Inc. expanded its central laboratory operations in Wisconsin and Kentucky and region with an aim to serve the biotechnology and pharmaceutical and industries.

Europe & Asia Pacific

Other regions such as Europe and Asia Pacific are anticipated to witness a notable growth in the coming years. During the forecast period, European region is projected to record the growth rate of 8.85%, which is the second highest out of all regions and is anticipated to touch the valuation of USD 34.7 million in 2025. This is primarily due to the advancing research capabilities in these regions leading to high demand for these enzymes. After Europe, the market in Asia Pacific is estimated to reach USD 25 million in 2025 and secure the position of third-largest region in the market.

Latin America and Middle East & Africa

Over the forecast period, Latin America and Middle East & Africa regions would witness a moderate growth in this marketspace. Latin America market in 2025 is set to record USD 6.0 million as its valuation. Rising incidence of genetic disorders and need for biomarker discovery further drive usage in these regions.

COMPETITIVE LANDSCAPE

Key Industry Players

Wide Range Of Product Offerings Coupled With Strong Distribution Network Of Key Companies Supported Their Leading Positions

The global exonucleases market shows a semi-concentrated structure with numerous small-to-mid-size companies actively operating across the globe. These players are actively involved in product innovation, strategic partnerships, and geographic expansion.

New England Biolabs, Takara Bio Inc., and Thermo Fisher Scientific Inc., are some of the dominating players in the market. A comprehensive range of exonucleases enzymes, global presence through strong distribution network, and collaborations with research and academic institutes are few characteristics of these players which support their dominance.

Apart from this, other prominent players in the market include Promega Corporation, QIAGEN, KACTUS, Jena Bioscience GmbH, and others. These companies are undertaking various strategic initiatives such as investments in R&D and partnerships with pharmaceutical companies to enhance their market presence.

LIST OF KEY EXONUCLEASES COMPANIES PROFILED

- Takara Bio Inc. (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- New England Biolabs (U.S.)

- Promega Corporation (U.S.)

- BioCat GmbH (Germany)

- QIAGEN (Germany)

- KACTUS (U.S.)

- Jena Bioscience GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- February 2025: Osang Healthcare invested USD 2.0 million in Kryptos Biotechnologies focusing on innovative molecular diagnostics.

- July 2024: The U.S. FDA launched ‘Rare Disease Innovation Hub’ with an aim to accelerate the advancements to develop promising drug and gene therapies for rare diseases.

- June 2024: Zymo Research, has launched a new nuclease called PureRec Duplex-Specific Nuclease (DSN) that selectively digests double stranded DNA (dsDNA) potential applications.

- January 2023: Agilent Technologies, Inc. invested approximately USD 725.0 million to double manufacturing capacity of therapeutic nucleic acids in Colorado.

- September 2021: Fortis Life Sciences, LLC. acquired Empirical Bioscience, Inc. By this acquisition, the company entered in to genomic technologies and expanded our recombinant protein manufacturing capabilities.

REPORT COVERAGE

The global exonucleases market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The exonucleases market research report also encompasses detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.45% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Formulation

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 125.87 million in 2025 and is projected to reach USD 135.96 million by 2034.

In 2025, the market value stood at USD 56.31 million.

The market is expected to exhibit a CAGR of 8.45% during the forecast period.

The exonucleases II segment led the market by type.

The key factors driving the market are the expanding applications in genomic research coupled with rising demand for precision tools in genome based studies, and others.

New England Biolabs, Thermo Fisher Scientific Inc., and Takara Bio Inc., are some of the prominent players in the market.

North America dominated the market in 2024.

Increase in demand from genomics and gene editing, rise in synthetic biology, and focus on innovative therapeutics development are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us