Restriction Enzymes Market Size, Share & Industry Analysis, By Type (Type I, Type II, Type III, and Type IV), By Application (Genomics & Genetic Engineering, Drug Discovery & Research, and Others), By End User (Pharmaceutical and Biotechnology Companies, Academic & Research Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

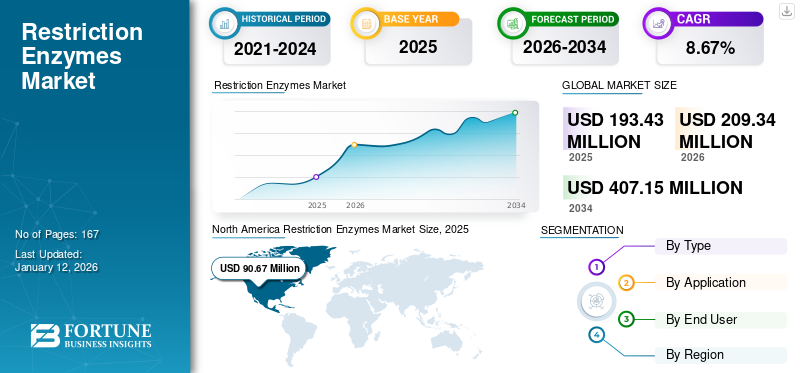

The global restriction enzymes market size was valued at USD 193.4 million in 2025. The market is projected to grow from USD 209.34 million in 2026 to USD 407.15 million by 2034, exhibiting a CAGR of 8.67% during the forecast period. North America dominated the restriction enzymes market with a market share of 46.87% in 2025.

Restriction enzymes, also known as restriction endonucleases, are proteins that act similar to molecular scissors by recognizing and cutting DNA at specific sequences. These enzymes, produced by bacteria, are widely used in genetic engineering and biotechnology. The market is experiencing robust growth, driven by the increasing demand for precision tools in molecular biology and the rising use of these enzymes in genetic research. Additionally, the advances in biotechnology, genomics research, and the expanding application of these enzymes in genome editing, diagnostics, and therapeutics further drives the market growth. The rise of personalized medicine, as well as the growing focus on genetic modifications in crop development, further propels the demand for high-fidelity enzymes in various fields.

These enzymes are integral to genome mapping, gene expression studies, and sequencing. Their use in Next-Generation Sequencing (NGS) and personalized medicine is driving market demand.

- For instance, the use of restriction enzymes in conjunction with CRISPR-Cas systems is enabling precise genome modifications, opening new opportunities for therapeutic applications and functional genomics. CRISPR-Cas technology, particularly CRISPR-Cas9, has revolutionized the field of genetic engineering.

Some of the leading market players include Thermo Fisher Scientific, Inc., Takara Bio Inc., and New England Biolabs. Active involvement in product innovation, strategic partnerships, and geographic expansion have supported the dominance of these companies in the global market.

Restriction Enzymes Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 193.4 million

- 2026 Market Size: USD 209.34 million

- 2034 Forecast Market Size: USD 407.15 million

- CAGR: 8.67% from 2026–2034

Market Share:

- North America dominated the restriction enzymes market with a 46.87% share in 2025, owing to strong investments in genomics research, widespread adoption of biotechnology tools, and advanced infrastructure supporting R&D.

- By type, Type II restriction enzymes held the largest market share in 2026 due to their specificity in recognizing and cutting DNA sequences, making them essential in cloning, gene editing, and sequencing workflows.

Key Country Highlights:

- Japan: Market growth is driven by increasing governmental and academic investment in synthetic biology and CRISPR-based research, fostering enzyme demand for innovative therapies.

- United States: A leading hub for genomics research and biotechnology innovation; increasing FDA approvals for gene therapies like Casgevy (2024) support the growing use of restriction enzymes in therapeutic development.

- China: Rising genetic engineering projects, such as the 2025 creation of genetically engineered mice with two male parents, reflect rapid growth in genome manipulation tools, boosting enzyme demand.

- Europe: Growth supported by major R&D investments and biotech infrastructure expansion, such as BioPharmaSpec’s new research facilities in Germany, Italy, and Lithuania launched in 2024.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Precision Tools in DNA Manipulation to Propel Market Growth

The most prominent driver for the market is the increasing demand for precision tools in DNA manipulation. The growing need for precision in molecular biology, including gene editing, cloning, and sequencing, increases the reliance on restriction enzymes. These enzymes are essential in cutting DNA molecules at specific sequences, which is a foundational technique in genetic research.

- For instance, The U.S. Food and Drug Administration (FDA) approved Casgevy (exa-cel) to treat Transfusion-Dependent Beta Thalassemia (TDT) in January 2024. Casgevy is a cell-based gene therapy developed by Vertex Pharmaceuticals and CRISPR Therapeutics using this tool.

The emergence of synthetic biology, which combines principles of engineering and biology, has led to innovative solutions for enzyme design and application. Enzymes such as polymerases and restriction enzymes are being engineered to improve industrial processes such as biofuel production, biodegradable plastics, and new antibiotics. These are some of the key factors driving the restriction enzymes market growth.

MARKET RESTRAINTS

High Production Costs to Limit Market Expansion

One of the main challenges faced by market players is the higher cost of producing high-fidelity restriction enzymes. The complex biochemical processes involved in enzyme production require sophisticated technologies and infrastructure, leading to higher manufacturing costs. Additionally, the restriction of endonucleases production and use are subject to stringent quality control and regulatory standards, especially when used in clinical or therapeutic applications. Maintaining the quality and consistency of enzyme products across batches is a significant issue for manufacturers. This also results in increasing manufacturing costs, in turn limiting the market growth.

MARKET OPPORTUNITIES

Growing Biotechnology and Pharmaceutical Sector Creates Lucrative Growth Opportunities

Biotechnology and pharmaceutical industries increasingly utilize these enzymes for therapeutic development, diagnostics, and protein engineering. Moreover, the growing demand for biopharmaceuticals and biologics in the treatment of genetic disorders has created lucrative opportunities for the players operating in the market to capture the untapped avenues of the market. The demand for these enzymes is influenced by increasing research funding, advancements in genomics, and the overall biotechnology industry, which supports the market growth in the coming years. Few major areas where these enzymes witness strong demand include gene cloning and genetic engineering, DNA mapping and sequencing, DNA fingerprinting and forensic analysis, genome editing, synthetic biology, and bioengineering. With the significant growth in the arena, the demand for these enzymes is also anticipated to grow.

RESTRICTION ENZYMES MARKET TRENDS

Advancements in Genome Editing Technologies is a One of the Significant Market Trends

Restriction enzymes are being increasingly integrated with genome-editing technologies such as CRISPR-Cas to improve the accuracy of DNA manipulation. This trend is creating new avenues for gene therapy, genetic research, and even in-vitro diagnostics, driving the growth of the market. Additionally, researchers are developing engineered enzymes with improved specificity and activity under a broader range of experimental conditions. Innovations in enzyme engineering are making it possible to overcome different limitations associated with traditional enzymes, such as sequence bias and inefficient cutting under certain conditions.

Other trends in the market include expansion of product offerings. Well-known companies are expanding their portfolios to include a wide range of enzymes, enzyme kits, and reagents for molecular biology research. These products cater to a broad spectrum of applications, from academic research to industrial biotechnology.

MARKET CHALLENGES

Limited Availability of Novel Enzymes to Hamper Market Growth

While many restriction enzymes are commercially present, the availability of new and optimized enzymes for specific applications remain limited. This can hinder researchers who are seeking specialized solutions in their genomic work. The discovery of new enzymes often relies on screening bacterial strains for the presence of genes encoding these enzymes, which can be a time-consuming and resource-intensive process.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Growing Usage of Type II Products Contributed to Segmental Growth

Based on type, the market is classified into Type I, Type II, Type III, and Type IV.

The type II segment captured the significant restriction enzymes market share in 2024. They are most widely used in molecular biology, Type II enzymes recognize and cut DNA at specific sequences, making them essential for cloning, sequencing, and other applications. Some of the leading factors driving the segmental growth include widespread usage in biotechnology and molecular biology coupled with their strong commercial availability through various operating players.

- For instance, Thermo Fisher Scientific Inc. is one the major players in the market that offers a wide range of type II enzymes.

On the other hand, type I & type III segments are anticipated to witness considerable growth throughout the forecast period. These enzymes cut DNA at a specific distance from their recognition site and are used in certain specialized applications. Also, these enzymes are complex and require multiple subunits for activity.

By Application

Increasing R&D Investments in Genomics Research Fueled Growth of Genomics & Genetic Engineering

In terms of application, the market is categorized into drug discovery & research, genomics & genetic engineering, and others.

The genomics & genetic engineering segment held a prominent portion of the global market in 2024. Restriction enzymes play a crucial role in manipulating genes for various applications, including the production of Genetically Modified Organisms (GMOs) and gene therapy. Continuous innovations in enzyme engineering are enhancing the specificity, efficiency, and performance of restriction enzymes. This includes improvements in enzyme purity, optimal working conditions, and novel applications in Next-Generation Sequencing (NGS) and CRISPR-Cas genome editing technologies.

- For instance, in October 2023, the Yale School of Medicine received a funding of USD 40 million from the National Institutes of Health (NIH) announced to support the development of a gene-editing platform capable of reaching the human brain.

Drug discovery & research segment is expected to grow at a higher CAGR during the forecast period. The high prevalence of chronic diseases, such as cancer and cardiovascular conditions across the world increases the demand for innovative treatments, including gene therapies that along with extensive pre-clinical studies is projected to fuel the segment growth.

By End User

Increase in Research Activities by Pharmaceutical & Biotechnology Companies Boosted Segment Growth

Based on end-user, the market is segmented into pharmaceutical and biotechnology companies, academic & research institutes, and others.

Pharmaceutical and biotechnology companies segment dominated the market in 2024. These industries rely heavily on restriction enzymes for drug development, diagnostics, and genetic engineering. Rapidly increasing activities in genomics coupled with strong emphasis on development of innovative gene therapies by pharmaceutical companies has also supplemented the segmental growth.

On the other hand, academic & research institutes are anticipated to witness a considerable growth in the coming years. Research institutions use restriction enzymes for fundamental biological studies and advancing genetic technologies.

Restriction Enzymes Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Restriction Enzymes Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America is the largest regional market for restriction enzymes, contributing a significant share of the global market in 2024, with the regional market valued at USD 90.67 million in 2025. This is majorly due to the advanced infrastructure for research and development, extensive funding for genomics research, and the high adoption of biotechnology and molecular biology tools in the region.

The U.S. has a well-established biotechnology sector with extensive research infrastructure, supporting the development and application of DNA modifying enzymes. Additionally, the U.S. is at the forefront of adopting new technologies, including gene editing tools such as CRISPR-Cas9, which rely on DNA modifying enzymes for precise genetic modifications. Furthermore, key player’s strategic initiatives are expected to fuel the country’s market growth.

- For instance, in June 2024, Thermo Fisher Scientific Inc. expanded its central laboratory operations in Kentucky and Wisconsin region, dedicated to serve the pharmaceutical and biotech industries.

Europe

Europe holds the second-largest market share and is expected to maintain steady growth. The region benefits from significant investments in scientific innovation and research, with many prominent universities and research institutions focusing on genomic studies.

- For instance, in November 2024, BioPharmaSpec launched three new R&D facilities in Europe, located in Germany, Italy, and Lithuania. These facilities will focus on drug discovery and R&D services, including structural and physicochemical characterization of biopharmaceutical products.

Asia Pacific

Asia Pacific is anticipated to exhibit the highest growth rate in the coming years. This growth is driven by increasing government initiatives, rising investments in biotechnology, and a growing emphasis on genetic engineering in China, India, and Japan.

- For instance, in January 2025, scientists from China have created mice with two male parents using genetic engineering.

Latin America and the Middle East & Africa

The market in Latin America and the Middle East & Africa is expected to witness moderate growth in the coming years. Companies are focusing on expansion into emerging economies, where biotechnology research is expanding rapidly. These regions present new growth opportunities, especially as governments and private sectors invest heavily in genomics research and healthcare infrastructure.

COMPETITIVE LANDSCAPE

Key Industry Players

Broad Product Offerings and Introduction of New Products by Key Companies Resulted in their Dominating Position

The global restriction enzymes market showcases a semi-concentrated structure with numerous small-to-mid-size companies actively operating across the globe. These players are actively involved in product innovation, strategic partnerships, and geographic expansion.

New England Biolabs, Thermo Fisher Scientific Inc., and Takara Bio Inc., are some of the prominent players in the market. Leading players in the restriction enzyme market are forming strategic collaborations and partnerships to combine expertise and resources. These alliances are aimed at developing advanced enzyme products and expanding distribution channels across the globe.

Apart from this, other prominent players in the market include Merck KGaA, Promega Corporation, Danaher Corporation among others. These companies emphasize on investments in R&D and strategic partnerships to enhance its market presence.

LIST OF KEY RESTRICTION ENZYMES COMPANIES PROFILED

- Takara Bio Inc. (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- New England Biolabs (U.S.)

- Promega Corporation (U.S.)

- BioCat GmbH (Germany)

- Fortis Life Sciences (U.S.)

- Merck KGaA (Germany)

KEY INDUSTRY DEVELOPMENTS

- November 2024: Danaher Corporation opened a FlexFactory delivered by Cytiva, spanning over 7,000 m2, including lab and production areas, offices, and shared spaces to enhance the manufacturing in Poland.

- September 2024: Agilent Technologies Inc. acquired BIOVECTRA, a Canada-based contract development and manufacturing organization that specializes in biologics, highly potent active pharmaceutical ingredients, and other molecules for targeted therapeutics.

- November 2023: Element Biosciences, Inc. and QIAGEN partnered strategically to provide broad NGS workflows for the innovative Element AVITI System. This partnership enhances the capabilities for epigenetic analysis and sequencing.

- August 2023: BestEnzymes Biotech Co., Ltd. announced the launch of New GMP Grade Restriction Endonuclease.

- March 2023: Creative Enzymes introduced a new line of restriction enzymes with an aim to improve the precision and flexibility of molecular biology experiments.

REPORT COVERAGE

The global restriction enzymes market analysis provides market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The report covers detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.67% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Type

|

|

By Application

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 193.43 million in 2025 and is projected to reach USD 407.15 million by 2034.

In 2025, the market value stood at USD 90.67 million.

The market is expected to exhibit a CAGR of 8.67% during the forecast period of 2026-2034.

The type II segment led the market by type.

The key factors driving the market are the rising demand for precision tools in DNA manipulation, coupled with expanding applications in genomic research.

New England Biolabs, Thermo Fisher Scientific Inc., and Takara Bio Inc., are some of the prominent players in the market.

North America dominated the restriction enzymes market with a market share of 46.87% in 2025.

Rise in research and development activities by pharmaceutical companies coupled with advancements in genomics research are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us