Eyewear Packaging Market Size, Share & Industry Analysis, By Material (Plastic, Paper & Paperboard, Leather, and Others), By Product Type (Boxes, Cases, Pouches, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

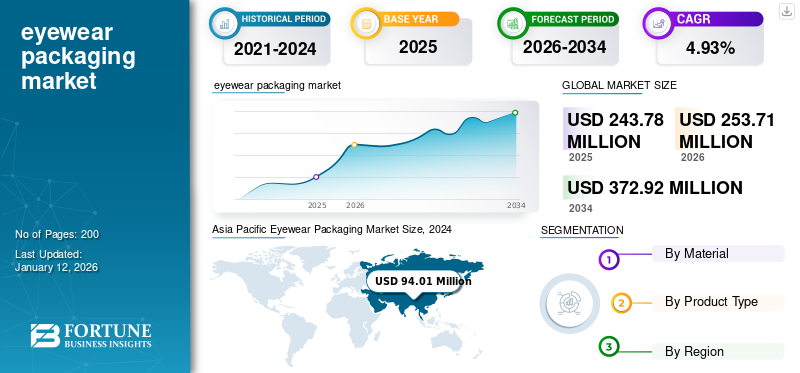

The global eyewear packaging market size was valued at USD 243.78 million in 2025. It is projected to be worth USD 253.71 million in 2026 and reach USD 372.92 million by 2034, exhibiting a CAGR of 4.93% during the forecast period. Asia Pacific dominated the eyewear packaging market with a market share of 40.37% in 2025.

Eyewear packaging involves the design, production, and evaluation of the packaging for eyewear items such as glasses, sunglasses, and goggles. It plays a major role in attracting consumers, safeguarding eyewear products, and increasing the overall brand experience. This growth is attributed to increasing demand for eyewear products, rising disposable incomes, and heightened awareness of eye health.

KLING GMBH and Packman Packaging Private Limited are the leading manufacturers, accounting for the largest share.

GLOBAL EYEWEAR PACKAGING MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 243.78 million

- 2026 Market Size: USD 253.71 million

- 2034 Forecast Market Size: USD 372.92 million

- CAGR: 4.93% from 2026–2034

Market Share:

- Asia Pacific dominated the market in 2025 with a 40.37% share, rising from USD 98.43 million in 2025 to USD 103.26 million in 2026.

- By material, plastic led the market due to its durability, cost-effectiveness, and protective qualities.

- By product type, boxes held the largest share and are projected to account for 47.60% of the market in 2026.

- The increasing demand for sustainable, personalized, and luxury packaging is significantly shaping market dynamics.

- KLING GMBH and Packman Packaging Pvt. Ltd. are the leading manufacturers globally.

Key Country Highlights:

- China & India (Asia Pacific): Export hubs for eyewear products; rising disposable incomes and urbanization fuel packaging demand.

- United States: Surge in e-commerce (22.0% of retail in 2023) and AI-driven eyewear personalization boost packaging innovation.

- Germany & Italy (Europe): Strong eyewear manufacturing tradition and premium branding drive demand for eco-friendly packaging.

- Brazil & Mexico (Latin America): Demand rising for luxury packaging tied to designer and limited-edition eyewear collections.

- Middle East & Africa: Growth supported by rising e-commerce, eyewear subscription services, and expanding middle-class consumer base.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Sustainable & Eco-friendly Packaging Solutions Drives Market Growth

Consumers are becoming more eco-conscious, prompting eyewear brands to adopt sustainable packaging solutions. It includes using recyclable, biodegradable, or compostable materials for cases, boxes, and inserts. Eco-friendly technologies, such as the development of recyclable containers for eyewear packaging, are transforming the eyewear case packaging sector. These containers provide unparalleled sustainability and effectiveness, enabling the development of complex designs suited to the unique requirements of the eyewear. Sustainable packaging is witnessed as a responsible choice and as a competitive differentiator, particularly among younger, environmentally conscious consumers. The growing demand for sustainable packaging solutions is driving the growth of the global eyewear packaging market.

Augmenting Demand for Personalized and Luxury Packaging Propels Market Growth

Eyewear brands are increasingly offering personalized packaging to enhance the customer experience. It includes custom-printed boxes, cases with unique designs, and even engraved or monogrammed eyewear cases. Personalized and eye-catching packaging can help brands stand out in a competitive market and build a strong emotional connection with consumers. For high-end or luxury eyewear brands, packaging has become a key factor in communicating the premium nature of the product. It involves using materials such as leather, velvet, and high-quality hard cases, along with sleek, elegant designs. Luxury eyewear brands are using packaging as a way to reinforce their brand's high-end positioning and provide a memorable experience. The increasing demand for premium and customized packaging boosts market growth.

MARKET RESTRAINTS

High Upfront Costs & Design Complexity Impede Market Growth

The cost of raw materials for packaging, such as cardboard, paper, and plastic, fluctuates, and this can drive up the overall packaging costs for eyewear companies. In some cases, the rising cost of materials such as recycled plastics or custom packaging materials can be significant. Custom-designed packaging or packaging that requires additional features can significantly increase production costs. Eyewear packages often have to look luxurious and visually appealing to align with the premium nature of many eyewear brands. Creating distinctive, innovative designs and attractive packaging while ensuring practicality can be complex and costly, thus hindering market growth.

MARKET OPPORTUNITIES

Integration of Smart Packaging and New Technologies Will Generate Growth Opportunities

Many eyewear companies are incorporating QR codes, NFC chips, or AR elements into their packaging. Scanning these codes can provide customers with additional product information, instructional content (e.g., care guides), or virtual try-on experiences. Some brands are experimenting with augmented reality features where consumers can interact with the packaging via smartphones, enhancing the consumer journey. Technology-integrated packaging elevates the customer experience, making it more informative and engaging. Henceforth, the implementation of smart packaging and new technologies is being explored to generate profitable growth opportunities.

MARKET CHALLENGES

Health and Safety Regulations Challenges to Market Growth

The eyewear package market, which plays a crucial role in both protecting and branding eyewear products, faces several challenges. In some regions, eyewear packages must comply with specific health and safety regulations, particularly for eyewear products that are intended for children or have special safety features. Ensuring compliance with these regulations can add complexity to packaging design and material selection. The rising health and safety regulations in major countries are, thus, a key factor that challenge eyewear packaging market growth.

Download Free sample to learn more about this report.

EYEWEAR PACKAGING MARKET TRENDS

Augmenting Demand for Minimalism & Aesthetic Packaging Emerges as a Key Trend

Minimalism and aesthetic packaging are two powerful trends currently shaping the eyewear industry. These trends cater to consumer needs for simplicity, sophistication, and sustainability while enhancing the overall brand experience. Brands that embrace minimalist design can build a strong, premium identity through carefully selected materials, functional designs, and elegant simplicity. The trend also aligns with broader consumer demand preferences for sustainability, efficiency, and a cleaner, more thoughtful aesthetic. As eyewear brands continue to differentiate themselves in an increasingly competitive market, minimalist packaging will remain a powerful tool for enhancing product appeal, creating a memorable unboxing experience, and communicating brand values. Asia Pacific witnessed a eyewear packaging market growth from USD 89.81 billion in 2023 to USD 94.01 billion in 2024.

IMPACT OF COVID-19

The eyewear industry faced a difficult period due to the COVID-19 pandemic, with substantial declines in production and demand. The coronavirus outbreak had a restricted effect on the eyewear industry; however, with the ease of lockdown, the production and logistics supply chain returned to normal, thus impacting the market positively.

Trade Protectionism and Its Impact

Trade protectionist policies, such as tariffs and import restrictions, can significantly impact the eyewear packaging market. For instance, increased tariffs on raw materials or finished goods can raise production costs, affecting pricing strategies. Additionally, import restrictions may limit the availability of certain materials, forcing manufacturers to seek alternative sources or materials, potentially impacting product quality or design.

SEGMENTATION ANALYSIS

By Material

Plastic Segment Dominates due to its Significant Benefits

Based on material, the market is segmented into plastic, paper & paperboard, leather, and others.

Plastic is the dominating material segment and is expected to witness massive growth during the forecast period. Plastic is the most common material used for eyewear products as it is durable, affordable, and protects eyewear from damage. It is a durable material that protects eyewear from moisture, humidity, and other external forces. Moreover, the plastic packaging can be designed to be tamper-evident, which helps ensure that the product remains secure until it reaches the consumer, thus enhancing growth in the segment. Plastic segment acquired 47% of the market share in 2024.

Paper and paperboard are the second-dominating material segment and are expected to grow rapidly during the coming years. Boxes manufactured with paperboard material are stronger than other materials and offer maximum protection for eyewear products.

By Product Type

To know how our report can help streamline your business, Speak to Analyst

Increased Usage of Boxes by Eyewear Brands Boosted Segment Growth

Based on product type, the market is classified into boxes, cases, pouches, and others.

Boxes held the largest global eyewear packaging market share in the product type segment. Eyewear boxes possess a sense of elegance and sophistication while effectively showcasing the eyewear brand. The printing and manufacturing process reflects refinement, assuring the protection of eyewear while also serving as a promotional tool for the brands. The rising utilization of eyewear boxes by major brands is driving the segment's growth.

- Boxes segment is anticipated to hold 47% of the market share in 2025.

The case product type is the second dominating segment and is expected to experience rapid CAGR of 4.53% during the forecast period. The primary function of eyewear cases is to safeguard the glasses during transit & handling.

EYEWEAR PACKAGING MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Eyewear Packaging Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Well-established Eyewear Industry Boosts the Market Growth in Asia Pacific

Asia Pacific is the dominating region of the global market with a value of USD 103.26 million in 2026. In 2025, the Asia Pacific region held market value of USD 98.43 million. Rapid urbanization, increasing disposable incomes, and a growing middle class are driving the demand for eyewear and, consequently, packaging solutions. Eyewear products are majorly traded in the region. The rising demand for eyewear products and the increasing exports from major countries such as China and India boost market growth. The market value of China is likely to hit USD 45.87 million in 2026. Japan’s market is expected to reach USD 10.75 million whereas India is likely to be accountable for USD 22.77 million in 2026.

- According to the Observatory of Economic Complexity (OEC), in 2022, the top exporters of Eyewear were China (USD 4.53 billion), Italy (USD 3.48 billion), Chinese Taipei (USD 521 million), U.S. (USD 514 million), and Germany (USD 468 million).

North America

Rapidly Growing E-commerce Sales Drives Market Growth

North America is likely to be the second-dominating region with a market value of USD 63.85 million in 2026 and expected to hold a significant CAGR of 4.13% during the forecast period, driven by high consumer spending on eyewear and a strong emphasis on sustainable packaging solutions. Online shopping has grown rapidly in the U.S., and Artificial intelligence (AI) has had a notable impact on the eyewear industry. The growing e-commerce sales in the country are influencing market growth. The U.S. market is expected to hit USD 47.11 million in 2026.

- According to the Census Bureau U.S., in 2023, U.S. e-commerce represented 22.0% of total retail sales. Moreover, e-commerce sales in the third quarter of 2024 accounted for 16.2% of total retail sales.

Europe

Growing Eyewear Manufacturing Boosts Market Growth

Europe is the third-largest contributor to the market with a value of USD 51.57 million in 2026. Stringent environmental regulations and a rising focus on luxury eyewear brands ared driving the demand for premium and eco-friendly materials packaging. Europe has historically been a global hub for the production of high-quality eyewear, which is characterized by a profound legacy of craftsmanship, cutting-edge technology, and a dedication to excellence. From high-end fashion labels to meticulously crafted optical products, European producers establish the worldwide benchmark in eyewear production. The market in U.K. is estimated to hit USD 10.73 million in 2026. Germany’s market is expected to reach USD 10.11 million in 2026 whereas France is likely to be accountable for USD 6.51 million in 2025.

Latin America

Rising Demand for Luxury Packaging Drives Market Growth

Latin America will experience steady growth with a value of USD 24.21 million in 2025 as the fourth-largest market. The tactile and visual appeal of the packaging enhances the perception of the eyewear, especially when it comes to limited-edition collections of designer eyewear. The augmenting demand for luxury experience for eyewear product packaging enhances market development. Moreover, the increasing awareness of eye health and a growing middle-class population further boost market growth.

Middle East & Africa

Increasing E-commerce & Subscription Services Boosts Market Growth

The Middle East region will experience significant growth during the projected period. Subscription services for eyewear have grown, with companies offering packages that deliver new pairs of glasses or contact lenses at regular intervals. Custom packaging for these subscriptions often includes surprise elements or exclusive items. Rising disposable incomes and increasing eyewear awareness are poised to drive steady growth in the market. Saudi Arabia is projected to hit USD 2.60 million in 2025.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global eyewear packaging market is highly fragmented and competitive, with significant players dominating the market by offering innovative packaging solutions in the packaging industry. These major market players constantly focus on expanding their customer base across regions by innovating their existing range of products. The key developments by manufacturers are analyzed to propel market expansion.

Major players in the industry include KLING GMBH, Packman Packaging Private Limited, Giorgio Fedon & Figli Spa, Classic Packaging, Gatto Astucci Spa, MARBER S.R.L., and others. Other companies operating in the market are focused on analyzing market trends and delivering advanced packaging solutions.

List of Key Eyewear Packaging Companies Profiled

- KLING GMBH (Germany)

- Packman Packaging Private Limited (India)

- Giorgio Fedon & Figli Spa (Italy)

- Classic Packaging (China)

- Gatto Astucci Spa (Italy)

- MARBER S.R.L. (Italy)

- Rongyu Packing (China)

- Umiya Plast (India)

- Wadpack Pvt. Ltd. (India)

- King Home Printing (Taiwan)

- Well Packaging Limited (China)

- Processo Plast Enterprise Private Limited (India)

- lsunny Company Limited. (China)

- Salazar Packaging (U.S.)

- IBEX Packaging (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2024- The Nissan Formula E Team declared its affiliation with sunglasses and apparel company Coral Eyewear on a multi-year deal. All of the label's packaging and glass cloths utilize recycled paper and PET. At the same time, their delivery partner, DPD, manages 1,600 electric vehicles throughout the U.K., guaranteeing sustainability from production to final delivery.

- February 2024- Bollé Safety, a globally recognized producer of safety eyewear, introduced the SWIFT industrial collection featuring safety glasses and over-the-glasses goggles. Bollé Safety is pleased to announce that both SWIFT choices are made from recycled polycarbonate, are entirely recyclable, including the packaging, and feature a mono-material design free of metal parts to showcase environmentally friendly production while maintaining quality and performance.

- April 2023- VSP Vision revealed the introduction of new responsibly sourced shipping materials for the online store Eyeconic and Visionworks physical outlets. The packaging provided by California consists of 100% FSC-certified recycled corrugated materials, eco-friendly ink, and contains no plastic. The new packages can also be recycled at the curb, which aids in reducing environmental impact even more.

- September 2022- U.S. Vision, a prominent seller of optical goods and services with over 370 outlets in diverse retail categories, teamed up with Miami's MITA Eyewear to serve as the exclusive distributor for the brand's range of optical frames. The latest collection is crafted from sustainable materials, including recycled water bottles, recycled aluminum, biodegradable nose pads, lenses, and artisanal bio-acetate. MITA is also proud of its packaging, which is made entirely from sustainable materials.

- April 2022- Luxottica announced plans to purchase 90.9% of Fedon to venture into the packaging and eyewear cases market. The acquisition would enable a better alignment of eyewear and spectacles with their cases and packaging, ensuring optimal protection and integrity of the product and ultimately benefiting the end consumer.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market will witness astonishing growth with the growing collaborations, mergers, and investments. These initiatives help in increasing the importance of eyewear packages. In December 2024, the European Commission approved a USD 1.41 billion subsidy from the Italian government to semiconductor packaging and testing company Silicon Box. The funds will support the construction of an advanced packaging and testing facility in Novara, Piedmont, Italy.

Silicon Box’s factory will utilize panel-level packaging (PLP) technology and is expected to begin construction in the second half of 2025. Initial production is planned for Q1 2028, with full capacity projected by 2033, capable of processing approximately 10,000 panels per week.

REPORT COVERAGE

The market research report provides a detailed market analysis, focusing on key aspects, such as top key players, competitive landscape, product/service types, market segments, Porter's five forces analysis, and leading segments of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.93% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Material

|

|

By Product Type

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 243.78 million in 2025.

The market will likely grow at a CAGR of 4.93% over the forecast period (2026-2034).

By product type, the box segment led the market in 2026.

The Asia Pacific market size stood at USD 103.26 million in 2026.

Rising demand for sustainable & eco-friendly packaging solutions and augmenting demand for personalized and luxury packaging are key factors driving market growth.

Some of the top players in the market are KLING GMBH, Packman Packaging Private Limited, Giorgio Fedon & Figli Spa, Classic Packaging, Gatto Astucci Spa, MARBER S.R.L., and others.

The global market size is expected to reach USD 372.92 million by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us