Eyewear Market Size, Share & Industry Analysis, By Product Type (Spectacles {Frames and Lens}, Sunglasses {Plano and Prescription}, and Contact Lens {Toric, Multifocal, and Sphere}), By Distribution Channel (Retail Stores, Online Stores, and Ophthalmic Clinics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

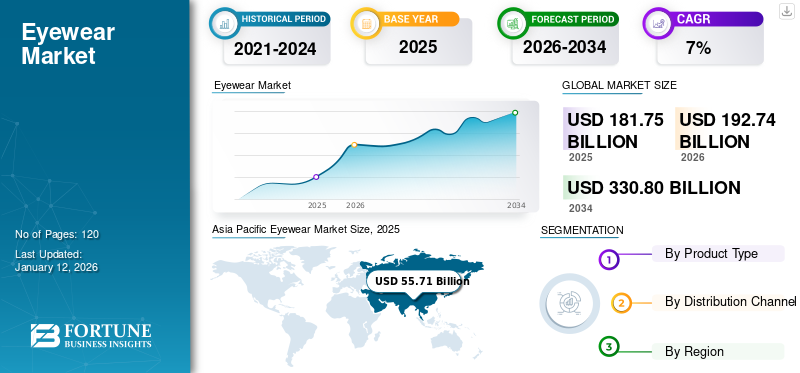

The global eyewear market size was valued at USD 181.75 billion in 2025. The market is projected to grow from USD 192.74 billion in 2026 to USD 330.08 billion by 2034, exhibiting a CAGR of 7% during the forecast period. Asia Pacific dominated the eyewear market with a market share of 30.70% in 2025.

The market includes products, such as spectacles, sunglasses, and contact lenses. These products offer vision correction and protection from harmful Ultraviolet A (UVA) and Ultraviolet B (UVB) sun rays. Currently, people prefer using spectacles owing to the rising awareness regarding ocular diseases, combined with the increasing prevalence of vision disorders such as myopia and presbyopia. The industry is highly fragmented, with many local and international players operating in the market. EssilorLuxottica and Johnson & Johnson Services, Inc. are some of the leading players in the market, with a strong focus on research and development activities to launch novel products in the market.

- For instance, according to the data published by the Official Journal of the British Contact Lens Association (BCLA) in August 2024, the number of people suffering from presbyopia is expected to reach a peak of around 2.1 billion globally by 2030, driving the demand for spectacles.

The increasing patient population with vision impairment, along with the growing demand for consumer preference for eyewear as a fashion accessory, is fueling demand for eyewear products such as sunglasses, and contact lenses. This, along with the increasing focus of market players towards strategic initiatives such as acquisitions and mergers among the other players to cater to the growing demand, is expected to support global eyewear market growth.

Global Eyewear Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 181.75 billion

- 2026 Market Size: USD 192.74 billion

- 2034 Forecast Market Size: USD 330.08 billion

- CAGR: 7% from 2026–2034

Market Share:

- Region: Asia Pacific dominated the market with a 30.70% share in 2025. This leadership is driven by the rising prevalence of ocular diseases, a large and growing population, increasing disposable incomes, and growing awareness about eye health in the region.

- By Product Type: The Spectacles segment held the largest market share in 2024. The segment's dominance is attributed to growing awareness of eye health and the increasing incidence of vision issues such as myopia and presbyopia, which are boosting the demand for spectacles across the globe.

Key Country Highlights:

- Japan: As a key country in the dominant Asia Pacific market, growth is fueled by a high prevalence of vision disorders, increasing brand consciousness, and a strong demand for high-quality and technologically advanced eyewear products.

- United States: The market is driven by a large base of contact lens users, with approximately 45.0 million Americans wearing them. The market is also characterized by a high out-of-pocket expenditure on prescription eyewear, with the average pair of glasses costing around USD 351.0 without insurance.

- China: Growth is propelled by a very high prevalence of myopia, with projections indicating that 50% of the global population will be myopic by 2050. The country is also a key focus for major players, with companies like Carl Zeiss Meditec AG opening new R&D and manufacturing facilities to strengthen their presence.

- Europe: The market is advanced by a high adoption rate of vision correction products. For instance, there are more than 3.9 million people in the U.K. wearing contact lenses. The market also sees a strong trend toward fashion collaborations and premium eyewear, particularly in countries such as Germany and France.

Market Dynamics

Market Drivers

Increasing Prevalence of Ocular Disorders to Boost Market Growth

The rising prevalence of ocular diseases, including myopia and presbyopia, especially among children and adults, combined with reluctance toward vision correction is leading to a large population base suffering from vision impairment globally. Uncorrected refractive errors are among the leading causes of vision impairment and blindness globally.

- For instance, according to the 2025 data published by the International Myopia Institute (IMI), about 30% of the population is suffering from nearsightedness globally, with projections indicating that about 50% of the population will be myopic by 2050 worldwide.

Moreover, the increasing availability of sunglasses and spectacles in retail and online channels in emerging and developed nations is expected to drive the growth of the market during the forecast period. This, along with the growing disposable income among individuals in emerging countries such as Brazil and India, has further spurred the demand for higher-value sunglasses. The increasing brand consciousness is also projected to drive the market globally.

Moreover, the growing geriatric population is further expected to surge the prevalence of eye disorders among the patient population. The increasing geriatric population is also contributing to the rising adoption rate for products such as contact lenses and spectacles.

- For instance, according to a study published by a team of researchers from Iran in January 2023, in the elderly Iranian population, the prevalence of refractive errors was significantly high. Out of the total study participants, the prevalence of myopia and hyperopia was estimated to be 31.65%.

Market Restraints

Availability of Alternative Treatment of Refractive Errors to Hamper Market Growth

Products such as contact lenses offer short-term vision correction benefits; however, prolonged use is associated with a number of side effects. As a result, many individuals with vision impairment and refractive errors are turning to alternative products such as LASIK surgery. The LASIK surgery is often regarded as a transformative solution for vision correction among the patient population. Furthermore, the advancements in technology are continuously refining the procedure of LASIK procedures, making them more precise, safer, and capable of addressing a wider range of visual impairments.

Additionally, a growing number of surgical procedures for vision and refractive error correction are acting as a direct restraint to the market. Laser treatments such as Photorefractive Keratectomy (PRK), and Laser-Assisted In Situ Keratomileusis (LASIK) offer permanent solutions to vision impairment. These surgeries are popular in the general population for nearsightedness, farsightedness, astigmatism, and presbyopia.

- For instance, according to 2023 data published by Conlon Eye Institute, approximately 30.0 million people opt for laser eye surgery each year globally, highlighting its global acceptance as an effective vision corrective procedure.

The increasing number of LASIK surgeries is permanently addressing vision impairment and refractive errors, which is responsible for the decline in the number of product users in developed and developing countries.

Market Opportunities

Untapped Emerging Markets to Present a Lucrative Opportunity

The growing awareness about these products in emerging countries such as China, Brazil, and Mexico, is resulting in the growing adoption rate for these products in the market. Market growth in these nations is fueled by factors, such as the entry of major players and increasing cases of myopia and other ophthalmic disorders. Additionally, consumers in India and China are demanding high-quality and technologically advanced products similar to those available in developed countries.

Emerging economies offer high potential for players operating in the industry. Consumers in emerging economies are shifting toward modern products for vision correction. This, along with rising awareness about sunglasses for anti-glare protection from UV rays, digital displays, and others in the general population, is being reinforced by awareness campaigns launched by major players operating in the market.

- For instance, in April 2023, Fastrack Specs launched the “Necessary Not Accessory,” campaign to highlight the importance of sunglasses for the protection of eyes among the general population.

Moreover, many eyewear companies are shifting from traditional distribution models toward Omni channel models. In this distribution model, the companies will be able to market their products directly to the customers via online channels. This shift is expected to help major companies expand into untapped markets across developing regions, driving industry growth.

Market Challenges

Lack of Reimbursement for Products to Hinder Market Growth

The users in the majority of the countries are purchasing spectacles and contact lens products out-of-pocket, as these products are not covered by medical insurance policies in developed and developing regions.

- For instance, according to the 2024 data published by the Vision Council, consumers frequently purchase prescription eyewear that costs about USD 100 out-of-pocket expense.

Moreover, the National Association of Statutory Health Insurance Funds (GKV) does not provide coverage for contact lenses in Germany. However, private insurance providers, such as Siemens-Betriebskrankenkasse, offer coverage for contact lenses after confirmation from a medical practitioner.

In India, National Insurance Company Limited excludes products such as spectacles, contact lenses, hearing aids, and cochlear implants from coverage. Similarly, in other Asian and Latin American countries, major insurance providers are not offering coverage for contact lenses.

Along with this, the higher costs associated with these products and solutions compared to other vision correction options such as surgery, and others is a significant factor limiting the adoption of these products among the general population.

- Additionally, according to 2024 statistics published by Overnight Glasses, the average pair of glasses costs around USD 351.0 without insurance in the U.S.

The patient with medical insurance policies is likely to go with other treatment options, such as surgeries, which are usually covered under medical insurance. Therefore, economic downturns, particularly in emerging countries, are impacting the demand and sales further, resulting in slowing revenue growth for key players.

Other Prominent Challenges

- Market Consolidation Concerns: There is an increasing number of acquisitions and agreements among key players, further resulting in higher prices and limited consumer choices.

- Economic Slowdowns: Economic downturns, particularly in key markets such as China, have impacted sales, with companies reporting slower revenue growth due to reduced consumer spending.

Eyewear Market Trends

Emergence of 3D Printing is a Prominent Trend in Market

There is a growing trend toward the customization of eyeglasses, driven by advancements in 3-D printing. This innovation allows for quick and easy customization, enabling consumers to design eyewear that suits their preferences. Key players operating in the market are also focusing on the development and introduction of novel technology for the manufacturing of products.

This technology combines objects such as waveguides and liquid crystal foils during the 3D printing process. Companies are actively collaborating with social media influencers to increase their brand presence and customer reach across the globe. Alongside these efforts, major players operating in the market are focusing on the introduction of advanced materials for 3D-printed eyewear. For instance, in September 2023, Materialise, one of the prominent players in 3D printing, introduced a translucent 3D printing material for eyewear, offering new design possibilities.

Other Prominent Trends

- Smart Product Integration: Companies such as EssilorLuxottica are collaborating with technology giants such as Meta to develop glasses equipped with cameras and AI assistants, potentially positioning them as smartphone replacements.

- Fashion Collaborations: Luxury brands are entering the market through collaborations, enhancing brand visibility and attracting younger consumers. For instance, Saint Laurent's partnership with Ray-Ban led to a 41% increase in online searches.

- E-commerce Expansion: The convenience and accessibility of online shopping have led to a surge in these product purchases through e-commerce platforms, offering consumers a wider selection and competitive pricing.

Download Free sample to learn more about this report.

Impact of COVID-19

The rapid spread of the COVID-19 pandemic significantly affected the sales of contact lenses, sunglasses, prescription eyeglasses, and sunglasses. Government bodies globally enforced strict lockdowns in the primary phase of the COVID-19 pandemic, leading to the closure of ophthalmic clinics and retail stores for an extended period. The postponement of non-urgent eye examination further contributed to a dip in the sales revenue of many players operating in the market. Additionally, disruptions in manufacturing and transportation of sunglasses affected the supply chain for spectacle lenses and contact lenses, further slowing market growth in 2020. However, in 2021, the market clawed its way back to growth, driven by the uplifting of restrictions and the unavoidable momentum of e-commerce. The market is anticipated to witness steady growth from 2022 onwards.

Trade Protectionism

The optical industry is subject to international trade regulations, with companies navigating tariffs and trade policies that can affect supply chains and pricing. For instance, fluctuations in trade relations between major economies can impact the sourcing of materials and distribution of products.

Segmentation Analysis

By Product Type

Spectacles Segment Dominated the Market Owing to Increasing Awareness of Eye Health

Based on product type, the market is segmented into spectacles, sunglasses, and contact lenses.

The spectacles segment is further bifurcated into frames and lenses. The sunglasses segment is divided into plano and prescription sunglasses. The contact lenses segment is further segmented into toric, multifocal, and sphere.

The spectacles segment dominated the market share 72.14% in 2026 and is expected to maintain its dominance during the forecast period. Key factors supporting the dominance of the segment include growing awareness of eye health and increasing incidence of vision issues such as myopia and presbyopia, which are boosting demand for spectacles across the globe. This, along with the growing focus of key players toward research and development activities to launch novel spectacles is likely to support the growing adoption rate for these products in the market.

- For instance, in September 2023, Amazon launched Echo Frames, a new line of smart glasses integrated with Alexa.

The contact lenses segment is also expected to grow with a considerable CAGR during the forecast period. The growth of the segment can be attributed to the constant initiatives by regional and national government agencies and market players toward increasing awareness among the general population toward vision correction, thereby boosting the use of contact lenses. For instance, as per the data provided by the American Optometric Association (AOA) in August 2023, around 45.0 million Americans wear contact lenses, anticipated to rise due to awareness initiatives.

Additionally, the sunglasses segment held the second-largest market share in 2024, supported by a growing awareness among consumers regarding the harmful effects of UV radiation on eye health. As more consumers prioritize sunglasses with UV protection to prevent conditions such as cataracts and macular degeneration, demand for high-quality sunglasses is expected to increase, further driving market growth.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel

High Accessibility of these Products in Retail Stores to Drive Retail Stores Segment Growth

By distribution channel, the market is segregated into retail stores, online stores, and ophthalmic clinics.

The retail stores segment accounted for the highest market share with 79.58% in 2026 and is further expected to continue dominating the market during the forecast period. The high accessibility of sunglasses and spectacle products in retail stores, shopping malls, branded stores, and others drives the retail store segment. This, along with the emphasis of major market players on the acquisition of shares in the retail outlets of these products, is likely to support the growth of the segment in the market.

- For instance, in July 2024, Fielmann Group announced the acquisition of Shopko Optical, an optical retailer operating over 140 stores in the U.S. The acquisition is expected to expand the penetration of their products in the market through retail channels.

However, there is a rise in the popularity of purchasing eyeglass products through online stores and channels. This trend is estimated to propel significant growth in online eyewear sales in the upcoming years.

Eyewear Market Regional Outlook

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Eyewear Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 55.71 billion in 2025 and USD 60.04 billion in 2026. The rising prevalence of ocular disease in the region is expected to contribute to the high penetration of these products, further emphasizing researchers to develop advanced products and contribute to market growth. Furthermore, increasing population, the higher availability of cheaper eyeglass products, growing awareness of eye health, increasing disposable incomes in developing countries of Asia Pacific are some of the factors expected to drive market growth. The Japan market is projected to reach USD 15.01 billion by 2026, the China market is projected to reach USD 14.53 billion by 2026, and the India market is projected to reach USD 14.23 billion by 2026.

- For instance, as per the data provided by the Royal Australian and New Zealand College of Ophthalmologists (RANZCO) in January 2022, the prevalence of glaucoma in Australia is predicted to reach 379,000 patients by 2025, driving higher demand for vision correction products.

North America

North America is also expected to experience a considerable growth rate during the forecast period, driven by the well-established e-commerce delivery system in the U.S., increasing consumer awareness, strong retail network, and availability of services with increased local production is propelling market growth in North America. The growing focus of key players operating in the optical industry toward developing and introducing innovative products is further likely to support the growth of the market. The U.S. market is projected to reach USD 50.27 billion by 2026.

- In February 2023, Carl Zeiss Meditec AG unveiled ClearView Single Vision lenses to provide the highest optical quality and clearest vision with the cost benefits.

Europe

Europe is projected to grow at a considerable growth rate during the forecast period. Factors such as the higher awareness of ocular disorders, increasing demand for premium eye care products, and increasing affordability of purchasing expensive sunglasses are expected to drive market growth in European nations, such as Germany, France, the U.K., and others. The growing trend of the adoption of fashionable frames and spectacles is also expected to boost market growth in Europe. The UK market is projected to reach USD 8.94 billion by 2026, and the Germany market is projected to reach USD 10.53 billion by 2026.

- For instance, in April 2024, the Association of Optometrists reported that there were more than 3.9 million people in the U.K. wearing contact lenses, which is augmenting the country’s market growth.

Latin America

Latin America is estimated to drive the adoption of spectacle in the forecast years. This can be attributed to the increasing awareness of ophthalmic issues, increasing healthcare expenditure, and government initiatives.

- For instance, in December 2022, Menicon Co., Ltd. partnered with the International Association of Contact Lens Educators (IACLE), a prominent provider of educational resources related to contact lenses. This initiative aimed to boost contact lens education in Brazil, solidify its presence in the market.

Middle East and Africa

The market in the Middle East and Africa is estimated to grow at a considerable growth rate during the forecast period. The growth of the segment can be attributed to the increasing investments by key players in these products, including spectacles, to drive the expansion across the region.

- For instance, in January 2024, Lapaire, a pan-African startup, raised an investment of USD 3.0 million to spur its expansion across the region, contributing to segment growth.

Competitive Landscape

Key Industry Players

Key Players Focus on Collaborations to Strengthen their Position

The global market is highly fragmented, with many companies competing for global eyewear market share. EssilorLuxottica remained the market leader in terms of revenue, attributable to the increasing number of product launches and strategic collaborations to strengthen its position. Additionally, the increasing focus of the company on participation in healthcare conferences to showcase product innovations further enhance its global eyewear market presence.

- In August 2023, EssilorLuxottica launched Essilor's Varilux XR Series, an innovative eye-responsive lens powered by artificial intelligence (AI), aiming to set new standards in visual clarity, comfort, and adaptability.

The Cooper Companies Inc., is also growing in the market owing to the strong focus on research and development activities, resulting in a growing number of product launches in the market.

Other prominent players in the global market are Carl Zeiss Meditec AG, Hoya Corporation, and others. A significant rise in the number of patients suffering from refractive errors and the growing adoption of products in emerging countries are projected to propel the entry of emerging players into the market by 2032.

List Of Key Eyewear Companies Profiled

- Bausch + Lomb (Canada)

- Alcon (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Carl Zeiss Meditec AG (Germany)

- The Cooper Companies, Inc. (U.S.)

- HOYA Corporation (Japan)

- EssilorLuxottica (U.S.)

- Fielmann AG (Germany)

- SAFILO GROUP S.P.A. (Italy)

Key Industry Developments

- November 2024 – Johnson & Johnson Vision Care, Inc. presented new data on its ACUVUE OASYS MAX 1-Day contact lenses at Academy 2024, highlighting the OptiBlue Light Filter, which blocks 60% of blue-violet light, and improvements in lens handling and comfort.

- July 2024 – Carl Zeiss Meditec AG opened a new R&D and manufacturing facility in China to strengthen its market presence in the country.

- June 2024 – Bausch + Lomb introduced INFUSE for Astigmatism, a silicone hydrogel daily disposable contact lens, in the U.S. market.

- April 2024 – The Cooper Companies, Inc. extended its partnership with Plastic Bank through 2026, reinforcing its plastic neutrality initiative and introducing a vision care program in Indonesia, providing vision screenings and vouchers to collection members.

- October 2023 – Alcon launched TOTAL30 Multifocal contact lenses for the treatment of patients with Presbyopia, expanding the company’s product portfolio.

REPORT COVERAGE

The global eyewear market research report provides qualitative and quantitative insights and a detailed analysis of the global market size and growth rate for all market segments. Along with this, the report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are the epidemiology of ocular disease by key countries, 2024, key industry developments, new product launches, key industry trends, and healthcare industry overview by key countries.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market value stood at USD 192.74 billion in 2026 and is projected to be worth USD 330.8 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 55.71 billion.

The global market will exhibit a steady CAGR of 7% during the forecast period of 2026-2034.

The spectacles segment led the market.

The increasing prevalence of ocular disorders globally is a key factor driving the growth of the market.

EssilorLuxottica, Alcon, and Johnson and Johnson Services, Inc. are the top players in the market.

Asia Pacific dominated the eyewear market with a market share of 30.70% in 2025.

New product launches and increasing awareness regarding the harmful effects of sun rays on the eyes are a few factors driving the adoption of sunglasses.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us