Spectacles Market Size, Share & Industry Analysis, By Product Type (Frames and Lenses), By Modality (Prescription and OTC), By Distribution Channel (Retail Stores, Online Stores, and Ophthalmic Clinics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

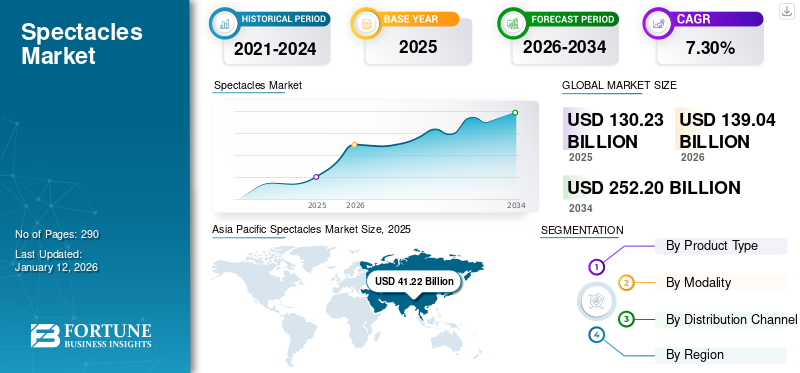

The global spectacles market size was valued at USD 130.23 billion in 2025. The market is expected to grow from USD 139.04 billion in 2026 to USD 252.2 billion by 2034, exhibiting a CAGR of 7.30% during the forecast period. Asia Pacific dominated the spectacles market with a market share of 31.66% in 2025.

Spectacles provide vision correction for patients suffering from eye disorders such as hypermetropia, myopia, and others. The market includes products such as spectacle lenses, prescription glasses, frames, and over-the-counter products. The increasing prevalence of vision impairment among the population is resulting in a rising diagnosis rate, further supporting the growing adoption rate of the products in the market.

- For instance, according to statistics published by the International Myopia Institute (IMI) in 2025, approximately 30% of the population is suffering from myopia, and about 50% of the population will be myopic by 2050 worldwide.

Technological advancements and evolving consumer preferences are also fueling the market growth. Additionally, the introduction of premium spectacles has led to their use as a fashion statement in developed and emerging countries.

The market is highly fragmented, with many regional and international players operating in it. The growing demand and awareness about the benefits of the products have led key players such as EssilorLuxottica, Johnson & Johnson Services, Inc., Carl Zeiss AG, among others, to focus on launching advanced products.

Global Spectacles Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 130.23 billion

- 2026 Market Size: USD 139.04 billion

- 2034 Forecast Market Size: USD 252.2 billion

- CAGR: 7.30% (2026–2034)

Market Share:

- Asia Pacific dominated the global spectacles market with a 31.66% share in 2025, driven by a large population base, increasing prevalence of myopia and hypermetropia, rising disposable income, and aggressive market expansion by key players.

- By Product Type, the Lenses segment held the largest market share in 2025, supported by technological advancements, increasing prevalence of ocular disorders, and strong R&D initiatives by leading players.

Key Country Highlights:

- China & India: High myopia prevalence, rapid urbanization, increasing consumer awareness, and strong growth of organized retail eyewear chains are key growth drivers.

- United States: Growth driven by technological innovations, fashion-focused consumer base, and increasing adoption of premium eyewear products.

- Europe: Rising geriatric population with visual impairments and a robust presence of premium eyewear brands bolster market growth.

- Latin America: Rising disposable income, growing preference for sustainable eyewear, and local initiatives like eco-friendly product launches are key contributors.

- Middle East & Africa: Market growth is spurred by healthcare infrastructure development, expansion strategies of international players, and startup-driven innovations in affordable eyewear solutions.

Market Dynamics

Market Drivers

Increasing Prevalence of Ocular Diseases Supports Market Growth

The increasing prevalence of eye disorders, including nearsightedness, farsightedness, among others, is resulting in the growing diagnosis and treatment rate among patients. This further supports the growing demand for vision corrective wear among patients.

- According to the 2023 statistics published by the World Health Organization (WHO), it was reported that about 2.2 billion people have near-distance vision impairment worldwide.

Additionally, the growing geriatric population with increased susceptibility to ocular disorders, such as presbyopia, hypermetropia, among others, is expected to contribute to the spectacles market growth.

- For instance, according to the 2023 data published by Time Magazine, about 297 million people are aged 60 and above in China.

Furthermore, the key players are also focusing on research and development activities to develop and introduce novel products, thereby supporting global market growth.

Market Restraints

Availability of Alternative Treatment for Refractive Errors Restrains Market Growth

Increasing awareness about the benefits, including improved vision, quick surgery, immediate results, painlessness, and others, of alternative treatment options such as Laser-Assisted In Situ Keratomileusis (LASIK) surgery and others among patients is resulting in a growing preference for these treatments among patients. These factors restrain the overall market growth.

LASIK surgery is regarded as a transformative solution for vision correction among patients. Growing technological advancements are continuously improving LASIK procedures, making them more precise, safer, and capable of addressing visual disorders among patients.

- For instance, according to 2024 statistics published by Laser Eye Surgery Hub, more than 120,000 patients choose to undergo LASIK surgery every year in the U.K.

- Additionally, according to a 2025 article published by Laser Vision Delaware, it was reported that about 96% of patients who choose LASIK surgery achieve 20/20 vision.

Additionally, an increasing number of surgical procedures for vision and refractive error correction is likely to hinder the growth of the adoption rate for spectacles in the market. Laser treatments, such as Photorefractive Keratectomy (PRK), provide permanent vision correction. These surgeries are popular in the general population for myopia, presbyopia, and others. This is resulting in declining adoption rates and demand for these products, thereby hampering the market growth in developed and developing countries.

Market Opportunities

Rising Awareness about the Product Benefits in Underpenetrated and Underserved Areas Presents a Lucrative Opportunity for Market Growth

There has been a substantial increase in the adoption and demand for these products owing to the rising awareness of the benefits of spectacles in emerging countries, including Poland, Brazil, and China.

The market in developing countries is growing owing to the entry of prominent players and the increasing prevalence of nearsightedness and other ocular disorders. Additionally, there is an increasing demand for technologically advanced products among consumers in emerging countries such as China and India, which presents a lucrative opportunity for companies in the market.

Moreover, developing countries have high potential for companies operating in the industry. Consumers in emerging countries are shifting toward modern products for vision correction, leading the key players to launch advanced products in the market. Additionally, in developing nations such as India, hospitals, charitable trusts, and social welfare organizations frequently organize low-cost or free eye examination campaigns, which are anticipated to boost the use of spectacles further.

- For instance, in May 2024, Prevent Blindness launched the “It Started with an Eye Exam” campaign with the aim to encourage, educate, and empowering the public to make vision and eye care a part of their overall healthcare.

Market Challenges

Unfavorable Reimbursement Policies for Products Limit Market Growth

The lack of adequate reimbursement policies for spectacles, especially in developing countries, including Poland, Mexico, and others, is limiting the adoption of these products. Various regions and their changing reimbursement policies have further challenged the growth of the global market.

For instance, the U.S. Centers for Medicare and Medicaid Services (CMS) does not provide reimbursement for eyeglasses. It only offers partial coverage for corrective lenses if the patient has undergone cataract surgery to implant an intraocular lens.

- According to the 2024 statistics published by the Vision Council, individuals frequently purchase prescription eyewear that costs about a USD 100 out-of-pocket expense.

Therefore, economic factors, such as unfavorable reimbursement policies and others, are expected to impact the adoption of these products.

Other Prominent Challenges

Price Sensitivity: In emerging markets, consumers’ sensitivity to pricing poses challenges for premium brands aiming to penetrate these regions.

Counterfeit Products: The proliferation of counterfeit eyewear undermines brand reputation and impacts sales of authentic products.

Spectacles Market Trends

Adoption of Eco-friendly Materials has emerged as a Growing Trend in the Market

The adoption of environmentally friendly and sustainable materials to develop eyewear products globally is increasing in popularity. Eyewear crafted from recycled plastics, biodegradable materials, and plant-based materials appeals to eco-conscious consumers and contributes to environmental conservation.

Moreover, the key players are also focusing on manufacturing and developing environment-friendly eyewear products by reducing their carbon footprint and aligning with the values of eco-conscious consumers.

- For instance, in September 2023, Eyebuydirect, one of the leading online retailers for prescription eyewear, launched its Bio-Nylon collection, featuring eco-friendly eyewear made from renewable, recyclable, and bio-based materials, including castor plants.

This, along with a growing number of acquisitions and partnerships among the prominent players, is also expected to boost the adoption rate and demand for sustainable eyewear products in the market.

- In February 2024, the Nissan Formula E Team collaborated with Coral Eyewear, a sunglasses and apparel company, aiming to strengthen its presence in the market. This partnership enabled Coral Eyewear to supply its distinctive, sustainable eyewear products crafted using recycled plastic and plant-based materials to all Nissan Formula E Team members in the 2023/24 campaign to raise awareness about sustainability globally.

Other Prominent Trends

Technological Advancements: Innovations such as blue-light filtering lenses and lightweight materials are gaining higher traction, addressing the needs of digital device users and enhancing comfort.

Fashion Integration: Eyewear has transcended its functional role, becoming a fashion accessory. Collaborations between eyewear brands and fashion designers are leading to the introduction of stylish and trendy products to the market.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic negatively impacted the global market in 2020. The industry relies heavily on supply chains, especially from manufacturing nations, including China. During the pandemic, many factories faced closures or operated at reduced capacity owing to health concerns and labor shortages. This impacted the production and supply chain capacity, leading to disruptions that further exacerbated the availability of products globally, hindering market growth.

Furthermore, the major companies operating in the market reported a decline in revenue during the pandemic. Also, it considerably impacted day-to-day lives, including wearing eyewear products.

- For instance, in March 2021, the Association of Optometrists stated that the SAFILO GROUP S.P.A., a prominent sunglasses manufacturer, witnessed a decline in net sales of -15.2% in 2020.

Trade Protectionism

Trade policies and import regulations significantly influence the market. Tariffs and trade barriers can affect the pricing and availability of eyewear products, impacting both manufacturers and consumers. For instance, stringent import policies in certain countries may encourage local production but could also limit the diversity of products available to consumers.

Segmentation Analysis

By Product Type

Lenses Dominated the Market due to Increasing Research and Development Initiatives by Key Players

Based on product type, the market is divided into frames and lenses.

The lenses segment dominated the market in 2026 with a share of 57.07%, owing to an increasing prevalence of ocular disorders, resulting in a growing adoption rate for the products in the market. The growing number of R&D initiatives among the key players is one of the major factors supporting the segment’s growth in the market.

- For instance, in February 2025, HOYA Vision Care launched its new power range of MiYOSMART spectacle lenses, specifically designed for children who have high myopia.

The frames segment is expected to record a considerable CAGR during the forecast period. The increasing prevalence of eye disorders, such as nearsightedness and farsightedness, and the growing number of acquisitions and collaborations among the key companies to strengthen their presence are some of the factors contributing to the segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By Modality

Prescription Segment Dominated the Market Owing to Growing Benefits of the Prescribed Products

Based on modality, the market is segmented into prescription and OTC.

The prescription segment held a dominating market share of 87.07% in 2026. The benefits of prescription eyeglasses, such as efficacy, stronger lenses, improved diagnosis of the disease, and accurate monitoring of the disorders, among others, are driving the preference toward these glasses, thereby supporting segmental growth.

- For instance, according to a 2025 article published by Overnight Glasses, about 168 million people use prescription eyewear in the U.S.

The OTC segment is also expected to record a considerable growth rate during the forecast period. The growing demand for over-the-counter glasses among patients, along with an increasing number of key players providing OTC glasses, is likely to support the segment’s growth in the market.

By Distribution Channel

Increasing Number of Retail Stores Boosted the Growth of the Segment

Based on the distribution channel, the market is segmented into retail stores, online stores, and ophthalmic clinics.

The retail stores segment dominated the market share of 79.58% in 2026. The growth is owing to the increasing number of these stores, further contributing to the increasing adoption rate of products among patients. This, along with a growing number of retail stores offering a wide variety of eyewear products such as spectacles, is likely to support the segmental growth in the market.

- For instance, according to the 2023 data published by the U.S. Bureau of Labor Statistics, there are approximately 1,076,931 retail establishments in the U.S.

The online stores segment is also expected to register the highest CAGR during the forecast period. The segment’s growth is primarily due to the increasing benefits of online stores, such as the availability of a wider range of products, discounts, among others, thereby augmenting the growth of the segment.

SPECTACLES MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Spectacles Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Focus of Key Players toward Strengthening Their Presence to Support the Region’s Growth

Asia Pacific dominated the market with a valuation of USD 41.22 billion in 2025 and USD 44.65 billion in 2026. The growth can be highly attributed to the rising number of eye examinations, which is increasing the demand for products and vision treatments. Additionally, the significant focus of retail eyewear companies on the acquisition of multiple eyewear businesses strengthens their product availability in the region. It offers premium and luxury brands in countries such as India and Japan. The Japan market is projected to reach USD 11.89 billion by 2026, the China market is projected to reach USD 11.17 billion by 2026, and the India market is projected to reach USD 10.47 billion by 2026.

- For instance, in March 2024, Reliance Retail acquired LensCrafters’ India business from DLF Brands, an eyewear manufacturer owned by the Luxottica Group, expanding its portfolio of eyewear products in India. Reliance Retail is now responsible for developing and managing the LensCrafters franchise in India, thereby supporting the market’s growth in the region.

Europe

Europe is anticipated to grow at a significant rate during the forecast period. The growth is attributed to the presence of numerous prominent players focused on manufacturing these products and the region's population opting for prescription eyewear products, especially older individuals. Moreover, the growing prevalence of major eye issues, such as visual impairment in the region, is anticipated to boost the adoption of these products, contributing to regional growth. The UK market is projected to reach USD 6.54 billion by 2026, while the Germany market is projected to reach USD 8.9 billion by 2026.

- For instance, in June 2023, the World Health Organization stated that approximately 90.0 million people in the European region have some vision impairment, which represented 9.0% of the region's population. This is propelling the use of corrective eyewear products, thus fueling the market growth in the region.

North America

North America is estimated to record the second-highest market share. This growth is attributed to the established healthcare infrastructure in the region and the healthcare organizations recommending regular eye check-ups for early detection of vision issues, which may increase the prescription rate of products in the region.

- For instance, in March 2023, the American Optometric Association (AOA) recommended that all adults 18 and older should get a comprehensive eye exam annually, which may fuel the prescription rate of these products in the region, supporting the market’s growth.

U.S.

The U.S. market growth can be attributed to the rising launches of products by key players in the country, which may lead to an increased growth rate. Moreover, strategic initiatives such as product launches and collaborations by key players for these products are also projected to spur the country’s market expansion. The U.S. market is projected to reach USD 34.53 billion by 2026.

Latin America

The Latin American market is anticipated to account for a considerable growth rate during the forecast period. The growth of this segment can be highly attributed to rising disposable income, resulting in the increasing focus of regional companies on the introduction of sustainable products such as optical frames for these products.

- For instance, in April 2024, Ben & Frank, a prominent Mexican eyewear brand, launched a new line of optical frames on Earth Day, utilizing Eastman Acetate Renew, a sustainable material made from biobased and recycled content. This initiative aims to reduce plastic waste and greenhouse gas emissions while maintaining quality and design.

Middle East & Africa

The Middle East & Africa region is growing due to a rising focus on the development of healthcare infrastructure, acquisitions & collaborations among key players, and increasing investments of players to expand their presence in emerging countries.

- For instance, in January 2024, Lapaire, a pan-African eyewear startup, raised an investment of USD 3.0 million to spur its expansion across the region, thereby contributing to the segment’s growth in the coming years.

Competitive Landscape

Key Industry Players

Players Emphasize Strategic Initiatives, including Partnerships, to Strengthen Their Market Positions

The global market is highly fragmented, with many players operating in the market. EssilorLuxottica remained the market leader in terms of revenue. This dominance is due to the growing number of product launches and partnerships with other players to increase its brand presence and global spectacles market share.

- In August 2023, EssilorLuxottica launched Essilor's Varilux XR Series, an innovative eye-responsive spectacle lens powered by artificial intelligence, aiming to set new standards in visual clarity, comfort, and adaptability.

The strategic acquisitions and collaborations among the other players are contributing to the growing opportunities for these companies in the market.

LIST OF KEY SPECTACLES COMPANIES PROFILED

- SAFILO GROUP S.P.A. (Italy)

- Carl Zeiss Meditec AG (Germany)

- HOYA Corporation (Japan)

- EssilorLuxottica (U.S.)

- Warby Parker (U.S.)

- Oakley, Inc. (U.S.)

- Prada (Italy)

- RODENSTOCK GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- January 2025 – SAFILO GROUP S.P.A. and Under Armour renewed their global eyewear licensing agreement till 2031, extending their partnership until 2031. This collaboration aims to deliver lightweight and versatile eyewear solutions for athletes, enhancing comfort, fit, and visibility.

- October 2024 – EssilorLuxottica showcased groundbreaking innovations such as ultra-dynamic Transitions GEN S lenses, the smart Ray-Ban Meta glasses with AI and live-streaming capabilities, and Nuance Audio eyewear at Vision Expo West 2024.

- April 2024 – HOYA Corporation launched a new Hi-Vision Meiryo coating to offer spectacle wearers superior clarity that lasts even longer. This strengthened the company’s product reputation globally.

- March 2024 – EssilorLuxottica launched a new edging system range at 100% Optical, featuring ES700 and ES800, designed to simplify processes and offer bespoke lens design.

- September 2023 – SAFILO GROUP S.P.A. and Amazon launched new Carrera Smart Glasses featuring Alexa technology, combining Italian design with smart functionality. The glasses utilize open-ear audio for discreet sound delivery and offer up to six hours of media playback on a full charge.

REPORT COVERAGE

The global spectacles market report provides a detailed analysis and market forecast. It focuses on key aspects, such as an overview of the product, the prevalence of ocular disorders, key countries, and market dynamics. Additionally, it includes key industry developments, such as mergers, partnerships & acquisitions, and the impact of COVID-19 on the market. The report covers an in-depth analysis encompassing trends, challenges, key players, regional insights, recent industry developments, facts and figures, and market segmentation.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.30% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Modality

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 139.04 billion in 2026 and is projected to reach USD 252.2 billion by 2034.

In 2025, Asia Pacific was valued at USD 41.22 billion.

Registering a CAGR of 7.30%, the market will exhibit healthy growth during the forecast period of 2026-2034.

By product type, the lenses segment dominated the market in 2025.

The increasing adoption of spectacles and the rising prevalence of ocular diseases are major factors driving the market’s growth.

EssilorLuxottica, HOYA Corporation, and SAFILO GROUP S.P.A. are the major players in the market.

Asia Pacific held a dominant market share in 2025.

Adoption of eco-friendly materials, technological advancements, and fashion integration are the key market trends.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us