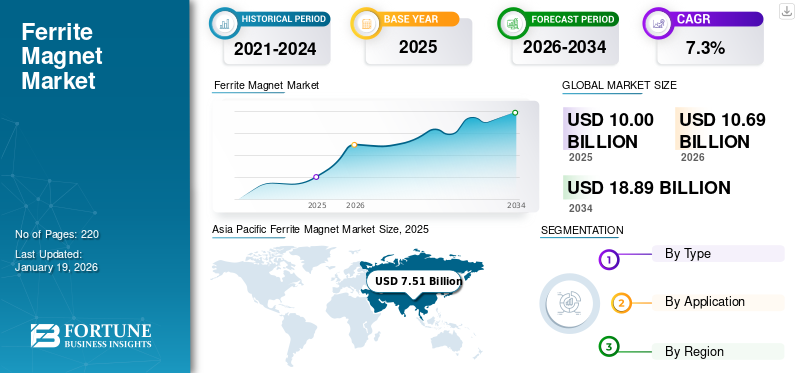

Ferrite Magnet Market Size, Share & Industry Analysis, By Type (Hard and Soft), By Application (Consumer Electronics, General Industrial, Automotive, Energy, Aerospace & Defense, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global ferrite magnet market size was valued at USD 10.0 billion in 2025 and is projected to grow from USD 10.69 billion in 2026 to USD 18.89 billion by 2034, exhibiting a CAGR of 7.3% during the forecast period. Asia Pacific dominated the ferrite magnet market with a market share of 75% in 2025.

Ferrite magnets are produced by combining iron oxide with barium, strontium, or other metallic elements. They offer strong magnetic properties, excellent corrosion resistance, and low production costs. These magnets are widely used in the automotive industry, electronics, and household appliances owing to their stable performance and affordability. The market is experiencing steady growth, driven by the rising demand for electric motors, loudspeakers, and magnetic separators. The increasing use of electric vehicles, along with the growth of the consumer electronics sector and renewable energy projects, is further fueling demand. The major manufacturers operating in the market include Arnold Magnetic Technologies, Integrated Magnetics, TOKYO FERRITE MFG.CO.LTD., Mitsubishi Materials Trading Corporation, and BGRIMM Technology Group.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Industrial Base and Growing Electronics Sector to Drive Product’s Demand

The increasing pace of industrial development, particularly in developed economies, is boosting the demand for the product. These magnets are highly used in electric motors, transformers, loudspeakers, and various electronic devices due to their affordability, corrosion resistance, and thermal stability. As the consumer electronics industry consistently grows, the need for reliable and cost-effective magnetic materials is rising. Additionally, the move toward electric vehicles and renewable energy sources is further boosting their adoption in automotive and energy applications. This rising demand across multiple sectors is expected to drive the global ferrite magnet market growth.

MARKET RESTRAINTS

Changes in Raw Material Prices to Hinder Market Growth

The production of ferrite magnet depends heavily on raw materials such as iron oxide, strontium carbonate, and barium carbonate. Shifts in the prices of these materials can substantially alter manufacturing costs and profit margins for manufacturers. Sudden price hikes or supply shortages may also disrupt the production process, affecting overall output and delivery timelines. To manage these challenges, manufacturers often explore alternative sourcing strategies and cost-optimization measures. However, the unpredictability of raw material availability and pricing remains a key concern. Such fluctuations in input prices are expected to restrict the growth of the product’s market over the forecast period.

MARKET OPPORTUNITIES

Increasing Electric Vehicles and Renewable Energy Sector to Offer Growth Opportunities

The increasing shift toward sustainable transportation and clean energy solutions is creating growth opportunities for the market. They are highly used in electric vehicles (EVs) in components such as motors, sensors, and energy management systems due to their affordability and heat resistance. In addition, their demand is growing in renewable energy applications, including wind power generators and solar systems. As investments in electric mobility and green energy projects increase, the demand for the product is expected to rise. This trend is likely to support the market’s growth in the coming years.

- According to the Observatory of Economic Complexity (OEC), the global trade in electric motor vehicles reached USD 150 billion in 2023. This significant growth in the EV market indicates a rising demand for ferrite magnets due to their cost effectiveness and thermal stability.

FERRITE MAGNET MARKET TRENDS

Rising Focus on Magnet Recycling and Circular Economy Practices to be a Market Trend

With a growing emphasis on environmental sustainability and resource conservation, the market is seeing increased adoption of recycling and circular economy strategies. Companies are actively working on recovering ferrite materials from used electronic products, motors, and other industrial components to reduce dependence on raw materials. This shift is being driven by stricter environmental regulations and the rising need for responsible material sourcing. The development of advanced recycling technologies is expected to improve material efficiency, lower production waste, and ensure a more sustainable supply chain in the long term.

MARKET CHALLENGES

Environmental Regulations and Availability of Alternative Magnet Materials Pose a Challenge to Market

The manufacturing of this product can generate emissions waste, raising environmental concerns. As a result, regulatory authorities are imposing stricter guidelines to minimize the environmental impact. Meeting these requirements demands substantial investments in cleaner and more sustainable production methods. Additionally, the market is witnessing a growing shift toward high performance magnets such as rare earth magnets, which offer stronger magnetic properties. The rising preference for advanced alternatives is creating competitive pressure for ferrite magnet producers. These challenges may hamper the growth of the market in the coming years.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Rising Demand for Hard Ferrite Magnets Boosted Market Growth in Automotive and Industrial Applications

Based on type, the market is segmented into hard and soft.

The hard ferrite magnet segment held a dominant market share in 2024, driven by its wide usage in automotive components, household appliances, and electric motors. These magnets offer strong resistance to demagnetization, cost-effectiveness, and excellent performance in high-temperature environments. Rapid industrialization and the growing demand for fuel-efficient vehicles are accelerating the adoption of this market segment. Moreover, their durability, availability of raw materials, and low manufacturing costs make them ideal for large-scale applications across emerging and developed economies.

The soft ferrite magnet segment also holds a significant share in the market. Their growth is primarily fueled by rising demand in telecommunications, power electronics, and data storage devices. Soft ferrites are preferred for their low electrical conductivity, high magnetic permeability, and ability to operate efficiently at high frequencies. With advancements in electronics and the rising need for lightweight magnetic materials, the demand for this segment continues to grow.

By Application

Consumer Electronics Segment to Lead Market with Rising Demand for Compact and Energy-Efficient Devices

Based on the application, the market is segmented into consumer electronics, general industrial, automotive, energy, aerospace & defense, and others.

The consumer electronics segment holds the largest ferrite magnet market share, driven by the increasing demand for compact, energy-efficient devices such as speakers, headphones, and kitchen appliances. They are widely used in these products due to their cost-effectiveness, corrosion resistance, and stable magnetic properties. As global consumer electronics production expands, the need for high-performance magnetic components continues to rise, reinforcing the dominance of this segment.

In the general industrial segment, they are extensively used in electric motors, transformers, magnetic separators, and measuring instruments. Its ability to operate under high temperatures and withstand harsh industrial environments makes it ideal for a range of machinery and automation systems. The steady growth of the manufacturing sector and advancements in factory automation are propelling the demand for the product in this segment.

The automotive segment is also witnessing robust growth owing to the increasing vehicle production and the rising integration of electronic components in modern vehicles. They are critical in applications such as electric motors, sensors, actuators, and fuel pumps. With the global shift toward electric mobility, demand for energy-efficient and durable magnet solutions is increasing. Additionally, stringent emission standards and the push for lightweight and cost-effective automotive components are further fueling the adoption of the product in this segment.

Ferrite Magnet Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Ferrite Magnet Market Size, 2025 (USD billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominated the market with a size of USD 7.51 billion in 2025 due to strong industrial growth, expanding electronics manufacturing, and high demand from the automotive and consumer goods sectors. Countries such as China, Japan, India, and South Korea are major contributors, supported by large-scale production facilities and favorable government policies. The rapid rise in electric vehicle adoption, renewable energy projects, and advancements in telecommunication infrastructure further drive magnet consumption. In addition, the presence of key raw materials and cost-effective labor enhances regional production capacity. These factors together contribute to the dominant position of the regional market.

North America

In North America, the market is supported by the expanding automotive and electronics industries. These magnets are extensively used in motors, sensors, and loudspeakers. Rising demand for energy-efficient appliances and electric vehicles, particularly in countries including the U.S. and Canada, is also contributing to market growth. Government emphasis on clean energy technologies further fuels adoption. Additionally, advancements in manufacturing processes and a growing preference for cost-effective magnetic materials strengthen the demand for products in the region.

Europe

In Europe, the demand for sustainable and cost-effective magnetic materials, including automotive and consumer electronics, is driving the demand. Strict environmental regulations support the use of eco-friendly components, further supporting the product’s adoption. Countries including Germany, France, and the U.K. are investing in electric mobility, renewable energy, and advanced manufacturing technologies. Additionally, the region’s strong focus on innovation sustains steady demand for the product.

South America

In South America, the market is growing owing to the increasing demand from the automotive, consumer electronics, and household appliance sectors. Countries including Brazil and Argentina are witnessing increased industrial activities, which boosts the use of ferrite magnets in motors, sensors, and electronic devices. Infrastructure development and government initiatives to strengthen local production capabilities are further supporting market expansion. Additionally, their cost-effectiveness and thermal stability make them a preferred choice across various applications in the region.

Middle East & Africa

In the Middle East and Africa, the market is growing due to expanding automotive and electronics industries. Countries such as the UAE, Saudi Arabia, and South Africa are driving demand through the growth of electric appliances, renewable energy projects, and smart infrastructure. The region’s focus on economic diversification and the push toward energy-efficient technologies are also contributing to the adoption of ferrite magnets across various applications.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Investments in R&D to Introduce New Products by Key Companies to Maintain their Dominating Position in Market

The global market is highly competitive, with key players that focus on technological advancements, mergers & acquisitions, and capacity expansion to increase their market presence. Key global companies include Arnold Magnetic Technologies, Integrated Magnetics, TOKYO FERRITE MFG.CO.LTD., Mitsubishi Materials Trading Corporation, and BGRIMM Technology Group, among others. These companies compete based on purity levels, cost-effective processing techniques, supply chain integration, and regional dominance while also investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY FERRITE MAGNET MARKET COMPANIES

- Arnold Magnetic Technologies (U.S.)

- Integrated Magnetics (U.S.)

- Ningbo Relay Magnetics Co., Ltd (China)

- Hangzhou Permanent Magnet Group (China)

- TOKYO FERRITE MFG.CO.LTD. (Japan)

- Mitsubishi Materials Trading Corporation (Japan)

- Guangdong LingYI Co., Ltd. (China)

- BGRIMM Technology Group (China)

- UNION MATERIALS CORPORATION (South Korea)

- Proterial, Ltd. (Japan)

REPORT COVERAGE

The market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of product in key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.3% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 10 billion in 2025 and increased to USD 10.69 billion in 2026, with the market projected to reach USD 18.89 billion by 2034.

In 2025, the market value stood at USD 7.51 billion.

The market is expected to exhibit a CAGR of 7.3% during the forecast period of 2026-2034.

The key factors driving the market are the growing electronics sector and the increasing industrial applications of magnets.

Arnold Magnetic Technologies, Integrated Magnetics, TOKYO FERRITE MFG.CO.LTD., Mitsubishi Materials Trading Corporation, and BGRIMM Technology Group are the top players in the market.

Asia Pacific dominated the market in 2024.

Rising demand for cost-effective, durable magnets in electronics and automotive applications and their thermal stability and suitability for high-frequency use are some of the key factors expected to favor the product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us