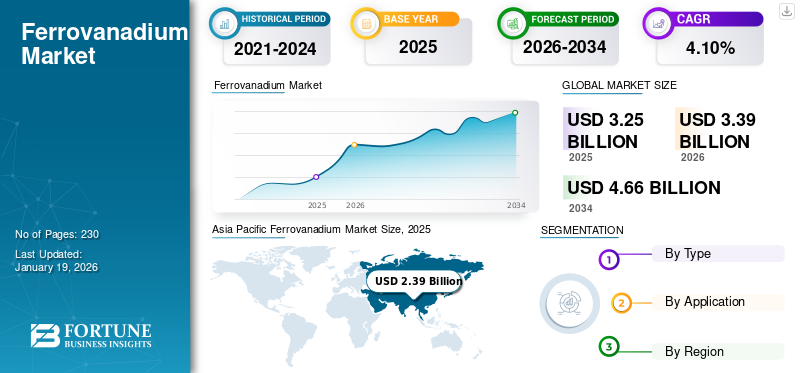

Ferrovanadium Market Size, Share & Industry Analysis, By Type (FeV 80, FeV 60, FeV 40, and Others), By Application (Steel Manufacturing, Automotive, Aerospace & Defense, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global ferrovanadium market size was valued at USD 3.25 billion in 2025. The market is projected to grow from USD 3.39 billion in 2026 to USD 4.66 billion by 2034, exhibiting a CAGR of 4.10% during the forecast period. Asia Pacific dominated the ferrovanadium market with a market share of 74% in 2025.

The global market is witnessing significant growth opportunities driven by various applications such as construction, energy, aerospace, and transport. Ferrovanadium (FeV) is commonly produced using the aluminothermic reduction technique and is categorized into several grades, such as FeV40, FeV50, FeV60, FeV75, and FeV80, based on vanadium content. The alloy is essential in applications requiring high tensile strength and corrosion resistance, including automotive parts, aerospace components, structural beams, and pipelines. Its addition in manufacturing high-strength steel and titanium alloys enhances product longevity and performance. Rising demand for construction growth, rising automotive industry, defense investments, and the development of energy-efficient technologies are driving the market growth.

The main players working in the market include AMG, Bear Metallurgical Company., Treibacher Industrie AG, Bushveld Minerals, and Hickman Williams & Company.

FERROVANADIUM MARKET TRENDS

Shift toward High-Strength, Low-Alloy (HSLA) Steel in Construction and Automotive to be a New Market Trend

There is a growing shift in construction and transportation sectors toward high-strength, low-alloy (HSLA) steel to reduce weight without compromising durability. This transformation is creating consistent demand for alloying elements including vanadium, which improve tensile strength. Urbanization, especially in Asia and the Middle East, is accelerating infrastructure projects that require longer-lasting, lighter structural components. Automakers also adopt HSLA steel to meet fuel efficiency and emission standards while maintaining crash performance. This trend is boosting the incorporation of vanadium in chassis, body frames, and suspension parts.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand from Steel Sector in Various Emerging Industries is Driving Market Growth

A primary factor contributing to the ferrovanadium market growth is the increasing consumption of high-strength steel across infrastructure and industrial projects. FeV is added to steel to improve strength, toughness, and corrosion resistance, making it essential in construction, shipbuilding, and machinery. Developing countries are witnessing a boom in real estate and public infrastructure, driving the need for advanced materials that comply with modern standards. Additionally, growth in urbanization and industrialization accelerates the need for steel used in bridges, pipelines, and high-rise structures. These factors collectively increase demand for FeV as a critical additive.

MARKET RESTRAINTS

Volatile Raw Material Prices and Supply Instability Could Restrain Market Growth

One of the primary challenges for FeV producers and end-users is the fluctuation in raw material prices. These prices are sensitive to geopolitical tensions, regulatory shifts in mining regions, and changing export-import policies. Such volatility hinders cost planning for manufacturers, disrupts long-term contracts, and can lead to uncertainty in downstream applications such as steel production and aerospace. Furthermore, limited diversification in sourcing contributes to vulnerability in the supply chains. Periods of price spikes or shortages often force smaller steelmakers and alloy producers to seek alternative materials, impacting overall market demand.

MARKET OPPORTUNITIES

Expansion of High-Strength Steel Demand in Infrastructure and Green Energy Brings a Strong Opportunity

The increasing global importance of infrastructure development and the transition toward greener technologies offer a substantial opportunity for FeV adoption. High-strength steel, essential in bridges, high-rise buildings, and renewable energy structures including wind turbines, often relies on vanadium-based alloys to meet safety and performance standards. Developing nations in Asia Pacific, Africa, and Latin America are investing heavily in urban infrastructure, transportation, and utilities, boosting demand for structural steel. Simultaneously, the clean energy shift drives growth in offshore wind power, where lighter yet stronger materials are needed. FeV enhances steel’s tensile strength without compromising flexibility or weldability, making it ideal for these evolving applications.

- As per the India Brand Equity Foundation (IBEF), in 2024-25 India’s budget plan shows the capital investment for infrastructure development increased by 11.1% USD 133.86 billion, compared to last year. This investment budget covers 34 sub-sectors such as highways, airports, railways, and other sectors, showcasing a significant infrastructure boost in the country. This growth brings opportunity for the steel industry as they are used in development. The ferrovanadium sector also gets a good boost as it is used in steel production.

MARKET CHALLENGES

Environmental and Regulatory Pressures Could Challenge Market Growth

Vanadium extraction and ferrovanadium production are resource- and energy-intensive processes, often causing harmful emissions, waste generation, and land degradation. Increasing global scrutiny on environmental practices is placing regulatory burdens on mining and metal refining companies. Environmental impact assessments, waste disposal restrictions, and emissions controls are becoming more stringent, particularly in the European Union and North America. These regulations can delay project approvals, increase operational costs, and require ongoing investment in cleaner technologies.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Growing Use of FeV80 Type of Ferrovanadium in Steel Manufacturing is Driving Segment Growth

Based on type, the market is classified into FeV 80, FeV 60, FeV 40, and others.

The FeV80 segment holds the largest ferrovanadium market share, as it has great structural demand and superior strengthening capabilities, as this type has the highest vanadium content compared to other types. This type is typically used in high-strength low-alloy and micro-alloyed steels, often applied in critical areas including oil pipelines, construction-grade rebar, and vehicle chassis. The high vanadium percentage ensures minimal addition by weight, making it cost-efficient for manufacturers aiming for targeted property enhancement.

FeV60, with moderate vanadium content, offers a balanced combination of cost-effectiveness and performance, making it suitable for general-purpose steel applications. It is widely utilized in structural beams, tools, and forged parts, particularly where moderate toughness and strength are required without excessive alloying cost. The FeV60 segment benefits from its adaptability across multiple industries such as construction, automotive, and basic manufacturing. In regions where high-grade FeV may be cost-prohibitive, FeV60 provides a reliable alternative.

FeV40 grade is often utilized in smaller production runs or regional applications where cost control is critical and ultra-high strength is not a primary concern. Applications include agricultural tools, secondary construction supports, and light automotive components. This segment is gradually being phased out in developed countries in favor of higher vanadium grades; however, it maintains relevance in cost-sensitive regions. Its use allows steelmakers to meet minimum alloy requirements while conserving resources and managing production expenses.

By Application

Steel Manufacturing Sector Drives Substantial Demand for Ferrovanadium Owing to its

Based on the application, the market is classified into steel manufacturing, automotive, aerospace & defense, and others.

Steel manufacturing holds the largest share in the ferrovanadium market, driven by its ability to significantly enhance steel's strength, hardness, and fatigue resistance. FeV is used in various steel types, including high-strength low-alloy (HSLA), tool, and spring steel, allowing manufacturers to produce lighter, more durable structures. Its effectiveness in refining grain structure makes it essential in improving the weldability and toughness of steel products.

The automotive segment increasingly uses FeV to produce components that require a high strength-to-weight ratio, such as chassis, suspension systems, and crash-resistant frames. As vehicle manufacturers aim to reduce weight while enhancing safety, vanadium-alloyed steels have become essential for meeting structural and emission standards. FeV allows automakers to design thinner components without sacrificing strength, directly contributing to better fuel efficiency and lower emissions.

FeV plays a crucial role in creating advanced alloys used in aircraft frames, jet engine components, armor plating, and defense-grade structures in the aerospace and defense segment. Its ability to improve toughness, fatigue resistance, and high-temperature strength makes it vital for ensuring the durability and safety of military and aerospace hardware. High-performance titanium alloys that use vanadium are commonly used in critical flight components due to their light weight and resistance to extreme conditions.

Ferrovanadium Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, and the Rest of the World.

Asia Pacific

Asia Pacific Ferrovanadium Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.39 billion in 2025 and USD 2.5 billion in 2026. The Asia Pacific market holds the largest share, with China serving as both the largest producer and consumer of the alloy. The region's rapid urbanization, booming infrastructure projects, and extensive steel output fuel continuous demand for FeV. China’s construction and economic boom and India’s infrastructure programs, including highways, railways, and smart cities, significantly contribute to increased consumption. Japan and South Korea maintain high standards for alloy quality, requiring FeV in automotive and advanced manufacturing sectors.

North America

North America holds a significant share in the FeV market, driven by consistent aerospace, automotive, and defense demand. The region benefits from strong manufacturing capabilities and well-regulated alloy production processes. The U.S. government’s focus on strengthening domestic steel supply chains and modernizing infrastructure has increased demand for high-strength vanadium-based alloys. Though smaller in demand, Canada sees consistent consumption in construction and rail infrastructure.

Europe

Europe remains a significant market for ferrovanadium, largely driven by demand from automotive, construction, and specialty steel producers. Countries such as Germany, France, and the U.K. have mature metallurgical industries where FeV is vital for producing high-performance steels. Sustainability policies and the European Union’s Green Deal foster growth in clean energy and eco-friendly building materials, where FeV-infused steel plays a crucial role.

Latin America

Latin America presents a moderate but steadily growing market for ferrovanadium, with Brazil and Chile emerging as key contributors. Brazil’s large-scale steel manufacturing and mining sectors are primary end users of FeV-enhanced steels, especially for tools, heavy-duty equipment, and infrastructure. Chile, known for its mining activities, supports demand by using durable alloys in extraction and processing equipment.

Middle East & Africa

The Middle East & Africa market demonstrates steady growth, driven by infrastructural development and resource-intensive industries. Large-scale construction, pipeline expansion, and oil & gas operations in the Middle East in nations such as Saudi Arabia, the UAE, and Qatar are generating rising demand for vanadium-based steel alloys. Africa, particularly South Africa, contributes through its substantial vanadium reserves and mining output.

COMPETITIVE LANDSCAPE

Key Industry Players

Constant Development and Launch of Novel Products by Major Companies Led to their Dominating Position in Market

The market for ferrovanadium is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key market players include AMG, Bear Metallurgical Company., Treibacher Industrie AG, Bushveld Minerals, and Hickman Williams & Company, among others. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY FERROVANADIUM COMPANIES PROFILED

- AMG (U.S.)

- Bear Metallurgical Company. (U.S.)

- Treibacher Industrie AG (Austria)

- Masterloy Products Company (Canada)

- Bushveld Minerals (South Africa)

- Hickman Williams & Company (U.S.)

- TAIYO KOKO Co.,Ltd. (Japan)

- (India)

- NTPF Etalon LTD (Russia)

- Arth Metallurgicals Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- March 2021: MG Vanadium announces the groundbreaking of a new spent catalyst recycling facility in Zanesville, Ohio. The new plant, a significant investment exceeding USD 200 million, will double AMG's spent catalyst recycling and ferroalloy production capacity.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.10% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Segmentation |

By Type · FeV 80 · FeV 60 · FeV 40 · Others |

|

By Application · Steel Manufacturing · Automotive · Aerospace & Defense · Others |

|

|

By Region · North America (By Type, Application, and Country) o U.S. (By Application) o Canada (By Application) · Europe (By Type, Application, and Country) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Russia (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, Application, and Country) o China (By Application) o India (By Application) o Japan (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Type, Application, and Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Type, Application, and Country) o GCC (By Application) o South Africa (By Application) · Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.25 billion in 2025 and is projected to reach USD 4.66 billion by 2034.

In 2024, the market value stood at USD 2.39 billion.

The market is expected to exhibit a CAGR of 4.10% during the forecast period of 2026-2034.

The FeV 80 segment led the market by type in 2025.

The growing use of steel in the construction and automotive industry is set to be the key factor in driving the market.

AMG, Bear Metallurgical Company., Treibacher Industrie AG, Bushveld Minerals, and Hickman Williams & Company are some of the leading players in the market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us