Filler Masterbatch Market Size, Share & Industry Analysis, By Carrier Polymers (Polyethylene (PE) and Polypropylene (PP)), By End-use Industry (Packaging, Automotive, Building & Construction, Agriculture, Consumer Goods, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

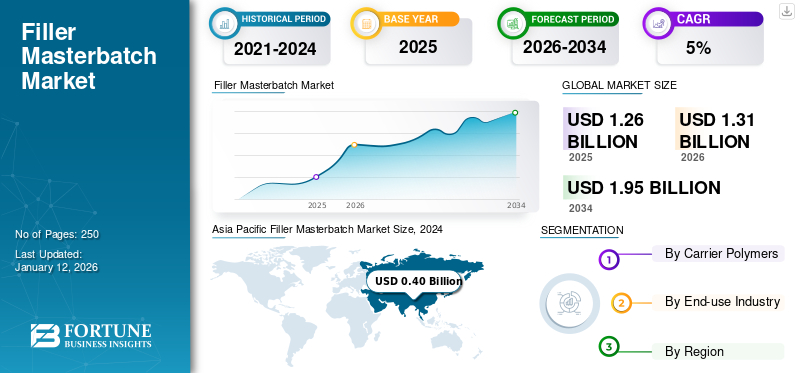

The global filler masterbatch market size was valued at USD 1.26 billion in 2025. The market is projected to grow from USD 1.31 billion in 2026 to USD 1.95 billion by 2034, exhibiting a CAGR of 5% during the forecast period. Asia Pacific dominated the filler masterbatch market with a market share of 33% in 2025.

Filler masterbatch is a concentrated mixture of fillers and a polymer carrier resin commonly used in the plastics industry to modify and enhance the properties of polymers. Incorporating cheaper fillers helps reduce production costs by replacing a portion of the more expensive polymer. Additionally, these masterbatches improve physical properties such as stiffness, durability, and impact resistance. The growing use of common fillers such as calcium carbonate, talc, clay, mica, and titanium dioxide is anticipated to boost market growth globally in the upcoming years.

Plastika Kritis S.A., Plastiblends India Ltd., LyondellBasell Industries, and Plasmix, Megaplast are the key players operating in the market.

Global Filler Masterbatch Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.26 billion

- 2026 Market Size: USD 1.31 billion

- 2034 Forecast Market Size: USD 1.95 billion

- CAGR: 33% from 2026–2034

Market Share:

- Asia Pacific dominated the filler masterbatch market with a 33.06% share in 2025, driven by expanding industrial sectors and rising demand for affordable plastic products in China, India, and Vietnam.

- By carrier polymer, polyethylene (PE) is expected to retain the largest market share in 2025, supported by strong demand from the packaging sector and its ability to enhance mechanical strength, puncture resistance, and overall film performance.

Key Country Highlights:

- China: Leads the market with large-scale manufacturing capabilities, high plastic production, and growing use of cost-effective fillers in packaging, construction, and automotive applications.

- United States: Growth is supported by demand for lightweight automotive components, innovations in sustainable packaging, and strong domestic plastic production.

- India: Rising demand from packaging, construction, and agriculture industries, along with government initiatives promoting cost-effective and sustainable plastics, is driving market expansion.

- Europe: Growth is driven by sustainability regulations encouraging eco-friendly plastics and adoption of performance-focused filler masterbatches in various industrial applications.

FILLER MASTERBATCH MARKET TRENDS

Sustainability Initiatives and Shift toward Eco-Friendly Solutions are Prominent Trends

The global focus on sustainability is a key trend in the market. Regulations such as the European Union’s Circular Economy Action Plan and the U.S.’s Break Free from Plastic Pollution Act are encouraging manufacturers to adopt more sustainable solutions. These masterbatches enable companies to achieve their sustainability goals by reducing the use of virgin plastic and promoting recycling efforts.

Many companies are now developing calcium carbonate filler masterbatches derived from natural and renewable sources or integrating biodegradable fillers such as starch or PLA-based materials. For example, in the packaging sector, brands are using these eco-friendly fillers in shopping bags and agricultural films to minimize their environmental footprint and enhance compostability. This helps them align with global initiatives such as the EU Green Deal and India’s Plastic Waste Management Rules.

MARKET DYNAMICS

MARKET DRIVERS

Cost Reduction in Polymer Processing to Boost Market Growth

The growing emphasis on reducing production costs while maintaining quality has led to increased adoption of filler masterbatches across various industries. By utilizing low-cost fillers such as calcium carbonate and talc, manufacturers can achieve significant cost savings while still producing high-quality plastic products.

For instance, in the production of polypropylene (PP) woven sacks, manufacturers incorporate 20–30% calcium carbonate filler masterbatch to lessen the reliance on virgin PP resin. This practice can reduce raw material costs by 15–20% while also enhancing properties such as stiffness and printability. As a result, the final product becomes more affordable and more functional.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Raw Material Price Volatility and Quality Concerns to Limit Market Expansion

Fluctuations in the prices of fillers and polymers, driven by market conditions or supply chain disruptions, can significantly impact the overall production costs, leading to price instability. Additionally, poor dispersion and the use of inferior fillers can compromise product quality. For example, in thin-film applications such as grocery bags, inadequate dispersion of fillers can result in issues such as pinholes, reduced tensile strength, and uneven film thickness. These defects can lead to a high rejection rate during quality checks and an increase in customer complaints, compelling companies to invest in improved compounding and dispersion technologies or risk losing contracts.

MARKET OPPORTUNITIES

Focus on Biodegradable and Recycled Fillers to Positively Impact Market Growth

As demand for specialized plastics grows, the market is evolving with advanced products that offer enhanced properties, such as UV resistance, antimicrobial effects, and higher load-bearing capacity. These advancements are expected to drive further market growth as industries demand more performance-oriented solutions.

With rising bans on single-use plastics, companies are creating masterbatches containing recycled mineral fillers or biodegradable polymers that break down safely in the environment. For instance, some suppliers are offering calcium carbonate masterbatches that enhance the biodegradability of polyethylene films, allowing packaging companies to market “eco-friendly” or “green” products and win over environmentally conscious consumers. Investments in research and development are being made to create biodegradable and eco-friendly filler masterbatches that cater to the increased demand for sustainable materials.

MARKET CHALLENGES

Technical Limitations of Using Masterbatches in Plastics are likely to Hamper the Market Growth

Balancing the performance characteristics of filler masterbatches while incorporating large quantities of fillers can be complex. Excessive fillers can change the physical properties of plastics, making them unsuitable for certain applications.

For instance, in the automotive sector, manufacturers aim to increase the use of fillers to reduce costs and weight in interior plastic components. However, adding too much talc or calcium carbonate can diminish impact resistance, making the parts brittle and more likely to crack. To address this issue, formulators must develop specialized coupling agents or surface treatments for fillers to maintain toughness while still achieving the desired cost savings.

Segmentation Analysis

By Carrier Polymers

Rising Applications in Food, E-Commerce, and Retail Industries to Drive the Polyethylene (PE) Segment

Based on carrier polymers, the market is classified into Polyethylene (PE) and Polypropylene (PP).

The Polyethylene (PE) segment accounted for a considerably larger market share, driven by strong demand from the packaging sector. With increasing demand for flexible packaging in the food, e-commerce, and retail sectors, the use of polyethylene (PE) is on the rise. This trend helps manufacturers achieve their cost and performance goals. Fillers enhance the mechanical strength, puncture resistance, and thickness of PE films, which, in turn, reduces waste and improves overall film performance.

The Polypropylene (PP) segment is expected to experience steady growth during the forecast period. PP woven bags, jumbo bags, and raffia tapes utilize 20–30% filler masterbatch to reduce production costs. This provides manufacturers with a significant price advantage, particularly in price-sensitive markets such as agriculture, cement, and fertilizer packaging. In applications such as automotive interiors and white goods (such as washing machine parts), PP with filler masterbatch offers lightweight yet strong components, enhancing cost efficiency.

By End-use Industry

Need for Cost-Effective and Lightweight Packaging Materials to Boost Packaging Segment Growth

The market is segmented, by end-use industry into packaging, automotive, building & construction, consumer goods, agriculture, and others.

The packaging segment dominated the market in 2024. As the demand for packaging increases, particularly in the food and beverage, retail, and e-commerce sectors, the need for cost-effective and lightweight packaging materials becomes more critical. The use of filler masterbatches allows manufacturers to reduce costs while still meeting performance standards.

The building and construction segment is anticipated to experience significant growth during the forecast period. The increasing demand for plastic materials in construction applications, such as insulation, pipes, and window profiles, is driving the rise of filler masterbatches in this sector. Additionally, the focus on cost-effective solutions and improved performance properties in construction plastics is expected to enhance filler masterbatch market growth further.

The consumer goods segment is expected to experience significant growth. The expanding middle class and increasing disposable income in emerging markets have created a substantial demand for consumer goods made from plastics, including electronics, home appliances, and personal care products. These masterbatches are used to lower production costs while maintaining the quality and durability of these products.

Filler Masterbatch Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Filler Masterbatch Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 0.42 billion in 2025 and USD 0.43 billion in 2026. Key contributors, including China, India, and Vietnam, have expanding industrial sectors and an increasing demand for affordable plastic products. Major market drivers in these countries include the packaging, construction, and automotive industries.

North America

North America is experiencing significant growth due to the rising demand in the automotive and construction sectors. The emphasis on lightweight materials and sustainable plastics is boosting the demand for masterbatches in the region. The U.S. leads the North American filler masterbatch market, driven by strong demand for plastic production. Additionally, the growing need for lightweight automotive components and innovations in sustainable packaging further fuels the demand for performance-focused masterbatches.

Europe

Europe is another key region, with Germany leading the market. The focus on sustainability and the growing demand for high-performance, eco-friendly plastics have led to the use of filler masterbatches in various applications.

Latin America

Latin America is experiencing steady growth. Countries such as Brazil, a key player in the region, are witnessing progress driven by the expanding packaging and automotive industries. Rising urbanization and industrialization are increasing product demand in this area.

Middle East & Africa

The Middle East, especially Saudi Arabia, shows promise due to its diversification into industries beyond oil, including infrastructure development and construction, which utilize masterbatches in various applications.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Adopting Innovation Strategies to Gain Competence

The global market is fragmented with companies such as Plastika Kritis S.A., Plastiblends India Ltd., LyondellBasell Industries, Plasmix, Megaplast, and others, along with small and medium regional players operating in different parts of the globe. Key companies have established strong geographical footprints across the globe. They have advanced technologies and product offerings to gain competence in the market.

LIST OF KEY FILLER MASTERBATCH COMPANIES PROFILED

- Plastika Kritis S.A. (Greece)

- Plastiblends India Ltd. (India)

- LyondellBasell Industries (Netherlands)

- Plasmix (India)

- GCR Plastic Solutions (Spain)

- Shivam Polychem (India)

- Megaplast (Vietnam)

- US Masterbatch JSC (Vietnam)

- Bajaj Plast Pvt. Ltd. (India)

- Alok Masterbatches Pvt. Ltd. (India)

REPORT COVERAGE

The global market analysis provides market size and forecast by all the segments included in the report. It includes details on the market dynamics and trends expected to drive the market in the forecast period. It offers information on filler masterbatches in key regions/countries, key industry developments, new product launches, details on partnerships, and mergers and acquisitions. It covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Carrier Polymers

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.31 billion in 2026 and is projected to record a valuation of USD 1.95 billion by 2034.

In 2025, the market value stood at USD 0.42 billion.

The market is expected to exhibit a CAGR of 5% during the forecast period of 2026-2034.

In 2025, the polyethylene (PE) segment led the market, by carrier polymers.

Technological advancements are expected to drive market growth as industries demand more performance-oriented solutions.

Plastika Kritis S.A., Plastiblends India Ltd., LyondellBasell Industries, Plasmix, and Megaplast are the top players in the market.

Asia Pacific dominated the market in 2025.

The increasing focus on reducing production costs while maintaining quality is expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us