Fishing Vessel Market Size, Share & Industry Analysis, By Deck Type (Large Decks, Medium Decks, and Small Decks), By Trawlers (Freezer Trawlers, Wet-Fish Trawlers, Side Trawlers, Outrigger Trawlers, Factory Trawlers, and Stern Trawlers), By Engine Capacity (<200 HP, 200-300 HP, and >300 HP), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

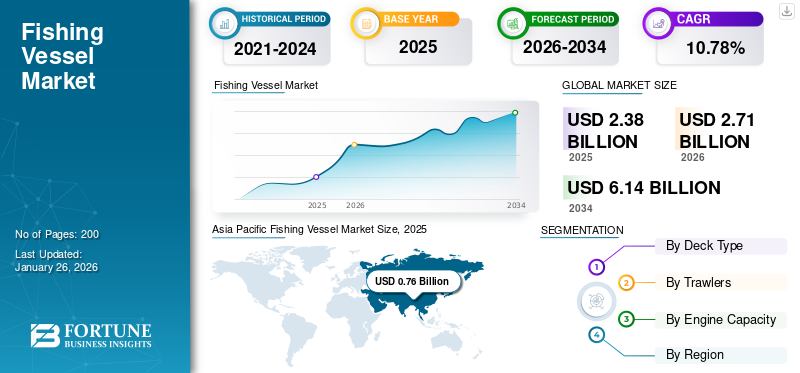

The global fishing vessel market size was valued at USD 2.38 billion in 2025 and is projected to grow from USD 2.71 billion in 2026 to USD 6.14 billion by 2034, registering a CAGR of 10.78% over the forecast period. Asia Pacific dominated the fishing vessel market with a market share of 31.88% in 2025.

Fishing vessels are designed specifically built and equipped for catching fish and other marine organisms. They are categorized into such as commercial, artisanal, and recreational. These vessels employ different types of fishing equipment such as nets, lines, and traps, and can vary in size from small boats to large factory ships.

The rising interest in recreational activities, along with a greater awareness of the health benefits associated with seafood, is expected to boost the demand for fishing boats. The increase in outdoor recreational activities is anticipated to generate significant investment opportunities for market growth.

Download Free sample to learn more about this report.

The rising global demand for seafood, growth in commercial fishing, an increase in deep-sea and aquaculture efforts, along with government backing for sustainable fisheries, are driving growth. Moreover, leading companies like Eastern Shipbuilding Group, Wärtsilä, Mitsubishi Heavy Industries, Rolls-Royce Marine, and Kleven Maritime are poised for robust, ongoing growth, supported by the demand for seafood, advancements in technology, and worldwide expansion in both traditional and aquaculture fishing.

GLOBAL FISHING VESSEL MARKET KEY TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 2.38 billion

- 2026 Market Size: USD 2.71 billion

- 2034 Forecast Market Size: USD 6.14 billion

- CAGR: 10.78% (2026–2034)

Market Share:

- Asia Pacific held the largest market share in 2025 at 31.88%.

Key Country Highlights:

- U.S.: Facing modernization and sustainability pressures; demand driven by regulatory compliance and eco-conscious consumers.

- China: Leads Asia Pacific in production and export, backed by strong infrastructure and seafood consumption.

- Scotland: Adoption of mandatory Remote Electronic Monitoring (REM) to enforce sustainable fishing.

- Norway & Finland: Home to key players like Kleven Maritime and Wärtsilä; focus on hybrid propulsion and eco-friendly designs.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Attention to Sustainable Fishing Methods to Support Market Development

The fishing industry plays a crucial role in the livelihoods of billions of people globally. To ensure the prosperity of the fishing sector while safeguarding the ecological integrity of marine environments, regional authorities and environmental groups are increasingly emphasizing sustainable fishing practices.

A prime example is the Magnuson–Stevens Fishery Conservation and Management Act, which manages and regulates fisheries in U.S. federal waters. It tackles problems such as overfishing and the recovery of diminished fish stocks. This initiative is further supported by the adoption of modern technologies, aiding the global fishing vessel market growth.

Fishing boats play a major role in carbon emissions due to their dependence on fuel-intensive engines. Research has demonstrated that improving vessel designs, lowering engine RPM, switching to more efficient engines (such as inboard diesel engines), and implementing hybrid systems can greatly decrease fuel consumption and emissions. For instance, hybrid battery-diesel systems, as used in Alaska, enable vessels to cut fuel usage by up to 80% while using renewable energy sources.

MARKET RESTRAINTS

High cost of fishing boats to Limit Market Growth

The global fishing vessel industry is anticipated to face limitations due to the high expenses associated with manufacturing and operations of these boats. These vessels are built with great accuracy and the fundamental materials utilized in making fishing vessels, including aluminum, steel, or composite materials, which also quite costly.

The price of smaller fishing vessels typically begins at around USD 10,000, while advanced vessels can cost up to USD 1,00,000. Additionally, the costs for maintaining and operating fishing vessels are relatively high, further contributing to the financial challenges within the industry.

MARKET OPPORTUNITIES

Rising Emphasis on Sustainable Fishing Methods to Support Industry Growth

With the global focus turning toward sustainable fishing methods, there is a growing demand for boats equipped with environmentally friendly technologies. This encompasses hybrid propulsion systems, recyclable hull designs, and energy-efficient equipment designed to lessen environmental impact and comply with stricter regulations. The implementation of Remote Electronic Monitoring (REM) technology is becoming compulsory in certain areas, such as Scotland, to ensure adherence to catch quotas and environmental laws. Vessels outfitted with REM systems can gain a competitive advantage by showcasing transparency and accountability in their shifting operations.

The rising global demand for seafood, driven by evolving dietary choices and the expanding hotel, restaurant, and café (HORECA) industry, is increasing the need for fishing boats with improved production and efficiency. Overfishing in coastal regions has led to fishing activities into deeper waters, creating a need for larger, specialized vessels tailored for offshore aquaculture and deep-sea fishing operations.

Contemporary fishing boats are utilizing sophisticated technologies such as GPS, sonar systems, automated processing machinery, and tools for optimizing routes. These advancements improve operational effectiveness and safety while lowering expenses. Coastal nation governments are encouraging the growth of the fisheries sector as part of wider economic initiatives. This includes funding projects that back sustainable vessel designs and environmentally responsible fishing practices.

Market Challenges

Regulatory Compliance, Workforce Development, Environmental and Emissions Regulations to Hamper the Growth of the Market

Regulatory Pressure: - Increasing government regulations, such as mandatory Remote Electronic Monitoring (REM) and emission controls, require significant adaptation and investment by vessel operators

Environmental and Emissions Regulations: - The industry faces increasing pressure to reduce greenhouse gas emissions and comply with stricter environmental standards, including new IMO and regional regulations on energy efficiency and carbon intensity.

Occupational Hazards and Safety: - Fishing remains one of the world’s most dangerous professions, with high rates of fatalities and injuries due to hazardous equipment, harsh weather, long hours, and limited access to safety training and gear

Workforce and Social Issues: - Attracting and retaining skilled crew, addressing poor safety culture, and improving working conditions are ongoing challenges, especially as the industry modernizes and faces demographic shifts

Climate Change: - Shifting ocean conditions and fish populations due to climate change require adaptive management and further complicate long-term planning and sustainability efforts

Fishing Vessel Market Trends

Ongoing Technological Development Drive Greater Efficiency, Safety, Sustainability, and Competitiveness

Smart and Autonomous Navigation: - Adoption of autonomous navigation systems and AI-driven route optimization is increasing, reducing human error and operational costs while enhancing safety and efficiency

Advanced Hull and Vessel Design: - New hull designs using advanced materials improve stability, speed, and fuel efficiency, with leading brands focusing on hydrodynamic engineering

Digitalization and IoT Integration: - Real-time monitoring, predictive maintenance, and remote vessel management are enabled by IoT sensors and big data analytics, optimizing performance and reducing downtime.

Enhanced Safety and Security: - Smart bridge systems, cybersecurity-enhanced navigation, and advanced surveillance (RADAR/SONAR) improve situational awareness and vessel protection

Sustainability and Regulatory Compliance: - Technologies like Remote Electronic Monitoring (REM) cameras ensure compliance with catch quotas and environmental regulations, supporting sustainability and transparency

Robotics and Automation: - Robotics streamline shipbuilding, maintenance, and onboard operations, improving efficiency and safety during construction and at sea.

Segmentation Analysis

By Deck Type

Large Deck Segment to Display Fastest Growth due to Rising Focus on Deep Sea Fishing

Based on deck type, the market is classified into large deck, medium deck, and small deck.

The large deck segment is estimated to be the fastest-growing during the forecast period. The increasing focus on deep-sea fishing is a major driver, as overfishing in coastal areas pushes operations into deeper waters. This requires specialized vessels capable of operating efficiently in challenging environments. Large-deck fishing vessels are increasingly being incorporated with advanced technologies such as intelligent navigation systems, fish detection tools, and eco-friendly engines. Innovations such as smart vessel blueprints and modern trawler designs further enhance operational efficiency and reduce environmental impact, thereby catalyzing market growth.

By Trawlers

Growing Adoption of Freezer Trawlers for the Expansion of Aquaculture Fishing to Anticipate the Market Growth

Based on trawlers, the market is divided into freezer trawlers, wet-fish trawlers, side trawlers, outrigger trawlers, factory trawlers, and stern trawlers.

The freezer trawlers segment is anticipated to be the fastest growing during the forecast period. The global demand for seafood is rising driven by its health advantages, increasing populations, and the expansion of aquaculture. Freezer trawlers are essential for maintaining seafood quality and prolonging storage life. Innovative freezing techniques such as air blast freezing, plate freezing, and individual quick freezing (IQF) are improving operational efficiency and product quality, thereby fueling market growth.

By Engine

>300 HP Segment to Showcase Fastest Growth due to Technological Advancements

Based on engine, the market is segmented into <200 HP, 200-300 HP, and >300 HP.

The >300 HP segment is estimated to be the fastest-growing during the forecast period due to its ability to support deep-sea fishing, handle increased production levels, and accommodate sophisticated onboard processing technologies. This segment is becoming more preferred for commercial activities that demand high performance and efficiency. The trend of overfishing production in coastal regions has led to a heightened emphasis on deep-sea fishing, necessitating vessels with greater engine power for longer missions and navigation in challenging sea conditions. High-powered vessels are integrating intelligent technologies such as GPS, sonar equipment, automated route planning, and onboard fish processing systems to improve operational efficiency and minimize downtime, which can further contribute to segment expansion.

Fishing Vessel Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

North America

Asia Pacific Fishing Vessel Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is anticipated to grow at a fastest growth rate during forecast period, with significant contributions from countries such as the U.S. and Canada. These countries frequently utilize large vessels for industrial fishing purposes. The region is home to well-known fishing vessel manufacturers, strengthening its market presence. Contemporary fishing vessels in North America are incorporating cutting-edge technologies such as GPS, sonar systems, and automated processing equipment. These advancements improve operational efficiency and safety while lowering operational costs.

The U.S. fishing vessel sector finds itself at a critical juncture, juggling the challenges of sustainability, safety, and modernization while facing regulatory and labor obstacles, yet there is a sense of cautious optimism regarding future growth. Environmentally aware consumers are progressively seeking seafood that is sustainably sourced, driving the industry to adopt environmental certifications and enhance transparency, which can provide a competitive edge.

Europe

The market for fishing vessels in Europe is experiencing steady growth, fueled by rising seafood consumption, technological advancements in vessel design, and government initiatives supporting sustainable practices. European governments are encouraging sustainable fishing through supportive policies and financial incentives. Efforts include modernizing fleets to cut carbon emissions and prevent overfishing. The integration of vessel monitoring systems with mobile applications is improving the management and oversight of fisheries. Additionally, aquaculture is emerging as a significant alternative to traditional fishing due to its affordability and dependability, prompting changes in vessel designs to accommodate offshore aquaculture operations.

Asia Pacific

Asia Pacific accounted for USD 0.76 billion in 2025. The global market is largely dominated by the Asia Pacific region, owing to its vast coastline, high demand for seafood, and notable aquaculture production. China is at the forefront of this region in terms of fishing vessel production and exports, backed by strong infrastructure development and technological progress. The region presents a large share of worldwide seafood consumption, with average fish consumption per person having doubled over the last 50 years. This increase is driven by health-oriented consumers and a rising middle class seeking high-quality seafood products.

Rest of the World

The market in the Rest of the World (RoW), encompassing the Middle East & Africa and Latin America, is seeing consistent growth. This is fueled by rising seafood consumption, advancements in technology, and a growing emphasis on sustainable fishing methods. Countries in the RoW have outdated fishing fleets, which creates opportunities for vessel manufacturers to offer modern, efficient, and eco-friendly fishing boats.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Firms Focus on Launch of Innovative Products to Gain Competitive Edge

The fishing vessel market features a multifaceted and competitive environment, shaped by a variety of elements including technological progress, regulatory policies, and the rising demand for sustainable fishing methods.

As the industry adjusts to changes in consumer expectations and ecological concerns, companies are increasingly prioritizing innovation, efficiency, and fleet modernization. The competitive landscape is influenced by the growing participation of new market entrants along with established companies utilizing their expertise and market insights.

With improvements in materials, design, and environmentally friendly technologies, businesses in this sector need to strategically position themselves to achieve a competitive advantage while complying with environmental regulations and meeting the needs of the fishing community.

LIST OF KEY FISHING VESSEL COMPANIES PROFILED

- Eastern Shipbuilding Group (U.S.)

- Wärtsilä (Finland)

- Kleven Maritime (Norway)

- Yangzijiang Shipbuilding (China)

- Rolls Royce Plc (U.K.)

- Damen Shipyards Group (Denmark)

- Vard Group (Norway)

- Astilleros Armon (Spain)

- Fincantieri (Italy)

- Astilleros Gondán (Spain)

KEY INDUSTRY DEVELOPMENTS

- September 2024: The Ministry of Agriculture, Fisheries, Blue and Green Economy signed agreements for the construction of fifty boats and the refurbishment of fish landing sites in Mahaut, Bioche, and Dublanc. These actions are part of the Dominica Emergency Agricultural Livelihoods and Climate Resilience Project (DEALCRP), with the goal of enhancing production capacity in the fisheries sector, increasing climate resilience, and improving the livelihoods of local fishermen.

- November 2024: A new agreement has been established for the manufacturing of four ARESA 2500 S RWS units, with Angola as the final destination. This project is funded by Deutsche Bank. The ARESA 2500 S RWS is a semi-industrial purse seiner fishing boat featuring an advanced suction fishing system and RWS Chilled Water Systems within the fish holds.

- December 2024: Namibia submitted its instrument of accession to the 2012 Cape Town Agreement, showcasing its commitment to the safety of fishing vessels and their crews. The High Commissioner and Permanent Representative of Namibia to IMO, H.E. Ms. Linda Scott, presented the instrument at IMO headquarters, becoming the 23rd nation to join the Agreement.

- June 2024: The VARD 8 02 trawler design is a reliable model that VARD consistently improves, incorporating cutting-edge technology. Known for its impressive fuel efficiency, this ship is equipped for both semi-pelagic and bottom-trawling activities, while ensuring adherence to the latest standards for fish health management, operational efficiency, and eco-friendly practices.

- June 2023: The government signed a contract worth approx. USD 95,7800 for the Environmental and Social Impact Assessment (ESIA) project, aimed at acquiring and building fishing vessels to enhance deep-sea fishing capabilities.

REPORT COVERAGE

The global fishing vessel market analysis provides comprehensive insights, including market size and forecast across all segments covered in the report. It highlights key market dynamics and trends expected to shape the market during the forecast period. It offers information on the key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and the number of in key countries and companies. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.78% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deck Type

|

|

By Trawlers

|

|

|

By Engine Capacity

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 2.38 billion in 2025 and is projected to grow from USD 2.71 billion in 2026 to USD 6.14 billion by 2034

In 2025, the market value stood at USD 0.76 billion.

The market is expected to exhibit a CAGR of 10.78% during the forecast period.

The freezer trawlers segment led the market by trawler type.

increasing attention to sustainable fishing methods are key factors driving market growth.

Damen Shipyards Group (Netherlands), Hyundai Heavy Industries (South Korea), Samsung Heavy Industries (South Korea) and so on the top players in the market.

Asia Pacific dominated the market in 2024.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us