Marine Hybrid Propulsion Market Size, Share & Industry Analysis, By Operation Type (Parallel Hybrid Propulsion System and Serial Hybrid Propulsion System), By Component (I.C. Engine, Generator, Power Management System, Battery, Gearbox, and Others), By Ship Type (Container Ship, Passenger Ship, Fishing Vessel, Yacht, Tanker, and Others), By Installment (Line Fit and Retrofit), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

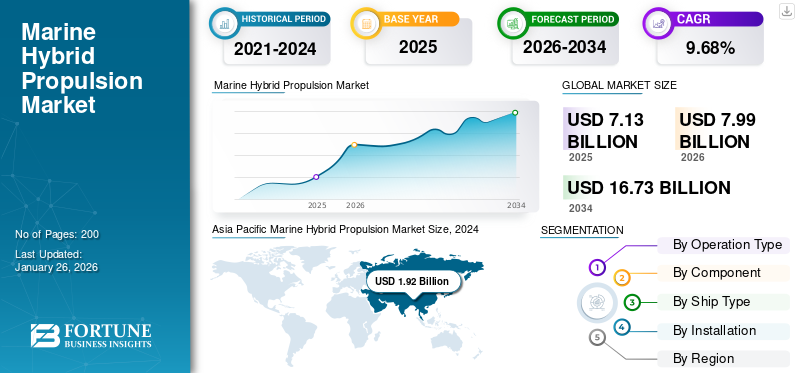

The global marine hybrid propulsion market size was valued at USD 7.13 billion in 2025 and is projected to grow from USD 7.99 billion in 2026 to USD 16.73 billion by 2034, exhibiting a CAGR of 9.68% during the forecast period. Asia Pacific dominated the marine hybrid propulsion market with a market share of 31.88% in 2025.

Hybrid propulsion systems for marine applications combine an internal combustion engine and battery power to optimize engine operation and reduce emissions. They are ideal for vessels with flexible operating profiles, runtimes, and varying power requirements. There are various types of hybrid propulsion configurations, and the most adopted are serial and parallel hybrid propulsion. The best hybrid configuration for a boat or business is determined by the type of operation, speed of operation, expected mileage and duration of operation, available charging infrastructure, local or national emission standards, among other factors.

Download Free sample to learn more about this report.

Major key players involved in the market include AB Volvo Penta, BAE System Plc., Beta Marine ltd., Caterpillar Inc., Cummins Inc., and Man Energy Solutions SE, among others.

Furthermore, there are various key features of marine hybrid propulsion systems, such as reduction in noise level, increased fuel efficiency, increased torque, and others. Moreover, hybrid propulsion helps the operators switch to electric propulsion during low-speed cruising or in the event of any internal combustion engine failure. Hybrid propulsion systems offer flexibility in power generation, lower carbon emissions, and decreased maintenance costs. Owing to such significant features, the market for marine hybrid propulsion systems is projected to grow during the forecast period. The rising demand for reductions in carbon emissions will boost the global market size from 2025 to 2032. For instance, in August 2022, BOS Power secured the contract to provide an electric/hybrid propulsion system for a new aquaculture work vessel for the end client, AQS, a group of Norwegian marine entrepreneurs.

GLOBAL MARINE HYBRID PROPULSION MARKET OVERVIEW

Market Size & Forecast

- 2025 Market Size: USD 7.13 billion

- 2026 Market Size: USD 7.99 billion

- 2034 Forecast Market Size: USD 16.73 billion

- CAGR: 9.68% from 2026–2034

Market Share

- Asia Pacific dominated the marine hybrid propulsion market with a 31.88% share in 2025, supported by expanding international trade and robust shipbuilding activities across China, India, Japan, and others.

- By operation type, the parallel hybrid propulsion system segment held the largest market share in 2024 due to its flexibility, ease of integration, and applicability across diverse vessel types such as OSVs, ferries, and tugboats.

Key Country Highlights

- China: Leads Asia Pacific due to strong shipbuilding capacity and active hybrid vessel projects; local shipyards are incorporating hybrid systems in new builds.

- India: Government-backed initiatives like the Shipbuilding Financial Assistance Policy are promoting hybrid technology adoption through financial support for vessel construction.

- United States: Growth is driven by environmental regulations, increased hybrid R&D, and government subsidies supporting hybrid conversions in the fishing fleet.

- Germany: Key player investments and EU Green Deal policies support market growth through hybrid retrofitting and new hybrid builds.

- Brazil: Pioneered hybrid vessel retrofitting in Latin America; the first hybrid offshore support vessel upgrade boosts regional adoption.

MARINE HYBRID PROPULSION MARKET TRENDS

Increase in Adoption of Vanadium Redox Flow Batteries in Marine Hybrid Propulsion Systems

Vanadium Redox Flow Batteries (VRFB) technology utilizes a non-flammable, aqueous electrolyte that contains vanadium that can be recovered and recycled at the end of the VRFB life cycle. Many key players are focused on adapting this technology to the marine hybrid propulsion system due to environmental factors related to carbon emissions.

Furthermore, the vanadium redox flow battery stores electrical energy in large tanks containing a liquid vanadium electrolyte. Although bulkier than lithium-ion batteries, they have potential advantages for marine applications. In December 2023, Wärtsilä, a technology company, has been contracted to provide a comprehensive hybrid propulsion system for three new self-discharging cargo ships currently under construction at the Royal Bodewes shipyard in the Netherlands for the Norwegian shipping company Aasen Shipping. This solution will include the latest version of Wärtsilä’s engine lineup, known as the Wärtsilä 25.

MARKET DYNAMICS

MARKET DRIVERS

Decrease in Fuel Consumption Resulting in Low Operating Costs to Drive Market Growth

The major concern for ship owners is fuel consumption in a diesel engine propulsion system. Apart from this, the fluctuation in fossil fuel prices, increase in sulfur emissions, and reliance on low-grade fuel are a few factors owing to which major players are focused on developing hybrid propulsion systems. Furthermore, according to various marine journals, the hybrid propulsion system reduces up to 40% of NOx due to the maximum load reduction. According to a report by the International Council on Clean Transportation (ICCT), a hybrid propulsion system installed on a container ship could reduce fuel consumption by 10-20%. Another study reported that hybrid propulsion systems can lead to fuel savings of up to 30% compared to traditional propulsion systems. These statistics demonstrate the significance of hybrid propulsion systems in reducing fuel consumption, resulting in low operating costs.

Technological Capabilities and Broad Network of OEMs to Drive Market

Technological advances and innovations are key trends gaining popularity in this market. Many combinations are possible due to different types of energy, power conversion, network technology, and drives. According to the Journal of Marine Science and Engineering, the study of hybrid propulsion shows a reduction of 66% in carbon emissions while increasing the lifetime cost by 40% when compared to a conventional propulsion system.

Furthermore, various OEMs are focused on taking collaborative steps to implement a marine hybrid propulsion system on board. For instance, in August 2023, HST Marine, part of Purus Wind, is integrating Reygar's BareFleet technology into new vessels being constructed by Damen Shipyards, all of which feature electric motors for hybrid propulsion. The Swansea-based company has seven new fast crewing service vessels ordered based on Damen’s FCS 2710 design and three vessels based on Damen's FCS 3210 design, all of which will come equipped with BareFleet as a standard feature. HST Marine is already utilizing Reygar’s software and hardware on four operational hybrid CTVs, with plans for three additional vessels to begin service soon

MARKET RESTRAINTS

Increase in Complexity of Propulsion System Compared to Conventional System will Hamper Market

The recent trend to design more efficient and versatile ships has led to a growing variety of hybrid propulsion and power supply architectures. Intelligent control strategies are required to improve performance in these architectures. Various types of ships, such as offshore vessels, naval ships, and container ships, have to perform different operations, such as transit and critical dynamic positioning, which makes it complex for the propulsion system. The varying operating profiles make it difficult to optimize power and propulsion plants for specific operating points during the vessel design stage, as has been traditionally done.

Furthermore, in marine hybrid electric propulsion systems, the electric drive system is usually controlled by a Power Management System (PMS), which optimizes load distribution. This is important because power supplies are connected to the same distribution grid, and improper power supply and demand can lead to a shutdown of the electrical system. However, developing an optimized PMS to achieve different operational load profiles is challenging as it requires sensor detection, such as fuel consumption, power output, and engine speed, which is typically not readily available. Additionally, a control strategy for the electrical network is required for the maintenance of voltage and frequency stabilization, which creates more complexities than the conventional system.

MARKET CHALLENGES

Intricate Nature of Systems and High Cost Hinders its Widespread Adoption Stifling Market Growth

Hybrid propulsion systems entail considerable initial costs compared to conventional mechanical systems. This includes expenses associated with onboard generation, distribution networks, specialized motors, and controllers. The elevated cost of these systems might discourage smaller operators or those with constrained budgets from embracing the technology. Additionally, hybrid systems require specialized maintenance and technical support, which might not be easily accessible in every port or region.

The intricate nature of these systems require experienced individuals for oversight, maintenance, and enhancements, which increases operational expenses. Incorporating lithium-ion batteries in hybrid systems presents hazards like thermal runaway, potentially leading to fires or explosions if the batteries are compromised or mismanaged. It is essential to guarantee correct installation, efficient cooling systems, and compliance with safety regulations, though this can be difficult.

Although hybrid systems help lower emissions, they continue to encounter obstacles in attaining full energy autonomy because they often depend on fossil fuels for backup power. The immediate torque generated by electric motors may lead to mechanical strain on shafts and other parts if they are not engineered to withstand such forces. There is an absence of standardized regulations specifically designed for hybrid propulsion systems in the industry. While stricter emission regulations are being developed, there is a need for better alignment with the capabilities of hybrid technology.

MARKET OPPORTUNITIES

Environmental, Technological, and Economic Factors Offers Promising Opportunities

Tighter environmental laws and policies aimed at reducing emissions are urging shipowners to embrace cleaner technologies, such as hybrid propulsion systems, to meet global standards. Additionally, government incentives and subsidies for eco-friendly shipping initiatives enhance the shift toward hybrid systems.

Hybrid propulsion systems greatly minimize fuel usage, resulting in reduced operational expenses for shipowners. The capability to alternate between electric and traditional power sources enable ships to optimize energy consumption according to operational requirements, increasing efficiency. Advances in battery technology, including enhanced energy density and better safety features, are rendering hybrid systems more practical and economically viable. The incorporation of alternative energy sources, such as hydrogen fuel cells and dynamic positioning systems, is broadening the applications of hybrid propulsion.

Hybrid propulsion is being implemented in a variety of vessel categories, such as ferries, offshore support vessels, luxury yachts, and military vessels. The adaptability of hybrid systems allow them to operate effectively in environmentally sensitive regions or emission-restricted zones. Additionally, the growth of charging and refueling infrastructure for hybrid vessels, including LNG and hydrogen fuel facilities, is opening up new market possibilities.

SEGMENTATION ANALYSIS

By Operation Type

By operation type, the market is classified into parallel hybrid propulsion system and serial hybrid propulsion system.

Parallel hybrid propulsion systems dominated the global market with share of 56.18% in 2026 owing to their operational flexibility, relatively straightforward integration, and suitability for a broad range of vessel types and duty cycles. This configuration allows the vessel's propeller shaft to be driven directly by either the Internal Combustion Engine (ICE), the electric motor, or both simultaneously. This flexibility is particularly advantageous for vessels requiring significant power bursts or variable speeds, such as Offshore Support Vessels (OSVs), ferries, tugboats, and certain yachts. The mechanical coupling is less complex than serial systems for retrofits. It often leverages existing drivetrain components, making it a cost-effective first step toward hybridization for many shipowners seeking fuel savings and emissions compliance without a complete redesign.

For instance, in May 2023, MAN Energy Solutions supplied its new 49/60DF dual-fuel engines integrated into parallel hybrid systems for newbuild ferries and OSVs, emphasizing fuel flexibility alongside hybridization. Similarly, companies such as Schottel (in October 2023) and Wärtsilä (March 2024) enhanced their parallel hybrid solutions, focusing on control systems for seamless mode switching and optimizing energy flow, further solidifying their appeal for diverse maritime applications seeking immediate operational benefits.

Serial hybrid propulsion systems are projected to depict the fastest-growth, driven by the increasing demand for pure electric operation, optimal efficiency in variable load profiles, and alignment with future zero-emission goals. This architecture excels in applications where vessels operate frequently at low speeds or require extended periods of zero-emission operation, such as harbor tugs, short-sea shipping vessels, research vessels, and superyachts. Furthermore, serial systems offer superior scalability for battery capacity, enabling longer zero-emission endurance and paving the way for eventual transition to full electrification as battery technology advances and charging infrastructure expands.

For instance, in January 2024, Damen Shipyards Group has launched multiple Serial Hybrid tugs (like the ASD Tug 2813 Hybrid) and ferries, emphasizing their capability for silent, emission-free operation in ports. Major engine manufacturers such as Rolls-Royce (mtu) (in February 2024) and Caterpillar (MaK) (in January 2024) heavily invested in gensets specifically designed for serial hybrid applications, focusing on transient response and optimized efficiency. The push for "cold ironing" and "green port" initiatives, coupled with tightening emissions regulations (especially in Emission Control Areas - ECAs), directly fuels the adoption of serial hybrids capable of extended battery-only operation, positioning this segment for accelerated growth as the industry moves toward decarbonization.

By Component

I.C. Engine Segment Dominates Market Owing to Significance of Engine Component in Propulsion System

By component, the market consists of I.C. engine, generator, power management system, battery, gearbox, and others.

The I.C. engine segment is anticipated to dominate the global market with share of 34.02% in 2026, during the forecast period owing to the requirement of power during hybrid propulsion. Furthermore, the cost of the I.C. engine makes it a significant component in the entire hybrid propulsion system.

The generator segment is anticipated to witness significant growth during the study period owing to the development of a new type of generator by various key players. The main advantages of marine generators are that they have lower maintenance costs than gas generators, improved noise reduction, safer operations due to no sparkling, and longer lifespan owing to lower burn temperatures. Owing to the significance of marine generators, the segment is anticipated to grow during the study period.

By Ship Type

Fishing Vessel Segment Dominates Market Owing to Rising Fleet

By ship type, the market is categorized into container ship, passenger ship, fishing vessel, yacht, tanker, and others.

The fishing vessel segment is anticipated to dominate the market with share of 33.90% in 2026, during the forecast period owing to an increase in fleet size of fishing vessels around the world. According to a report by the Food and Agriculture Organization of the United Nations, in 2020, the estimated number of fishing vessels was 4.1 million. Moreover, Asia has the world’s largest fishing fleet, with 2.68 million vessels.

The yacht segment showed significant growth in 2024 due to increasing demand for low-carbon emissions in commercial marine tourism. Many key players are focused on the development of technologies to tackle the problem of carbon emissions and improve energy efficiency. The development of air lubrication increases energy efficiency. Such key developments are a major reason for the growth of the segment during the study period.

To know how our report can help streamline your business, Speak to Analyst

By Installment

Owing to Demand for Technologically Advanced Ships, Line Fit Segment Dominates

By installment, the market is categorized into line fit and retrofit.

The line fit segment is expected to dominate the market with share of 58.55% in 2026, during the forecast period. Various OEMs and manufacturers install diesel-electric propulsion systems while manufacturing. The segment is projected to grow in the coming years due to technologically advanced ship requirements.

The retrofit segment is projected to show significant growth owing to the increased demand for retrofitting old propulsion systems with the advanced hybrid propulsion system.

MARINE HYBRID PROPULSION MARKET REGIONAL OUTLOOK

In terms of geography, the market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

The North America market was valued at USD 1.17 billion in 2024. This region's growth is due to the rise in marine fleet size. Furthermore, the increased focus of various OEMs on R&D and implementation of hybrid propulsion systems is a major market driver. Furthermore, in April 2022, the Canadian federal and provincial governments invested USD 3 million to adapt efficient hybrid and electric engines to fishing vessels. The funding will enable fishermen to invest in hybrid systems at a significantly lower investment cost. It will facilitate the adoption of hybrid fishing vessel systems by AKA Group and other companies operating in the hybrid propulsion market. The U.S. market is projected to reach USD 1.21 billion by 2026.

The U.S. marine hybrid propulsion market is poised for substantial growth due to regulatory pressures, technological innovation, and increasing demand for sustainable maritime solutions. With continued investment in R&D and infrastructure development, the industry is set to transform the maritime sector in the coming years.

Asia Pacific

Asia Pacific Marine Hybrid Propulsion Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest marine hybrid propulsion market share with 31.88% in 2025 at valued USD 2.27 Billion. The Asia Pacific marine hybrid propulsion market growth is owed to the increase in international trade, coupled with increasing shipbuilding activities in China, India, Japan, and other countries. China holds the dominant market share in the Asia Pacific region. In March 2022, the Indian government approved financial assistance of USD 110.39 million for building 47 vessels under the Shipbuilding Financial Assistance Policy (SBFA). In addition, in June 2022, Wärtsilä obtained a contract to provide its hybrid propulsion system for 11 new Pure Car and Truck Carrier (PCTC) vessels being constructed for Eastern Pacific Shipping (EPS), which is based in Singapore. The construction of the PCTC vessels is taking place at Jingling and Weihai shipyards in China. Wärtsilä’s hybrid solution includes in-line shaft generators, converters, an energy storage system, and the firm’s energy management system to oversee hybrid operations. The Japan market is projected to reach USD 0.63 billion by 2026, the China market is projected to reach USD 0.84 billion by 2026, and the India market is projected to reach USD 0.31 billion by 2026.

Europe

Europe is anticipated to experience significant growth and account for a substantial marine hybrid propulsion market share during the study period. In Europe, Germany, Italy, Russia, and France are major shipbuilding nations and are among the largest consumers of marine electronics. There is an increasing demand for autonomous cruises and vessels in Europe. The European Union's "Green Deal" and "Fit-for-55" policies are significant factors pushing the shipping industry toward becoming a zero-emission transportation method. Hybrid systems enhance fuel efficiency and decrease emissions, making them appealing to operators focused on cost savings and sustainability. The emergence of energy-efficient propulsion systems stands out as a prominent trend. These systems integrate internal combustion engines with battery power, which enhances efficiency and minimizes environmental impact. Major players in Europe consist of MAN Energy Solutions (Germany), Siemens (Germany), Nidec Industrial Solutions (Italy), ABB Ltd. (Switzerland), and BAE Systems (U.K.), all of which are actively investing in research and development as well as introducing new products. Updating older ships with hybrid systems presents a growth opportunity in the market, bolstered by initiatives such as the EU's Green Deal and FuelEU Maritime initiative. The UK market is projected to reach USD 0.38 billion by 2026, and the Germany market is projected to reach USD 0.15 billion by 2026.

Middle East

The market in the Middle East is projected to witness substantial growth shortly. The rise in demand for investment in the oil and gas industries makes it a rising opportunity for offshore vessels, container ships, and bulk carriers. Furthermore, in November 2021, a new patrol vessel, Ribcraft, was launched in Dubai, equipped with a unique hybrid-electric system provided by Transfluid and Elcome International.

South American

The South American market is expected to grow at a moderate rate during the forecast period. The increase in contracts for marine hybrid propulsion in Brazil and Argentina is projected to boost market growth in the region. In November 2020, a Brazilian offshore support hybrid propulsion vessel operator, CBO, signed a contract with Wärtsilä to convert the CBO Flamengo to hybrid propulsion. This will be the first vessel in Latin America to be fitted with a high-power rating battery pack for hybrid propulsion.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Increase in Joint Ventures by Key Players to Boost Market Growth

The global market is highly fragmented, with the presence of various key players such as ABB Ltd. (Switzerland), BAE Systems (U.K.), Caterpillar Inc. (U.S.), General Electric Company (U.S.), Nidec Industrial Solutions (Italy), MAN Energy Solutions (Germany), Siemens (Germany), and others. Implementation of a marine hybrid propulsion system is the most important metric by which companies can compete. Other factors, such as technological advances and collaboration, help companies reduce manufacturing and installation costs and increase the number of system installments.

LIST OF KEY MARINE HYBRID PROPULSION COMPANIES

- ABB Ltd. (Switzerland)

- BAE Systems (U.K.)

- Caterpillar Inc. (U.S.)

- General Electric Company (U.S.)

- Nidec Industrial Solutions (Italy)

- MAN Energy Solutions (Germany)

- Siemens (Germany)

- Mitsubishi Heavy Industries (Japan)

- Wärtsilä Corporation (Finland)

- Steyr Motors (Austria)

KEY INDUSTRY DEVELOPMENTS

- February 2025 – From the largest cable-laying vessels to smaller utility and workboats in the Middle East, ship owners are incorporating batteries and hybrid propulsion systems in their new builds to lower fuel use and emissions. ADNOC Logistics & Services (L&S) is investing in hybrid propulsion and electric-driven vessels to aid its offshore energy initiatives in one of the biggest markets in the Middle East. This offshore logistics division of the Abu Dhabi National Oil Company is contemplating placing an order for newly designed OSVs to upgrade and extend its fleet with modern designs and hybrid propulsion technologies.

- November 2024 – All American Marine (AAM), a frontrunner in the construction of vessels featuring hybrid and electric propulsion systems, announced that it obtained a contract to create a 63-foot hybrid catamaran for the Orange County Sanitation District (OC San). The vessel, designed by Teknicraft, is intended to aid in ocean sampling and scientific research and will be an advanced hybrid-powered boat that will promote environmental sustainability in marine operations.

- August 2024 – Volvo Penta introduced its innovative hybrid-electric propulsion system, demonstrating a strong dedication to progressing marine technology for both the yacht and commercial marine sectors. This distinctive solution provides a completely integrated hybrid-electric package, guaranteeing smooth operation and an outstanding user experience.

- July 2024 – ABB obtained a contract as the sole propulsion vendor with Washington State Ferries (WSF), which is the largest ferry system in the U.S., for the construction of five new hybrid electric vessels. This contract will utilize ABB's systems integration expertise from the project’s shipyard bidding phase all the way through vessel commissioning and initial operations. The hybrid electric ships, capable of carrying 1,500 passengers and 160 vehicles, are essential to WSF’s Ferry System Electrification strategy and contribute to its objective of achieving a zero-emission fleet by 2050.

- November 2022 – The UECC launched a new vessel called 'Autoachieve' in Gothenburg to provide short-haul sea transport. The ship was in the port of Gothenburg and was introduced on 16 November. Once in service, the ship will call at the port of Gothenburg every week.

- September 2022 – L.R. granted Empresa Naviera Elcano Approval in Principle (AiP) for its patented steam hybrid conversion design for converting a steam turbine LNG carrier to a dual fuel-efficient propulsion system.

- June 2022 – Wärtsilä and Stena signed a joint contract to build the largest hybrid vessel. Technology group Wärtsilä will supply hybrid propulsion systems for three new RoPax vessels currently under construction for Stena RoRo, Europe's largest ferry operator. The two ferries have a battery capacity of 11.5 MWh, making them the largest hybrid vessels in the shipping industry.

REPORT COVERAGE

The market research report provides a detailed analysis of the market. It comprises all major aspects, such as R&D capabilities and manufacturing process optimization. Moreover, it offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, it mainly focuses on several factors that have contributed to the global market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.68% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Operation Type

|

|

By Component

|

|

|

By Ship Type

|

|

|

By Installment

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 7.13 billion in 2025.

The market is likely to grow at a CAGR of 9.68% during the forecast period of 2026-2034.

Due to increased component costs in marine hybrid propulsion systems, the I.C. engine segment is expected to lead the market.

Decrease in fuel consumption resulting in low operating costs is expected to drive market growth.

Some of the top players in the market are ABB Ltd. (Switzerland), BAE Systems (U.K.), Caterpillar Inc. (U.S.), and General Electric Company (U.S.).

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us