Fruit Extracts Market Size, Share & Industry Analysis, By Fruit Type (Citrus Fruits, Apple, Berries, Mango, Pineapple, Grape, and Others), By Form (Liquid and Powder), By Application (Food & Beverages [Bakery, Dairy Products, Ice Cream, Beverages, and Others], Cosmetics & Personal Care, and Pharmaceuticals), and Regional Forecast, 2026-2034

FRUIT EXTRACTS MARKET SIZE AND FUTURE OUTLOOK

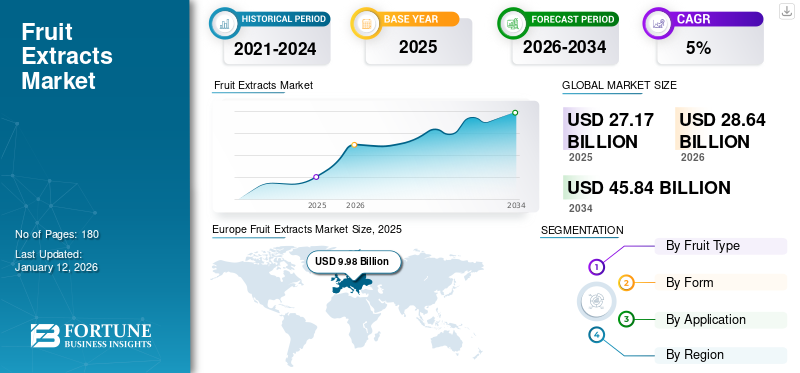

The global fruit extracts market size was valued at USD 27.17 billion in 2025. The market is projected to grow from USD 28.64 billion in 2026 to USD 45.84 billion by 2034, exhibiting a growth at a CAGR of 6.06% during the forecast period. Europe dominated the fruit extracts market with a market share of 36.74% in 2025.

Some of the prominent manufacturers of fruit extract include AGRANA Beteiligungs-AG, Kerry Group, International Flavors & Fragrances, Döhler GmbH, and Kerr/Ingredion.

Fruit extract is a concentrated form of fruit that contains color, nutritional value, and flavor. Fruit-based extracts such as concentrates, flavors, and syrups are widely used in food, beverages, dietary supplements, skincare, haircare, and medicinal products. Increasing demand for fruit juices and fruit-based food products is likely to drive the global fruit extracts market growth in the forecast period. Additionally, the adoption of fruit colors and extracts in skincare products and cosmetics products is expected to significantly contribute to the expansion of the global fruit extracts market size in the coming years.

Impact of COVID-19

The restrictions imposed during the COVID-19 pandemic negatively influenced the production. It affected businesses with varying degrees of intensity across the value chain. Companies reworked their existing models to navigate the impacts of the COVID-19 pandemic. Supply chain disturbance and trade restrictions during the pandemic significantly affected the import of citrus fruits, especially oranges. Additionally, the trade of extract products such as orange concentrates and flavors across the world declined, which affected the fulfillment of domestic market demand for several import-dependent countries. It negatively affected the market growth during the pandemic period. According to the United States Department of Agriculture, orange juice concentrate import in the U.S. declined from 346 thousand metric tons in 2019 to 210 thousand metric tons in 2020. Additionally, the production of orange juice concentrate declined from 329 thousand tons in 2019 to 297 thousand tons in 2020.

Fruit Extracts Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 27.17 billion

- 2026 Market Size: USD 28.63 billion

- 2034 Forecast Market Size: USD 45.83 billion

- CAGR: 6.06% from 2026–2034

Market Share:

- Europe dominated the fruit extracts market with a 36.74% share in 2025, driven by strong demand for natural, clean-label ingredients in food, beverage, and personal care products across countries such as Germany, France, and the U.K.

Key Country Highlights:

- United States: Production of orange juice concentrate rose to 111,000 metric tons in 2023/24, up from 84,000 metric tons in 2022/23, supporting growing demand for fruit-based ingredients.

- Mexico: Major producer of orange extract and key supplier to the North American market.

- India: Government-backed agencies produced 1,545 metric tons of juice concentrates in 2024, reinforcing domestic supply for food and cosmetic applications.

- Brazil: World's leading orange producer, accounting for 27% of global output; produced 12.3 million metric tons in 2023/24.

- South Africa: Orange juice concentrate production increased from 37,000 metric tons in 2022/23 to 55,000 metric tons in 2023/24, driven by rising regional demand.

FRUIT EXTRACTS MARKET TRENDS

Developing Clean-label Products to Meet Growing Market Demand

In the changing era, consumers are actively seeking natural, organic, and clean-label food products as these category food products pretend to be healthy and chemical-free. Increasing clean-label ingredient demand is creating potential opportunities for extract manufacturers in the industry. Thus, companies are developing innovative products with clean-label, natural and organic standards. For instance, in November 2022, Duas Rodas, one of the Brazilian flavor manufacturers, launched Acerola fruit extract - Vitamin-Ace™ 40, with a standardized 40% natural vitamin C content. The newly launched fruit extract is a clean-label, kosher, and halal-certified product that enhances baked goods and can be used as an antioxidant in meat products. Therefore, the growing demand for clean-label food ingredients and new product launches is likely to propel the market growth in the near future.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Fruit Juice Popularity to Propel Fruit Extract Demand in Upcoming Years

Emerging lifestyles and changing consumer preferences significantly drive the demand for fruit juices and clean-label food ingredients. Additionally, the fast-paced modern lifestyle, coupled with consumers' willingness to try different tastes, increases the sales of ready-made fruit juices, which drives the demand for the product from different end-use sectors. Furthermore, the increasing income and earning capacity among users in developing countries is significantly rising demand for ready-to-prepare and ready-to-drink fruit juices. This factor significantly supports the consumption of juice concentrates and powdered fruit flavors across the world.

Emerging Sugar-Free Beverages Demand across World is Likely to Push Product Demand

Fruit extracts are traditionally used in the beverage industry to produce a variety of beverage products, including juices, smoothies, and energy drinks. Consumption of fruit-based RTE beverages is showcasing positive and dynamic growth with rising awareness of the potential health benefits of fruit juice consumption. Additionally, young consumers are actively seeking reduced and low-sugar-packed beverages to meet their dietary practices and fitness goals. The rising demand for sugar-free and preservative-free fruit juices and RTE fruit-flavored beverages are influencing beverage companies to search for good quality sugar-free extracts such as concentrates and syrups. This factor is expected to encourage the ingredient producers to develop reduced sugar and sugar-free extracts and drive the global fruit extracts market growth in the near future.

MARKET RESTRAINTS

Decline in Raw Material Production Due to Climatic Change to Impede Market Growth

Fruit is the key ingredient in producing various types of extracts such as concentrates, colors, flavors, and syrups. Fruit yield is primarily and significantly associated with the climate. Changing climatic conditions in key producing countries such as the U.S., Canada, Mexico, India, and China are adversely affecting the raw material supply. Challenges in the supply chain may negatively affect the industry's growth. Brazil is one of the key orange-producing countries and holds the largest proportion of the global orange production. Over the past couple of years, the country’s orange production has declined due to climate change and the spread of citrus greening disease. According to the United States Department of Agriculture, orange production in Brazil has declined from 16.9 million metric tons in 2021 to 12.3 million metric tons in 2023.

MARKET OPPORTUNITIES

Adoption of Sustainability Approaches to Unleash Growth Opportunities in Upcoming Years

Companies are embarking on several methods to achieve sustainability in the supply chain, production, and other processes of business. Pioneers such as Agrana AG, Kerry Group PLC, and Mexifrutas SA are collaborating with farmers to extend their vertical integration. They are also updating production plants with eco-friendly machinery to reduce carbon emissions, which can also positively impact the industry growth. For instance, In May 2022, Agrana AG, a global food and beverage ingredients company, collaborated with wholesale company RWA Raiffeisen Ware Austria AG to install a 556-kWp solar array on a fruit concentrate plant in Lower Austria.

MARKET CHALLENGES

Safety and Quality are Key Challenges for Extracts Manufacturers

Quality and safety are key concerns for market players. Farmers frequently use pesticides, chemicals, and fertilizers during fruit cultivation to improve yield and fruit quality. It includes toxins such as mycotoxins, aflatoxins, and fumonisins, which may create a concern for the safety of the food products. It creates difficulties in adopting such products in organic and natural beverages and prepared food products. Additionally, several extraction methods and technical challenges may change the product’s sensory attributes, such as color, flavor, taste, mouth-feel, texture, and overall acceptability descriptors. It may negatively affect the usage of the product in food and beverage applications. Thus, the safety and quality of the product may create a challenge for extract manufacturers in the near future.

SEGMENTATION ANALYSIS

By Fruit Type

Rich Nutritional Benefits and Adaptability Drives Citrus Fruits to Leading Position

Based on fruit type, the market is segmented into citrus fruits, apple, berries, mango, pineapple, grape, and others.

Citrus fruit extracts hold the largest share of 11.10% in 2026. Citrus fruits such as orange are a natural source of minerals and vitamins, including vitamins A, B1, B2, and C, copper, potassium, sulfur, calcium, and iron. These citrus fruits boost antioxidants in the juice and assist users in improving their immunity and skin health. Furthermore, the low production cost and easy availability of oranges will significantly influence the segmental revenue growth in the upcoming years.

Apple extracts are expected to exhibit the highest growth trajectory during the forecast period and capture the share by 16% in 2025. Apple contains ample amounts of pectin, which improves gut health, aids in weight loss, and helps reduce blood sugar levels. Thus, consumers are opting for apple-flavored beverages, bakery products, and confectioneries. Additionally, beverage companies are introducing new products using apple flavors and concentrates to meet the growing market demand. It will drive the demand for apple extract in the upcoming years. For instance, in March 2022, Coca-Cola India, one of the key beverage manufacturers, launched Apple Delite, a refreshing sparkling drink with apple flavor under its Fanta brand.

Mango is expected to grow at a CAGR of 5.63% during the forecast period (2025-2032).

By Form

Less Technical Complexities to Drive Liquid Form of Extracts in Near Future

Based on form, the market is segmented into powder and liquid.

Liquid-form extracts are dominating the global market by holding the largest share of 21.86% in 2026. Liquid forms of extracts are ready to use, and their technical complexities are relatively less. As a result, manufacturers from the confectionery and beverage industries widely prefer liquid forms of extracts such as concentrates, flavors, and syrups. Furthermore, wider availability and easy accessibility of liquid forms are likely to propel the market in the near future. Therefore, the segment is anticipated to expand at the highest growth rate during the forecast period.

The powder form of extracts reached a market share of 41% in 2024. This form of extract often has a longer shelf life and takes relatively less storage space than liquid concentrates. Additionally, powdered extracts are cheaper than liquid extracts, which assists manufacturers in sourcing less-expensive flavor ingredients. However, a few technical challenges, such as improper desolation and uneven distribution of ingredients, will affect product demand in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Application

Wider Application of Product in Food and Beverages Industry to Drive Extract Demand

Based on application, the market is segmented into food & beverages, cosmetics & personal care, and pharmaceuticals. The fruit & beverages segment is further categorized into bakery, dairy products, ice cream, beverages, and others.

Fruit-derived extracts are used significantly in the food & beverage industry, ranging from flavor enhancers to texture enhancers and preservatives. Fruit-based extracts serve as natural flavoring agents in many applications, including bakery products, dairy products, ice creams, and beverages. They provide authentic taste profiles that appeal to consumers seeking natural alternatives to artificial flavors. Furthermore, the extract product offers vibrant colors to food & beverage products to attract users. Therefore, increasing demand for natural ingredients in food & beverage applications is likely to drive the product demand. The pectin content in citrus and apple fruits enhances the stability of beverage products, including smoothies and other beverages. Therefore, the segment is anticipated to exhibit the highest CAGR growth during the forecast period and capture a share of 27.31% in 2026.

The cosmetics & personal care segment is another fastest growing segment for fruit extract. The product is widely utilized in cosmetics for its ability to rejuvenate skin, deliver antioxidants, and promote moisture. Citrus fruits such as orange and grapefruit contain antioxidants such as vitamin C and vitamin E, which help to improve skin hydration and reduce radical damage while protecting against aging, wrinkles, and autoimmune disorders. Thus, skincare & personal care product manufacturers are utilizing these extracts in their products. Thus, the segment is anticipated to exhibit the second-highest growth trajectory during the forecast period.

The pharmaceuticals segment is anticipated to grow at a CAGR of 5.08% during the forecast period (2025-2032).

FRUIT EXTRACTS MARKET REGIONAL OUTLOOK

Based on region, the global fruit extracts market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Europe

Europe Fruit Extracts Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe holds the largest proportion and accounted for USD 9.98 billion in 2025 and USD 10.48 billion in 2026. Europeans are increasingly prioritizing natural and healthy food products. Fruit concentrates and syrups are used in manufacturing fruit juices. The U.K. market is increasing, projected to reach a value of USD 1.93 billion in 2026. Diversified natural flavor ingredients and nutritional benefits are strongly driving the demand for fruit extract in European countries, including Germany, France, the U.K, Belgium, and the Netherlands. Additionally, increasing demand for clean-label and natural flavor enhancers in the European beverage industry is significantly forcing extract manufacturers to develop new products. As a result, companies are engaging in developing and innovating new ingredients from fruits and berries. It will drive the industry growth in the coming years. Germany is expected to capture a share of USD 2.66 billion in 2026, while France is anticipated to be valued at USD 1.46 billion in the same year.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is second major market for fruit extracts with a market share of USD 7.89 billion in 2026, exhibiting a CAGR of 6.19% during the forecast period (2025-2032). This growth is driven because consumers’ buying behavior is changing rapidly in the region. Food industry players are actively seeking natural food additives in dairy products, and bakery foods are significantly driving the demand for fruit extract in the region. Orange extract is one of the key segments that is produced significantly in the U.S., Canada, and Mexico. Mexico is one of the key manufacturing countries. Thus, the abundant availability of raw materials significantly influences the industry's growth. According to the United States Department of Agriculture, orange juice concentrate production in the U.S. reached 111,000 metric tons in 2023/24, increasing from 84,000 metric tons in 2022/23. The U.S. market is expected to be valued at USD 6.52 billion in 2026.

Asia Pacific

Asia Pacific is the third largest market with a valuation of USD 6.51 billion in 2026. This region is anticipated to exhibit the highest growth trajectory during the forecast period with the increase in fruit extract application in skincare and cosmetics products. China is expected to lead the market in Asia Pacific with a valuation of USD 2.35 billion in 2026. Furthermore, increasing concentrates and other extract product production in Asian countries such as China, India, and Australia is further contributing to the growth of the industry. For instance, the Himachal Pradesh Horticultural Produce Marketing and Processing Corporation, an Indian government-supported agency, recorded 1,545 metric tons of juice concentrates in 2024 across its three plants in the country. Additionally, an increasing number of new product launches in personal care and skin care products across the region are likely to drive the industry growth. Factors including technological advancement, new product launches, and R&D activities contribute to regional market growth. As a result, the Asia Pacific fruit extracts market share is expected to grow significantly in the upcoming years. India is expected to capture a share of USD 1.24 billionin 2026, while Japan is anticipated to be valued at USD 1.38 billionin the same year.

South America

South American countries such as Brazil, Argentina, and Chile are key fruit-producing countries. Brazil is the leading orange-producing country globally. According to the USDA Foreign Agricultural Service, Brazil holds nearly 27% of the global production. In 2023/24, Brazil produced 12.3 million metric tons. The increasing availability of fruits is likely to contribute to the growth of the fruit extract industry in the South Asian countries.

Middle East & Africa

The Middle East & Africa is the fourth largest market and is anticipated to capture a share of USD 2.20 billion in 2026. The increasing demand for natural food ingredients in Middle East & Africa markets is likely to drive the demand for extracts. Increasing fruit concentrate import in Middle Eastern & African countries is likely to exhibit steady growth. According to the USDA, the orange juice concentrate production in South Africa has increased from 37,000 metric tons in 2022/23 to 55,000 metric tons in 2023/24. The UAE market is poised to be valued at USD 0.52 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Increasing Product Launches and Base Expansion is Likely to Strengthen their Industry Presence

The global market exhibits a highly fragmented structure with a presence of international and regional players. The leading players in the global market, such as AGRANA Beteiligungs-AG, Kerry Group, International Flavors & Fragrances, Döhler GmbH, and Kerr/Ingredion, are actively embarking upon new product launches and base expansion activities to strengthen their industry presence. These key players account for nearly 24% of the global market. Industry players are also focusing on merger & acquisition, collaboration, and fundraising activities. It additionally contributes to staying competitive in the industry.

Major Players in the Fruit Extract Market

To know how our report can help streamline your business, Speak to Analyst

LIST OF KEY FRUIT EXTRACT MARKET COMPANIES PROFILED:

- Naturalin Bio-Resources Co. (China)

- AGRANA Beteiligungs-AG (Austria)

- Citrofrut (Mexico)

- Sensient Technologies Corporation (U.S.)

- ABC Fruits. (India)

- Symrise (Germany)

- TBF Group (Ukraine)

- Döhler GmbH (Germany)

- International Flavors & Fragrances Inc. (U.S.)

- Kerr by Ingredion (U.S)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: AUSTRIA JUICE GmbH, one of the key fruit extract and flavors manufacturing companies, launched its latest organic juice concentrate, including a new pomegranate berry mix and lime guava drink at BioFach 2023.

- May 2022: Agrana AG, a global food and beverage ingredients company, collaborated with wholesale company RWA Raiffeisen Ware Austria AG to install a 556-kWp solar array on a fruit concentrate plant in Lower Austria.

- September 2021: Global Concentrate Inc., an American producer, and supplier of traditional and organic fruit and vegetable juice concentrate and other products, invested USD 121 million to purchase approximately 170 acres of industrial land in Franklin to establish their largest processing and operation plant in the U.S.

- August 2021: Peterson Farms Inc., a U.S. company producing and selling quality fruit products to the food service industry, acquired Florida’s Miami juice-producing company, Lakewood Organics. This acquisition helps the company expand its client base. It may also assist the company in procuring raw materials for the manufacture of fruit concentrates.

INVESTMENT ANALYSIS AND OPPORTUNITIES:

Digitalization and technology are the other key factors unlocking an opportunity for fruit extract manufacturers to produce high-quality products. Maintaining aroma and sensory properties in juice concentrates and flavors is a challenging factor for the producers. Therefore, they are developing and investing in advanced machinery and digital equipment to develop new solutions. Several manufacturers have their production plants in European countries due to the easy availability of raw materials. Moreover, they are partnering with food tech companies to develop novel solutions. For instance, in June 2022, Prodalim Group, a multinational company in the beverage industry, acquired a German food tech company, Flavologic GmbH. Flavologic has developed a proprietary technology to produce quality natural aroma concentrates with outstanding concentration and sensory properties. This acquisition helps Prodalim to produce concentrates with the highest sensorial quality. Leading companies focus on investing in research and development activities is significantly contributing to the industry's growth.

REPORT COVERAGE

The global fruit extracts market research report includes quantitative and qualitative insights into the market using different research methodologies. This global market growth forecast also offers a detailed regional analysis, market analysis, market trends, market dynamics, regional market forecast, global fruit extracts market analysis, forecast, and the market rate for all possible market segments. This market analysis report provides various key insights on the market, an overview of related markets, the competitive landscape, the forecast period, recent industry developments, such as mergers & acquisitions, the regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.06% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Fruit Type, Form, Application, and Region |

|

Segmentation |

By Fruit Type

By Form

By Application

|

|

Region |

|

Frequently Asked Questions

Fortune Business Insights says that the market size is expected to be valued at USD 27.17 billion in 2025.

The market is projected to exhibit promising growth during the forecast period, increasing at a CAGR of 6.06%.

The orange extract segment is expected to be the leading segment during the forecast period.

The increasing fruit juice popularity is expected to propel the fruit extracts demand during the forecast period.

AGRANA Beteiligungs-AG, Kerry Group, International Flavors & Fragrances, Döhler GmbH, and Kerr/Ingredion are a few of the leading players in the market.

Europe dominated the global market in terms of share in 2025.

Developing clean-label products is anticipated to meet the growing market demand.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us