Gastrointestinal Therapeutics Market Size, Share & Industry Analysis, By Product Type (Small Molecules/Conventional Drugs and Biologics & Biosimilars), By Therapy Type (Acid Suppression Therapies {Proton Pump Inhibitor (PPI) and Others}, Targeted Therapies {Antibodies, JAK Inhibitors, and Others}, Anti-Inflammatory & Immunomodulators, Antibiotics, Antiemetics, Motility Agents & Secretagogues, and Others), By Route of Administration (Oral, Parenteral, and Others), By Age Group (Pediatrics and Adults), By Application, By Distribution Channel, and Regional Forecast, 2026-2034

GASTROINTESTINAL THERAPEUTICS MARKET OVERVIEW

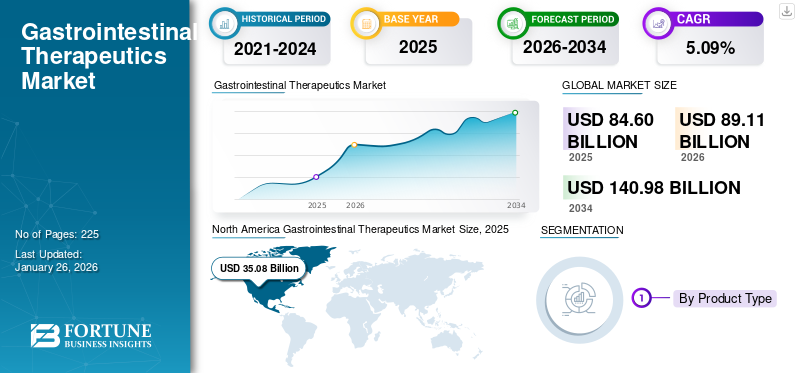

The global gastrointestinal therapeutics market size was valued at USD 80.60 billion in 2025. The market is projected to grow from USD 89.11 billion in 2026 to USD 140.98 billion by 2034, exhibiting a CAGR of 5.09% during the forecast period. North America dominated the gastrointestinal therapeutics market with a market share of 42.32% in 2025.

Gastrointestinal therapeutics encompasses treatments for various conditions affecting the digestive tract. These treatments include medications such as antacids, anti-diarrheal, and proton pump inhibitors (PPIs) for acid reduction, as well as biologics for inflammatory bowel diseases (IBD) such as Crohn's disease and ulcerative colitis. The upward trajectory of the market can be attributed to several factors such as increasing prevalence of GI disorders, research & innovation in pipeline therapies, and others.

Furthermore, the market encompasses several major players such as Abbott, Pfizer Inc. Johnson and Johnson, Bayer AG, and others. A wide range of product portfolio coupled with strong geographic expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Prevalence of Gastrointestinal Diseases to Boost Market Growth

One of the significant growth drivers in the market is the increasing prevalence of gastrointestinal diseases. Factors such as sedentary lifestyle, changing dietary habits, increasing alcohol consumption, and stress levels have significantly contributed to the growing burden of these disorders globally. The growing burden of GI diseases necessitates increased focus in public health policies to promote healthier lifestyles, address dietary patterns, and provide support for those affected. The expanding patient base increases the need for effective treatments along with fueling the adoption of advanced diagnostics and endoscopic procedures. Consequently, pharmaceutical companies are intensifying their R&D investments to develop novel therapies, thereby propelling the overall global gastrointestinal therapeutics market growth.

- For instance, according to the data published by the Crohn’s & Colitis Foundation in June 2023, the number of American individuals suffering from IBD ranges between 1.6 and 3.1 million.

MARKET RESTRAINTS

High Cost of Advanced Therapies to Restrict Market Expansion

The high cost of advanced therapies is one of the restraining factors for the global market growth. Innovative therapies such as targeted therapies and advanced biologics require high research and development, which results in higher cost of these treatments. The high price of these products makes them unaffordable for many patients, especially in low- and middle-income countries. The lack of adequate insurance coverage in several developing markets further creates financial burden. As a result, many patients and healthcare providers continue to rely on traditional drugs, which are less expensive but often less effective for severe conditions. This cost barrier limits widespread adoption of advanced therapies and ultimately slows down the overall market growth.

- For example, according to a study published in National Center for Biotechnology Technology in February 2023, the bundled cost for a 5 mg/kg dose of infliximab is about USD 2,634 in the U.S.

MARKET OPPORTUNITIES

Rising Focus on Biologics and Targeted Therapies to Offer Lucrative Growth Opportunities

Traditionally, a high number of conventional molecules have been used to treat various gastrointestinal conditions. In recent years, the market is witnessing an increasing shift toward the adoption of biologics and targeted therapies for chronic GI diseases. Traditional drugs usually provide only symptomatic relief and are associated with adverse effects, creating a strong demand for advanced, disease-modifying treatments. Innovative biologics have demonstrated superior efficacy in reducing inflammation and maintaining long-term remission by specifically targeting cytokines. Moreover, ongoing pipeline developments including biosimilars and next-generation oral small-molecule inhibitors are expected to enhance treatment accessibility and affordability. As a result, the growing clinical adoption and continuous R&D focus on biologics are set to reshape the GI therapeutics landscape, offering substantial opportunities for pharmaceutical innovation and market expansion.

- For instance, in June 2024, the U.S. FDA approved SKYRIZI (risankizumab-rzaa) for adult patients with moderately to severely active ulcerative colitis.

GASTROINTESTINAL THERAPEUTICS MARKET TRENDS

Increased Emphasis on Early Screening & Preventive Diagnostics is One of Significant Market Trends

A key recent trend in the market is the growing emphasis on early disease screening and preventive diagnostics to reduce mortality associated with GI cancers and other chronic digestive conditions. With colorectal and gastric cancers ranking among the leading causes of cancer deaths globally, healthcare systems are shifting focus toward early detection using non-invasive and minimally invasive techniques. Moreover, molecular diagnostics and biomarker-based assays are increasingly being used to identify precancerous changes and monitor disease progression in patients with inflammatory bowel disease (IBD). Companies are also investing in AI-powered imaging systems that enhance endoscopic visualization and improve the accuracy of lesion detection. This growing integration of precision diagnostics and preventive screening is not only improving patient outcomes but also creating significant growth opportunities for manufacturers of advanced diagnostic tools in the GI market.

MARKET CHALLENGES

Adverse Drug Reactions and Safety Concerns to Hamper Market Growth

A major challenge limiting the gastrointestinal products market is the growing concern over adverse drug reactions and long-term safety issues associated with commonly used GI medications. These safety concerns have prompted regulatory bodies such as the U.S. FDA to issue warnings and encourage limited-duration prescriptions. As a result, healthcare providers are increasingly shifting toward safer alternatives, combination therapies, or step-down treatment approaches, which in turn moderate the overall market expansion for traditional GI drugs.

- For instance, proton pump inhibitors (PPIs), widely prescribed for GERD and acid reflux, have been linked to serious side effects when used for extended periods, including chronic kidney disease, vitamin B12 deficiency, bone fractures, and increased risk of gastrointestinal infections such as Clostridium difficile.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

High Usage of Conventional Drugs Contributed to Segment Growth

On the basis of the product type, the market is classified into small molecules/conventional drugs and biologics & biosimilars.

The small molecules/conventional drugs segment accounted for the largest global gastrointestinal therapeutics market share 71.36% in 2026. The factors such as cost-effectiveness of these drugs, their widespread accessibility, and their long-standing clinical use have primarily driven the segment growth. Additionally, generic availability and oral formulations result in more convenience and affordability for the large patient population. In addition, frequent new product launches also support the segment’s dominance.

- For instance, in August 2025, Braintree Laboratories, a part of Sebela Pharmaceuticals announced positive results from Phase 3 TRIUMpH Program of Tegoprazan in GERD.

To know how our report can help streamline your business, Speak to Analyst

By Therapy Type

High Demand for Acid Suppression Therapies Contributed to Segmental Growth

On the basis of therapy type, the market is segmented into acid suppression therapies, targeted therapies, anti-inflammatory & immunomodulators, antibiotics, antiemetics, motility agents & secretagogues, and others.

The acid suppression therapies segment captured the dominating share 23.84% of the market in 2026. The strong consumer demand for these products due to high prevalence of acid-related disorders such as GERD, coupled with high prescription volumes and OTC sales of these products have majorly driven the segment growth. Moreover, active involvement of companies in offering innovative products also supplements the segment growth.

- For instance, in June 2025, Eisai Co., Ltd. announced the OTC launch of “Pariet S” (rabeprazole) in Japan. It is the first proton pump inhibitor transitioning from prescription to OTC in that market.

The targeted therapies segment is expected to grow at a CAGR of 14.77% over the study period.

By Route of Administration

Advantages Offered by Oral Formulations Supplemented Segmental Growth

In terms of route of administration, the market is divided into oral, parenteral, and others.

The oral segment held the foremost share 70.41% of the market in 2026. This can be attributed to advantages offered by these formulations, which result in higher demand of these products. Oral administration is the most convenient, patient-friendly method, which drives therapy adherence especially for chronic GI conditions. Additionally, lower costs and strong OTC presence further boost the segment dominance. Moreover, new product introductions by operating players also supports the segment growth.

- For instance, in May 2025, Eton Pharmaceuticals, Inc. received the U.S. FDA approval for KHINDIVI, a hydrocortisone oral solution.

The parenteral segment is expected to grow at a CAGR of 8.99% over the forecast years.

By Age Group

Growing Shift toward Multimineral Products Contributed to Segmental Growth

On the basis of age group, the market is segmented into pediatrics and adults.

The pediatrics segment is projected to gain the dominating share 87.39% over the forecast period. Key factors augmenting this growth include increasing prevalence of pediatric GI disorders such as IBD, eosinophilic esophagitis, pediatric reflux, and others, rising diagnosis and treatment rates, and introduction of novel therapies specific to this age group. Additionally, increasing focus on creating awareness among the population also supports the segment growth.

- For instance, in October 2025, the U.S. FDA approved SIMPONI (golimumab) developed by Johnson & Johnson for pediatric ulcerative colitis in children ≥15 kg.

The adults segment is expected to grow at a CAGR of 8.10% over the study period.

By Application

Increasing Focus on Genomics Research Fuels Growth of Research Applications Segment

In terms of application, the market is categorized into gastroesophageal reflux disease (GERD), functional gastrointestinal disorders (FGIDs), inflammatory bowel disease (IBD), irritable bowel syndrome (IBS), GI cancers, and others.

The inflammatory bowel disease (IBD) segment is anticipated to witness the highest market share over the forecast period. Rising awareness about these diseases, high patient burden and high cost of treatments for Crohn’s disease and ulcerative colitis are some of the factors propelling the segment growth. Furthermore, increasing awareness programs by operating companies and government organizations are also supplementing the market growth.

- For instance, in September 2025, Johnson & Johnson announced the launch of the Dual Control campaign in Asia Pacific with an aim to increase awareness about IBD balanced diet management.

The GI cancers segment is expected to witness 8.99% growth over the forecast period.

By Distribution Channel

Easy Availability of Products through Retail Pharmacies & Drug Stores Propelled Segment Growth

Based on distribution channel, the market is segmented into retail pharmacies & drug stores, hospital pharmacies, and online channels.

In 2024, retail pharmacies & drug stores held the dominating share of the global market in terms of distribution channel. This owing to their established distribution networks, and strong credibility. Furthermore, the segment is set to hold 50.9% share in 2025.

In addition, the online channels segment is projected to grow at a CAGR of 10.16% during the forecast period.

Gastrointestinal Therapeutics Market Regional Outlook

By region, the market is divided into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America Gastrointestinal Therapeutics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America captured the dominating share of the global market in 2025 valuing at USD 35.80 billion and also took the leading share in 2026 with USD 37.69 billion. The dominance of the region can be attributed to the factors such a high number of prevalent population, increasing awareness, and rising focus on development of innovative therapies in the region. In 2025, the U.S. market is estimated to reach USD 34.94 billion.

- For instance, according to the data published by National Cancer Institute, the estimated number of new colorectal cancer cases in 2025 is 154,270.

On the other hand, markets in the Europe and Asia Pacific regions are projected to grow at a notable rate in the near future. During the forecast period, the European region is anticipated to grow at a CAGR of 5.31%, which is the second largest region amongst all the regions and touch the valuation of USD 21.81 billion in 2025. Key factors responsible for this include increasing awareness among the general population, advanced healthcare infrastructures, along with a rising number of government initiatives in the region. Backed by these factors, countries including the U.K. anticipate to record the valuation of USD 5.30 billion, Germany to record USD 4.78 billion, and France to record USD 3.53 billion in 2026. After Europe, the market in Asia Pacific is valued to reach USD 20.95 billion in 2025 and secure the position of third-largest region in the market. In the region, India and China both are estimated to reach USD 4.03 billion and USD 4.13 billion respectively in 2026.

Furthermore, Latin America and Middle East & Africa regions are anticipated to witness a slower growth over the study period. The Latin America market in 2025 is set to record USD 3.44 billion as its valuation. Improvements in healthcare infrastructure is anticipated to drive the adoption of these products in these regions in the coming years. In Middle East & Africa, GCC is set to attain the value of USD 1.26 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Availability of Diversified Therapeutic Portfolio and Robust R&D Capabilities Strengthened Market Position of Leading Companies

The global market is semi-consolidated, with a few major pharmaceutical companies contributing to substantial market share due to their broad product portfolios, robust research pipelines, and broad global presence. Key players such as AbbVie Inc., Takeda Pharmaceutical Company Limited, Johnson & Johnson (Janssen Biotech, Inc.), Pfizer Inc., and Bristol Myers Squibb dominate the global market. Their dominance is driven by continued innovation in biologics, biosimilars, and small-molecule therapies, particularly across indications such as inflammatory bowel disease (IBD) and.

- For instance, in March 2025, Takeda received the U.S. FDA approval for EOHILIA (budesonide oral suspension) as the first and only FDA-approved oral therapy for eosinophilic esophagitis (EoE).

The other prominent players include Eli Lilly and Company, Ferring Pharmaceuticals, Gilead Sciences, Inc., and Ironwood Pharmaceuticals. These companies are actively developing novel targeted and immune-modulating therapies for conditions such as ulcerative colitis, Crohn’s disease, and GERD.

LIST OF KEY GASTROINTESTINAL THERAPEUTICS COMPANIES PROFILED:

- Abbott (U.S.)

- Bayer AG (Germany)

- Johnson & Johnson (U.S.)

- AbbVie Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Bristol-Myers Squibb Company (U.S.)

- Pfizer Inc. (U.S.)

- UCB S.A. (Belgium)

- Bausch Health Companies Inc. (Canada)

- CELLTRION INC. (South Korea)

KEY INDUSTRY DEVELOPMENTS

- September 2025: The U.S. FDA approved TREMFYA (guselkumab) to treat moderately to severely active ulcerative colitis (UC) in adults. It is a subcutaneous (SC) induction regimen developed by Johnson & Johnson.

- July 2025: The U.S. FDA accepted and granted priority review for AstraZeneca’s supplemental Biologics License Application (sBLA) for Imfinzi (durvalumab).

- December 2024: Sanofi along with Teva Pharmaceuticals reported positive Phase 2b results for duvakitug (a TL1A monoclonal antibody) in both UC and Crohn’s disease, achieving primary endpoints.

- July 2024: Reddy’s Laboratories Ltd secured a non-exclusive licensing deal with Takeda Pharmaceutical Company Limited to launch Vonoprazan (a novel acid suppressant, P-CAB) in India under the brand VONO.

- February 2024: The European Commission (EC) granted the marketing authorization for VELSIPITY (etrasimod) manufactured by Pfizer Inc. in the European Union.

REPORT COVERAGE

The global gastrointestinal therapeutics market analysis focuses in detailed study of the market size and forecast for all the market segments. The report is inclusive of in-depth analysis of market dynamics and market trends that would boost the market over the study period. Additionally, the report also offers insights on new product launches, technological advancements, and key industry developments. The global gastrointestinal therapeutics market forecast also includes competitive landscape with profiles of key operating players and information on the market share of key companies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.09% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Therapy Type Acid Suppression Therapies

By Route of Administration

By Age Group

By Application

By Distribution Channel

By Region North America (By Product Type, Therapy Type, Route of Administration, Age Group, Application, Distribution Channel, and Country)

Europe (By Product Type, Therapy Type, Route of Administration, Age Group, Application, Distribution Channel, and Country/Sub-region)

Asia Pacific (By Product Type, Therapy Type, Route of Administration, Age Group, Application, Distribution Channel, and Country/Sub-region)

Latin America (By Product Type, Therapy Type, Route of Administration, Age Group, Application, Distribution Channel, and Country/Sub-region)

Middle East & Africa (By Product Type, Therapy Type, Route of Administration, Age Group, Application, Distribution Channel, and Country/Sub-region)

|

Frequently Asked Questions

The global gastrointestinal therapeutics market size was valued at USD 80.60 billion in 2025. The market is projected to grow from USD 89.11 billion in 2026 to USD 140.98 billion by 2034, exhibiting a CAGR of 5.09% during the forecast period.

In 2025, the market value stood at USD 35.08 billion.

The market is expected to exhibit a CAGR of 5.09% during the forecast period.

The small molecules/conventional drugs segment led the market by product type.

The key factors driving the market are increasing prevalence of GI disorders, research & innovation in pipeline therapies, and others.

AbbVie Inc., Takeda Pharmaceutical Company Limited, Johnson & Johnson, Pfizer Inc., and Bristol Myers Squibb., are some of the prominent players in the market.

North America dominated the market in 2025.

Innovation in products and shifting focus toward targeted therapies are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us