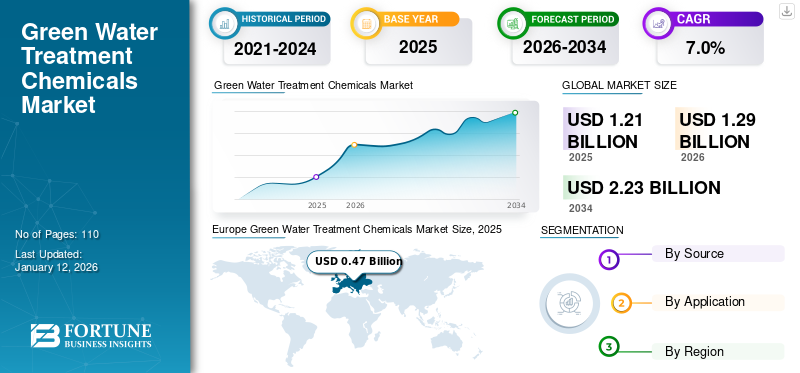

Green Water Treatment Chemicals Market Size, Share & Industry Analysis, By Source (Plant and Animal), By Application (Municipal and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global green water treatment chemicals market size was valued at USD 1.21 billion in 2025. The market is projected to grow from USD 1.29 billion in 2026 to USD 2.23 billion by 2034 at a CAGR of 7.0% during the 2026-2034 period. Europe dominated the green water treatment chemicals market with a market share of 39% in 2025.

Green water treatment chemicals are plant and animal-based substances used to treat or clean water in a sustainable, environmentally friendly way. Sourced from renewable materials such as tree bark, seaweed, shells, and agricultural by-products, they include natural polymers, tannins, chitosan, enzymes, and plant oils. These chemicals perform key functions such as flocculation, coagulation, disinfection, and scale prevention while being biodegradable and less toxic than synthetic or petroleum-based alternatives. Their use supports reduced environmental impact, regulatory compliance, and safer handling. As industries prioritize sustainability and circular economy practices, green water treatment chemicals offer an effective solution for lowering ecological footprints and meeting Environmental, Social, and Governance (ESG) goals, making them an increasingly preferred choice in industrial and municipal wastewater treatment processes. This trend is anticipated to benefit and drive market growth. SNF, Kemira, Veolia, and Aries Chemical, Inc. are the key players operating in the market.

GREEN WATER TREATMENT CHEMICALS MARKET TRENDS

Rising Adoption of Sustainable Bio-based Water Treatment Chemicals to Replace Synthetic Alternatives

The water treatment industry is increasingly shifting toward sustainable solutions by adopting green chemicals derived from plant and animal sources. This trend is driven by the need to reduce environmental impact, comply with stricter regulations, and meet growing stakeholder expectations around sustainability. Unlike synthetic or petroleum-based chemicals, green water treatment alternatives are biodegradable, non-toxic, and align with circular economy principles. Industries such as textiles, food processing, and manufacturing are exploring these options to lower their ecological footprint and improve ESG performance. As awareness grows and lifecycle impacts are more closely evaluated, the demand for eco-friendly water treatment methods is expected to rise, positioning green chemicals as a key component of future-ready, sustainable water management strategies.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Adoption of Stricter Environmental Regulations to Prompt Rise in Demand for Green Products

Tightening environmental regulations are a key factor driving demand for these water treatment chemicals. Regulatory bodies worldwide are imposing stricter limits on discharging toxic and non-biodegradable substances into water systems. Traditional synthetic or petroleum-based chemicals often fall short of these standards due to environmental persistence and potential health risks. In contrast, plant and animal-derived alternatives offer better biodegradability and lower toxicity, making them more compliant with evolving regulations. As industries and municipalities seek to avoid penalties, reduce environmental impact, and meet sustainability goals, the shift toward natural, green water treatment solutions is rising. This regulatory push is positioning green chemicals as a strategic choice for long-term compliance and risk mitigation in the water treatment sector, driving the green water treatment chemicals market growth in tandem.

MARKET RESTRAINTS

Higher Production Costs in Comparison to Synthetic Alternative Limit Market Growth

Higher production costs remain a key barrier to adopting green water treatment chemicals. Unlike synthetic alternatives, bio-based chemicals require specialized extraction and processing techniques, often leading to more expensive and less efficient manufacturing. Natural feedstocks, such as plant and animal derivatives, also vary in quality and availability, adding to quality control and supply chain expenses. Furthermore, the lack of large-scale production infrastructure for these green alternatives prevents manufacturers from achieving economies of scale. These factors make green chemicals more costly per unit, which can limit their appeal in cost-sensitive industries. As a result, many industrial users remain hesitant to switch, despite environmental benefits, due to concerns about cost-effectiveness and budget constraints in water treatment operations.

MARKET OPPORTUNITIES

Supportive Government Policies to Drive Wider Adoption and Create New Market Growth Opportunities

Government incentives are a key driver in promoting the adoption of these water treatment chemicals. Many countries are supporting sustainable water practices through grants for R&D, tax benefits, and subsidies for industries using bio-based solutions. These measures help reduce costs and encourage innovation in plant and animal-derived chemical development. Public-private partnerships are also encouraged to boost local production and align with circular economy goals. Moreover, green policies in public projects are creating new demand for eco-friendly water treatment solutions. By easing financial and regulatory barriers, government support is accelerating market growth and helping establish green chemicals as a viable and scalable alternative to traditional treatment methods, creating new market growth opportunities.

MARKET CHALLENGES

Limited Awareness Related to Green Alternative Creates Challenges for Market Growth

A key challenge in the green water treatment chemicals market is the limited awareness among users, such as businesses and water treatment facilities, about the benefits and availability of plant and animal-based chemicals. Many operators continue to rely on traditional, synthetic chemicals because of their familiarity. Since green alternatives are relatively new, there is often a lack of information on their working, cost-effectiveness, and environmental benefits. This lack of awareness can make industries hesitant to switch to greener options. To address this issue, it is important to share more information through education, real-world examples, and success stories, helping to build trust and encourage the adoption of these sustainable alternatives.

TRADE PROTECTIONISM AND ITS EFFECTS

Trade War to Realign Trade Dynamics Influencing Market Growth

U.S. tariffs on imported chemicals, especially from key suppliers including China, will likely impact the global green water treatment chemicals market by raising costs and disrupting supply chains. Many plant and animal-based ingredients used in green formulations rely on global sourcing, and increased tariffs make imports less economically viable for U.S. buyers. This may slow down adoption in the U.S. while encouraging regional alternatives and domestic production. Globally, suppliers may shift focus to less tariff-affected regions, altering trade flows and competitiveness. Overall, tariffs are prompting market realignment, potentially accelerating local sourcing and innovation in alternative supply chains.

SEGMENTATION ANALYSIS

By Source

Plant Segment to Hold Major Market Share Owing to High Availability and Renewability

Based on source, the market is bifurcated into plant and animal.

The plant segment is expected to hold the largest green water treatment chemicals market share of 78.29% in 2026. A major factor driving demand for plant-based water treatment chemicals is the abundance and renewability of agricultural by-products. Materials such as starches, tannins, and cellulose can be sustainably sourced from crops and agro-waste, making them cost-effective and widely available. Their low toxicity, high biodegradability, and compatibility with circular economy goals make them attractive for industries aiming to reduce environmental impact and meet regulatory standards, particularly in regions emphasizing organic and sustainable practices in water management.

The key driver for animal-based water treatment chemicals is their high operational efficiency, especially in processes that use coagulants and flocculants. Compounds such as chitosan, derived from crustacean shells, offer superior performance in removing heavy metals, oils, and suspended solids. Their strong antimicrobial properties also enhance water disinfection. As industries seek effective yet biodegradable alternatives to conventional treatment agents, animal-derived chemicals are gaining traction, especially in applications where performance and environmental safety are equally critical.

By Application

To know how our report can help streamline your business, Speak to Analyst

Municipal Remains Dominant Due to Rising Demand for Sustainable Water Treatment Solutions

Based on application, the market is segmented into municipal and industrial.

The municipal segment is anticipated to hold the dominant share of 75.19% in 2026. A key factor driving demand for these water treatment chemicals in the municipal sector is increasing regulatory pressure to reduce the environmental and health impacts of water treatment processes. Governments and local authorities are mandating the use of biodegradable, non-toxic alternatives to conventional chemicals to ensure safer discharge into natural water bodies and compliance with public health standards. In addition, growing public demand for sustainable and eco-friendly alternatives is prompting municipalities to adopt plant and animal-based treatment solutions that align with long-term environmental sustainability goals, driving the growth of the green water treatment chemicals market in tandem.

In the industrial sector, the primary driver for green water treatment chemical adoption is the growing emphasis on corporate sustainability and ESG compliance. Companies across sectors, especially in food processing, textiles, and chemicals, are under increasing pressure from regulators, investors, and global customers to minimize their ecological footprint. Using bio-based water treatment chemicals enables industries to meet stringent discharge norms, reduce hazardous waste, and improve workplace safety. Furthermore, aligning with sustainability targets enhances brand reputation, access to green financing, and competitiveness in global supply chains, prioritizing environmentally conscious operations.

GREEN WATER TREATMENT CHEMICALS MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

Europe

Europe Green Water Treatment Chemicals Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe is expected to dominate the market during the forecast period. Europe leads in green water treatment adoption due to its progressive environmental policies, including the EU Green Deal and REACH regulations, which restrict harmful substances and promote sustainable alternatives. Industrial and municipal sectors are incentivized to use bio-based chemicals through carbon pricing mechanisms and circular economy mandates. Public awareness around the ecological impacts of water treatment chemicals is high, and consumers expect green compliance across industries. Germany, France, and Italy are especially proactive, with strong regulatory and funding support for R&D in bio-based solutions. This regulatory and social alignment makes Europe a pioneer in driving demand for green water treatment technologies. The UK market is projected to reach USD 0.1 billion by 2026, while the Germany market is projected to reach USD 0.11 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

In North America, demand for these water treatment chemicals is driven by stringent environmental regulations, increasing ESG commitments from corporations, and a strong push for sustainable industrial practices. The U.S. Environmental Protection Agency and Canadian environmental agencies enforce tight restrictions on synthetic chemical discharge, prompting a shift toward biodegradable, plant and animal-based alternatives. In addition, consumer and investor expectations are influencing industries to adopt greener water treatment methods. The presence of advanced research institutions and a growing market for organic and eco-labeled products further supports innovation and adoption of bio-based solutions in municipal and industrial water treatment sectors, driving market growth in tandem. The U.S. market is projected to reach USD 0.31 billion by 2026.

Asia Pacific

In Asia Pacific, rapid industrialization, urbanization, and growing water stress fuel demand for sustainable water treatment solutions. Governments in China, India, and Japan are introducing stricter environmental regulations and pollution control measures, particularly in heavily polluting industries such as textiles, chemicals, and food processing. Rising public concern over water quality and increased government spending on wastewater infrastructure support the shift to green chemicals. In addition to this, the region’s abundant agricultural and marine resources offer local sourcing potential for plant and animal-based ingredients. These factors, combined with high export potential, are creating strong momentum for bio-based water treatment adoption, driving market growth in tandem. The Japan market is projected to reach USD 0.04 billion by 2026, the China market is projected to reach USD 0.11 billion by 2026, and the India market is projected to reach USD 0.08 billion by 2026.

Rest of World

In Latin America, and the Middle East & Africa, the demand for these water treatment chemicals is driven by environmental concerns, water scarcity, and a push for sustainable industrial practices. In Latin America, rising water pollution, agricultural expansion, and international sustainability requirements encourage adoption, supported by government programs and access to natural feedstock. In the Middle East & Africa, severe water scarcity and the need for reuse and desalination are prompting investment in eco-friendly solutions. Both regions benefit from locally available bio-resources, aligning green chemical adoption with economic and environmental goals.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Operating in the Market Compete on the Basis of Innovative Product Offerings

The global market is dominated by major players such as SNF, Kemira, Veolia, and Aries Chemical, Inc., and they compete on the basis of their product offerings. Competitive rivalry in the global green water treatment chemicals market is growing as demand for sustainable solutions rises. Established chemical firms and new startups compete by offering bio-based products that meet performance, cost, and environmental standards. Key differentiators include access to reliable natural feedstocks, regulatory compliance, and innovation in formulations. While moderate entry barriers allow new players to enter the market, thus intensifying competition. As regulatory and ESG pressures increase, firms also focus on green certifications and customer alignment, making the market increasingly dynamic and innovation-driven across both industrial and municipal segments.

LIST OF KEY GREEN WATER TREATMENT CHEMICALS COMPANIES PROFILED

- Aries Chemical, Inc. (U.S.)

- Dober (U.S.)

- Economy Polymers and Chemicals (U.S.)

- Genesis Water Technologies (U.S.)

- Hawkins (U.S.)

- Kemira (Finland)

- SNF (France)

- Tramfloc, Inc. (U.S.)

- Univar Solutions LLC (U.S.)

- Veolia (France)

KEY INDUSTRY DEVELOPMENTS

- July 2024 – Kemira launched the first full-scale production line for its newly developed, bio-based polyacrylamide polymer. The first commercial shipment was delivered to a wastewater treatment plant in Helsinki, Finland. The move demonstrates the company’s commitment toward developing sustainable green chemistry-based products.

REPORT COVERAGE

The global market report provides a detailed analysis of the market. It focuses on key aspects such as profiles of leading companies, product sources, and leading applications of the product. Besides this, it offers insights into the analysis of key market trends and highlights key industry developments. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 7.0% during 2026-2034 |

|

Segmentation |

By Source

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.29 billion in 2026 and is projected to record a valuation of USD 2.23 billion by 2034.

In 2025, Europe stood at USD 0.47 billion.

Registering a CAGR of 7.0%, the market will exhibit steady growth during the forecast period of 2026-2034.

The municipal end-use is expected to lead this market.

Adoption of stricter environmental regulations to prompt rise in demand for green water treatment chemicals.

SNF, Kemira, Veolia and Aries Chemical, Inc. are the major players operating in the market.

Supportive government policies to drive wider adoption and create new market growth opportunities.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us