Heart Rate Monitor Market Size, Share & Industry Analysis, By Product (Wearable [Smart Watches, Pulse Oximeters, and Others], and Non-wearable), By Type (Electrical-detection Devices and Optical-detection Devices), By End User (Hospitals, Specialty Clinics, Home Care Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

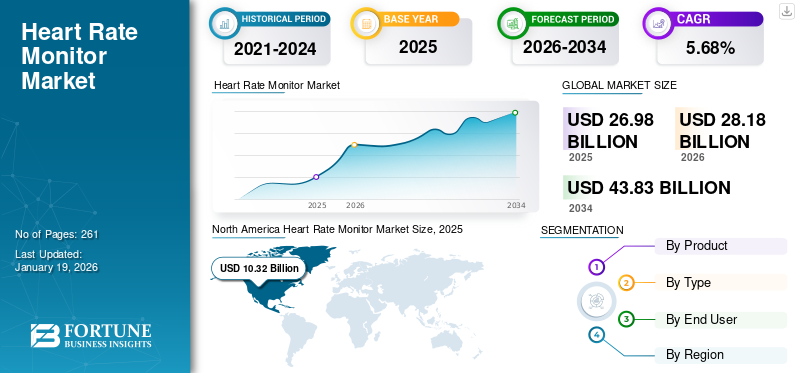

The global heart rate monitor market size was valued at USD 26.98 billion in 2025 and is projected to grow from USD 28.18 billion in 2026 to USD 43.83 billion by 2034, exhibiting a CAGR of 5.68% during the forecast period. North America dominated the heart rate monitor market with a market share of 38.24% in 2025.

Heart rate monitors are devices used to detect and track the heart or pulse rate in the general population. The increasing prevalence of cardiovascular diseases, increasing per capita healthcare expenditure, and growing awareness about the benefits of these devices are among the key factors supporting their market penetration.

- For instance, as per the 2024 data published by the Center for Disease Control and Prevention (CDC), it was stated that nearby 5% of the adult population is suffering from coronary artery disease in the U.S.

Additionally, growing technological advancements such as digitalization and miniaturization, along with rising preference toward wearable products, are likely to further augment market demand.

Key players such as Apple Inc., Garmin Ltd., Medtronic, and others are also focusing on their R&D efforts to create and launch novel products, thereby driving growth in the global heart rate monitor market.

Market Dynamics

Market Drivers

Growing Prevalence of Chronic Diseases to Fuel Industry Expansion

The growing incidence of various chronic conditions, such as arrhythmias, and others among the patient population is resulting in an increasing diagnosis rate for these diseases globally. Growing disease burden, coupled with increasing technological advancements, is boosting the adoption of innovative patient monitoring products in the market.

- For instance, according to the 2023 data published by the National Center for Biotechnology Information (NCBI), about 1.5% to 5.0% of the population is expected to suffer from arrhythmia, with atrial fibrillation being the most common in the U.S.

Moreover, there is an upward surge in the adoption of health and fitness monitoring devices among the general population. The increasing benefits of these devices, such as the provision of real-time insights for their vital metrics, tracking of their fitness progress, among others, are some of the factors further contributing to their adoption rate in the market. This rising usage supports the global heart rate monitor market growth.

The combination of increasing prevalence, growing awareness, and technological advancements is also prompting key players to intensify their research and development activities, with a strong focus on developing and introducing novel products in the market.

Market Restraints

Privacy and Data Safety Concerns to Hinder Industry Expansion

Patient monitoring devices provide several benefits, such as continuous health and fitness monitoring, improved workplace productivity, convenience, and hands-free access. However, many of these devices collect an enormous amount of personal and biometric data, including birth date, background data, and other sensitive data, which further raises concerns among the individual population.

Smartwatches and other monitors often sync this information with cloud-based services, making them vulnerable to cyberattacks. The leak of such confidential information poses a major threat to the use of the information illegally, resulting in the infringement of human dignity. Thus, the increasing use of technology in the patient monitoring industry challenges the protection of private information of the individuals, which is anticipated to hinder the uptake of such devices among the general population nationwide.

- For instance, as per the data published by the National Center for Biotechnology Information (NCBI), it was noted that there were about 1,463 cyberattacks per week globally.

Market Opportunities

Increasing Adoption of Wearable Devices Among the General Population to Offer Significant Growth Opportunities

The growing prevalence of chronic disorders and the benefits of these wearable monitors, such as enhanced real-time health monitoring, early detection of potential health conditions, and reduced healthcare costs, are driving significant demand in the market.

Increasing benefits and adoption rate for these wearable patient monitoring devices, such as chest strap heart rate monitors, and others, is encouraging prominent players to intensify their focus on research and development activities to develop and introduce innovative products such as smartwatches, pulse oximeters, smart rings, and others in the market.

- For instance, in January 2024, G-SHOCK launched two new models in the GPR-H1000 range featuring an optical heart sensor and GPS functionality, designed to provide support even in harsh environments. This launch helped the company strengthen its brand presence.

- In June 2024, ŌURA, a key player focused on the development of smart rings, announced that it had sold more than 2.5 million smart rings, reflecting the rapid adoption of its product in the wearable health technology space.

Additionally, increasing government initiatives aimed at raising awareness about the health benefits of wearable monitoring products are anticipated to further augment the demand for these products, especially in developing countries. Such efforts present lucrative growth opportunities for market players seeking to expand their footprints.

Market Challenges

High Expense Associated with Cutting-edge Heart Health Monitors to Hinder Industry Expansion

The long-term benefits of technologically advanced patient monitoring systems are fueling demand for these products in the market. However, the high expense linked with these devices is one of the crucial factors hindering the adoption of these devices in the market. The increasing use of technology in these devices among key players operating in the industry is contributing to the rising cost of these devices, further expected to hinder the rate of adoption, particularly in developing nations such as Brazil, Poland, China, and others.

- For instance, the Fitbit Charge 6 Fitness Tracker, which includes heart rate monitoring, GPS, and premium membership health tools, ranges from about USD 109.95 – USD 149.00.

The increasing costs linked with advanced devices are expected to hamper the adoption rate of these products among the population nationwide.

Other Prominent Challenges

- Regulatory Challenges to Hamper Market Growth: Stringent regulations by the regulatory bodies and clinical acceptance hurdles may slow the entry of products into medical-grade segments.

Heart Rate Monitor Market Trends

Increasing Technological Advancements to Fuel Product Demand

There has been an increasing focus on the integration of technology into these devices by major players in the market. The integration of technology such as wearables and others represents a shift from episodic care to continuous, patient-centric monitoring. The incorporation of these monitoring functions offers significant benefits in the proactive management of heart conditions, sleep cycle management, and stress management. These devices allow the early detection of key physiological changes, reducing hospitalization risks and improving patient outcomes. The provision of real-time data improves compliance and personalized health strategies among patients.

Moreover, increasing benefits of advanced patient monitoring systems, such as wearable devices in sports and fitness, home-health monitoring, among others, are resulting in the growing adoption rate for these products, further driving the focus of prominent players toward the development and introduction of novel products in the market.

- In February 2025, Apple, Inc., launched Powerbeats Pro 2, an edition of earbuds equipped with a built-in heart rate monitoring system, with an aim to strengthen its product portfolio.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product

Growing Number of Product Launches Boosted the Wearable Segment Growth

Based on product, the industry is segmented into wearable and non-wearable. The wearable segment is further classified into smart watches, pulse oximeters, and others.

The wearable segment held a dominant market share in 2026 with 75.20%. The increasing benefits of wearable health monitors, such as improved health management, convenience, continuous monitoring, workout optimization, and others, are leading to a rising adoption rate for wearable products in the market. This, along with the growing emphasis of prominent players toward R&D activities to develop and launch innovative products, is poised to drive the demand for these products, thereby supporting segment growth.

- In February 2024, Samsung launched its smart ring featuring heart rate and respiratory rate tracking in order to strengthen its product portfolio.

The non-wearable segment is anticipated to grow at a considerable CAGR over the forecast period. The growing incidence of acute and chronic conditions, the increasing number of patient admissions, and growing technological advancements in these products by market players are key factors contributing to the segment's growth.

To know how our report can help streamline your business, Speak to Analyst

By Type

Increasing Product Launches Encouraged the Optical-detection Devices Segment Growth

Based on type, the market is bifurcated into electrical-detection devices and optical-detection devices.

The optical-detection devices segment dominated the market in 2026 with 73.93%. The dominance is primarily due to certain benefits, including comfort, convenience, and the ability to track heart rate during various activities. This, coupled with an increasing number of prominent players focusing on launching new remote patient monitoring products such as optical monitors, is poised to boost the expansion of the segment.

- In June 2024, Samsung launched Galaxy Watch FE, a smartwatch with health and fitness monitoring features, including an optical heart rate sensor, aimed at widening its product offerings.

The electrical-detection devices segment is likely to grow at a considerable CAGR during the study timeframe. The growth is attributed to increasing demand for advanced patient monitors for clinical use, further supported by the focus of key players on acquisitions and mergers to develop novel products in the market.

By End-user

Increasing Adoption Rate of these Devices Supported the Home Care Settings Growth

Based on end user, the market is classified into hospitals, specialty clinics, home care settings, and others.

The home care settings segment dominated the market holding a 53.10% share in 2026.. The growing incidence of chronic conditions, increasing advancements in technology, and growing adoption rate for wearable devices such as smartwatches are certain vital factors responsible for the segment’s dominance.

The hospitals segment is likely to grow at a considerable CAGR from 2025-2032. The growth is attributed to an increasing number of patient admissions for the diagnosis of chronic conditions, coupled with a growing number of healthcare facilities, further facilitating the demand for these products in the market.

- For instance, as per the 2025 statistics published by Definitive Healthcare, there are about 7,300 hospitals in the U.S.

Heart Rate Monitor Market Regional Outlook

Based on region, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Heart Rate Monitor Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market, generating a revenue of USD 10.32 billion in 2025. The increasing incidencde of chronic diseases, such as heart diseases, rising awareness about the benefits of patient monitoring products, rising healthcare expenditure, and growing initiatives by prominent players to launch novel products are some of the factors supporting the growth of the segment.

- For instance, as per 2025 study published by The Ohio State University Wexner Medical Center, nearly two-thirds of the 1,008 surveyed people use a device on a regular basis to monitor their heart health in the U.S.

The high adoption rate of wearable devices in the U.S. and growing healthcare expenditure are the major factors driving the market growth in the country. Along with this, the growing emphasis on R&D activities for novel patient monitoring products among major players is expected to further boost market growth in the region.

Europe

The European market is poised to expand at a considerable CAGR during the forecast period due to the growing prevalence of chronic conditions, increasing health awareness, and growing technological advancements in patient monitoring systems. This, coupled with the increasing focus of key industry participants on R&D activities to launch novel products, is likely to further fuel adoption, thereby supporting the growth of the market in the region. The UK market is valued at USD 9.15 billion by 2026, while the Germany market is valued at USD 12 billion by 2026.

- According to statistics published by BioMed Central Ltd., it was estimated that the overall heart failure cases were around 920,616 in the U.K. in 2023.

Asia Pacific

Asia Pacific is anticipated to register considerable growth during the forecast period. The growth is primarily due to the increasing geriatric population, resulting in a rising number of heart failure cases among patients. Additionally, the growing focus of key players to expand their geographical presence in developing nations, especially China and India, is also likely to contribute to the adoption of these devices in the market. The Japan market is valued at USD 8.19 billion by 2026, the China market is valued at USD 10.68 billion by 2026, and the India market is valued at USD 6.55 billion by 2026.

- For instance, according to 2024 statistics published by the China Government, about 297 million people were aged 60 and above.

Latin America

The market in Latin America is expected to grow at a considerable CAGR during the forecast period. This growth is primarily attributed to the growing prevalence of acute and chronic conditions, rising healthcare expenditure leading to increasing affordability, and the growing demand for patient monitors among the population. These factors are collectively boosting the adoption and driving the growth of the market.

- For instance, according to the 2023 data published by the International Trade Administration (ITA), Brazil spends about 9.47% of its GDP on healthcare.

Middle East & Africa

The increasing prevalence of heart failure, along with growing emphasis among governmental organizations of many countries toward raising awareness about early detection of diseases, developing healthcare infrastructure, and growing emphasis of key players on product launches. These factors collectively supporting the higher adoption of these products in the region.

- In February 2025, Samsung launched two new health features, including irregular heart rhythm notification and sleep apnea features, on its Galaxy watch with an aim to strengthen its geographical footprint in South Africa.

Competitive Landscape

Key Industry Players

Major Players Focus on Product Launches to Boost their Market Presence

The increasing focus on R&D activities to launch novel products, coupled with a strong geographical presence, are some of the vital factors supporting the dominance of players such as Apple, Inc., Garmin Ltd., and others in the market. Moreover, the growing focus of key players on showcasing their patient monitoring products to strengthen their presence is contributing to their global heart rate monitor market share.

- In September 2024, Apple Inc., launched new sleep apnea and heart rate monitoring features in its AirPods Pro 2 to strengthen its product portfolio.

Other key players, such as Medtronic, and others, are also expanding their presence in the market through growing initiatives toward partnerships with other players to enhance their brand visibility.

List of Key Heart Rate Monitor Companies Profiled

- Polar Electro (Finland)

- Apple Inc. (U.S.)

- Garmin Ltd. (U.S.)

- Medtronic (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- Masimo (U.S.)

- Samsung (South Korea)

KEY INDUSTRY DEVELOPMENTS

- January 2025 – Garmin Ltd., launched HRM 200, a heart rate monitoring device designed for athletes, with an aim to reinforce its product portfolio.

- January 2024 – Garmin Ltd., launched HRM-Fit, a new heart rate monitor for women, with an aim to widen its product portfolio.

- March 2022 – MFine launched a new heart rate monitoring tool on its app, which measures heart rate by the photoplethysmogram (PPG) signal from the user’s fingertip. This helped the company to increase its brand visibility.

- February 2022 – Peloton Interactive, Inc., launched a new Bluetooth heart rate monitoring device with an aim to strengthen its product offerings.

- December 2021 – Eka Care collaborated with Father Muller Medical College and Hospital to launch a new heart rate monitoring tool, a scientific mobile-based feature on smartphones, with an aim to strengthen its product offerings.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product, type, and end user. Besides this, the global report offers insights into the global heart rate monitor market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth and advancement of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.68% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Type

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

The global heart rate monitor market size was valued at USD 28.18 billion in 2026 and is projected to reach USD 43.83 billion by 2034, exhibiting a CAGR of 5.68% during the forecast period.

In 2025, the North America regional market value stood at USD 10.32 billion.

Growing at a CAGR of 5.68%, the market will exhibit steady growth over the forecast period (2026-2034).

By product, the wearable segment led the market.

The introduction of technologically advanced products is one of the major factors driving the markets growth.

Apple Inc., Garmin Ltd., and Medtronic are the major players in the global market.

North America dominated the market share in 2025.

The increasing prevalence of heart failures and growing awareness about the benefits of early detection of diseases are some of the factors expected to drive the adoption of these products globally.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us