Smart Ring Market Size, Share & Industry Analysis, By Application (Health & Wellness Tracking, Fitness & Activity Tracking, Medical/Clinical Monitoring, Lifestyle & Productivity and Others), By Technology (Bluetooth Low Energy (BLE) and NFC), By Distribution Channel (Direct-to-Consumer, E-commerce Marketplaces and Retail/Electronics Stores), By End-user (Corporate, Individuals/Professionals, Healthcare, and Others) and Regional Forecast, 2025 – 2032

SMART RING MARKET SIZE AND FUTURE OUTLOOK

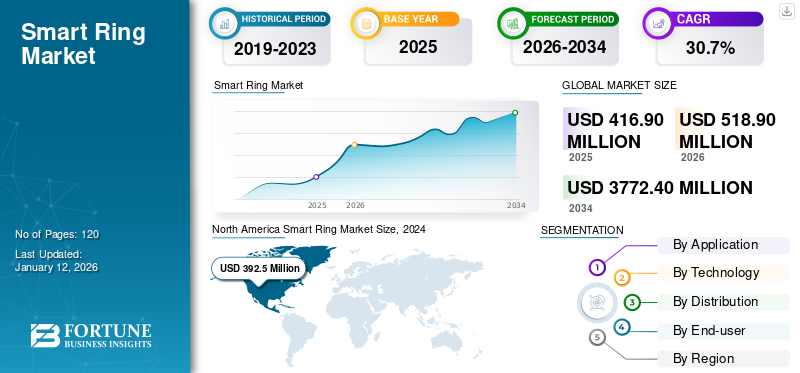

The global smart ring market size was valued at USD 706.5 million in 2024. The market is projected to grow from USD 1,129.0 million in 2025 to USD 7,353.1 million by 2032, exhibiting a CAGR of 30.7% during the forecast period.

Smart rings are small, lightweight gadgets featuring smart sensors that allow users to monitor several health indicators, including heart rate, sleep quality, activity intensity, and blood oxygen levels. A major factor driving the increasing popularity of smart technology is its capacity to offer instant health information conveniently. Compared to larger wearable gadgets, these rings are made for constant wear, allowing for ongoing data collection and monitoring without interruption. This makes them attractive, especially for those seeking a smooth method to oversee their health and wellness.

Additionally, this technology is increasingly being linked to mobile applications, allowing users to retrieve and review health information from anywhere. This link enhances health management by enabling users to exchange their information with healthcare providers, fostering enhanced patient care and customized treatment plans.

Market players such as Oura Ring, Ultrahuman, Samsung, and Noise are focusing on investment opportunities and the acquisition of other players in order to expand their market dominance. For instance, Oura Ring has acquired three companies in the last two years, namely Sparta Science, Veri, and Proxy.

IMPACT OF AI

Implementation of AI Capabilities to Fuel Market Growth

The integration of Artificial Intelligence (AI) into the smart ring is revolutionizing wearable tech by enhancing capabilities and user satisfaction. AI-driven algorithms enable intelligent health monitoring, providing immediate evaluations of heart rate, sleep patterns, and activity metrics and offering personalized insights and recommendations. Additionally, AI enhances data accuracy and predictive capabilities, making rings more reliable for health and fitness applications.

- In December 2024, Oura raised USD 200 million at a valuation of USD 5 billion to invest in the development of AI-powered wearables.

MARKET DYNAMICS

Smart Ring Market Trends

Integration of NFC Technology into Smart Rings Fuels Major Market Trends

The integration of NFC (Near Field Communication) technology into smart rings is transforming how consumers engage with their environment, providing effortless and contactless payments, access management, and transportation options.

NFC-equipped rings such as Mclear, Ringpay, and Token Ring enable users to execute payments, open doors, and utilize public transport with a simple tap, eliminating the necessity for cards, keys, or mobile phones. For instance,

- In July 2024, Vezopay launched Africa’s first smart ring for seamless contactless payments. It enables fast contactless payments in just 1 second, connecting hands to any terminal.

This gadget merges convenience, security, and style, making it more than a simple wearable—they represent the future of seamless living.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Growing Emphasis on Health, Fitness, and Preventive Care to Enhance Market Development

The growing worldwide emphasis on health, wellness, and preventive care is a major factor propelling the market growth. Lately, consumers have become more proactive in managing their health, driven by an awareness of lifestyle-related diseases, the importance of mental well-being, and the need for continuous health tracking. The World Health Organization (WHO) mentions that Non-Communicable Diseases (NCDs), such as cardiovascular diseases, diabetes, and respiratory disorders, account for 71% of global deaths, highlighting the necessity for health initiatives.

Compact and modern design rings are increasingly favored by individuals who prioritize their health. These gadgets provide enhanced tracking features, such as heart rate monitoring, sleep quality assessment, activity monitoring, blood oxygen saturation (SpO2) tracking, and even stress level evaluation. For instance,

- A survey by industry expertsfound that 75% of consumers consider health and fitness tracking as a key feature when purchasing wearable devices. This underscores the importance of health metrics in driving wearable technology adoption.

- According to the World Health Organization (WHO), stress-related health issues are on the rise, with 1 in 4 peopleglobally experiencing mental health problems. Smart rings that offer stress monitoring features are increasingly sought after as tools for managing mental well-being.

Market Restraints

Competition from Smartwatches and Fitness Bands Can Hamper Market Growth

A major challenge for the market is the tough competition from established wearable technology, especially smartwatches and fitness trackers. These devices dominate the global wearable technology market, offering various features at affordable prices, making it difficult for this technology to capture a significant share. For instance,

- As per industry experts, smartwatches represented 29.1% of the worldwide wearable device market share in 2024, establishing them as the largest segment in the sector.

Smartwatches, such as the Apple Watch and Samsung Galaxy Watch, are very popular due to their flexibility. They monitor health indicators such as heart rate, sleep, and activity while also featuring extras such as GPS, mobile alerts, app connections, and even contactless payment options.

Market Opportunities

Advancing Women’s Health Insights through Continuous Bio-Signal Monitoring Unlocks Significant Market Potential

The women’s health category remains significantly less saturated compared to broader wearable segments. While traditional wrist-based devices provide general wellness indicators, they often lack the precision required for temperature-based insights or are not consistently worn during sleep.

There is also rising consumer interest in personalized health guidance driven by lifestyle shifts, increased awareness of hormonal health, and broader acceptance of digital health solutions. Smart rings can leverage this trend by enabling users to track cycle-related symptoms, understand fertility windows, and gain insights into how sleep, stress, or activity patterns correlate with the hormonal phase.

The instances given below highlight how the growing demand for women’s health insights is opening new opportunities for smart rings:

- In August 2025, Oura expanded its smart ring features for women’s health by updating Pregnancy Insights and launching a Perimenopause Check-In, offering personalized tracking, educational insights, and expert support through the app.

- In June 2025, Healthtech startup Janitri launched Momi, a smart ring for maternal and postpartum care that tracks vitals and provides personalized recovery, nutrition, and wellness guidance.

Segmentation Analysis

By End-User

Extensive Use of Technology in Athletic Purposes to Drive Individuals/Professionals Segmental Growth

Based on end-user, the market is divided into corporate, individuals/professionals, healthcare, and others (government & defense, insurance, etc.)

Individuals/professionals hold the majority of the smart ring market share in 2024 due to the extensive use of technology for personal, athletic, and professional purposes. Technology is favored by individuals for tracking health and fitness, providing functions such as heart rate monitoring, sleep analysis, and activity tracking.

Athletes, especially, represent an important subset within this group, as the technology offers advanced metrics such as recovery rate, stress levels, and workout efficiency, aiding them in enhancing performance and avoiding injuries. For instance,

- In June 2024, Gareth Southgate and his 26-memberEngland team were given an Oura Ring to wear throughout the Euros. It will serve as a resource for tracking health, recovery, and sleep patterns.

Healthcare is expected to witness the highest Compound Annual Growth Rate (CAGR) of 39.3% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Application

Health & Wellness Segment Rises Owing to Everyday Consumer Needs

Based on application, the market is segmented into health & wellness tracking, fitness & activity tracking, medical/clinical monitoring, lifestyle & productivity, and others.

Health & Wellness tracking holds the majority share by application in 2024. In 2025, the segment is anticipated to dominate with a 35.9% as it directly addresses everyday consumer needs. Users increasingly seek convenient, always-on devices to monitor vital signs such as heart rate, sleep quality, activity levels, and stress without the bulk of traditional wearables. Smart rings offer comfort, discretion, and continuous data collection, making them ideal for long-term health monitoring.

Medical/Clinical Monitoring is expected to witness the highest Compound Annual Growth Rate (CAGR) of 40.7% during the forecast period.

By Technology

Widespread Usage of Wireless Communication Fuels Bluetooth Low Energy (BLE) Segmental Growth

Based on technology, the market is bifurcated into Bluetooth Low Energy (BLE) and NFC.

Bluetooth Low Energy (BLE) holds the highest share of the market due to its widespread application in wireless communication and its ability to facilitate seamless connections between rings and different devices such as smartphones, tablets, and laptops. Bluetooth technology enables instant data synchronization, making it ideal for monitoring health and fitness, getting notifications, and using various smart functionalities. The Bluetooth Low Energy (BLE) segment is expected to capture 85.30% of the market share in 2025.

The above bar graph represents the shipments of Bluetooth devices, which are increasing year by year.

NFC technology is expected to witness the highest CAGR of 36.3% during the forecast period.

By Distribution Channel

Rising Digital-First Nature of Wearable Technology Sales Leads Direct-to-Consumer Segment’s Growth

Based on distribution channel, the market is bifurcated into direct-to-consumer, e-commerce marketplaces, and retail/electronics stores.

Direct-to-Consumer holds the majority share by distribution in 2024. In 2025, the segment is anticipated to dominate with a 68.0% due to the digital-first nature of wearable technology sales. Brands commonly sell through their own websites and online platforms, allowing better customer engagement, pricing control, and access to product education. Consumers also prefer online purchases for convenience, customization options, and easy comparison of features.

E-commerce marketplaces are expected to witness the highest CAGR of 36.7% during the forecast period.

SMART RING MARKET REGIONAL OUTLOOK

By region, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Smart Ring Market Size, 2024 (USD Million) To get more information on the regional analysis of this market, Download Free sample

North America holds the highest share of the market due to its advanced technological infrastructure, higher consumer awareness of wearable technology, and a strong focus on health and fitness. The region hosts numerous top tech firms and startups that are advancing innovation in this technology. The North American market held the largest market at USD 622.6 million in 2025. Furthermore, the rising use of connected health technologies, along with an increasing focus on preventive healthcare, has driven the demand for technology. For instance,

- As per the 2022 IT World Canada study, 33% of Canadians utilize at least one wearable tech device, while 61% intend to boost their usage of wearable technologies and related apps in the upcoming year.

U.S. Smart Ring Market

Based on North America’s strong contribution and the U.S. dominance within the region, the U.S. market can be analytically approximated at around USD 500.1 million in 2025, accounting for roughly 44.28% of smart ring sales.

Europe

Europe is projected to record a growth rate of 30.9% in the coming years, which is the second highest among all regions, and reach a valuation of USD 344.8 million by 2025. The growth is driven by a combination of technological advancements, increasing health awareness, and an emphasis on fitness and wellness. Consumers throughout Europe, notably in Germany, the U.K., and France, are increasingly utilizing wearable devices to monitor their health metrics, such as heart rate, sleep tracking, and exercise intensity. Furthermore, the region’s strong healthcare system and growing focus on preventive care are additionally boosting the demand for smart technology. For instance,

- In 2022, the University of Manchester initiated a pilot program to evaluate wearable devices such as smart rings and watches on individuals who have undergone cancer therapy. The purpose of the trial was to acquire a new understanding of how individuals manage cancer treatment and what measures can be taken to enhance their recovery.

U.K Smart Ring Market

The U.K. smart ring market in 2025 is estimated at around USD 76.2 million, representing roughly 6.7% of global smart ring revenues.

Germany Smart Ring Market

Germany’s smart ring market is projected to reach approximately USD 60.9 million in 2025, equivalent to around 5.3% of global smart ring sales.

Asia Pacific

Asia Pacific is projected to grow as the third-largest market size of USD 86.4 million. A distinct mix of demographic, economic, and technological influences fuels this growth. A major factor contributing to this growth is the region’s vast and swiftly increasing population, especially in nations such as India and China, where urbanization and higher disposable incomes are developing a large consumer market for wearable technology. For instance,

- As reported by the Statesman, Smart Ring is expanding in India by shipping over 72,000 rings in the second quarter of 2024. Ultrahuman possesses 48.4% of the shares, with Pi Ring in second at 27.5% and Aabo in third place at 10.5%.

As an increasing number of individuals in the region obtain smartphones and internet access, the acceptance of connected gadgets is speeding up.

The market size for China is likely to be valued at USD 24.8 million in 2025, and India’s market is expected to hit USD 11.5 million in 2025.

Japan Smart Ring Market

The Japan smart ring market in 2025 is estimated at around USD 14 million, accounting for roughly 1.3% of global smart ring revenues.

China Smart Ring Market

China’s smart ring market is projected to be one of the largest worldwide, with 2025 revenues estimated at around USD 24.8 million, representing roughly 2.19% of global smart ring sales.

India Smart Ring Market

The India smart ring market in 2025 is estimated at around USD 11.5 million, accounting for roughly 1.0% of global smart ring revenues.

South America and the Middle East & Africa

The Middle East & Africa is expected to reach USD 51.1 million in 2025, as the fourth-largest market, and is emerging as a significant player in the market, with a remarkable CAGR. The growing use of wearable technology drives it. The UAE and Turkey are at the forefront of this trend, fueled by increasing disposable incomes and expanding interest in fitness and wellness. The region’s push toward digital healthcare is creating opportunities for smart technology, particularly for remote health monitoring. The GCC market is expected to hit USD 15.9 million in 2025. For instance,

- In January 2024, Metabolic, a Dubai-based startup, partnered with Oura Ring to help combat the Middle East region’s metabolic diseases crisis. The aim is to stop the loss of billions in healthcare systems treating illnesses such as diabetes, liver disease, and high cholesterol.

The market share is projected to grow with a considerable CAGR across South American countries. Brazil and Argentina are experiencing an increase in demand for wearable technology, which is propelled by citizens seeking convenient methods to track their health and well-being.

GCC Smart Ring Market

The GCC smart ring market is projected to reach around USD 15.9 million in 2025, representing roughly 1.4% of global smart ring revenues.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Implement Strategic Initiatives to Adapt to Tech Changes

The market players are improving their product portfolios due to the increasing demand for more accurate health-tracking products. They are implementing various business strategies, such as partnerships, mergers, and acquisitions, to expand their businesses across the world.

Major Players in the Smart Ring Market

RingConn, Movano Health, Oura Health Oy, Mclear Limited, Circular, Ultrahuman Healthcare Pvt Ltd, Zepp Health Corporation, and Samsung, among others, are the largest players in the market.

LIST OF KEY SMART RING COMPANIES PROFILED:

- RingConn (U.S.)

- Movano Health (U.S.)

- Oura Health Oy (Finland)

- Mclear Limited (U.K.)

- Circular (France)

- Ultrahuman Healthcare Pvt Ltd (India)

- Zepp Health Corporation (China)

- Samsung (South Korea)

- Noise (India)

- Imaging Marketing Limited (India)

- Pi Ring (India)

- Gabit (India)

- Jackcom (China)

- Gabit (India)

- Nuanic (Finland)

- Aabo (India)

- Adivaa Smart (India)

- Origami Group Limited (China)

- Fittr (India)

- Sevenring Innovations Pvt Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Movano Health has upgraded its Evie smart ring with new data visualization features, Apple Health integration, menstrual cycle tracking, and 7- to 30-day trend graphs for mood, sleep, and vital signs, enhancing its focus on women’s health and wellness.

- January 2025: Ultrahuman extends its partnership with UAE Team Emirates, a UCI WorldTour cycling team, to further enhance the team’s training, recovery, and performance by utilizing Ultrahuman’s technology.

- January 2025: QALO introduced its innovative silicon health-monitoring ring featuring nanotechnology. The ring includes capabilities such as tracking heart rate, oxygen level, heart rate variability, sleep phases, and stress indicators. These measurements can be accessed through a free app at no subscription fee.

- October 2024: Oura secured a USD 96 million contract from the U.S. Department of Defense. The contract involves providing rings and data services to the Pentagon’s Defense Health Agency Workforce.

- October 2024: Samsung introduced the Galaxy Ring in India, featuring AI-driven health and fitness tracking capabilities. It has been introduced in three color choices: Titanium Black, Titanium Silver, and Titanium Gold.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 30.7% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application, Technology, Distribution Channel, End-user, and Region |

|

By Application |

· Health & Wellness Tracking · Fitness & Activity Tracking · Medical / Clinical Monitoring · Lifestyle & Productivity · Others (NFC-enabled identification, IoT/Smart Home control, etc.) |

|

By Technology |

· Bluetooth Low Energy (BLE) · NFC |

|

By Distribution Channel |

· Direct-to-Consumer · E-commerce Marketplaces · Retail/ Electronics Stores |

|

By End-user |

· Corporate · Individuals/Professionals · Healthcare · Others (Government & Defense, Insurance, etc.) |

|

By Region |

· North America (By Application, By Technology, By Distribution Channel, By End-user, and By Country) o U.S. o Canada o Mexico · Europe (By Application, By Technology, By Distribution Channel, By End-user, and By Country) o U.K. o Germany o France o Italy o Spain o Russia o Benelux o Nordics o Rest of Europe · Asia Pacific (By Application, By Technology, By Distribution Channel, By End-user, and By Country) o China o India o Japan o South Korea o ASEAN o Oceania o Rest of Asia Pacific · Middle East and Africa (By Application, By Technology, By Distribution Channel, By End-user, and By Country) o Turkey o Israel o GCC o North Africa o South Africa o Rest of Middle East & Africa · South America (By Application, By Technology, By Distribution Channel, By End-user, and By Country) o Brazil o Argentina o Rest of South America |

Frequently Asked Questions

The market is projected to record a valuation of USD 7,353.1 million by 2032.

In 2024, the market was valued at USD 706.5 million.

The market is projected to grow at a CAGR of 30.7% during the forecast period of 2025-2032.

The individuals/professionals segment is expected to hold the highest share of the market.

Growing emphasis on health and fitness to enhance market progress.

Oura Health Oy, Ultrahuman Samsung, Mclear Limited, Circular, and Zepp Health Corporation are the top players in the market.

North America is expected to hold the highest market share.

By end-user, Healthcare is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us