Hepatitis B Therapeutics Market Size, Share & Industry Analysis, By Drug Class (Nucleoside Analogues, Nucleotide Analogues, Interferons, and Others), By Age Group (Adults and Pediatrics), By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

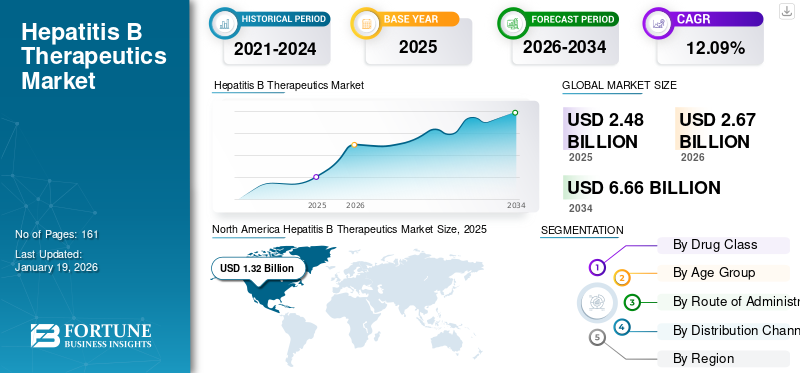

The global hepatitis B therapeutics market size was USD 2.48 billion in 2025. The market is projected to grow from USD 2.67 billion in 2026 to USD 6.66 billion in 2034 at a CAGR of 12.09% during the forecast period. North America dominated the hepatitis B therapeutics market with a market share of 52.31% in 2025.

Hepatitis B therapeutics are a group of medicines that are used to treat hepatitis B infections caused by the hepatitis B virus in humans. The hepatitis B virus is spread through sexual transmission, when in contact with blood or other fluids, and from the mother to the child during birth or delivery. The global market is witnessing significant growth due to the rising prevalence of hepatitis B globally, with increasing government initiatives to raise awareness, thus propelling the demand and adoption of therapeutics.

- For instance, in January 2025, the China CDC, in collaboration with the China Health Promotion Foundation, launched a nationwide initiative titled “Supporting China’s Action to Eliminate the Public Health Threat of Viral Hepatitis by 2030”. This program focuses on assessing the current landscape of chronic hepatitis B prevention and implementing integrated, collaborative models for disease control. Such programs boost the diagnosis rate and increase treatment adoption.

Moreover, the presence of key players such as Gilead Sciences, Inc. GSK plc, with robust product portfolio and advanced research and development facilities to launch novel treatments is expected to boost the growth of the market during the forecast period.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Hepatitis B Increases Demand for Effective Treatment

The increasing prevalence of hepatitis B across the globe is one of the major factors driving the market growth. Hepatitis B is a severe liver infection which can lead to both acute and chronic diseases. The disease is spread due to needle stick injuries, tattooing, body piercing, and exposure to infected blood or body fluids such as saliva, menstrual, vaginal, and seminal fluids.

- For example, according to a report published by the World Health Organization in April 2024, based on 2022 data from 187 countries, approximately 254 million people globally—around 3.3% of the world’s population were infected with hepatitis B, while only 2.6% of individuals with chronic HBV receiving treatment.

Such a high patient population increases the demand for adequate diagnosis and treatment, thus leading toward the global hepatitis B therapeutics market growth.

MARKET RESTRAINTS

Emergence of Drug Resistance in Hepatitis B Patients Restraining Market Growth

Anti-viral drug resistance in chronic hepatitis B patients is one of the prominent factors impeding market growth. The long-term treatment of chronic hepatitis B infection with antiviral drugs leads to the development of mutations in the virus, particularly for nucleoside and nucleotide analogs. This can lead to treatment failure, increased viral load, and potential liver disease progression. Moreover, many researchers are escalating their efforts to study the mechanisms of drug resistance and to identify biomarkers for early detection.

- For example, a study published in August 2022 by Springer Nature Limited, conducted by researchers from the University of Oxford, U.K., examined the genetic basis of viral drug resistance. They noted that lamivudine and adefovir dipivoxil, commonly used in the HBV treatment, showcased reduced effectiveness over time. In the randomized clinical trials, around 30.0% of patients developed lamivudine-resistant HBV strains within a year. Similarly, resistance to adefovir dipivoxil was observed in approximately 20.0–29.0% of patients after five years of therapy.

Such scenarios lead to lower product adoption by patients, restraining market growth.

MARKET OPPORTUNITIES

Emerging Pipeline Products to Provide Lucrative Opportunities in the Market

The emergence of anti-viral drug resistance and the limited availability of effective therapeutic options offer significant growth opportunities in the treatment landscape. Currently, the anti-viral monotherapies have shown limitations, including the emergence of drug-resistant strains, inadequate viral eradication, and recurrence of disease after treatment discontinuation.

To fulfill the unmet needs, various key players are focusing on developing a combination treatment that offers promising growth prospects for the market.

- For instance, in August 2022, Zhimeng Biopharma launched a Phase IIa clinical trial of ZM-H1505R in China and Hong Kong. This multicenter, randomized, double-blind, placebo-controlled study aimed to assess the efficacy and safety of ZM-H1505R in combination with Entecavir (ETV), compared to ETV monotherapy in patients with chronic hepatitis B who have been on ETV treatment for a minimum of 12 months. Such development leads to lucrative growth opportunities during the forecast period.

MARKET CHALLENGES

High Treatment Cost Associated to Therapeutics May Hinder Adoption and Market Growth

The high cost associated with its diagnosis, long-term management, and therapeutic interventions remains a significant barrier to the market growth. As hepatitis B progresses, it can lead to severe complications such as liver cirrhosis and hepatocellular carcinoma, requiring intensive and costly medical care. Thus, intensifying financial strain on the lower-middle economic population.

Additionally, the high cost of antiviral therapy is also impeding its access in low-income and middle-income countries. Also, the long-term medication adherence remains a challenge, especially with daily oral regimens that lead to poor compliance. So, it increases the risk of resistance development, thus challenging the market growth.

HEPATITIS B THERAPEUTICS MARKET TRENDS

Emergence of New Therapies for Hepatitis B Treatment is a Prominent Trend

The hepatitis B therapeutics landscape is evolving with a growing focus on targeting the root cause of chronic infection, i.e., cccDNA (covalently closed circular DNA) and integrated HBV DNA.

The rising prevalence of hepatitis B, along with the emergence of antiviral-resistant strains, has exposed the limitations of current therapies, which suppress viral replication but fail to eliminate cccDNA, which leads to viral persistence and recurrence.

This is driving the development of next-generation therapies aimed at eradicating cccDNA.

- For instance, in February 2025, Precision BioSciences, Inc. reported interim results from its ELIMINATE-B trial evaluating PBGENE-HBV, a lipid nanoparticle (LNP)-based gene editing therapy. PBGENE-HBV leverages ARCUS-encoded mRNA to eliminate cccDNA in HBeAg-negative chronic hepatitis B patients.

Such innovations signal a shift toward curative approaches and offer significant global hepatitis B therapeutic market trends.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Drug Class

Increasing Prescriptions for Nucleoside Analogues Boost Segment's Growth

Based on drug class, the global market is segmented into nucleoside analogues, nucleotide analogues, interferons, and others.

The nucleoside analogues segment accounted for the highest global hepatitis B therapeutics market share of 74.03% in 2026. This was driven by the rising prevalence of hepatitis B and increasing demand for adequate treatment to decrease the disease progression in the patients.

Moreover, increasing the prescription of nucleoside analogues for hepatitis B therapeutics is one of the factors boosting the segment’s growth.

- For instance, in September 2023, as per the data published by the Journal of Infection and Public Health, in Saudi Arabia and UAE, entecavir oral tablets were the most prescribed drug, i.e., around 73.0%, which is a nucleoside.

On the other hand, the nucleotide analogues held the second-largest share of the market and are expected to grow with a moderate CAGR during the forecast period. The slower growth of the segment is due to the increasing resistance for the drug in the hepatitis B patients.

The interferons segment held a considerable market share owing to increasing strategic activities by key players for developing new combination therapies products with interferons for addressing unmet medical needs in liver and viral disease.

- For instance, in July 2024, Aligos Therapeutics, Inc. entered into a clinical trial collaboration agreement with Xiamen Amoytop Biotech Co., Ltd. This agreement gave rights to perform the Phase 1b exploratory clinical study of ALG-000184 in combination with PEGBING (Mipeginterferon alfa-2b) in chronic hepatitis B (CHB) patients in China. Such activities aimed to propel the segment’s growth.

The others segment is expected to grow with a significant CAGR during the forecast period. Increasing anti-viral drug resistance due to traditional treatment and the increasing shift of key companies toward research and development for launching novel medication for hepatitis B is expected to boost the growth of the segment during the forecast period.

- For instance, in May 2024, Excision BioTherapeutics, Inc. announced the positive results from EBT-107 preclinical studies. It is a lipid nanoparticle (LNP) delivered CRISPR compound that helped in the successful reduction of Hepatitis B DNA and biomarkers in a mouse model of Hepatitis B.

To know how our report can help streamline your business, Speak to Analyst

By Age Group

Rising Prevalence of Hepatitis B Infection Amongst Adults Contribute to Segment’s Dominance

Based on age group, the segment is bifurcated into adults and pediatrics.

The adult segment held the maximum share of 77.87% in 2026 at the age group segment. The higher share of the segment is due to the higher transmission rates among adults, particularly through sexual contact, especially among unvaccinated individuals with multiple partners, and exposure to infected body fluids such as saliva, menstrual, vaginal, and seminal fluids.

Moreover, the rising focus of healthcare authorities of the different countries to expand the screening program for adults is leading towards efficient diagnosis. It increases the requirement for adequate treatment to frther decrease the disease progression.

- For instance, in March 2023, the U.S. Centers for Disease Control and Prevention (CDC) released a new testing guidance for hepatitis B infected adults aged 18 and older. The new screening guideline comprises of hepatitis B triple panel test for adults that provides a comprehensive view of a person’s hepatitis B status, which helps to take the necessary treatment to cure the disease. Such programs help to offer efficient treatment to adults and are thus expected to propel the segment’s growth in the market.

The pediatric segment held a comparatively lower share of the market and is expected to grow with a moderate CAGR during the forecast period. This lower share is primarily attributed to the declining prevalence of hepatitis B among children, driven by widespread vaccination initiatives.

However, many key companies are focusing on expanding indications of the already available drug for hepatitis B therapeutics in the pediatric population.

- For instance, in March 2024, Gilead Sciences, Inc. announced that the U.S. Food and Drug Administration (FDA) had approved the supplemental new drug application (sNDA) for Vemlidy (tenofovir alafenamide) 25 mg tablets as a once-daily treatment for pediatric patients suffering from chronic hepatitis B virus (HBV) infection.

By Route of Administration

Convenience of Oral Route of Administration Supports its Dominance

Based on route of administration, the market is classified into oral and parenteral.

The oral segment dominated the global market share of 94.76% in 2026. The convenience and effectiveness of oral dosage forms make it a preferred choice for healthcare providers and patients. Also, increasing research and development of new hepatitis B therapeutics for oral route of administration is boosting the growth of the segment.

- For instance, in May 2025, Arbutus Biopharma presented five posters, including one late-breaker, highlighting imdusiran, its RNAi therapeutic, and AB-101, its oral PD-L1 inhibitor, at the European Association for the Study of the Liver (EASL) Congress 2025.

The parenteral segment is expected to grow with a significant CAGR during the forecast period. This growth can be attributed to the rapid absorption and enhanced bioavailability of the parenteral dosage form. Also, increasing regulatory approval for the commercialization of hepatitis B therapeutics with parenteral dosage forms is expected to boost the growth of the segment.

- For instance, in May 2025, Argo Biopharma announced the positive phase 1/2a clinical data for BW-20507 is a siRNA molecule that is administered subcutaneously for the treatment of chronic hepatitis B. Such advancements in the segment offer extensive opportunities for the segment’s growth.

By Distribution Channel

Online Pharmacies Segment to Exhibit High Growth in the Near Future

Based on distribution channel, the global market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies.

The online pharmacy is expected to grow with the highest CAGR over the forecast period. Increasing e-commerce channels and convenience associated with the online channels due to doorstep delivery mode propel segment growth during the forecast timeframe.

In contrast, increasing collaborative activities amongst digital pharmacies and non-profit organizations to increase accessibility and affordability for such lifesaving medicine will boost the segment’s growth.

- For instance, in April 2022, Hepatitis B Foundation, in collaboration with DiRx, a digital pharmacy platform focused on generic medicine, added two front-line medications for chronic hepatitis B infection, i.e., generic Viread (Tenofovir) and generic Baraclude (Entecavir), at significantly discounted prices.

The retail pharmacies held the largest share of 52.53% in 2026. This is primarily due to the accessibility of drugs to consumers through prescription. Moreover, retail pharmacies serve as vital points for dispensing drugs and provide crucial information to patients about proper usage, potential side effects, and adherence to prescribed regimens.

On the other hand, the hospital pharmacies segment is projected to witness growth during the forecast period, driven by a growing preference among patients for hospital-based hepatitis B therapeutics and the availability of favorable reimbursement policies that help reduce drug costs, encouraging greater adoption through this channel.

- For example, according to the 2025–26 Federal Budget by Hepatitis Australia, the government has demonstrated a strong commitment to enhancing healthcare access by investing in Medicare, increasing funding for public hospitals, and reducing the cost of PBS-listed medicines. These measures are expected to improve patient access to essential hepatitis B therapeutics and further boost the segment’s growth in the market.

HEPATITIS B THERAPEUTICS MARKET REGIONAL OUTLOOK

On the basis of region, the global market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Hepatitis B Therapeutics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American market size stood at USD 1.32 billion in 2025 and is expected to dominate the global market during the forecast period. The rising prevalence of hepatitis B and the presence of advanced healthcare facilities for effective diagnosis and treatment of infectious diseases, helped to drive the region’s growth. Moreover, rising number of programs is anticipated to raise awareness for early diagnosis and treatment of this viral infection.

- For instance, in July 2024, on the occasion of World Hepatitis Day, the Chief Public Health Officer of Canada raised awareness about the importance of vaccination, diagnosis, and proper treatment to end viral hepatitis and avoid the severe complications associated with disease progression. Such programs increase the diagnosis rate and demand for drugs for treatment, thus driving market growth in the region.

Furthermore, the presence of key players in the market with advanced research and development facilities to launch novel therapeutic products for hepatitis B is anticipated to propel the regional market growth.

U.S.

The U.S. dominated the North America region, owing to the rising prevalence of the diseases and the presence of adequate reimbursement policies to offer low-cost treatment. Presence of key players with robust research and development initiatives to develop and commercialize novel drugs for hepatitis B therapeutics will propel the market’s growth in the U.S. The U.S. market is projected to reach USD 1.36 billion by 2026.

- For instance, in November 2024, GigaGen announced a Phase I dose escalation trial for GIGA-2339. It is a recombinant polyclonal drug candidate aimed at treating hepatitis B virus (HBV) infection.

Asia Pacific

Asia Pacific held the second largest share and is estimated to grow at the highest CAGR during the forecast period. Rising prevalence and presence of affordable and effective generic drugs collectively propel the market's growth in the region. Also, the region has a strong presence of global and regional players with strategic activities to launch new drugs for hepatitis B therapeutics. The Japan market is projected to reach USD 0.06 billion by 2026, the China market is projected to reach USD 0.56 billion by 2026, and the India market is projected to reach USD 0.06 billion by 2026.

- For instance, in December 2022, Zhimeng Biopharma entered into a global exclusive license agreement with GSK Plc, with an aim to manufacture and commercialize CB06, a toll-like receptor 8 agonist for the treatment of HBV.

Europe

Europe held the third-largest share of the market owing to the rising prevalence of hepatitis B, advanced healthcare facilities, and increasing investment in R&D activities driving the demand for these drugs in Europe. The UK market is projected to reach USD 0.08 billion by 2026, while the Germany market is projected to reach USD 0.05 billion by 2026.

- For instance, in August 2024, as per the data published by Open Forum Infectious Diseases, the prevalence of HBV surface antigen (HBsAg) was 0.22% in the general population of Spain.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa holds a comparatively lower share but is expected to grow during the forecast period. The growth of the regional markets is augmented by the increasing prevalence of hepatitis B due to limited knowledge and management of HBV infection. However, rising initiatives to eliminate sexually transmitted infectious diseases by the government authorities will propel the market’s growth in the region.

- For instance, in February 2025, the Pan American Health Organization (PAHO), in collaboration with Brazil's Ministry of Health, organized a regional meeting to discuss the challenges and strategies to eliminate HIV, tuberculosis, hepatitis B and C, measles, and diphtheria in correctional facilities. Such activities boost the demand for screening and adequate therapeutic measures to combat the disease.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Gilead Sciences, Inc. and Bristol-Myers Squibb Company to Hold Top Positions

This market holds a consolidated structure with players such as Gilead Sciences, Inc., and Bristol-Myers Squibb Company, accounting for a substantial share in 2024. The top market players are holding their position due to consistent sales of the key products in several key regions.

- For instance, in April 2025, Gilead Sciences, Inc. presented a new research at the European Association for the Study of the Liver (EASL) Congress. This development further highlights Gilead's commitment to transforming the lives of people living with liver disease.

Other key players with an important presence in the global market include Aurobindo Pharma Limited and Lupin, whose product portfolio includes several generics of key hepatitis B drugs.

LIST OF KEY HEPATITIS B THERAPEUTICS COMPANIES PROFILED

- Gilead Sciences, Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- GSK plc (U.K.)

- Excision BioTherapeutics, Inc. (U.S.)

- Arbutus Biopharma (U.S.)

- Assembly Biosciences, Inc. (U.S.)

- Aligos Therapeutics (U.S.)

- Barinthus Biotherapeutics (U.K.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Excision BioTherapeutics, Inc. announced new data presentations from its preclinical programs for EBT-107, at the 2025 American Society of Gene & Cell Therapy (ASGCT) Annual Meeting.

- November 2024: Barinthus Biotherapeutics plc announced the data from the ongoing Phase 2b HBV003 clinical trial with VTP-300 antigen-specific immunotherapy in combination with a low dose of the anti-PD1 antibody nivolumab that aims to reduce Hepatitis B surface antigen.

- February 2024: GSK plc received Fast Track designation for bepirovirsen from the U.S. Food and Drug Administration (FDA). It is an investigational antisense oligonucleotide ASO for the treatment of chronic hepatitis B (CHB).

- October 2023: Gilead Sciences, Inc. collaborated with Assembly Biosciences and signed a 12-year partnership agreement to advance the research and development of novel anti-viral therapies, with an initial focus on areas of herpesviruses (HSV), hepatitis B virus (HBV), and hepatitis D virus (HDV).

- October 2021: Zhimeng Biopharma announced the completion of Phase 1a clinical study for its novel ZM-H1505R candidate, which is an HBV capsid inhibitor.

REPORT COVERAGE

The report provides detailed industry analysis. It focuses on key aspects, such as the prevalence of hepatitis B, in key countries and regions. Additionally, it includes key industry developments such as partnerships, mergers & acquisitions, and pipeline analysis. Besides these, it offers insights into the market trends and highlights advancements in hepatitis B therapeutics.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.09% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug Class

|

|

By Age Group

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 2.67 billion in 2026 and is projected to reach USD 6.66 billion by 2034.

In 2025, market value in North America stood at USD 1.32 billion.

Registering a CAGR of 12.09% the market will exhibit steady growth over the forecast period.

Based on drug class, the nucleoside analogues segment leads the market.

Rising prevalence of hepatitis B is a major factor driving the growth of the market.

Gilead Sciences, Inc. and Bristol-Myers Squibb Company are major players in the global market.

Increasing government initiatives to combat hepatitis B in developing countries are expected to drive the growth and adoption of the products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us