High Performance Composites Market Size, Share & Industry Analysis, By Type (Carbon Fiber Reinforced Composites (CFRP), Aramid Fiber Reinforced Composites (AFRP), Ceramic Matrix Composites (CMC), Metal Matrix Composites (MMC), and Others), By Application (Aerospace & Defense, Wind Energy, Automotive & Transportation, Sports & Leisure, Marine, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

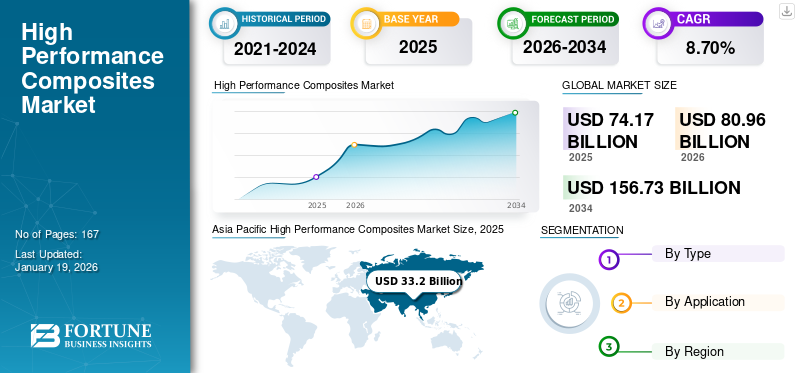

The global high-performance composites market size was valued at USD 74.17 billion in 2025. The market is projected to grow from USD 80.96 billion in 2026 to USD 156.73 billion by 2034, exhibiting a CAGR of 8.70% during the forecast period. Asia Pacific dominated the high-performance composites market with a market share of 45% in 2025.

High Performance Composites (HPC) are advanced materials combining high-strength fibers with polymer matrices, delivering high strength to weight ratios, stiffness, and durability. These are used in aerospace, automotive, defense, and industrial applications where traditional materials such as steel or aluminum cannot meet required performance standards.

Growth in the HPC market is primarily driven by rising demand for lightweight and fuel-efficient materials in aerospace and automotive sectors, as manufacturers aim to meet stricter emission and performance standards. Expanding renewable energy installations, especially large wind turbines, are accelerating composite adoption due to superior strength-to-weight benefits. In defense and industrial applications, increasing focus on structural integrity, corrosion resistance, and high-temperature performance further supports demand. Additionally, advancements in fiber manufacturing, resin chemistry, and automated processing technologies are reducing production costs and enabling broader use across end markets.

The market is led by Hexcel Corporation, Toray Advanced Composites, Teijin Limited, Mitsubishi Chemical Group (MCG), and SGL Carbon. Their broad portfolios, continuous innovation, and expanding global presence underpin their dominance, while close collaborations with aerospace, defense, and automotive industries further strengthen their competitive edge in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Aerospace & Defense Composites Demand Ignites Market Surge

The aerospace and defense sectors drive the high performance composite market through persistent demand for lightweight materials that enhance fuel efficiency and structural integrity. Stringent regulations for emissions reduction and the push for advanced aircraft designs necessitate composites such as carbon fiber reinforced polymers, which enable significant weight savings.

- For instance, NASA’s research highlights thermoplastic composites achieving up to 20% weight reduction in components such as Airbus A340 leading edges, directly addressing the need for fuel efficient, high-speed operations in both commercial and military applications.

The demand leads to market expansion, with composite improving performance metrics such as fracture toughness, yielding fuel saving in aircraft including the Boeing 787. In defense, enhanced damage tolerant supports net-gen vehicles, fostering innovation and sustained growth in the composites sector. Aerospace & defense drive the high performance composites market growth by leveraging advanced materials to meet rigorous performance and sustainability demand, shaping innovation and growth.

MARKET RESTRAINTS

High Costs and Complex Processes Limits Widespread Adoption of High Performance Composites

The market is restrained by high production costs, raw material price volatility, and stringent environmental regulations. Complex manufacturing processes and lengthy development cycles make scaling difficult, restricting widespread use in cost-sensitive sectors such as automotive and consumer goods.

- For instance, Carbon fiber remains 5–10 times costlier than steel or aluminum, preventing large-scale adoption in mainstream automotive despite its clear advantages in weight reduction and fuel efficiency.

MARKET OPPORTUNITIES

Integration of Energy Storage and Structure Creates Next-Gen Growth in High Performance Composites

Structural battery composites are redefining material performance by combining structural strength with energy storage. This multifunctionality directly addresses industry pressures to reduce weight, improve efficiency, and maximize usable space. By shifting from single-purpose to integrated material systems, sectors such as electric mobility, aerospace, and advanced electronics can unlock new efficiency gains and product design flexibility, positioning SBCs as a next-generation growth driver within high performance composites.

- According to the World Economic Forum (2025), Structural Battery Composites are listed among the Top 10 Emerging Technologies, recognized for their potential to make vehicles and aircraft lighter and more efficient.

MARKET CHALLENGES

Limited Recycling Pathways Challenge the Sustainability of High Performance Composites

End-of-life management is a growing challenge for the market. Unlike metals, composites are difficult to recycle due to the strong bonding of fibers and resins. Most waste currently ends up in landfills or incineration, raising environmental concerns and regulatory risks. Without scalable recycling solutions, industries face risks of higher costs, compliance pressure, and reputational impact, which could slower product adoption.

- According to the European Composites Industry Association (EuCIA), approximately 40–70% of composite waste in Europe currently ends up in landfill or incineration without energy recovery, highlighting a significant challenge in recycling infrastructure for end-of-life composite materials.

HIGH PERFORMANCE COMPOSITES MARKET TRENDS

Sustainability Pressures Accelerate Shift Toward Bio-Based and Recyclable High Performance Composites is Emerging Market Trend

Sustainability has become a prominent driver in the market as industries and regulators push for lower carbon footprints and circular material use. Companies are moving beyond traditional petroleum-based composites toward bio-based fibers, recyclable resins, and closed-loop systems. This trend not only addresses environmental compliance but also creates opportunities for differentiation in automotive, aerospace, and consumer goods.

- According to Airbus (2024 sustainability report), efforts are underway to integrate recyclable thermoplastic composites into next-generation aircraft to reduce lifecycle emissions.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Cost Effectiveness of Carbon Fiber Reinforced Composites (CFRP) to Bolster Segment Growth

On the basis of type, the market is classified into carbon fiber reinforced composites (CFRP), aramid fiber reinforced composites (AFRP), ceramic matrix composites (CMC), metal matrix composites (MMC), and others.

The carbon fiber reinforced composites (CFRP) segment accounted for significant high performance composites market share 66.39% in 2026. CFRP is the leading composite type in high performance markets as its exceptional strength and stiffness at low weight enable dramatic structural weight reductions. This efficiency gain translates directly into higher fuel savings, extended range, and lower operating costs across aerospace, wind energy, and transport. Its scalability and proven design maturity keeps CFRP ahead of other niche composite materials.

To know how our report can help streamline your business, Speak to Analyst

For instance, NASA Marshall identifies CFRP as a key aerospace material for reducing structural weight while maintaining rigidity, directly improving fuel efficiency.

By Application

Growing Product Demand Fuels Growth of Aerospace & Defense Segment

In terms of application, the market is categorized into aerospace & defense, wind energy, automotive & transportation, sports & leisure, marine, and others.

The aerospace & defense segment accounted for the largest share in 2025. In 2026, the segment is anticipated to dominate with 51.20% share. This is attributed to manufacturers integrating a range of high performance composites to achieve lighter, stronger, and more fuel-efficient airframes. CFRPs dominate in primary structures, while CMCs are increasingly applied in engine hot zones for thermal stability, and AFRPs contribute in ballistic protection. Collectively, these composites reduce fuel burn, emissions, and lifecycle costs while advancing sustainability goals.

- The Airbus A350 XWB incorporates ~53% composites by weight, and the Boeing 787 Dreamliner uses ~50% composites, reflecting the strategic role of composites in modern aircraft

Wind Energy segment is expected to grow at a CAGR of 8.1% over the forecast period.

High Performance Composites Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific High Performance Composites Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific held the dominant share in 2025, valued at USD 33.2 billion, and also took the leading share in 2026 with USD 36.44 billion. Asia Pacific dominates the market, combining scale, technology, and government-backed demand. China anchors growth through aerospace projects such as COMAC C919, EV lightweighting, and the world’s largest wind energy sector. Japan and South Korea lead in high-grade carbon fiber, while India expands aerospace and defense composites. The region sets global price and volume benchmarks, making it the central driver of the market growth. In 2026, the China market is estimated to reach USD 24.57 billion.

- COMAC’s C919 integrates CFRP in fuselage and wings, showing how China’s aerospace ambitions anchor regional HPC demand.

To know how our report can help streamline your business, Speak to Analyst

Europe is anticipated to witness notable growth in the coming years. The European region is projected to record a growth rate of 7.9% during the forecast period, and reach a valuation of USD 14.03 billion in 2025. The region’s stringent environmental regulations, circular economy initiatives, and strong culture of sustainability are key growth drivers. Countries such as Germany, France, and Italy serve as major hubs for aerospace, automotive, and wind energy industries, where the demand for lightweight and fuel-efficient solutions is accelerating. Backed by these factors, the U.K. is anticipated to record a valuation of USD 1.79 billion, Germany to record USD 3.65 billion, and France to record USD 1.91 billion in 2026.

The market in North America is estimated to reach USD 21.07 billion in 2025 and secure the position of the second-largest region in the market. North America has a mature market anchored by aerospace and defense, where Boeing, Lockheed Martin, and NASA rely on CFRP and CMC to achieve lighter and more fuel-efficient platforms. Wind energy adds to this demand through large-scale turbine blade production. In 2026, the U.S. market is estimated to reach USD 20.99 billion.

Over the forecast period, the Latin America and Middle East & Africa regions would witness a moderate growth in this market. The Latin America market in 2025 is set to record USD 2.44 billion in its valuation. Latin America is a small but strategically relevant HPC market, with aerospace and renewables as main drivers. Brazil’s Embraer sustains CFRP adoption in regional and business jets, while expanding wind capacity in Brazil and Mexico adds to structural demand for composites in wind turbine blades.

In the Middle East & Africa, Saudi Arabia is set to attain the value of USD 3.40 billion in 2025. Middle East & Africa is in the early stages of high performance composites adoption but shows clear potential. Gulf diversification strategies support composite manufacturing through aerospace joint ventures, while renewable energy in Egypt, Morocco, and South Africa lifts blade demand. Defense modernization also contributes through CFRP and aramid fibre adoption.

- UAE’s Strata manufactures CFRP components for Airbus and Boeing, embedding the region into global aerospace supply chains.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Alliances Enable Key Players to Consolidate the Market

The market is moderately consolidated, with few global leaders shaping production, technology development, and trade. These companies focus heavily on advanced material innovation, capacity expansions, and long-term partnerships with OEMs across aerospace, defense, wind energy, and automotive industry to reinforce their market positions.

Key companies in the global market include Hexcel Corporation, Toray Advanced Composites, Teijin Limited, Mitsubishi Chemical Group (MCG), and SGL Carbon. Their strong product portfolios across CFRP, CMC, and other composite types, coupled with robust manufacturing footprints and established relationships with tier-one suppliers, enable them to dominate the competitive landscape.

Other notable participants such as Solvay, Materion Corporation, and Rolls-Royce Plc strengthen the market through targeted strategies. These include sustainability-focused R&D, investments in next-generation resin and matrix systems, and collaborations with aerospace and industrial technology partners. Collectively, such initiatives enhance innovation pipelines and support the broader adoption of the product in high-growth applications.

LIST OF KEY HIGH PERFORMANCE COMPOSITES COMPANIES PROFILED

- Toray Industries (Japan)

- Hexcel Corporation (U.S.)

- Solvay (Belgium)

- Teijin Limited (Japan)

- Mitsubishi Chemical Group (Japan)

- DuPont (U.S.)

- SGL Carbon SE (Germany)

- Materion Corporation (U.S.)

- Rolls-Royce Plc (U.K.)

- Kolon Industries (South Korea)

KEY INDUSTRY DEVELOPMENTS

- July 2025: Toray Advanced Composites will supply space-grade composites for Constellation solar arrays, enhancing performance and durability in space, reinforcing its role in advancing high performance materials for demanding aerospace applications.

- June 2025: Kongsberg and Hexcel signed a five-year partnership to supply HexWeb honeycombs and HexPly prepregs for aerospace and defense, enhancing supply chain resilience, advancing lightweight composite technologies, and supporting long-term market stability.

- June 2025: Toray, Daher, and Tarmac Aerosave launched an End-of-Life Aircraft Recycling Program for thermoplastic composites, repurposing components such as Airbus A380 pylon covers, advancing circular economy practices, enhancing sustainability, and setting a precedent for aerospace composite recycling.

- February 2024: Mitsubishi Chemical Group (MCG) has developed a high-heat-resistant ceramic matrix composite (CMC) utilizing pitch-based carbon fibers, achieving heat resistance up to 1,500°C. This innovation is primarily aimed at space industry applications.

- September 2024: Teijin, with herone GmbH and Envision Racing, developed a lightweight, sustainable Formula E wishbone using Tenax thermoplastics and recycled aerospace composites, showcasing high performance, eco-friendly motorsport innovation.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.70% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Segmentation |

By Type · Carbon Fiber Reinforced Composites (CFRP) · Aramid Fiber Reinforced Composites (AFRP) · Ceramic Matrix Composites (CMC) · Metal Matrix Composites (MMC) · Others |

|

By Application · Aerospace & Defense · Wind Energy · Automotive & Transportation · Sports & Leisure · Marine · Others |

|

|

By Geography · North America (By Type, Application, and Country) o U.S. (By Application) o Canada (By Application) · Europe (By Type, Application, and Country/Sub-region) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, Application, and Country/Sub-region) o China (By Application) o Japan (By Application) o India (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Type, Application, and Country/Sub-region) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Type, Application, and Country/Sub-region) o Saudi Arabia (By Application) o South Africa (By Application) · Rest of the Middle East & Africa (By Application) |

Frequently Asked Questions

The global high-performance composites market size is projected to grow from $80.96 billion in 2026 to $156.73 billion by 2034.

In 2025, the market value stood at USD 33.2 billion.

The market is expected to exhibit a CAGR of 8.70% during the forecast period of 2026-2034.

The Carbon Fiber Reinforced Composites (CFRP) (BF) segment led the market by Type.

The key factors driving the market are the increasing HPC demand in Aerospace & Defense sectors.

Hexcel Corporation, Toray Advanced Composites, Teijin Limited, Mitsubishi Chemical Group (MCG), and SGL Carbon, are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

Integration of energy storage and structure creates next-gen growth in high performance composites are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us